Delaware Design Agreement - Self-Employed Independent Contractor

Description

How to fill out Design Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a range of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can locate the most recent versions of forms like the Delaware Design Agreement - Self-Employed Independent Contractor in just moments.

If you have a subscription, Log In and download the Delaware Design Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will be visible on every document you view. You can access all previously acquired forms in the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the downloaded Delaware Design Agreement - Self-Employed Independent Contractor.

Every template you add to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Delaware Design Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

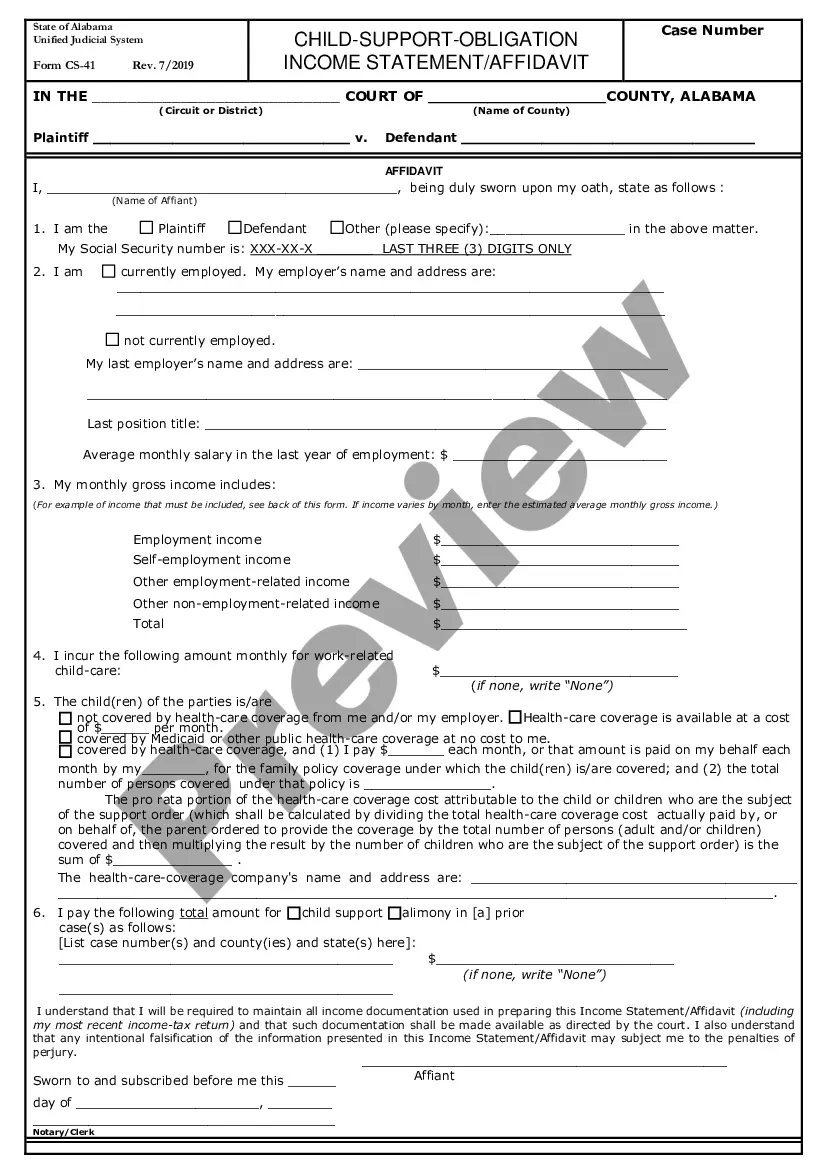

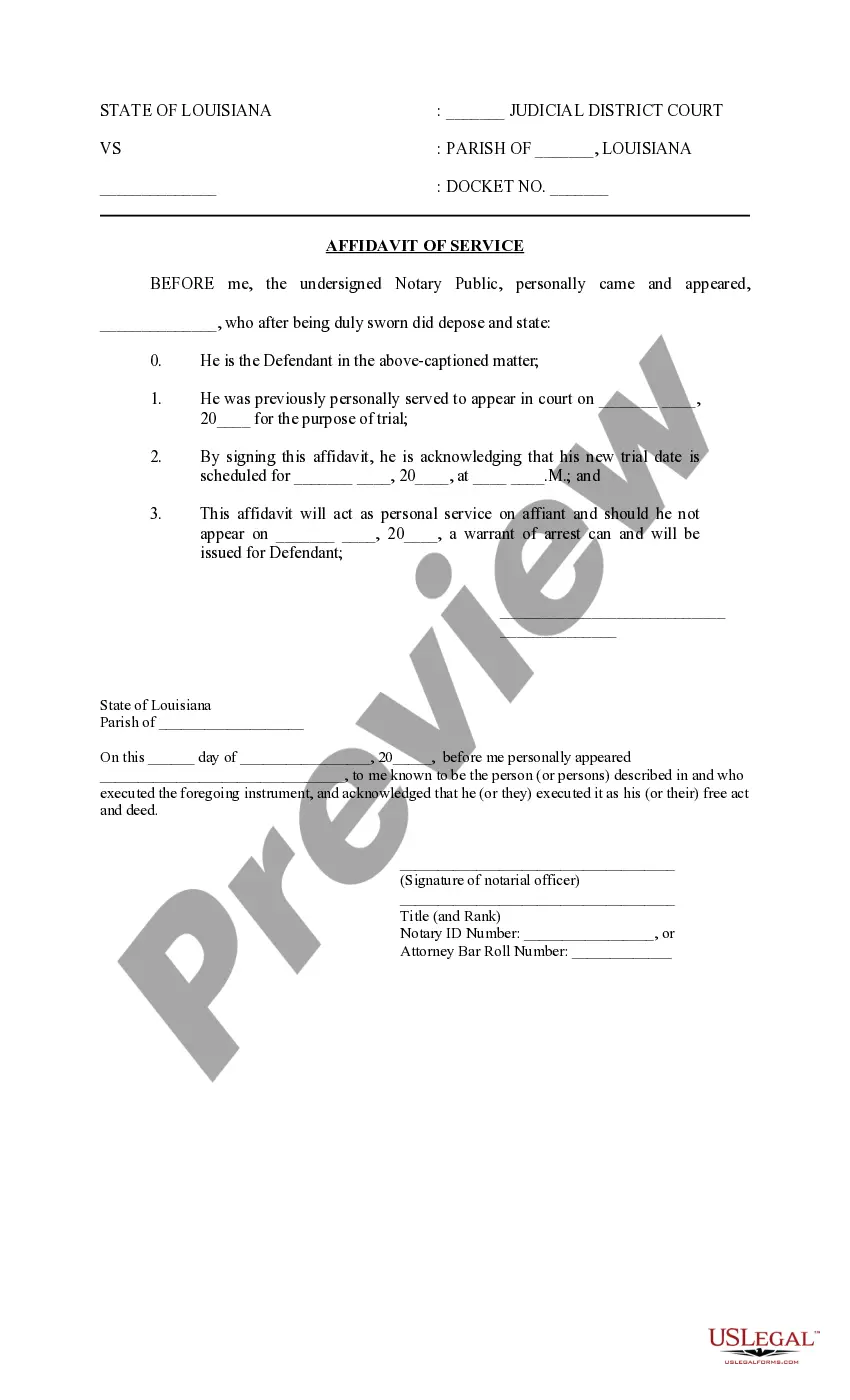

- Ensure you have selected the correct form for your state/region. Click the Preview button to review the form’s details.

- Examine the form summary to confirm that you have selected the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose your preferred payment plan and provide your information to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Yes, independent contractors must file as self-employed individuals. This classification means they report their earnings and expenses on their personal tax returns. A Delaware Design Agreement - Self-Employed Independent Contractor can help clarify the working relationship and assist with tax considerations. Proper documentation keeps everything transparent and compliant.

Typically, the hiring party drafts the independent contractor agreement. However, both parties can collaborate to ensure it meets their needs and addresses specific terms. Utilizing a Delaware Design Agreement - Self-Employed Independent Contractor template can streamline this process. It equips users with a solid foundation while minimizing misunderstandings.

Yes, you can write your own legally binding contract, but it is essential to ensure that it meets all legal requirements. A Delaware Design Agreement - Self-Employed Independent Contractor can serve as a strong guideline to ensure that you include all necessary terms. You should be aware of key components such as consideration, acceptance, and capacity to contract. Consider using platforms like US Legal Forms for templates and insights to help you draft a comprehensive agreement.

