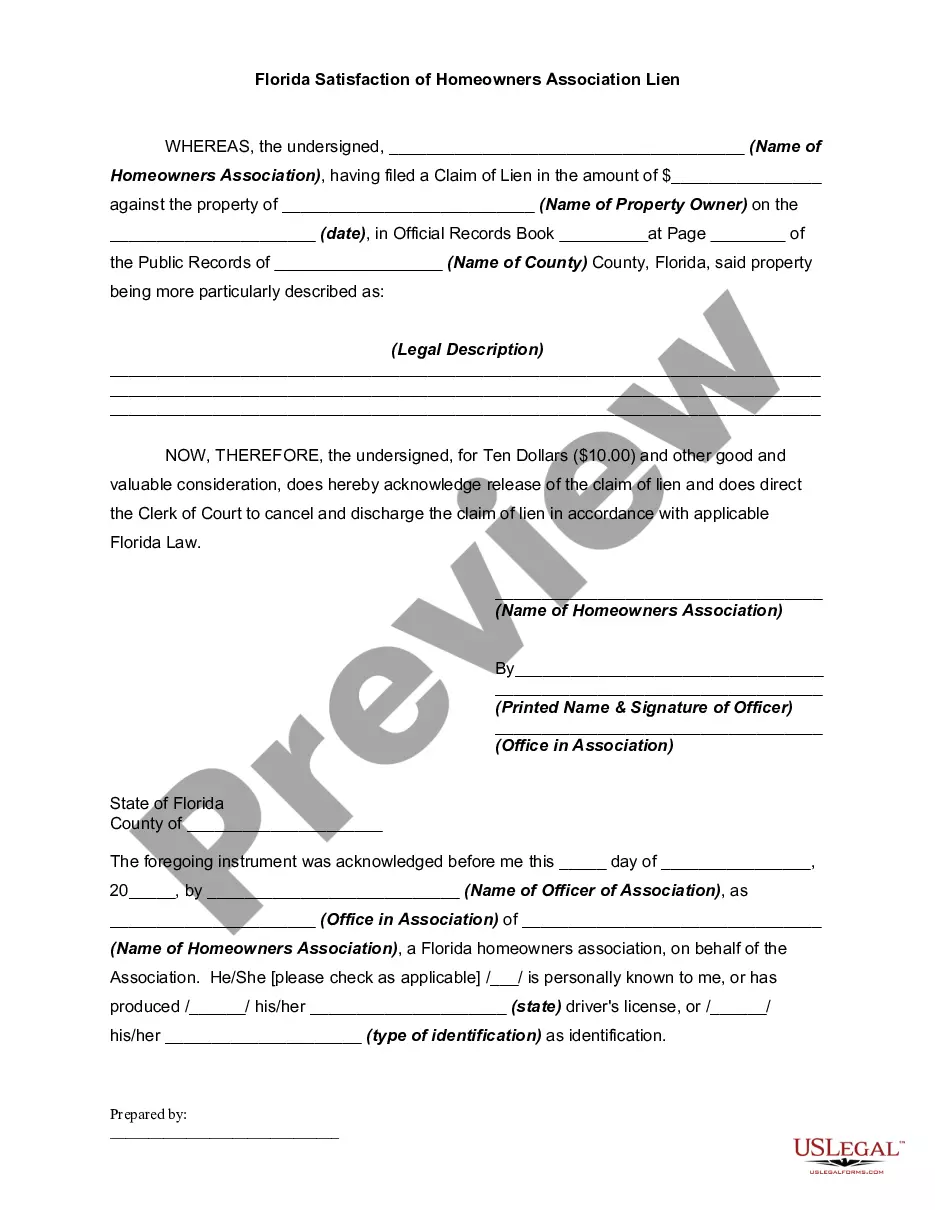

Often, by virtue of provision in the restrictive covenants affecting a subdivision, the homeowners' association will be granted the right to assess the owners, and failing payment have a lien on the defaulting member's property upon the filing in the public records of a notice or claim of the lien.

Florida Satisfaction of Homeowners Association Lien

Description

How to fill out Florida Satisfaction Of Homeowners Association Lien?

The larger quantity of documents you must create - the more anxious you feel.

You can find a vast array of Florida Satisfaction of Homeowners Association Lien forms online, yet you’re unsure which ones to rely on.

Eliminate the difficulty of sample searching by using US Legal Forms.

