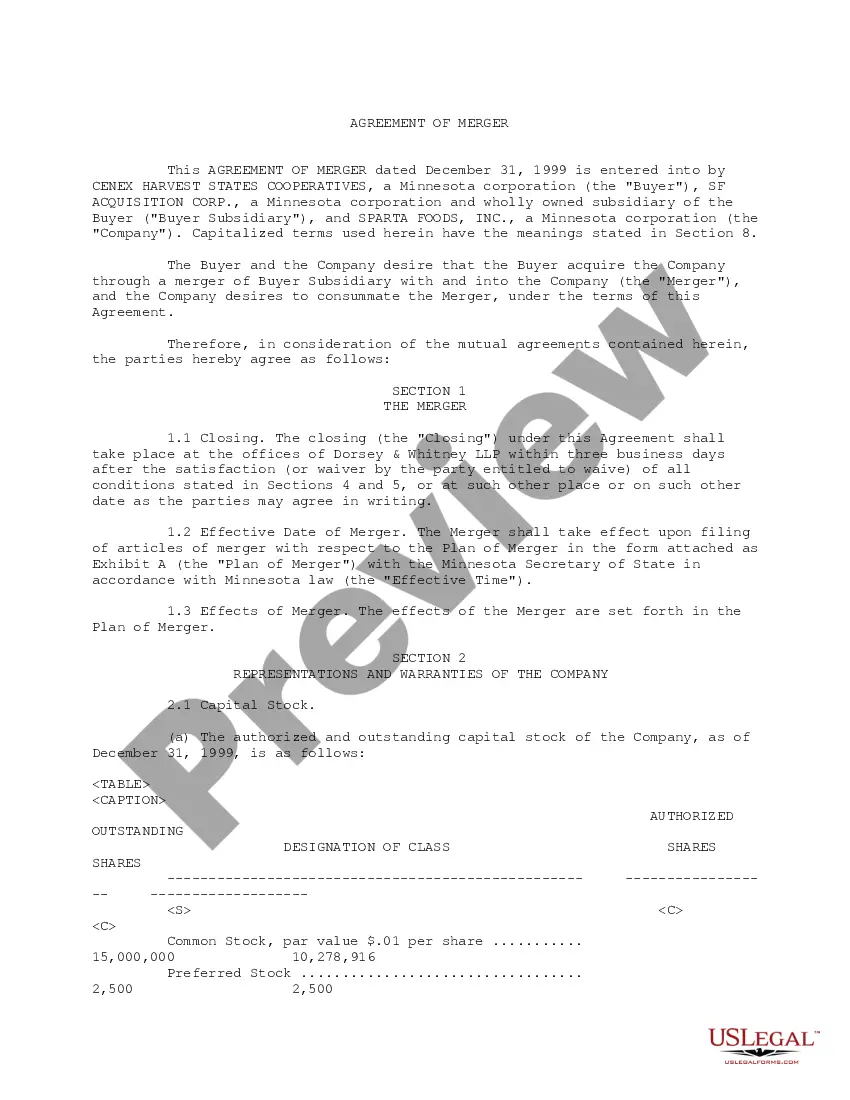

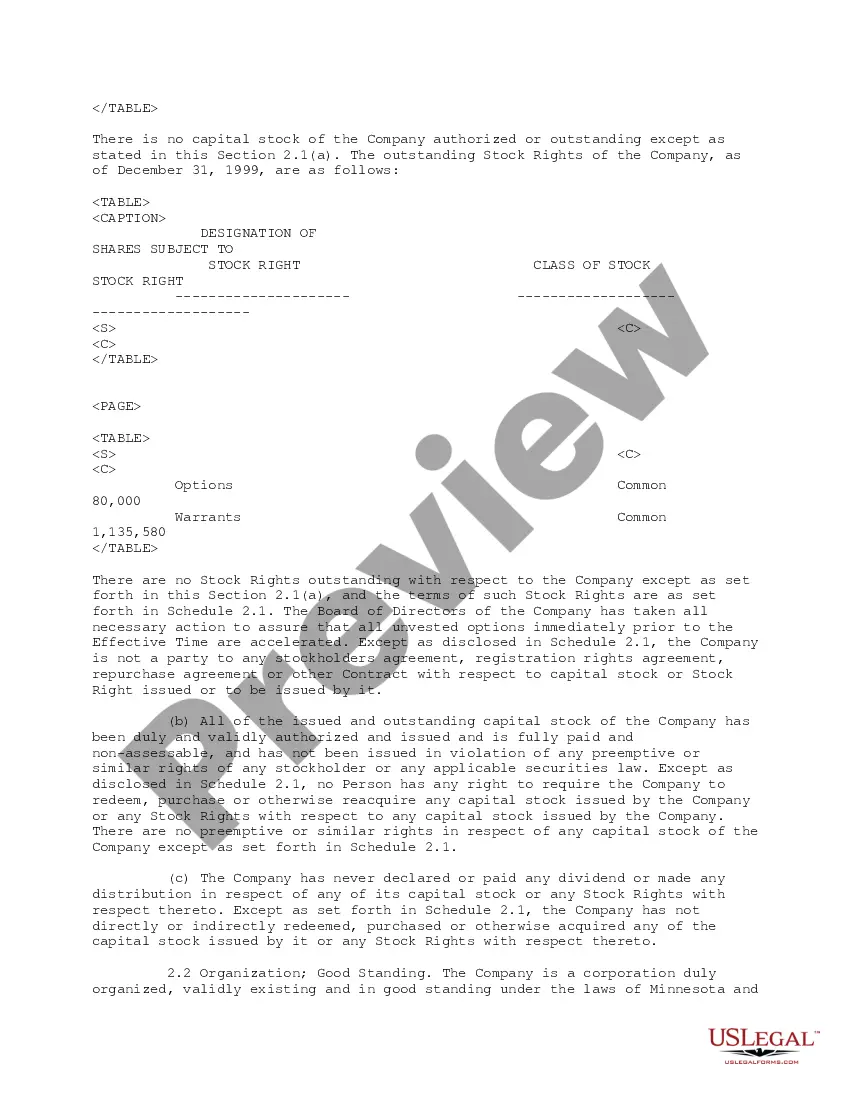

Delaware Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.

Description

How to fill out Merger Agreement Between Cenex Harvest States Cooperative, SF Acquisition Corporation And Sparta Foods, Inc.?

Finding the right lawful record format could be a battle. Obviously, there are plenty of templates available on the net, but how do you discover the lawful form you need? Use the US Legal Forms internet site. The support gives thousands of templates, such as the Delaware Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc., which can be used for organization and private requires. All the varieties are checked by specialists and meet federal and state demands.

In case you are already registered, log in for your profile and then click the Down load switch to obtain the Delaware Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.. Make use of profile to look with the lawful varieties you might have ordered previously. Go to the My Forms tab of your respective profile and have an additional duplicate from the record you need.

In case you are a fresh consumer of US Legal Forms, allow me to share straightforward recommendations that you can stick to:

- First, make certain you have selected the appropriate form to your city/region. It is possible to examine the shape utilizing the Preview switch and browse the shape description to guarantee this is basically the best for you.

- In case the form will not meet your needs, use the Seach industry to discover the correct form.

- When you are positive that the shape would work, click on the Acquire now switch to obtain the form.

- Pick the rates program you want and type in the required information. Build your profile and pay for the transaction using your PayPal profile or charge card.

- Pick the document file format and obtain the lawful record format for your system.

- Comprehensive, revise and print out and indication the obtained Delaware Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc..

