Delaware Exhibit C Accounting Procedure Joint Operations

Description

How to fill out Exhibit C Accounting Procedure Joint Operations?

You may devote time on-line searching for the legal document design that fits the federal and state needs you need. US Legal Forms provides 1000s of legal kinds that happen to be evaluated by pros. It is simple to obtain or printing the Delaware Exhibit C Accounting Procedure Joint Operations from our support.

If you already have a US Legal Forms accounts, you can log in and then click the Down load button. Following that, you can complete, edit, printing, or signal the Delaware Exhibit C Accounting Procedure Joint Operations. Every legal document design you acquire is your own property for a long time. To get yet another copy of the acquired kind, check out the My Forms tab and then click the related button.

If you are using the US Legal Forms web site for the first time, keep to the simple recommendations beneath:

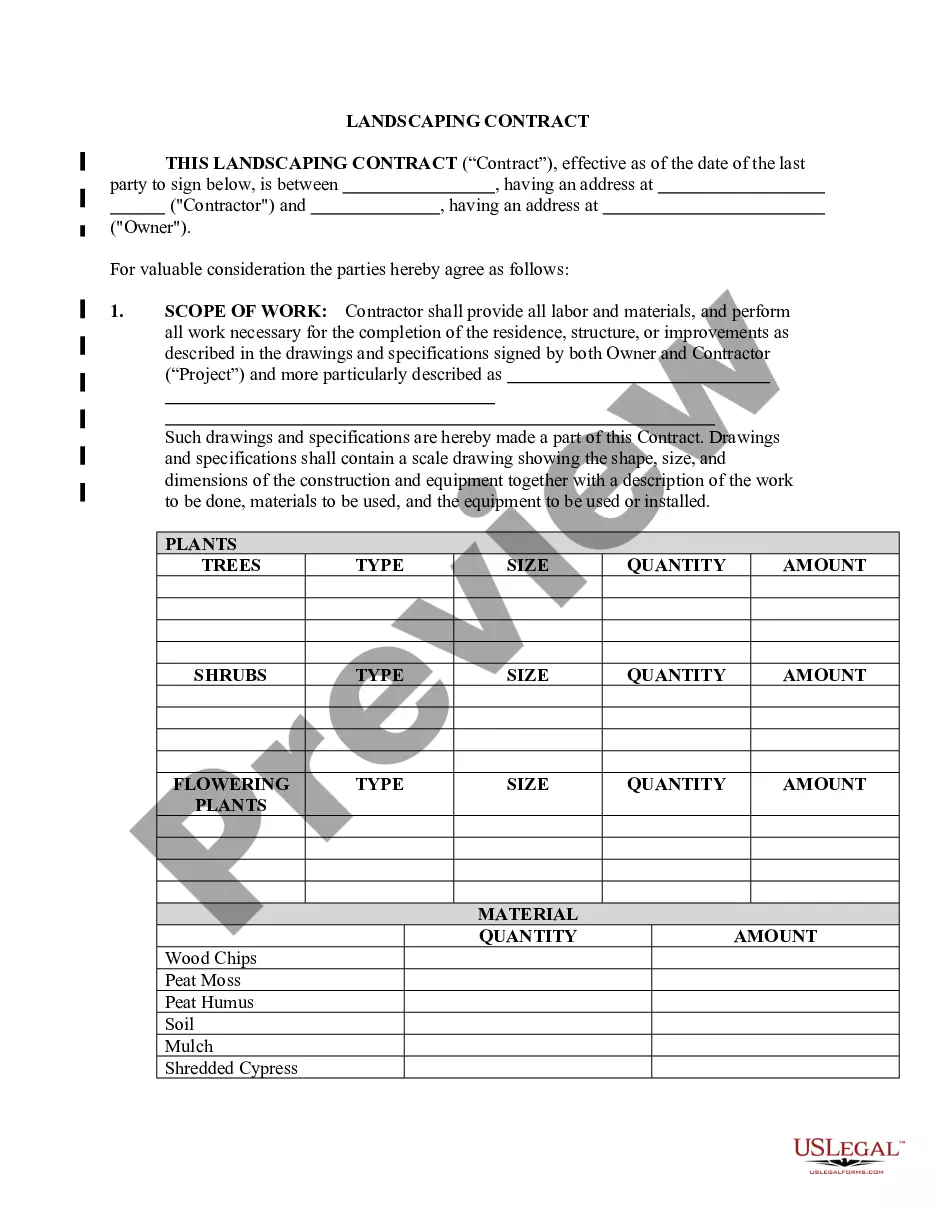

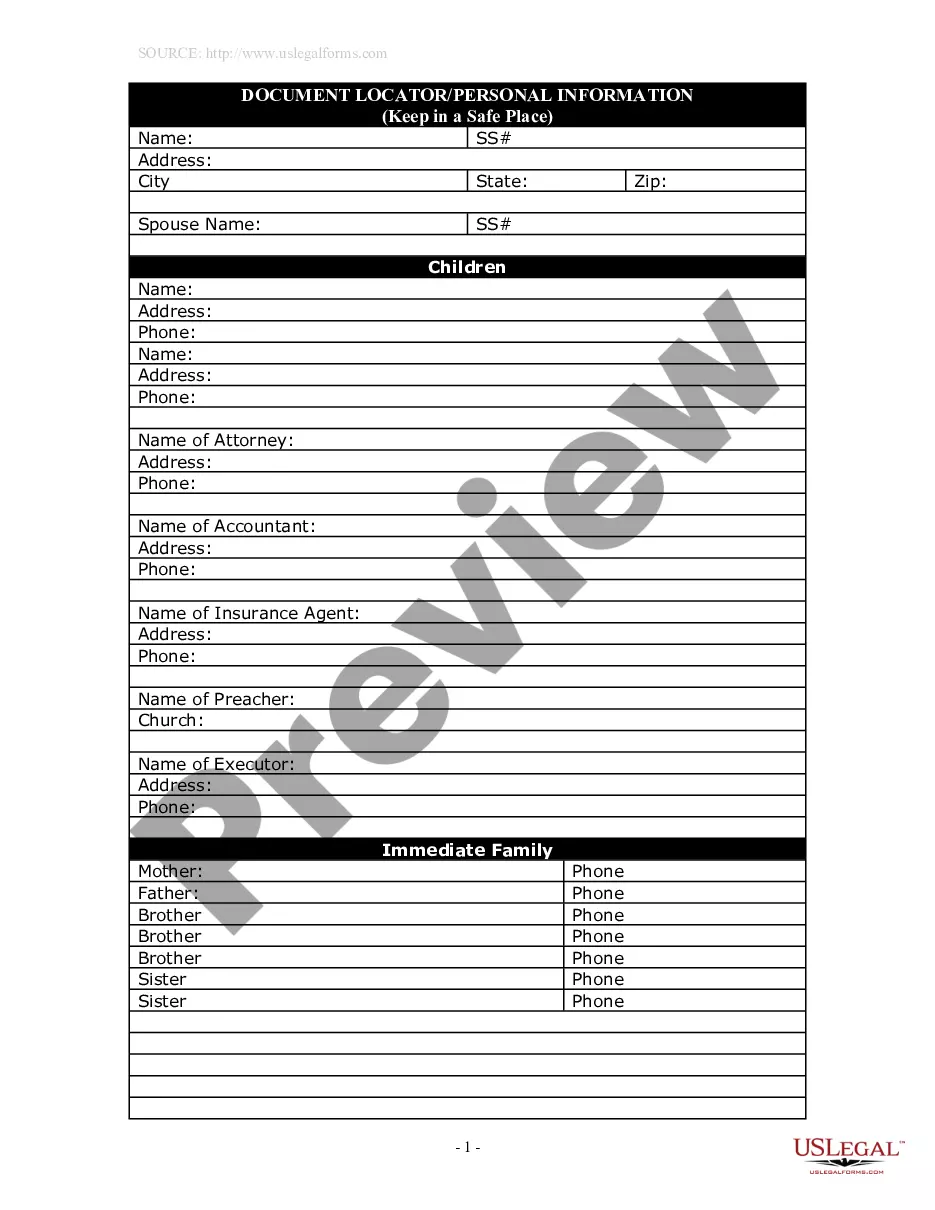

- Initial, be sure that you have selected the correct document design for that area/town of your choosing. Look at the kind outline to make sure you have chosen the appropriate kind. If accessible, utilize the Review button to search throughout the document design at the same time.

- If you want to discover yet another model in the kind, utilize the Look for discipline to get the design that meets your requirements and needs.

- Once you have identified the design you desire, simply click Acquire now to move forward.

- Choose the pricing strategy you desire, type your credentials, and register for your account on US Legal Forms.

- Comprehensive the deal. You can use your credit card or PayPal accounts to cover the legal kind.

- Choose the formatting in the document and obtain it to the system.

- Make alterations to the document if required. You may complete, edit and signal and printing Delaware Exhibit C Accounting Procedure Joint Operations.

Down load and printing 1000s of document templates utilizing the US Legal Forms Internet site, which provides the biggest collection of legal kinds. Use skilled and condition-certain templates to tackle your organization or personal requires.

Form popularity

FAQ

Appropriated Special Funds (ASF) ? A special fund that the Legislature has chosen to place under the same type of budgetary and financial controls as the State's GF. Annual budget requests must be submitted to OMB, and must be approved by the Legislature.