Delaware Attorney Agreement - Self-Employed Independent Contractor

Description

How to fill out Attorney Agreement - Self-Employed Independent Contractor?

Are you in the placement where you need to have files for possibly business or personal reasons nearly every working day? There are tons of lawful record themes available on the net, but getting kinds you can rely isn`t straightforward. US Legal Forms delivers a huge number of kind themes, such as the Delaware Attorney Agreement - Self-Employed Independent Contractor, which can be written in order to meet federal and state needs.

In case you are currently acquainted with US Legal Forms web site and have a merchant account, simply log in. Next, you may download the Delaware Attorney Agreement - Self-Employed Independent Contractor design.

If you do not come with an profile and want to begin using US Legal Forms, adopt these measures:

- Obtain the kind you will need and ensure it is for your appropriate town/area.

- Utilize the Preview switch to examine the shape.

- See the description to ensure that you have selected the correct kind.

- When the kind isn`t what you`re trying to find, use the Research field to obtain the kind that meets your requirements and needs.

- Whenever you find the appropriate kind, just click Get now.

- Opt for the rates strategy you desire, fill in the specified information to make your money, and pay money for the transaction with your PayPal or charge card.

- Select a practical file formatting and download your copy.

Discover all of the record themes you possess purchased in the My Forms menu. You can obtain a more copy of Delaware Attorney Agreement - Self-Employed Independent Contractor whenever, if required. Just go through the essential kind to download or print out the record design.

Use US Legal Forms, the most substantial variety of lawful kinds, to save some time and stay away from errors. The assistance delivers expertly manufactured lawful record themes which you can use for a variety of reasons. Produce a merchant account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