Proceed by clicking Buy Now to initiate the signup process and select a pricing plan that suits your needs.

- Obtain expertly prepared documents that align with state regulations.

- If you have a US Legal Forms membership, Log In to access your account, and you will discover the Download feature on the Florida Satisfaction of Homeowners Association Lien’s page.

- If you haven’t used our service previously, follow these guidelines to complete the registration process.

- Verify that the Florida Satisfaction of Homeowners Association Lien is applicable in your state.

- Review your selection by reading the description or by utilizing the Preview option if it’s available for the selected file.

Form popularity

FAQ

Yes, Florida is considered a super lien state for homeowners associations. This means that if an HOA places a lien on a property for unpaid dues, that lien takes priority over most other liens, including mortgages. As a result, HOA dues must be settled before other claims when a property is sold. Understanding the implications of the Florida Satisfaction of Homeowners Association Lien is crucial for homeowners to navigate these situations effectively.

Opting out of an HOA in Florida can be complicated, as it usually requires adherence to the community's governing documents. If you have purchased a property within an HOA's jurisdiction, you are generally bound by its rules. However, in certain cases, a homeowner may seek to dissolve their association or challenge specific regulations through legal channels. Consulting with a legal expert on the Florida Satisfaction of Homeowners Association Lien can clarify your options.

The new HOA law introduced by Governor Ron DeSantis aims to protect homeowners' rights while holding associations accountable. This legislation includes provisions for greater oversight of HOA operations and promotes ethical management practices. Residents should familiarize themselves with this law, as it impacts how associations handle liens and disputes. Understanding these regulations can empower homeowners when addressing the Florida Satisfaction of Homeowners Association Lien.

The new rules for HOAs in Florida focus on increasing member rights and responsibilities, including more accessible financial disclosures. These rules are designed to improve governance and ensure that homeowners are well-informed about the status of their accounts and any potential liens. By actively engaging with their associations, homeowners can better navigate these regulations and maintain a proactive stance regarding Florida Satisfaction of Homeowners Association Liens.

Recently, Florida enacted laws that enhance transparency and accountability within homeowners associations. These laws emphasize better communication between HOAs and their members, particularly concerning financial matters. Homeowners should stay updated on these changes, as they can significantly influence how associations manage liens and dues. Being informed about the new laws can support a clearer understanding of the Florida Satisfaction of Homeowners Association Lien.

Homeowners can file a complaint against an HOA in Florida by first reviewing the association's governing documents and state laws. If you have a valid reason, you may need to submit your complaint to the Florida Division of Florida Condominiums, Timeshares, and Mobile Homes. Alternatively, consider using legal resources, such as US Legal Forms, to draft your complaint and ensure it meets all legal requirements. Remember, addressing issues promptly can lead to a resolution regarding the Florida Satisfaction of Homeowners Association Lien.

In Florida, the 5-year rule indicates that a homeowners association lien remains enforceable for a maximum of five years after it is filed. If the lien remains unpaid, the HOA must take action to collect it within this period. After five years, the lien may become null and void, allowing the homeowner to regain a clear title. Staying informed about the Florida Satisfaction of Homeowners Association Lien is crucial for homeowners.

To file a complaint against your Homeowners Association in Florida, you should start by contacting the Florida Department of Business and Professional Regulation (DBPR). The DBPR oversees many aspects of homeowner associations, and they can guide you through the process. It is essential to document your issues thoroughly, as this evidence can strengthen your complaint. Additionally, if you're dealing with a Florida Satisfaction of Homeowners Association Lien, consider consulting with a legal expert or using US Legal Forms to understand your options better.

If you have a complaint about your HOA in Florida, begin by documenting your concerns clearly and thoroughly. Then, bring your issues to the HOA board or management in writing, as they may not be aware of the problems. If the response is unsatisfactory, you can escalate your complaint to state authorities or seek legal advice. Organizations like US Legal Forms can provide helpful resources related to Florida Satisfaction of Homeowners Association Lien to support your case.

While an HOA in Florida can place a lien on your property, they cannot outright take your house without going through a legal process. If you do not resolve the lien through payment or negotiation, the HOA may initiate foreclosure proceedings. It is crucial to act quickly if you find yourself facing this situation. Seeking assistance through platforms like US Legal Forms can help you navigate the complexities of Florida Satisfaction of Homeowners Association Lien.