To create a robust independent contractor agreement, start by clearly defining the scope of work. Include important details such as payment terms, deadlines, and confidentiality clauses to protect both parties. Utilizing a Delaware Design Agreement - Self-Employed Independent Contractor template can simplify the process, ensuring that you cover all necessary factors. This approach provides a solid foundation while allowing you to customize elements based on your specific needs.

Writing an independent contractor agreement involves drafting clear terms for the agreement. Start with the identification of the parties involved and then describe the services to be rendered. Include payment terms, deadlines, and any confidentiality clauses. For assistance, you can refer to a Delaware Design Agreement - Self-Employed Independent Contractor template from uslegalforms, making the process straightforward.

Filling out a declaration of independent contractor status form requires accurate information about your work arrangement. Begin by providing your name, address, and the nature of your work. Clearly state that you are self-employed and outline the services you offer. Resources from uslegalforms can assist you in completing this form correctly, ensuring it meets legal requirements.

To fill out an independent contractor form, start by entering your personal details, including your name and address. Next, specify the nature of the services you will provide and include payment details. Make sure to review the form for accuracy. Consider using the Delaware Design Agreement - Self-Employed Independent Contractor forms available on uslegalforms for guidance and efficiency.

As an independent contractor, you typically need to complete several important documents. These include a W-9 form to provide your Taxpayer Identification Number and an independent contractor agreement. Additionally, if applicable, you may need to submit a declaration of independent contractor status form. Utilizing tools from uslegalforms can help you ensure you have all necessary paperwork.

Filling out an independent contractor agreement involves several key steps. First, ensure you clearly identify the parties involved, including contact information. Then, outline the scope of work, payment terms, and timelines. Using a Delaware Design Agreement - Self-Employed Independent Contractor template from uslegalforms can simplify this process, providing you with a solid foundation.