US Legal Forms may be the most significant collection of lawful varieties for which you can find different record templates. Use the service to obtain skillfully-made files that stick to express demands.

Form popularity

FAQ

The first step is the tender (or exchange) offer, where the buyer seeks to achieve a majority ownership, and the second step seeks to get ownership to 100%. In this step, the acquirer needs to reach a certain ownership threshold that legally empowers it to squeeze out minority shareholders (illustrated below).

A merger structure comprised of a newly created holding company with two subsidiaries, with one subsidiary merging into buyer as the survivor and the other subsidiary merging into target as the survivor. The goal of this structure is to keep the stock portion of the deal's consideration tax-free.

Transactions involving only a statutory merger often are referred to as ?one-step? transactions, while transactions involving a tender or exchange offer followed by a back-end merger often are referred to as ?two-step? transactions.

In the first step, the buyer initiates a tender offer to acquire at least a majority of the outstanding target company's stock. In the second step, the buyer completes a back-end merger to acquire the balance of the target company's stock.

Short-form merger The short form is a type of ?friendly? merger that can be used to combine two LLCs in Delaware. The state of Delaware also approved the consolidation of a Delaware non-corporate entity as the parent and a subsidiary in which the parent accounts for a minimum of 90% outstanding shares per stock class.

The two-step merger is quicker to execute since no proxy period or SEC approval is required, but the disadvantage is that the buyer needs a large percentage of the shares tendered. Regulation M-A requires that a summary term sheet be provided to investors as part of the disclosures made in a tender offer or merger.