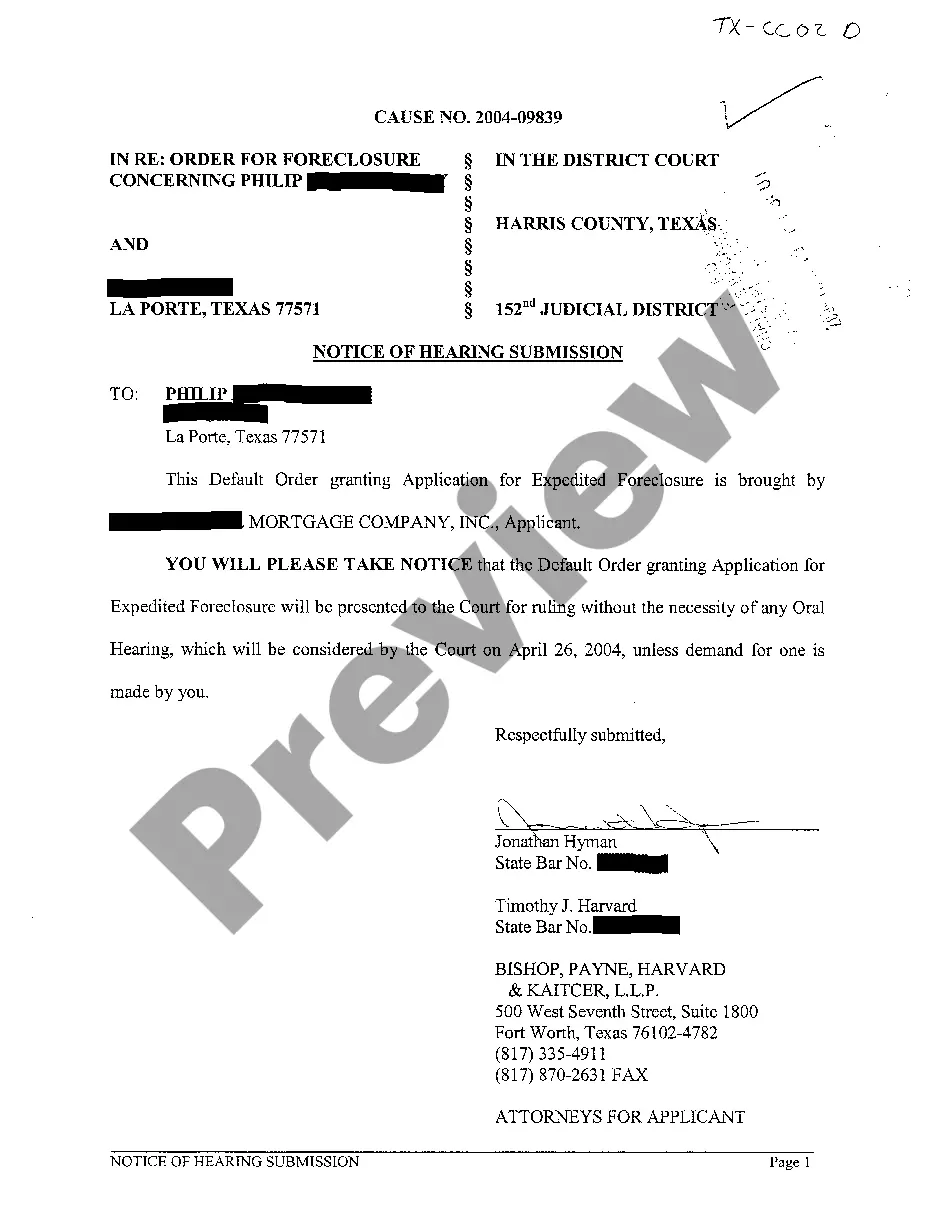

Delaware Release of Lien for Deed of Trust

Description

How to fill out Release Of Lien For Deed Of Trust?

US Legal Forms - one of the biggest libraries of legal varieties in the United States - offers a variety of legal document themes it is possible to down load or printing. While using website, you can find a huge number of varieties for company and individual reasons, sorted by classes, says, or keywords and phrases.You can find the newest types of varieties just like the Delaware Release of Lien for Deed of Trust within minutes.

If you already possess a subscription, log in and down load Delaware Release of Lien for Deed of Trust from the US Legal Forms library. The Download switch can look on every single kind you see. You gain access to all previously acquired varieties in the My Forms tab of your respective account.

If you want to use US Legal Forms for the first time, allow me to share simple guidelines to help you started out:

- Be sure you have chosen the proper kind for the area/region. Select the Preview switch to examine the form`s information. See the kind explanation to actually have chosen the appropriate kind.

- If the kind doesn`t suit your specifications, utilize the Research field near the top of the monitor to get the one that does.

- If you are content with the form, affirm your choice by clicking the Buy now switch. Then, choose the costs prepare you favor and supply your references to sign up to have an account.

- Process the transaction. Use your Visa or Mastercard or PayPal account to perform the transaction.

- Find the formatting and down load the form on the product.

- Make alterations. Load, revise and printing and indication the acquired Delaware Release of Lien for Deed of Trust.

Every web template you included with your account lacks an expiry day and it is yours permanently. So, if you would like down load or printing another duplicate, just proceed to the My Forms portion and click around the kind you require.

Get access to the Delaware Release of Lien for Deed of Trust with US Legal Forms, probably the most substantial library of legal document themes. Use a huge number of expert and status-distinct themes that fulfill your business or individual requires and specifications.

Form popularity

FAQ

(b) Notices of liens upon real property for obligations payable to the United States and certificates and notices affecting such liens shall be filed in the office of the recorder of deeds of the county or counties in which the real property subject to the liens is situated.

How to File a Delaware Mechanics Lien Prepare the lien form. Take care to include the necessary information as required by statute. ... Record the lien. ... Send a copy to the owner. ... Notify other lien holders.

Information on a tax lien is either maintained by the Secretary of State or the county tax office. Where the government records its interest depends on state law. Some states require recording certain interests at the state level.

Delaware's wiretapping law requires at least one party's consent to record both in-person conversations and electronic communications. However, there is some conflict in the laws. A more recently enacted state privacy law makes it illegal to intercept private conversations without the consent of all parties.

The Process of Transferring Property Identify the recipient or donee. Discuss the terms and conditions of the transfer with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.