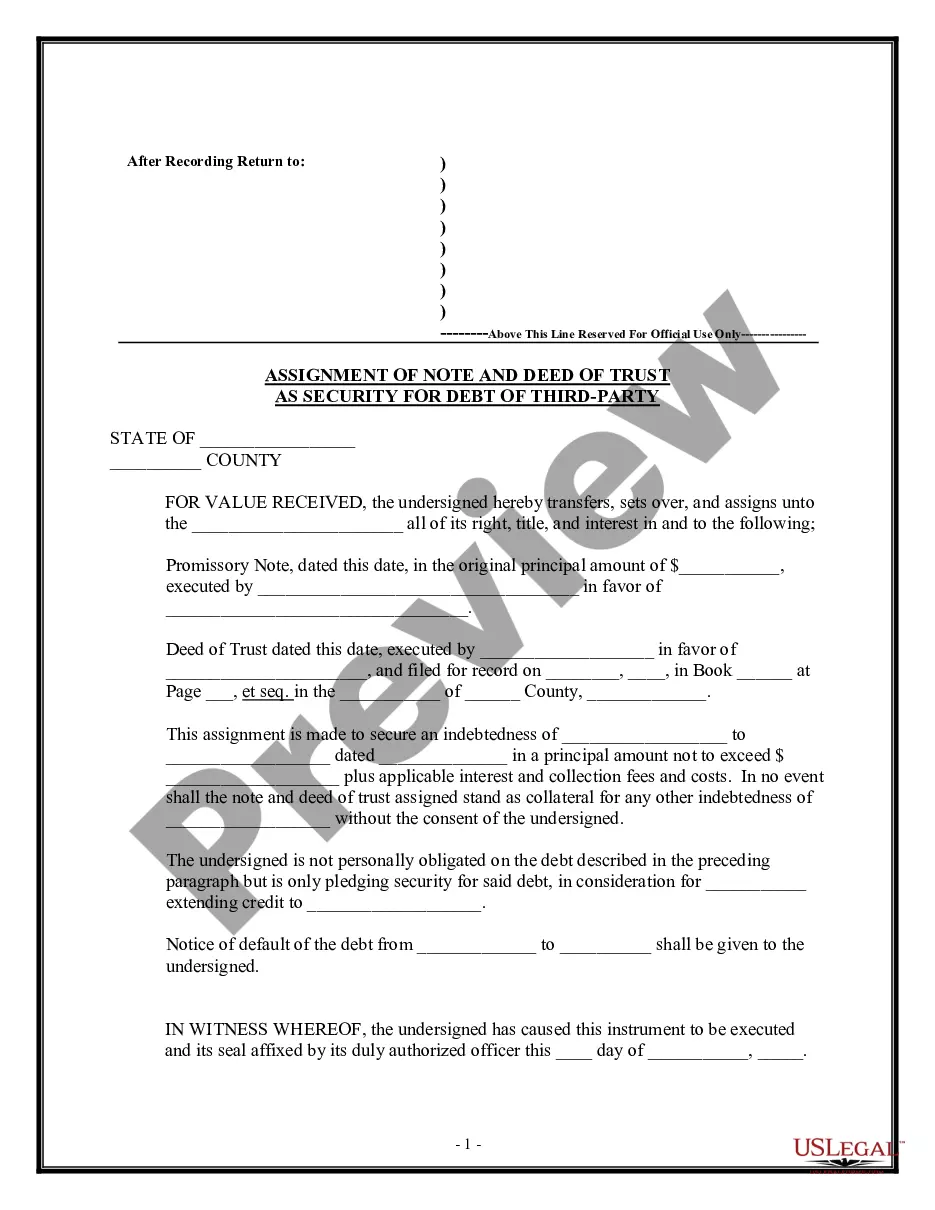

Delaware Agreement for Rights under Third Party Deed of Trust

Description

How to fill out Agreement For Rights Under Third Party Deed Of Trust?

It is possible to devote several hours online searching for the legal papers web template that suits the federal and state demands you will need. US Legal Forms provides 1000s of legal varieties that happen to be evaluated by experts. You can easily download or produce the Delaware Agreement for Rights under Third Party Deed of Trust from your service.

If you already have a US Legal Forms accounts, it is possible to log in and click on the Download button. Next, it is possible to full, modify, produce, or sign the Delaware Agreement for Rights under Third Party Deed of Trust. Every single legal papers web template you acquire is the one you have permanently. To acquire one more duplicate of any obtained develop, proceed to the My Forms tab and click on the related button.

If you use the US Legal Forms site initially, adhere to the easy directions listed below:

- First, make sure that you have selected the right papers web template to the county/area that you pick. Look at the develop information to make sure you have picked out the proper develop. If accessible, take advantage of the Preview button to search throughout the papers web template too.

