Delaware Investment Management Agreement

Description

How to fill out Investment Management Agreement?

Have you been in a place where you require papers for both company or specific reasons just about every working day? There are a variety of legal record web templates accessible on the Internet, but getting kinds you can rely on isn`t straightforward. US Legal Forms gives a huge number of form web templates, like the Delaware Investment Management Agreement, that happen to be composed to meet state and federal needs.

If you are previously knowledgeable about US Legal Forms internet site and possess a merchant account, simply log in. After that, you are able to download the Delaware Investment Management Agreement format.

Should you not provide an profile and need to begin to use US Legal Forms, abide by these steps:

- Discover the form you will need and ensure it is to the proper area/state.

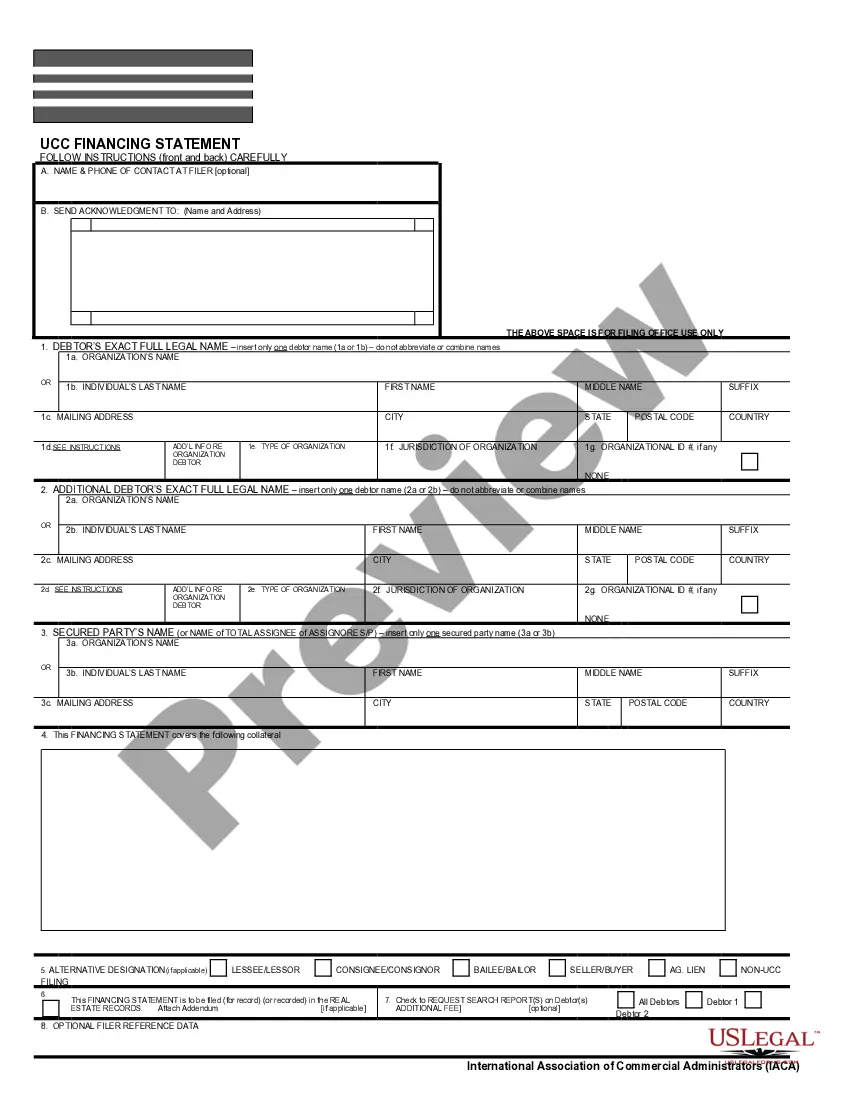

- Use the Review button to check the form.

- Look at the explanation to actually have selected the right form.

- In case the form isn`t what you are seeking, utilize the Lookup industry to find the form that suits you and needs.

- Whenever you get the proper form, click Purchase now.

- Select the prices strategy you need, submit the required details to produce your money, and pay money for an order with your PayPal or charge card.

- Select a hassle-free file structure and download your copy.

Find each of the record web templates you may have bought in the My Forms menu. You can aquire a additional copy of Delaware Investment Management Agreement any time, if necessary. Just go through the required form to download or print out the record format.

Use US Legal Forms, probably the most extensive selection of legal types, to save time and avoid blunders. The assistance gives appropriately manufactured legal record web templates which can be used for a range of reasons. Generate a merchant account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

Investment management is the maintenance of an investment portfolio, or a collection of financial assets. It can include purchasing and selling assets, creating short- or long-term investment strategies, overseeing a portfolio's asset allocation and developing a tax strategy.

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

Investment management refers to the handling of financial assets and other investments?not only buying and selling them. Management includes devising a short- or long-term strategy for acquiring and disposing of portfolio holdings. It can also include banking, budgeting, and tax services and duties, as well.

It consists of five steps: The transfer of mandate requirements into legal documentation; agreement of terms and conditions between the asset owner and the investment manager; legal review of documentation; the approval process; and the signing of the IMA or equivalent.

IMA means an investment management agreement, typically entered into between a client and an Advisor that governs the provision of advisory services to a client by Medley Capital and the fees to be paid to the applicable Advisor for such advisory services.

An Individually Managed Account or IMA is a discretionary management agreement whereby clients delegate the day to day investment decisions and implementation of their chosen investment strategy to PPM while retaining the full beneficial ownership of their investments.

An investment agreement will set out the company's obligations and warranties to the investor in return for the funding. The investor will not usually have any input into the company's affairs unless they are also becoming a shareholder.

In signing an asset management agreement, a client gives a service provider the responsibility of managing their assets in a pre-defined way, as specified in the contract. A difference is made between a special asset management agreement and a standard asset management agreement.