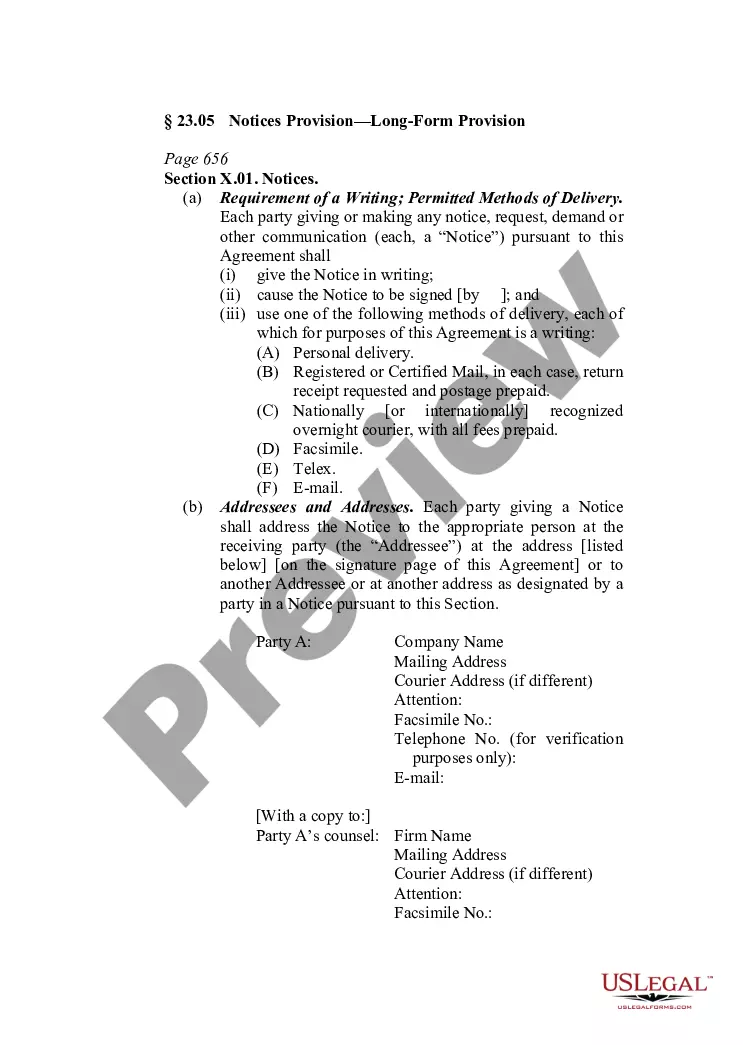

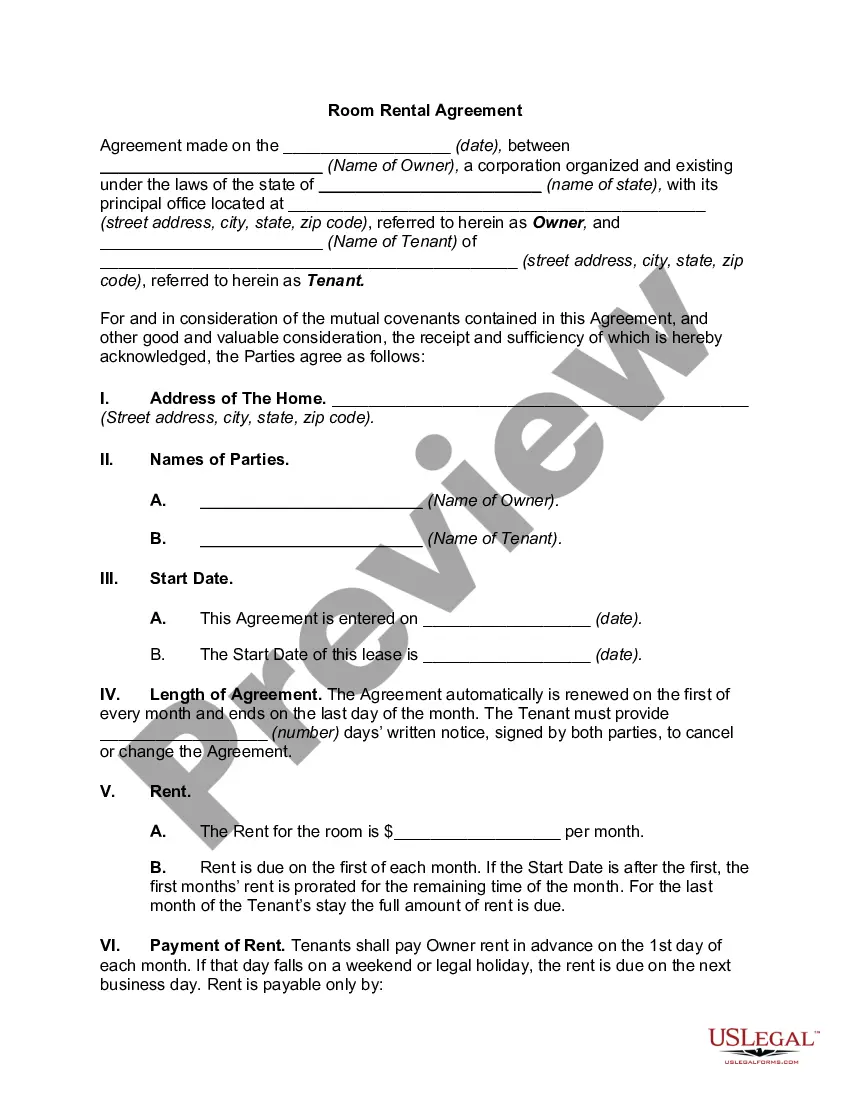

A contract should contain everything agreed upon by you and your licensed contractor. It should detail the work, price, when payments will be made, who gets the necessary building permits, and when the job will be finished. The contract also must identify the contractor, and give their address and license number.

How to Write a Contractor Agreement Outline Services Provided. The contractor agreement should list all services the contractor will provide. ... Document Duration of the Work. Specify the duration of the working relationship. ... Outline Payment Terms. ... Outline Confidentiality Agreement. ... Consult with a Lawyer.

