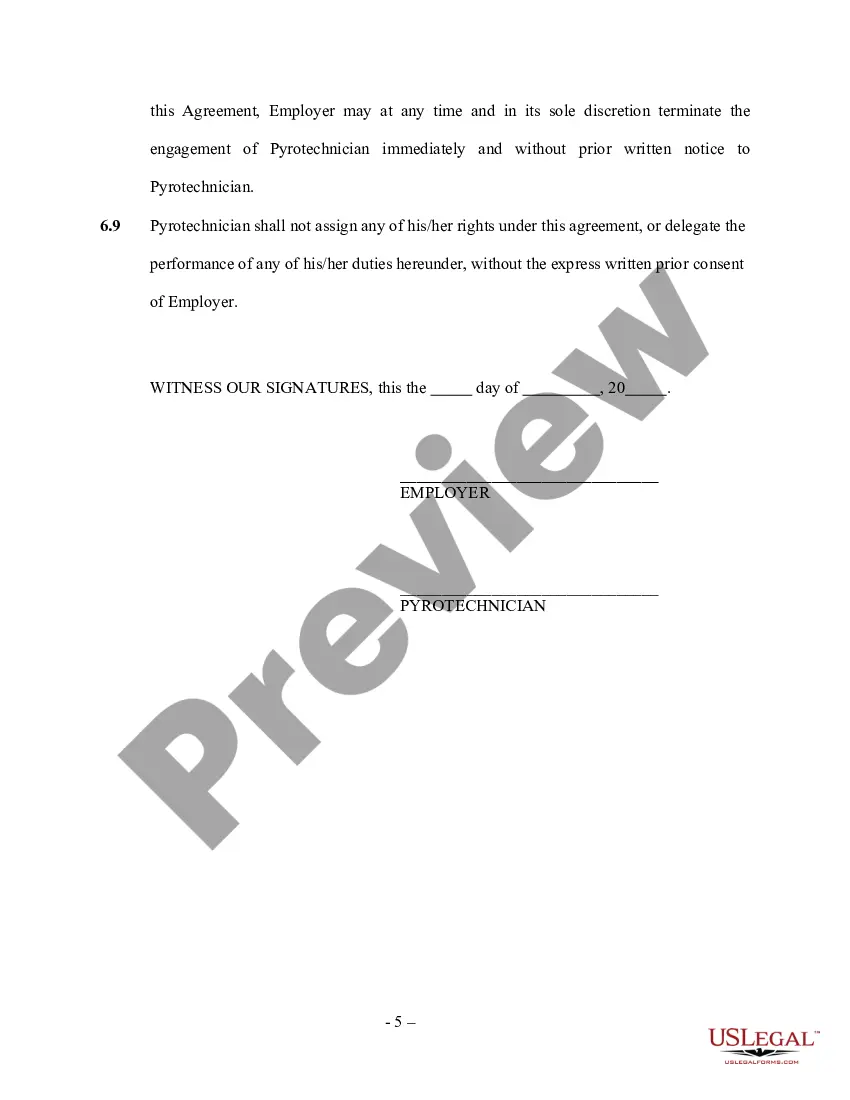

Delaware Self-Employed Independent Contractor Pyrotechnician Service Contract

Description

How to fill out Self-Employed Independent Contractor Pyrotechnician Service Contract?

If you intend to total, obtain, or create valid document templates, utilize US Legal Forms, the largest selection of legal forms, available online.

Employ the site's straightforward and user-friendly search to locate the documents you need.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you desire, click the Purchase now button. Choose the payment plan you prefer and enter your credentials to register for the account.

Step 5. Complete the transaction. You may use your Visa or MasterCard or PayPal account to finalize the payment. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Delaware Self-Employed Independent Contractor Pyrotechnician Service Contract. Every legal document template you purchase is yours forever. You have access to every form you downloaded within your account. Click the My documents section and select a form to print or download again. Stay competitive and acquire, and print the Delaware Self-Employed Independent Contractor Pyrotechnician Service Contract with US Legal Forms. There are many professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to locate the Delaware Self-Employed Independent Contractor Pyrotechnician Service Contract within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to find the Delaware Self-Employed Independent Contractor Pyrotechnician Service Contract.

