Delaware Shared Earnings Agreement between Fund & Company

Description

used as a substitute for equity-like structures like a SAFE, convertible note, or equity. It is not debt, doesn't have a fixed repayment schedule, doesn't require a personal guarantee."

How to fill out Shared Earnings Agreement Between Fund & Company?

Choosing the right legitimate document template could be a have a problem. Of course, there are a variety of templates available online, but how will you get the legitimate kind you want? Use the US Legal Forms internet site. The service delivers thousands of templates, for example the Delaware Shared Earnings Agreement between Fund & Company, that can be used for organization and private requires. Every one of the kinds are checked by experts and satisfy state and federal needs.

Should you be already registered, log in to your accounts and click on the Download option to have the Delaware Shared Earnings Agreement between Fund & Company. Use your accounts to search through the legitimate kinds you have bought in the past. Proceed to the My Forms tab of the accounts and obtain another copy in the document you want.

Should you be a fresh consumer of US Legal Forms, here are easy guidelines so that you can stick to:

- Initially, make sure you have chosen the proper kind to your town/state. You are able to look over the shape using the Review option and look at the shape outline to make sure it will be the best for you.

- In case the kind does not satisfy your requirements, utilize the Seach area to find the appropriate kind.

- When you are certain the shape is suitable, select the Buy now option to have the kind.

- Opt for the pricing prepare you need and enter the necessary information. Create your accounts and buy an order using your PayPal accounts or charge card.

- Select the submit formatting and obtain the legitimate document template to your device.

- Comprehensive, modify and print out and sign the acquired Delaware Shared Earnings Agreement between Fund & Company.

US Legal Forms is definitely the most significant catalogue of legitimate kinds in which you can discover various document templates. Use the service to obtain appropriately-manufactured files that stick to state needs.

Form popularity

FAQ

State Only Return Requirements ? The Delaware e-file program: Supports federal/state (piggyback) filing and state-only filing through the Federal/State Electronic Filing Program (Modernized e-File System). Allows electronic filing of part-year and nonresident returns. Delaware State Tax Return Information - Support TaxSlayer Pro ? en-us ? articles ? 36... TaxSlayer Pro ? en-us ? articles ? 36...

For faster turnaround times, citizens are encouraged to file their taxes online at tax.delaware.gov or through other electronic filing programs. Requesting refunds by direct deposit will also improve refund processing. Division of Revenue - Department of Finance - State of Delaware delaware.gov delaware.gov

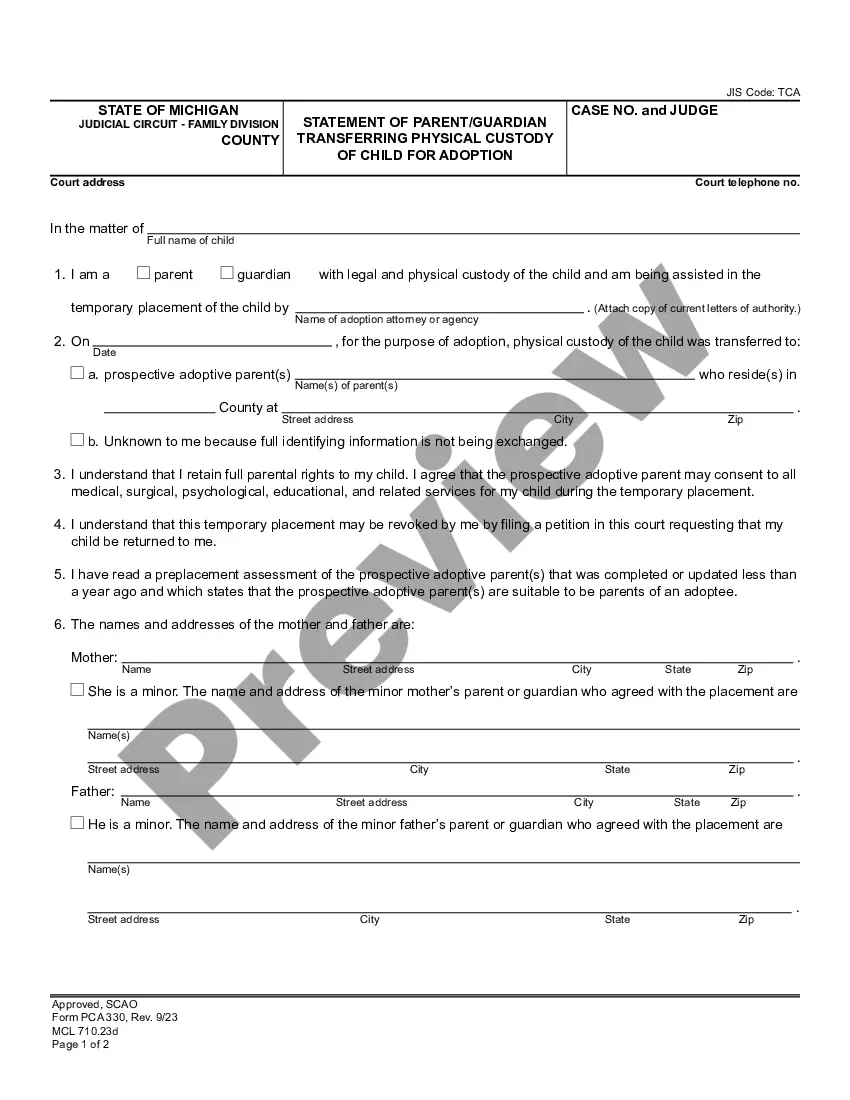

Form 300 is a partnership tax return that is used to reconcile income and expenses within and outside of Delaware. This tax return is filed in addition to Form 1065, which is used to report income on Federal level.

