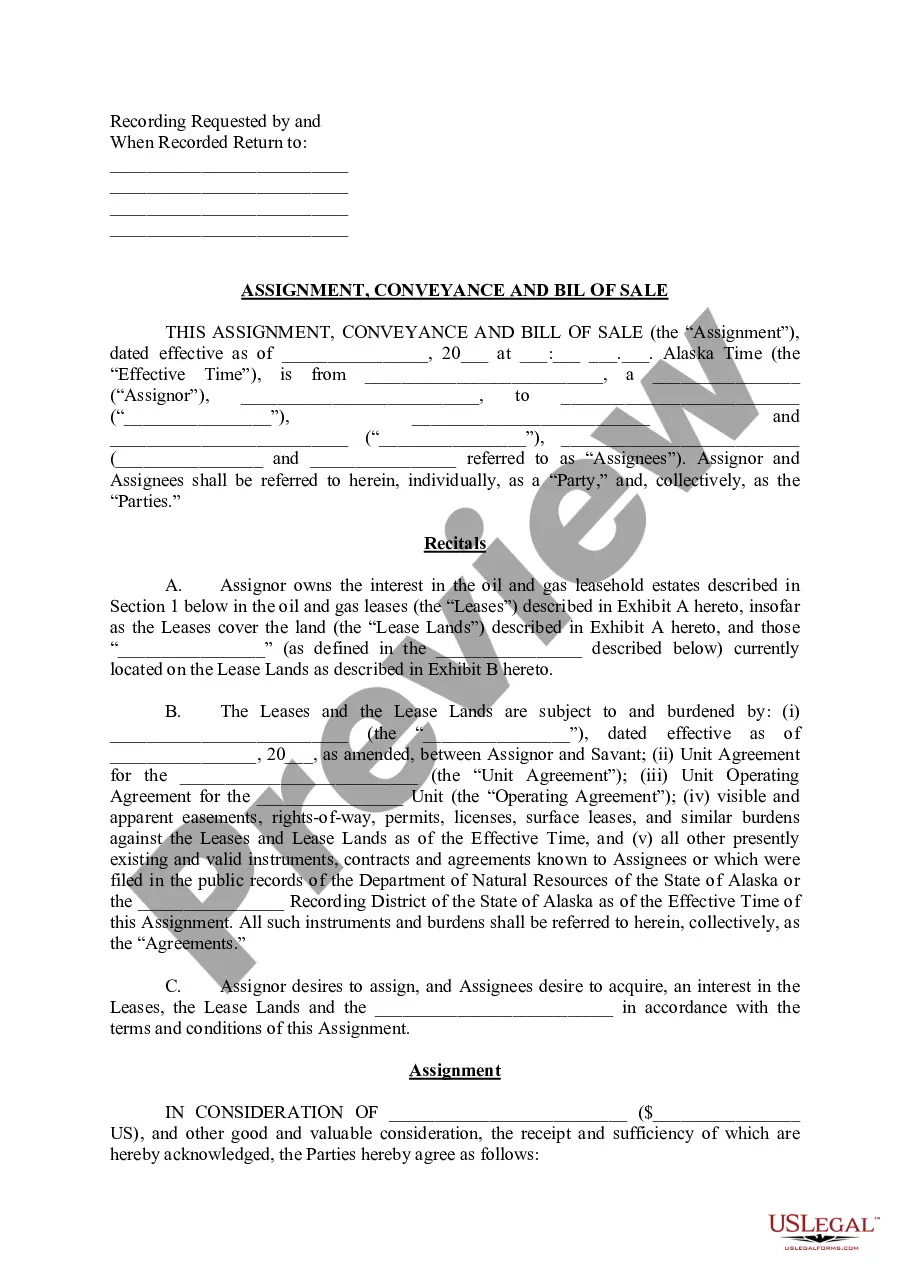

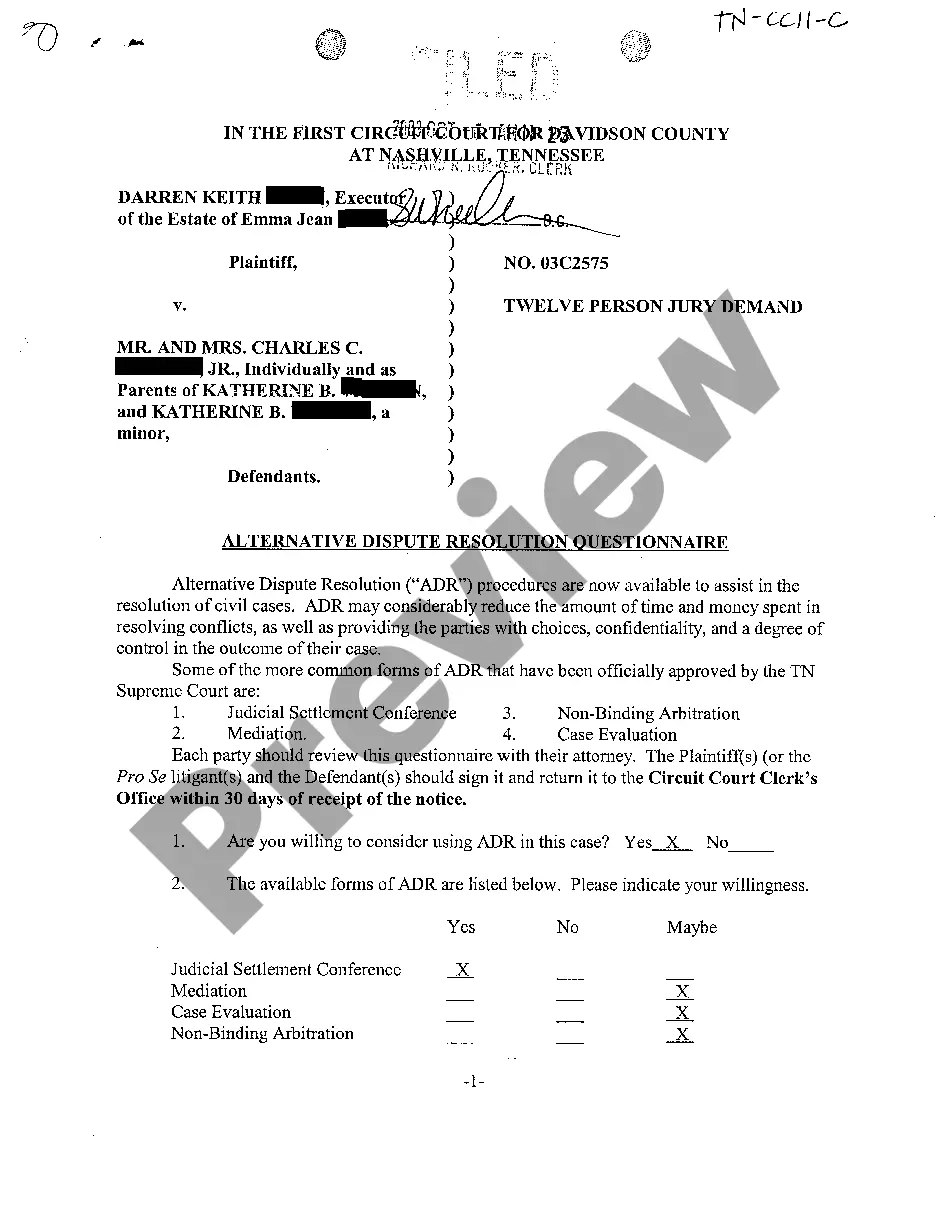

Delaware Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Summary Of Terms Of Proposed Private Placement Offering?

Choosing the best authorized papers template might be a have a problem. Naturally, there are a lot of web templates available on the net, but how do you get the authorized kind you want? Take advantage of the US Legal Forms internet site. The assistance offers 1000s of web templates, like the Delaware Summary of Terms of Proposed Private Placement Offering, that you can use for organization and private requires. All of the kinds are checked by professionals and meet state and federal demands.

If you are previously authorized, log in in your accounts and click the Down load key to find the Delaware Summary of Terms of Proposed Private Placement Offering. Utilize your accounts to look from the authorized kinds you might have bought formerly. Proceed to the My Forms tab of your accounts and have yet another copy in the papers you want.

If you are a fresh end user of US Legal Forms, listed here are straightforward guidelines so that you can comply with:

- Initial, ensure you have chosen the appropriate kind for the metropolis/county. It is possible to look over the form while using Preview key and look at the form information to guarantee it will be the right one for you.

- If the kind fails to meet your preferences, use the Seach industry to discover the right kind.

- When you are certain the form is proper, go through the Get now key to find the kind.

- Choose the prices plan you would like and enter in the essential information. Build your accounts and pay money for your order making use of your PayPal accounts or credit card.

- Pick the file file format and down load the authorized papers template in your gadget.

- Total, revise and printing and sign the attained Delaware Summary of Terms of Proposed Private Placement Offering.

US Legal Forms may be the most significant library of authorized kinds in which you can discover numerous papers web templates. Take advantage of the company to down load professionally-created papers that comply with status demands.

Form popularity

FAQ

A private placement is a security that's sold to an investor. Some common examples of private placements include: Real Estate Investment Trusts (REITs) Non-Traded REITs.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

??? ????????? ??????? ?? ? ?????? ?? ??? ????????? ???? ?????????? ??? ??? ??? ?????? ??? ????? ???????? ???????. ??? ????????? ??????? ?????? ?? ??????? ?? ?????? ?????????.

Executive Summary An overarching goal in this section of the private placement is to give investors an overview of the transaction, the high level structure of the investment and details on the market and opportunities.

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.