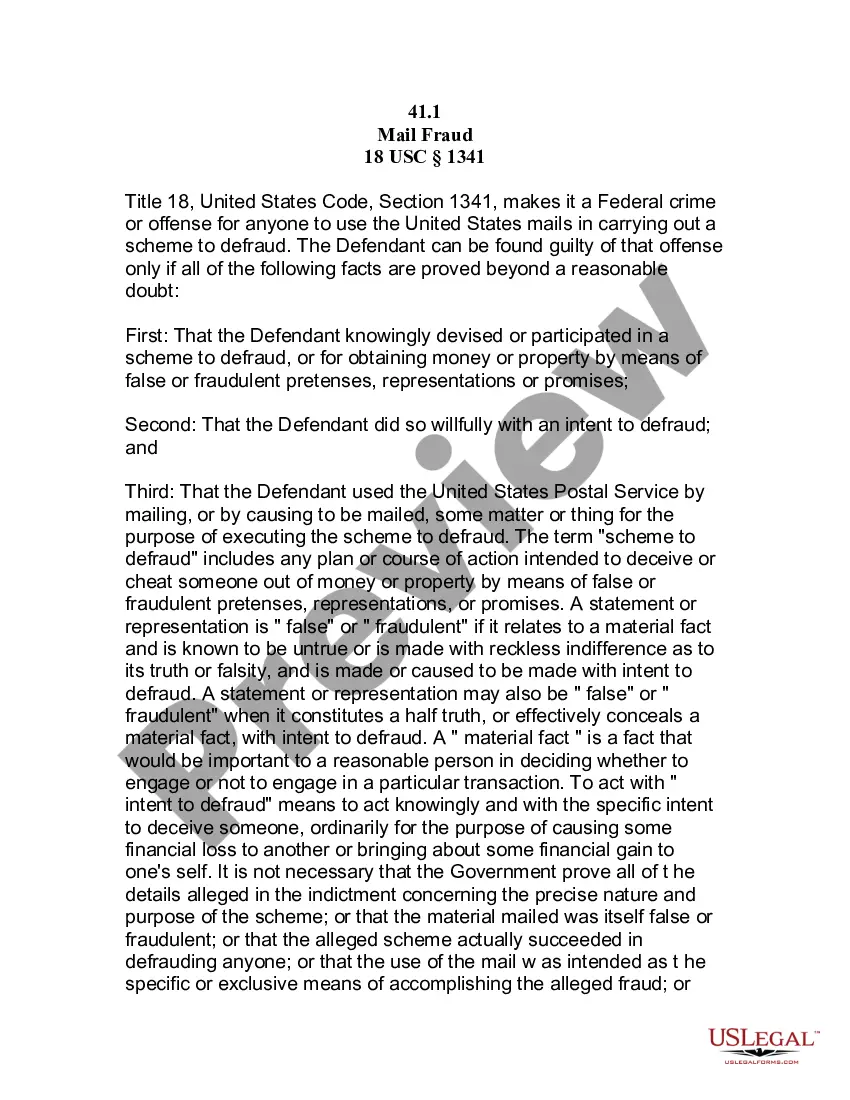

Yes, you can deduct self-employment tax as a business expense. It's actually one of the most common self-employment tax deductions. The self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings.

Terms to include in an independent contractor agreement General information about the parties. ... Scope of work and deliverables. ... Equipment and facilities. ... Compensation. ... Reimbursement policies. ... Benefits and liability exclusion. ... Termination. ... Indemnification clause.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

As a self-employed individual, you're required to report all income. If your net earnings are over $400, then you'll have to pay self-employment taxes using Schedule SE . You'll need to submit the 1099-NEC when you file your taxes, but remember, estimated tax payments are usually required throughout the year.

Self-employed income is calculated by adding up all the income recorded on your. This includes 1099-NEC, 1099-MISC and 1099-K forms. The total earned income is then subject to the independent contractor tax rate of 15.3%.

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed. For more information on your tax obligations if you are self-employed (an independent contractor), see our Self-Employed Individuals Tax Center.