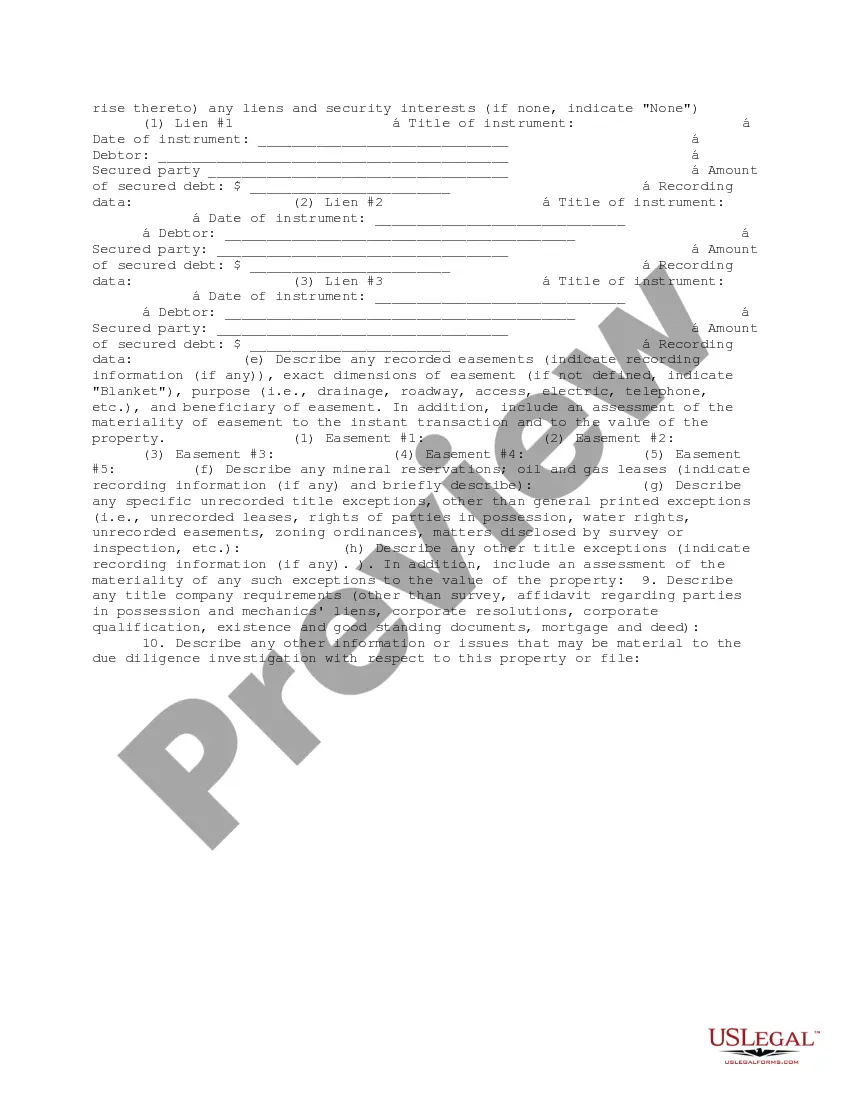

This due diligence workform is used to review property information and title commitments and policies in business transactions.

Delaware Fee Interest Workform

Description

How to fill out Fee Interest Workform?

Are you presently in a situation where you require documents for occasional organization or specific needs almost every workday.

There are numerous reliable document templates accessible online, but locating versions you can trust isn't straightforward.

US Legal Forms offers thousands of form templates, including the Delaware Fee Interest Workform, which are designed to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are currently familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Delaware Fee Interest Workform template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct jurisdiction.

- Use the Review option to examine the form.

- Check the details to confirm you have selected the correct form.

- If the form isn't what you're looking for, use the Research section to find the form that meets your needs and specifications.

- Once you locate the appropriate form, click Acquire now.

- Choose the payment plan you wish, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Delaware Fee Interest Workform at any time, if desired. Simply go through the necessary form to retrieve or print the document template.

Form popularity

FAQ

Yes, you can file Delaware state taxes online using the state's e-filing system. This process supports quick and secure submissions, allowing you to manage all tax-related documents efficiently. If you have questions about specific filings like the Delaware Fee Interest Workform, U.S. Legal Forms offers valuable resources to guide you through the process.

To obtain a copy of your Delaware Annual Report, you can visit the Delaware Division of Corporations' website. Here, you can request your report online, making it easy and quick. If you're managing your filings with the Delaware Fee Interest Workform, consider using tools like U.S. Legal Forms to access necessary documents efficiently.

Delaware does offer e-file forms, including those associated with the Delaware Fee Interest Workform. These forms can be filled out and submitted online, streamlining the filing process. To use e-file effectively, visit the appropriate Delaware state agency’s website for instructions and requirements.

Yes, e-filing remains a convenient option for many forms, including those concerning the Delaware Fee Interest Workform. This method allows you to submit your documents quickly and securely through authorized electronic channels. If you're considering e-filing, make sure you are using the latest version of the required forms for a seamless experience.

Certain forms, including specific legal documents and tax forms, cannot be submitted electronically. For instance, some traditional paper forms must be filed by mail. If you need to file documents related to the Delaware Fee Interest Workform, be sure to check the requirements carefully. This ensures you avoid delays and complications in processing.

The Delaware Annual Report fee is typically included in the franchise tax for most business entities, including LLCs. It is essential to submit this report annually to avoid potential penalties. The Delaware Fee Interest Workform assists you in completing the reporting requirements smoothly and accurately.

The annual fee for an LLC in Delaware is generally $300, which includes the franchise tax. This fee is necessary to keep your business legally compliant and active in Delaware's business environment. Leveraging the Delaware Fee Interest Workform can help you manage this annual fee efficiently.

The annual report fee in Delaware varies based on the type of business entity you have. For LLCs, this fee is typically included in the overall annual franchise tax. By utilizing the Delaware Fee Interest Workform, you streamline the reporting process, making it easier to stay on top of your obligations.

Yes, Delaware has a state withholding form that employers must use to manage employee taxes. This form ensures the correct amount of tax is withheld from wages. For those dealing with interest income, the Delaware Fee Interest Workform can help outline how much needs to be reported and what withholding applies, making tax administration smoother.

Yes, Delaware does tax interest income as part of its broader income tax structure. This means residents must include interest earnings when filing state taxes. To navigate this process effectively, the Delaware Fee Interest Workform can provide a helpful framework for declaring your interest income accurately.