Delaware Individual Non-Resident and Amended Income Tax Form (PIT-NON) ? Fillable Form: this form will allow you to download, enter figures and calculate. Delaware Individual Non-Resident Income Tax Form Schedule (PIT-NNS) Delaware Individual Non-Resident Schedule A Form (PIT-NSA)

The Division of Revenue links for online filing options are available at . Electronic filing is fast, convenient, accurate and easy. When completing a form electronically, please download the form prior to completing it to obtain the best results.

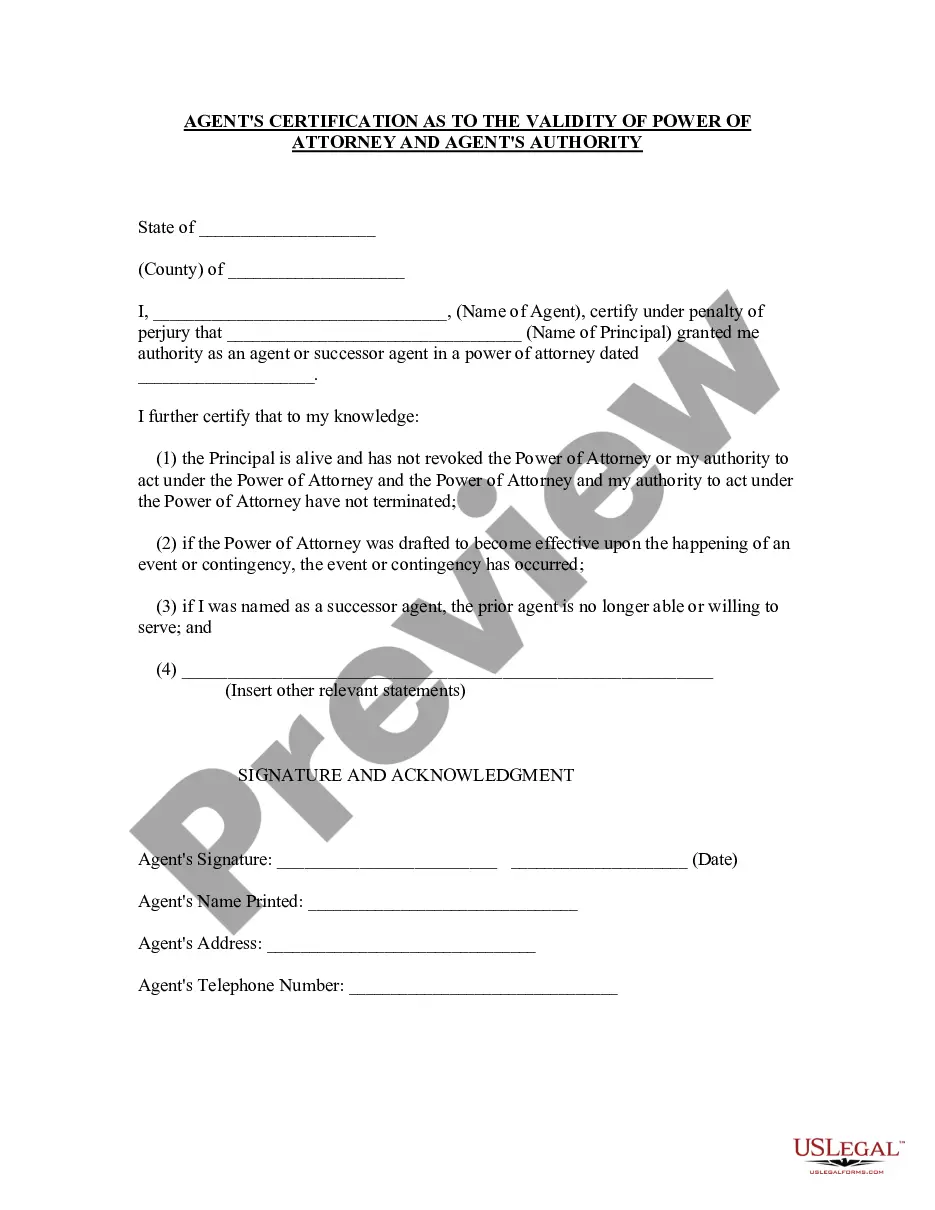

A Delaware tax power of attorney (Form 2848) is a paper submission that can be used to designate an agent to represent the principal in front of the Delaware Division of Revenue.

Income, gains, losses and deductions connected with any business, trade, commerce, profession or vocation carried on in Delaware must be included in a nonresident's Delaware source income.

Delaware does not impose a state or local sales tax, but does impose a gross receipts tax on the seller of goods (tangible or otherwise) or provider of services in the state.

Personal Income Tax forms are available for photocopying at many Delaware public libraries. Please contact your local library branch for availability. You may download and print Personal Income Tax Forms and Business Tax Forms directly from our website, or call (302) 577-8209 to have forms mailed to you. Paper Tax Forms - Division of Revenue - State of Delaware delaware.gov ? paper-tax-forms delaware.gov ? paper-tax-forms

Non-Residents ? File a tax return if you have any gross income during the tax year from sources in Delaware. If your spouse files a married filing separate return and you had no Delaware source income, you do NOT need to file a Delaware return.