Delaware Form of Anti-Money Laundering Policy

Description

How to fill out Form Of Anti-Money Laundering Policy?

Choosing the right authorized record design can be quite a struggle. Needless to say, there are tons of layouts available online, but how will you get the authorized develop you need? Make use of the US Legal Forms internet site. The service delivers thousands of layouts, such as the Delaware Form of Anti-Money Laundering Policy, which you can use for company and personal needs. All of the varieties are examined by professionals and fulfill state and federal requirements.

When you are already signed up, log in to your bank account and then click the Obtain button to find the Delaware Form of Anti-Money Laundering Policy. Make use of your bank account to search through the authorized varieties you might have ordered in the past. Check out the My Forms tab of your respective bank account and have an additional copy of your record you need.

When you are a whole new end user of US Legal Forms, here are easy instructions that you can comply with:

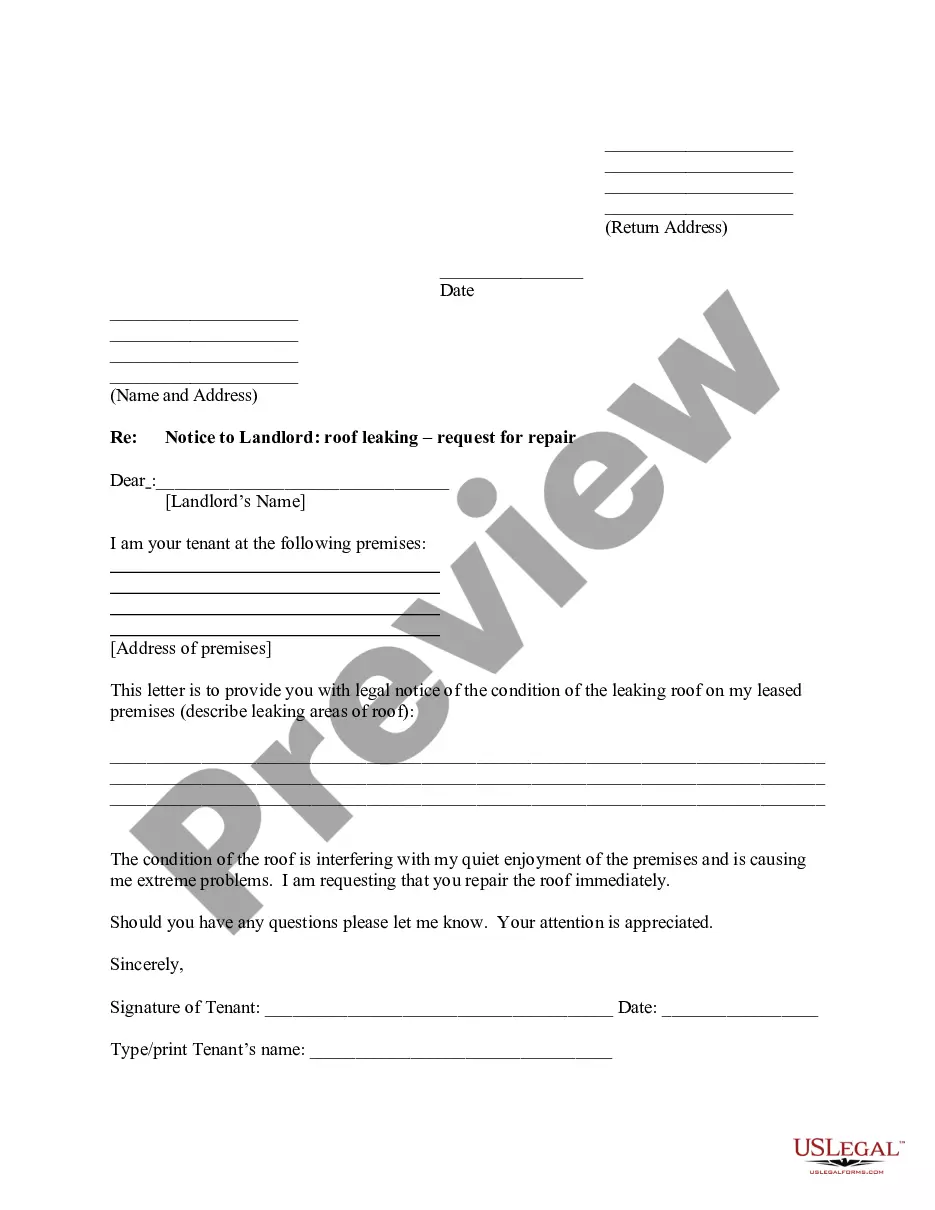

- First, make sure you have chosen the right develop for the metropolis/county. You are able to look over the form utilizing the Review button and look at the form information to make certain it will be the right one for you.

- When the develop will not fulfill your needs, make use of the Seach discipline to get the correct develop.

- When you are certain the form would work, go through the Purchase now button to find the develop.

- Select the pricing plan you desire and type in the necessary details. Build your bank account and pay for the transaction making use of your PayPal bank account or bank card.

- Pick the submit formatting and down load the authorized record design to your product.

- Complete, change and printing and indication the obtained Delaware Form of Anti-Money Laundering Policy.

US Legal Forms may be the most significant collection of authorized varieties that you can find a variety of record layouts. Make use of the company to down load professionally-made documents that comply with status requirements.

Form popularity

FAQ

Every money transmitter licensee and its agents shall transmit the monetary equivalent of all money or equivalent value received from a consumer for transmission, net of any fees, or issue instructions committing the money or its monetary equivalent, to the person designated by the consumer, or return such amount to ...

Anti-Money Laundering (AML) laws reduce the ease of hiding profits from crime. Criminals launder money to make illicit funds appear to have lawful origins. Financial institutions combat money laundering with Know Your Customer (KYC) and Customer Due Diligence (CDD).

No person, except those specified in § 2304 or agents of a licensee as provided in § 2311 shall engage in the business of selling checks, or issuing checks or engage in the business of receiving money for transmission or transmitting the same without having first obtained a license hereunder. § 2304.

Ingly, under Delaware statute, any check, draft, money order, personal money order, or other instruments for the transmission or payment of money is considered a transmission, and any entity selling, issuing, or engaging in the activity must obtain a money transmitter license.

The program must include appropriate risk-based procedures for conducting ongoing customer due diligence, including (i) understanding the nature and purpose of customer relationships for the purpose of developing a customer risk profile; and, (ii) conducting ongoing monitoring to identify and report suspicious ...

Money transmission is the act of one party receiving currency for the purpose of sending it over to another party.

What is an AML policy? An AML policy is a combination of measures to stop criminals from disguising illegally obtained money as legitimate income. Implementation is mandatory for financial institutions and overseen by regulatory authorities.

? The term ?money transmitting business? means any business other than the United States Postal Service which? (A) provides check cashing, currency exchange, or money transmitting or remittance services, or issues or redeems money orders, travelers' checks, and other similar instruments or any other person who engages ...