- You can also access forms you previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

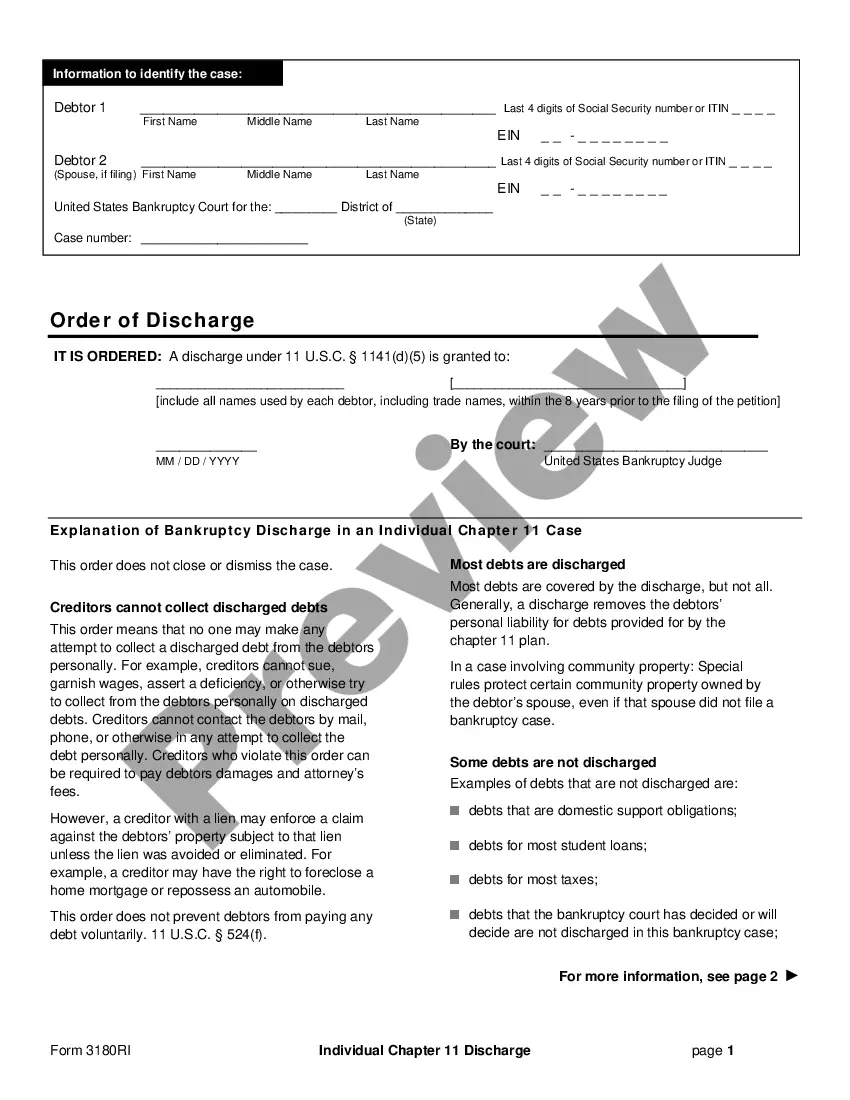

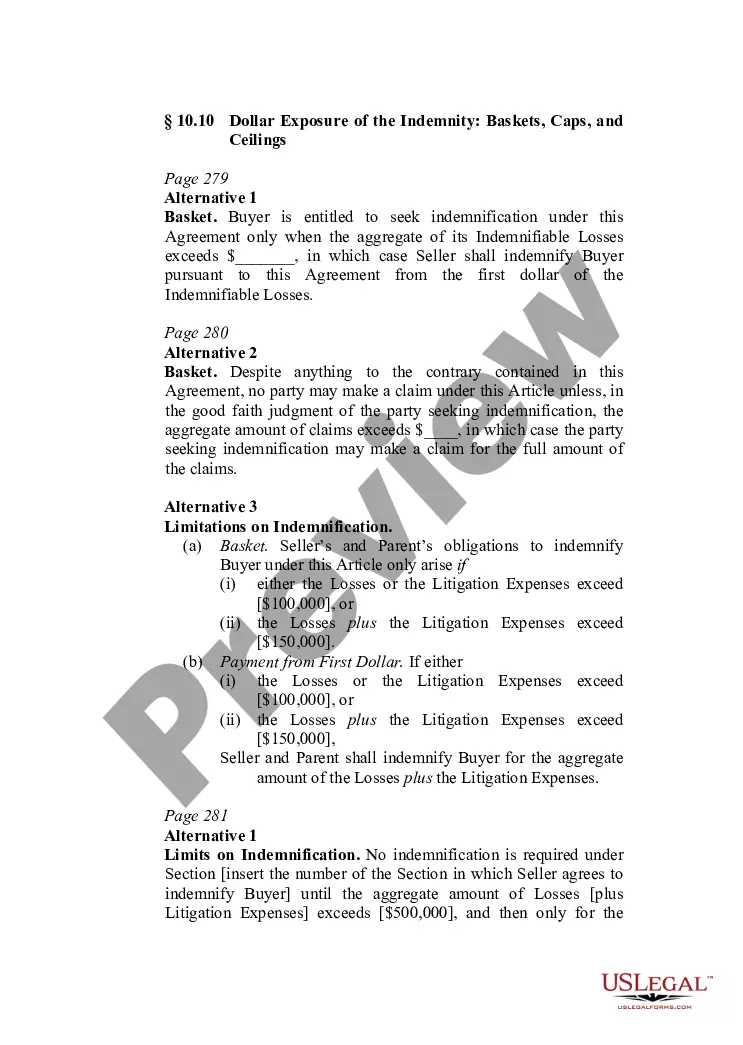

- Step 2. Utilize the Preview option to review the form's content. Remember to read through the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Yes, a 1099 independent contractor is generally considered self-employed. This classification highlights your status as an individual running your own business, which is particularly relevant for those working as Delaware Self-Employed Independent Contractor Pyrotechnicians. Understanding this distinction can help you manage your taxes and obligations more effectively.

In some cases, you can operate as an independent contractor without a specific license, but it depends on the type of work you do. While some fields may not require a license, obtaining a Delaware Self-Employed Independent Contractor Pyrotechnician Service Contract is crucial to define your terms. Always verify your local requirements to ensure you meet all necessary regulations.

Yes, if you are working as an independent contractor in Delaware, you need to register your business. This registration legitimizes your work and can open doors to additional benefits and protection. Platforms like uslegalforms can assist you in creating the right Delaware Self-Employed Independent Contractor Pyrotechnician Service Contract to ensure compliant operations.

Delaware does not specifically require a contractor license for all types of contractors; however, certain contractors may need additional licenses based on their work. For instance, if you're a Delaware Self-Employed Independent Contractor Pyrotechnician, it’s wise to verify if you need any special permits or licenses for your specific projects. This clarity can save you time and potential legal issues.

In Delaware, any individual or entity that plans to conduct business activities within the state typically needs a business license. This includes professionals like Delaware Self-Employed Independent Contractor Pyrotechnicians, who must adhere to state regulations. Ensuring you have the correct licensing helps avoid fines and keeps your business running smoothly.

A business permit is often required for specific activities, such as operating a food truck or running a construction business, while a business license is a general authorization to operate a business within a certain jurisdiction. If you're looking to operate as a Delaware Self-Employed Independent Contractor Pyrotechnician, you may need both, depending on your activities. Always check local regulations to ensure compliance.