- If you wish to locate one more variation of your develop, take advantage of the Search area to find the web template that suits you and demands.

- After you have identified the web template you want, click Buy now to continue.

- Choose the pricing strategy you want, enter your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You should use your credit card or PayPal accounts to pay for the legal develop.

- Choose the formatting of your papers and download it to your product.

- Make changes to your papers if needed. It is possible to full, modify and sign and produce Delaware Agreement for Rights under Third Party Deed of Trust.

Download and produce 1000s of papers layouts while using US Legal Forms web site, which provides the largest variety of legal varieties. Use professional and express-certain layouts to deal with your company or person requirements.

Form popularity

FAQ

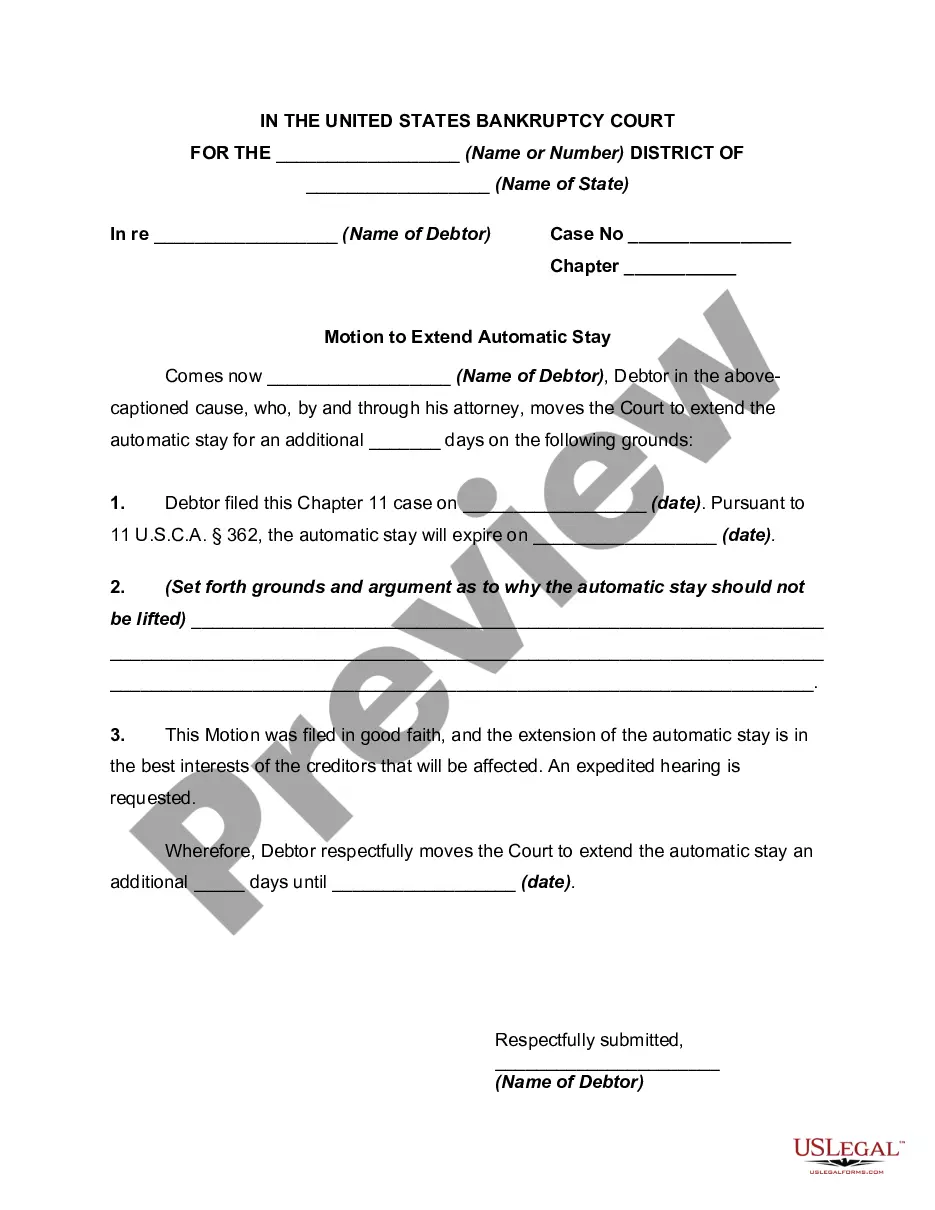

Illiquidity. DSTs have lengthy holding periods usually ranging between five and 10 years, making them highly illiquid investments. Your capital likely will be tied up throughout the lifecycle of the DST offering, which makes them suitable only for exchange investors who can afford to have their money tied up for years.

