Delaware Authorization to Release Wage and Employment Information

Description

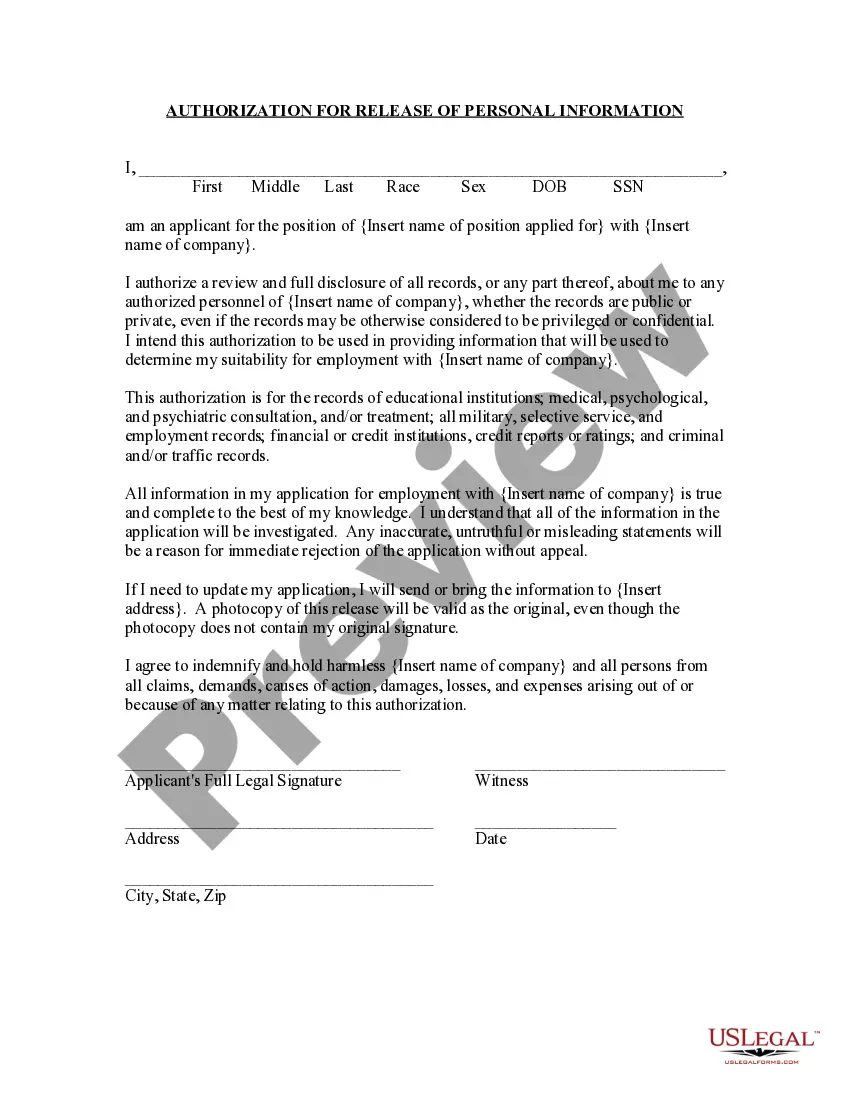

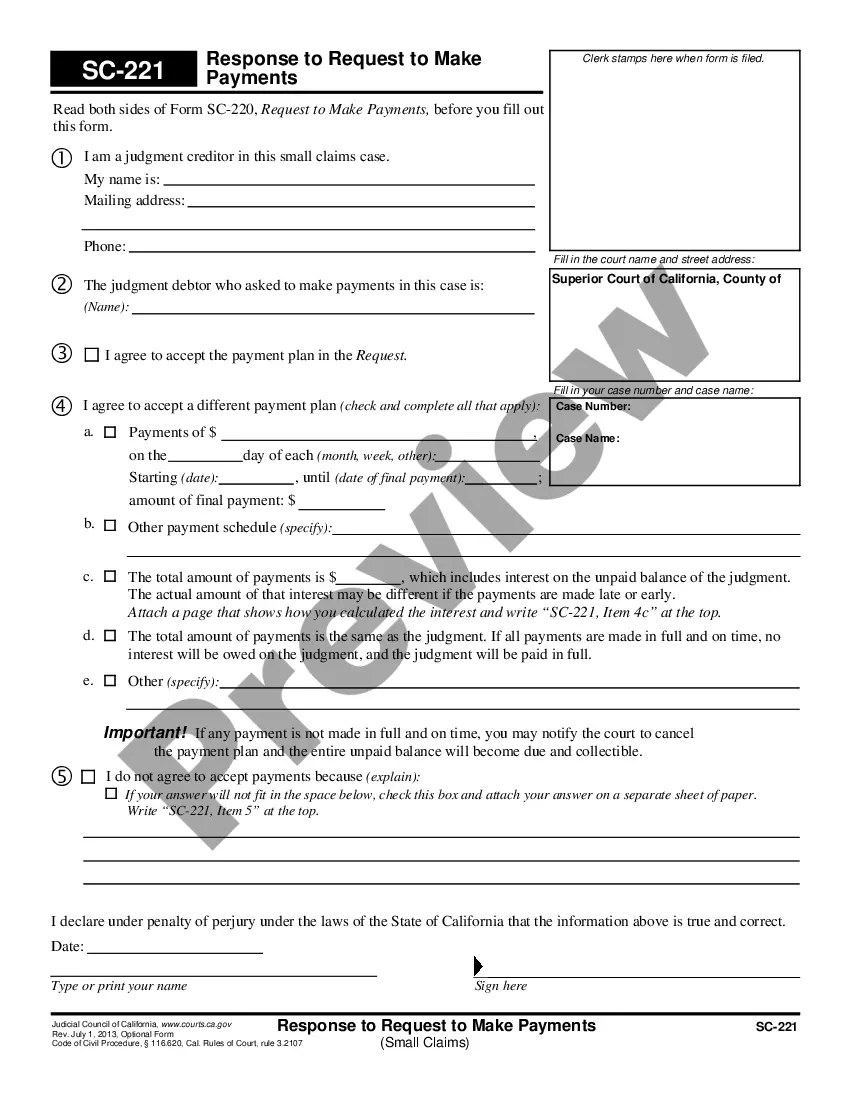

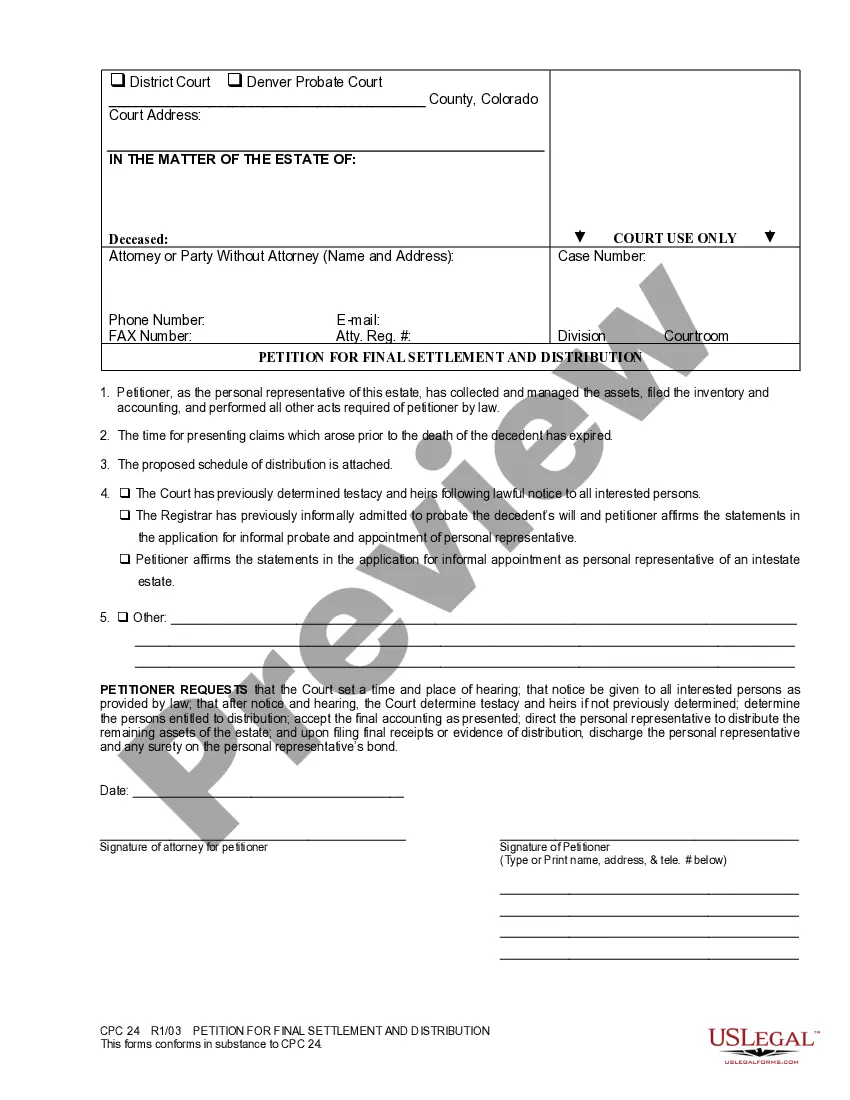

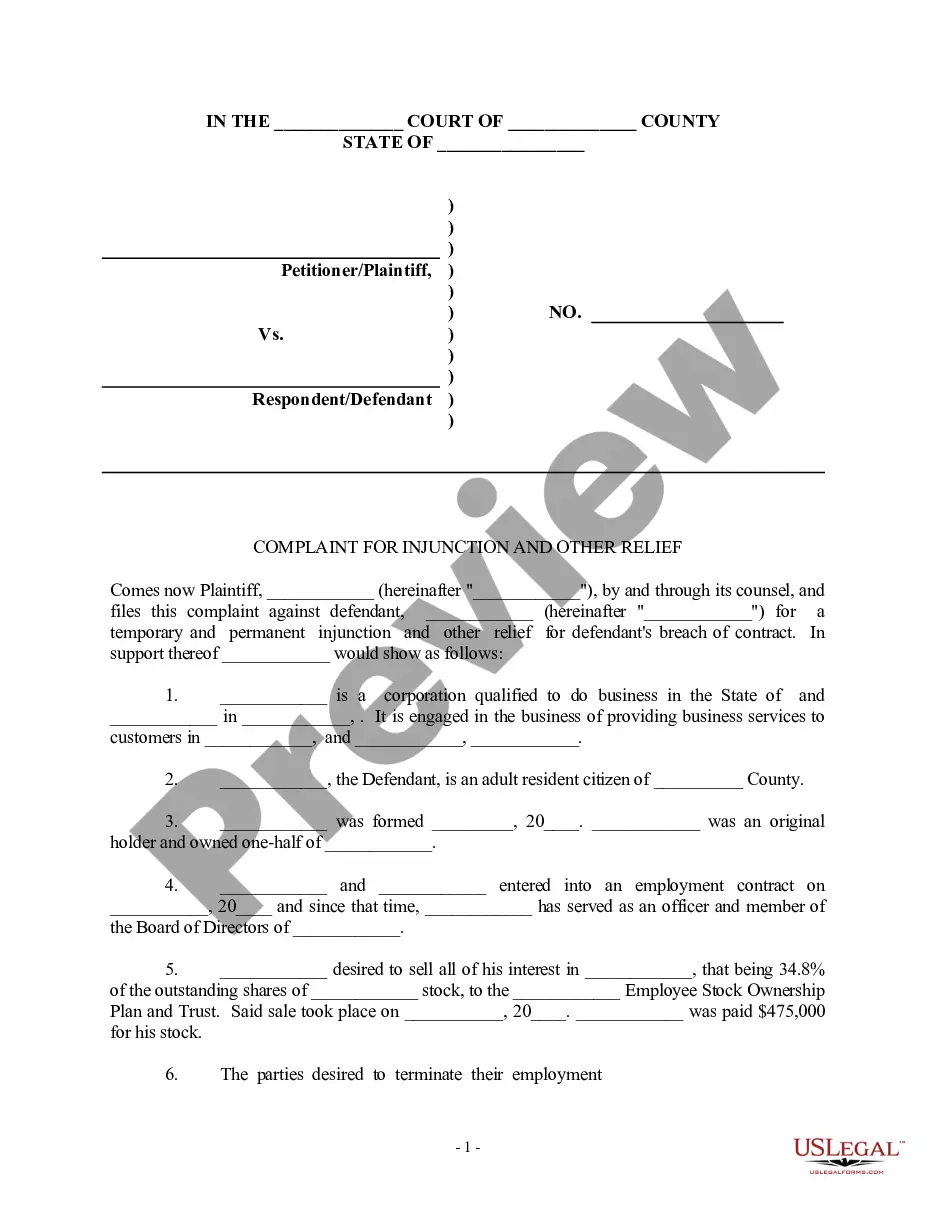

How to fill out Authorization To Release Wage And Employment Information?

US Legal Forms - one of the biggest libraries of legal types in the USA - offers a variety of legal papers web templates you may obtain or printing. Making use of the internet site, you may get a huge number of types for enterprise and person purposes, categorized by classes, claims, or keywords and phrases.You can find the most recent versions of types like the Delaware Authorization to Release Wage and Employment Information in seconds.

If you already have a membership, log in and obtain Delaware Authorization to Release Wage and Employment Information from the US Legal Forms catalogue. The Down load key can look on each and every kind you see. You get access to all earlier delivered electronically types inside the My Forms tab of your own account.

If you wish to use US Legal Forms the very first time, allow me to share straightforward guidelines to get you started:

- Ensure you have selected the right kind for your personal city/state. Select the Review key to analyze the form`s content. See the kind explanation to ensure that you have chosen the proper kind.

- In case the kind doesn`t satisfy your specifications, take advantage of the Lookup discipline at the top of the screen to get the one who does.

- In case you are pleased with the form, validate your selection by clicking on the Acquire now key. Then, pick the prices prepare you favor and supply your references to register on an account.

- Procedure the transaction. Make use of credit card or PayPal account to complete the transaction.

- Pick the formatting and obtain the form on your own system.

- Make alterations. Fill out, edit and printing and indication the delivered electronically Delaware Authorization to Release Wage and Employment Information.

Each format you included with your bank account does not have an expiry date and it is your own eternally. So, if you wish to obtain or printing an additional duplicate, just proceed to the My Forms section and click about the kind you need.

Gain access to the Delaware Authorization to Release Wage and Employment Information with US Legal Forms, probably the most considerable catalogue of legal papers web templates. Use a huge number of professional and status-distinct web templates that satisfy your small business or person needs and specifications.

Form popularity

FAQ

(1) Notify each employee in writing, at the time of hiring, of the rate of pay and of the day, hour and place of payment; (2) Notify each employee in writing or through a posted notice maintained in a place accessible to the employees and where they normally pass of any reduction in the regular rate of pay, and day, ...

As defined by the U.S. Internal Revenue Service (IRS), "convenience of employer" generally means that an employer has not provided an employee with the necessary resources for an employee to work remotely, such as a physical office or technology, which requires the worker to provide for their own home office equipment.

Delaware's ?convenience of the employer? rule requires that taxpayers who switch from commuting into Delaware to working remotely in another state still have to pay income taxes to Delaware.

Fail or refuse to hire or to discharge any individual or otherwise to discriminate against any individual with respect to compensation, terms, conditions, or privileges of employment because of the individual's family responsibilities, except with respect to the employer's attendance and absenteeism standards that are ...

Social Security and Medicare taxes Federal Insurance Contribution Act (FICA) taxes support the federal Social Security and Medicare programs. The total due every pay period is 15.3% of an individual's wages ? half of which is paid by the employee and the other half by the employer.

Bottom Line. The convenience of the employer rule allows some states to impose income tax on employees working remotely in other states for companies located within their borders. Unless employees live and work in a state with no income tax, they may be taxed twice.

Generally, under Delaware Code Ann. tit. 19, § 1103, an employer must issue a final paycheck to a terminated employee no later than the next regularly scheduled pay date.

The convenience of the employer rule, or convenience rule, sources wages to the location of a nonresident employee's assigned office. The rule applies even if the underlying work was physically performed at a home office in another state.