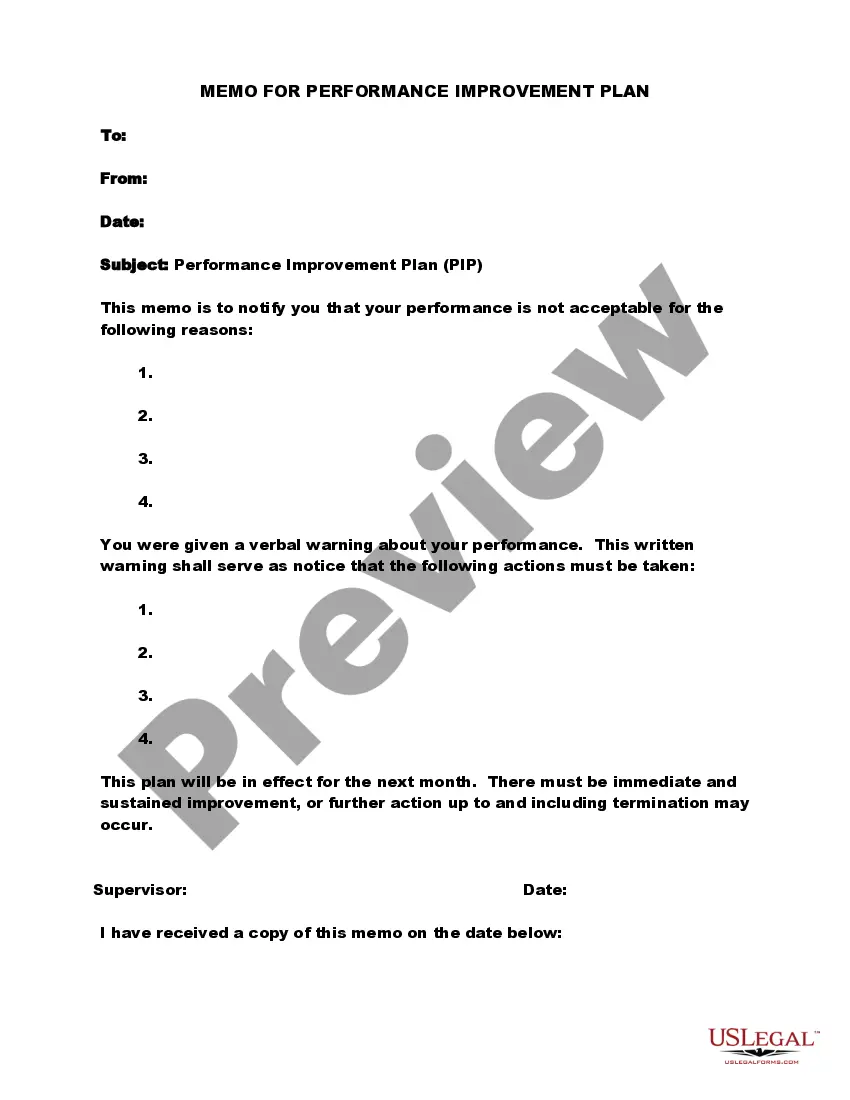

Writing an independent contractor agreement involves summarizing all key details of the work arrangement. Begin with an introduction stating the parties involved followed by a detailed description of services, payment conditions, and deadlines. It's beneficial to include confidentiality and termination clauses as well. Utilizing a Delaware Self-Employed Independent Contractor Pyrotechnician Service Contract template from USLegalForms can simplify this process.

To fill out an independent contractor agreement, start with the basic identifying information, including the names and addresses of both parties. Then, define the scope of work, payment terms, and timeline for services. After outlining the terms, ensure to include any specific clauses that pertain to your needs. For a comprehensive guide, consider using a Delaware Self-Employed Independent Contractor Pyrotechnician Service Contract template from USLegalForms.

To become authorized as an independent contractor in the US, begin by registering your business and obtaining any required licenses. This often involves filling out forms and providing necessary documentation. For professionals in specialized fields, like pyrotechnics, make sure to follow federal and state regulations that govern your services. Utilizing platforms such as uslegalforms can guide you through the process of creating a legal and comprehensive Delaware Self-Employed Independent Contractor Pyrotechnician Service Contract.

Creating an independent contractor contract is a straightforward process. To start, outline the scope of work and specify payment terms, including deadlines. Include details about confidentiality and any necessary licenses. Using a template, like those provided by uslegalforms, can simplify this process, ensuring that your Delaware Self-Employed Independent Contractor Pyrotechnician Service Contract meets legal standards.