As a real estate investor, there are many pros and cons to consider when investing in Delaware Statutory Trusts (DSTs). The advantages of DSTs include access to larger assets, tax benefits, and lower risk. They are often great passive investment options, too. But, DSTs are not for everyone.

§ 3313A. Excluded cotrustee. (3) The excluded trustee has no duty to monitor the conduct of the cotrustee, provide advice to the cotrustee or consult with or request directions from the cotrustee.

Section 3816 - Derivative actions (a) A beneficial owner may bring an action in the Court of Chancery in the right of a statutory trust to recover a judgment in its favor if persons with authority to do so have refused to bring the action or if an effort to cause those persons to bring the action is not likely to ...

Certain Risk Factors Associated with Delaware Statutory Trusts. Like any investment, 1031 Exchanges aren't without risks. DST risk factors can include illiquidity, macroeconomic factors such as rising interest rates, and changes in the regulatory environment.

§ 3807. Trustee in State; registered agent. (a) Every statutory trust shall at all times have at least 1 trustee which, in the case of a natural person, shall be a person who is a resident of this State or which, in all other cases, has its principal place of business in this State.

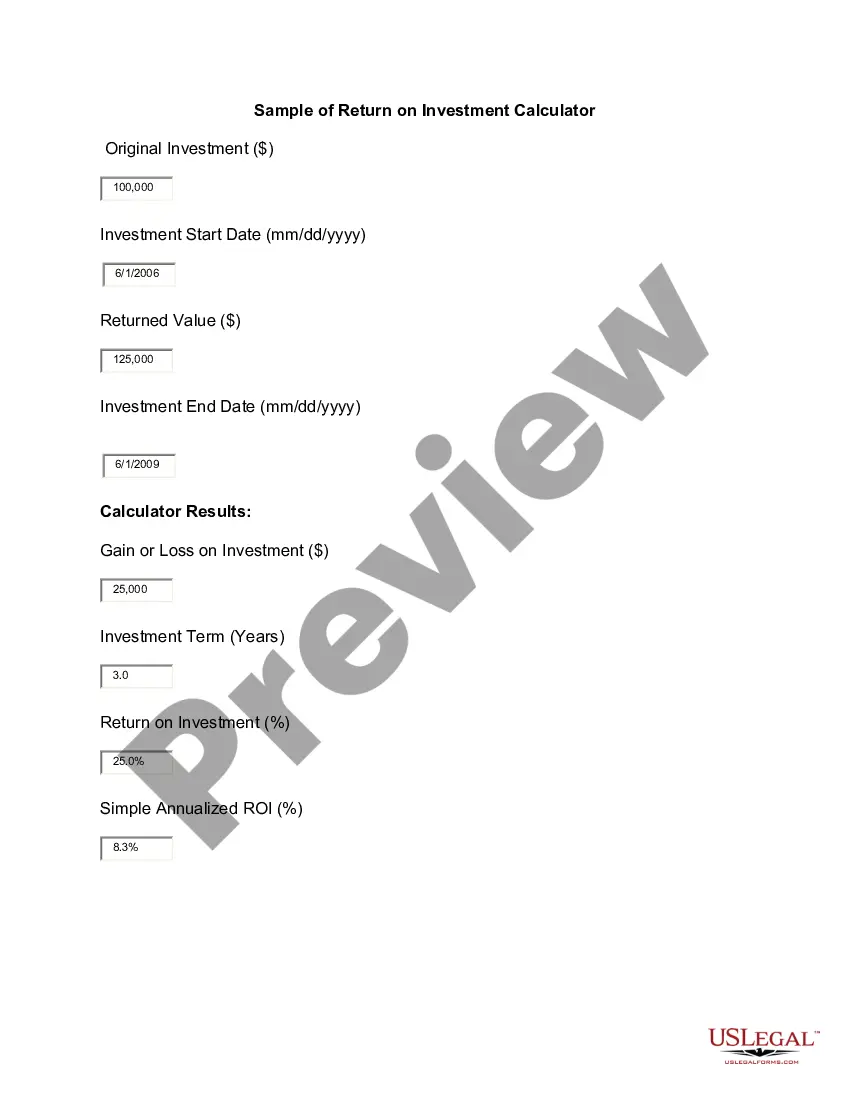

Delaware Statutory Trusts (DSTs) typically offer a cash-on-cash return of 5-9% per year, with the potential for additional appreciation. The overall return on a DST investment will depend on a number of factors, including the properties that the DST invests in, the management team, and the overall market conditions.

Like all real estate investments, investing in Delaware Statutory Trusts involve many of the same risks, including potential lack of return and loss of principal. As long-term, income-focused investments, DST performance is largely dependent upon the tenants' ability to pay rent.