The employee stock option prospectus explains the stock option plan to the employees. It addresses the employee's right to exercise the option of buying common stock in the company, along with explaining the obligations of the employee where taxes and capital gains are concerned.

Delaware Employee Stock Option Prospectus

Description

How to fill out Employee Stock Option Prospectus?

US Legal Forms - among the greatest libraries of legal types in the United States - offers a variety of legal record themes you are able to obtain or produce. Using the web site, you can get a large number of types for company and individual reasons, categorized by categories, suggests, or key phrases.You can get the most recent types of types just like the Delaware Employee Stock Option Prospectus in seconds.

If you currently have a monthly subscription, log in and obtain Delaware Employee Stock Option Prospectus from the US Legal Forms collection. The Obtain button can look on each and every type you look at. You gain access to all in the past saved types within the My Forms tab of your own profile.

In order to use US Legal Forms the first time, allow me to share basic guidelines to help you began:

- Be sure to have selected the right type to your metropolis/region. Click on the Review button to analyze the form`s content material. Read the type information to actually have selected the appropriate type.

- When the type doesn`t satisfy your requirements, utilize the Lookup area at the top of the display to find the one who does.

- If you are content with the form, verify your selection by clicking on the Acquire now button. Then, select the prices prepare you like and supply your accreditations to sign up to have an profile.

- Approach the financial transaction. Make use of your bank card or PayPal profile to perform the financial transaction.

- Choose the format and obtain the form in your product.

- Make changes. Fill out, modify and produce and indication the saved Delaware Employee Stock Option Prospectus.

Each web template you included in your money does not have an expiry date which is yours for a long time. So, if you want to obtain or produce another copy, just proceed to the My Forms area and click in the type you require.

Get access to the Delaware Employee Stock Option Prospectus with US Legal Forms, probably the most considerable collection of legal record themes. Use a large number of skilled and state-distinct themes that meet your company or individual requires and requirements.

Form popularity

FAQ

A leveraged employee stock ownership plan (LESOP) uses borrowed money to fund an ESOP as a form of equity compensation for employees. The company borrows against its assets and then repays the loan used to fund the ESOP via annual contributions.

Identification. An ESOP qualifies as a retirement plan, such as a 401 (k) or individual retirement account, while corporations use stock options as an employee benefit, like health insurance. In an ESOP, the company contributes to employee retirement plans with its own stock.

Employee stock options (ESOs) are a form of equity compensation granted by companies to their employees. ESOs give employees the right to purchase a certain number of shares of the company's stock at a fixed price (the ?strike price?) for a certain period of time.

There are two types of stock options: incentive stock options (ISOs) and non-qualified stock options (NSOs). These mainly differ by how and when they're taxed. ISOs could qualify for special tax treatment. With NSOs, you usually have to pay taxes both when you exercise and sell.

The most notable difference between an ESOP vs ESPP is in how the employee receives the stock and when they can sell the stock. ESOPs provide the stock or shares at no cost to employees. ESPPs require participants to contribute funds to purchase shares of stock, though at a discounted rate.

So start off right: Plan ahead. Your first step is planning. ... Manage your equity. ... Set some guidelines for stock options. ... Get a 409A valuation. ... Use the 409A to set the strike price. ... Adopt your vesting and cliff schedule. ... Set an expiration timeline. ... Create an ESO agreement and get your board's approval.

An Employee Stock Ownership Plan (ESOP) is an individual stock bonus plan designed specifically to invest in the stock of the employer corporation. An ESOP may be either nonleveraged or leveraged. An Employee Stock Ownership Trust (ESOT) is the entity responsible for administering the ESOP.

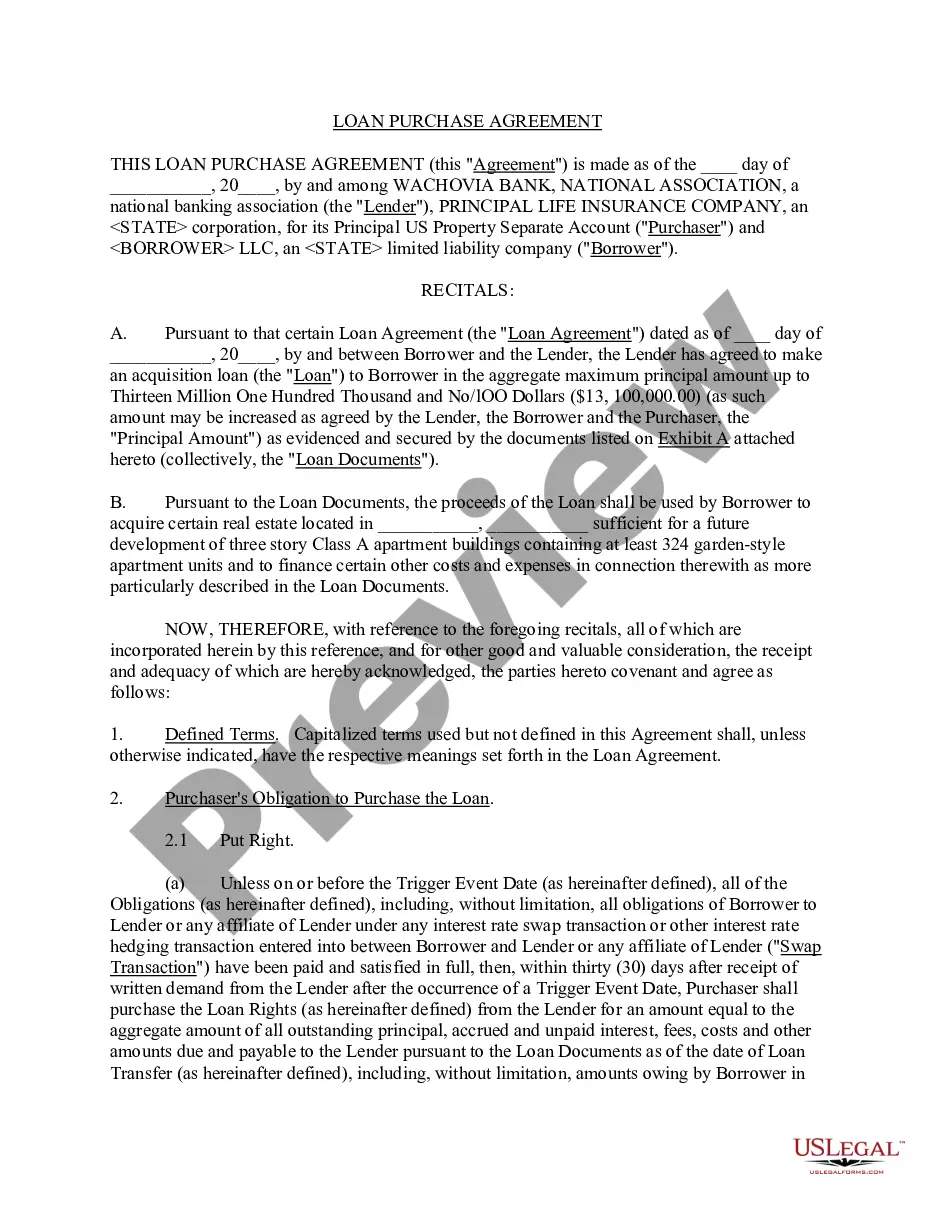

Stock Option Plan (the ?Plan?) is to assist Delaware Management Holdings, Inc., a Delaware corporation (the ?Corporation?), and its subsidiaries in attracting, retaining, and rewarding high-quality executives, investment professionals, employees, and other persons who provide services to the Corporation and/or its ...