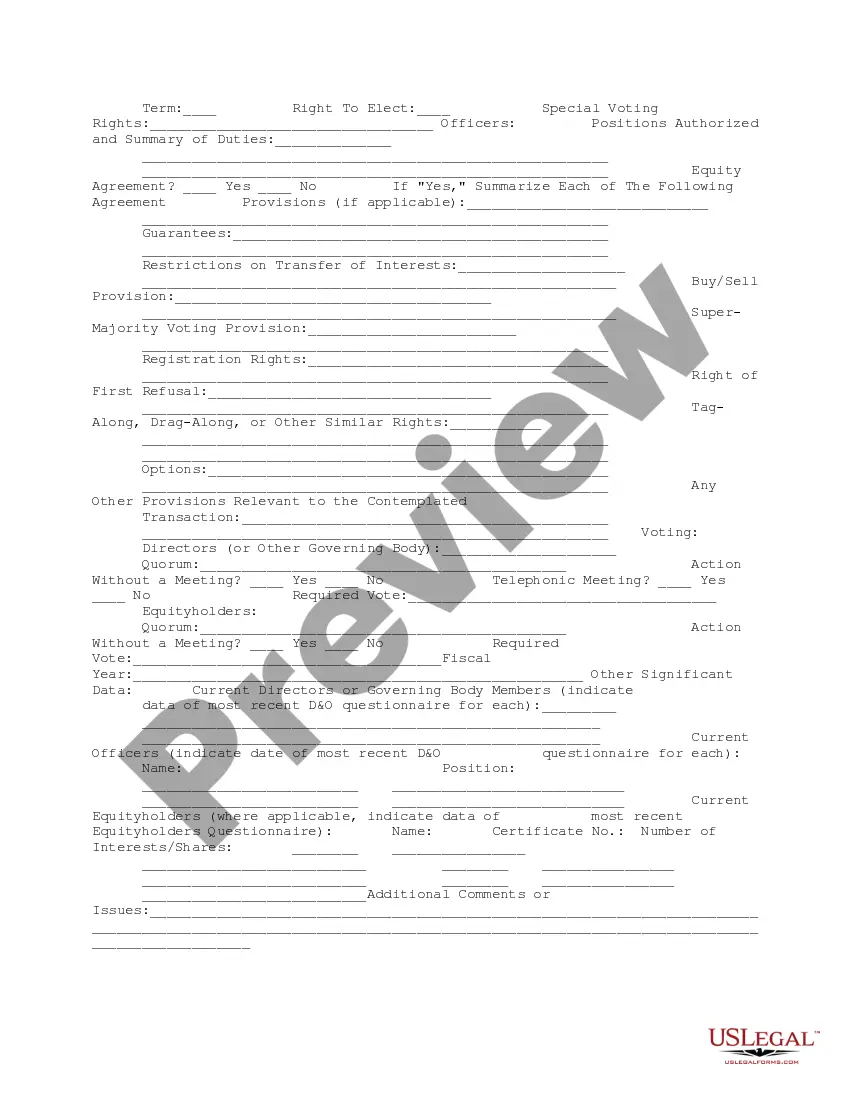

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

Delaware Company Data Summary

Description

How to fill out Company Data Summary?

Selecting the appropriate official documents template can be a challenge.

Of course, there are numerous templates available on the web, but how do you find the official form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Delaware Company Data Summary, which you can use for business and personal purposes.

You can view the form using the Preview button and read the form description to confirm it is the right one for you.

- All of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to access the Delaware Company Data Summary.

- Use your account to browse the official forms you have previously obtained.

- Visit the My documents section of your account to get another copy of the documents you need.

- If you are a new customer of US Legal Forms, here are some simple steps to follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

The UCC filing process in Delaware is crucial for businesses that wish to secure their interests in personal property. To file, businesses need to submit a UCC-1 form, which serves as a public notice of a secured interest. By completing this process, companies can protect their rights and ensure they have priority over competing claims. Accessing a detailed Delaware Company Data Summary can provide essential guidance throughout this process.

The Delaware business tax loophole allows companies to benefit from low or no state taxes on certain types of income. Many businesses choose to incorporate in Delaware to take advantage of these favorable tax laws. This strategy can significantly reduce a company's overall tax burden, making it appealing for entrepreneurs. Understanding these advantages requires a solid grasp of the Delaware Company Data Summary.

Yes, Delaware requires LLCs to file an annual report, but the filing process is straightforward. While the Delaware Company Data Summary provides essential information about an LLC, the annual report ensures compliance with state regulations. This report includes details like current business address and management structure. To simplify the process, uslegalforms offers tools and guidance to assist you in completing the annual report with ease.

To determine who legally owns a business in Delaware, you can request a Delaware Company Data Summary. This summary typically includes the names of the registered agents and any other individuals associated with the business. For more comprehensive ownership details, consider using the services offered by uslegalforms, which can help you navigate the required inquiries effectively.

To find business information in Delaware, you can visit the Delaware Division of Corporations' website. They provide access to a Delaware Company Data Summary that outlines essential details about businesses registered in the state. This data includes information on formations, good standing status, and filing history. You can easily search by business name or entity number to get the information you need.

No, the ownership information for Delaware LLCs is typically not public. While you cannot view the names of the owners directly, you can access other helpful details using the Delaware Company Data Summary. This summary can provide necessary insights that support your understanding of the LLC's operations and standing in Delaware.

To search Delaware business entity records, visit the Delaware Division of Corporations' online search portal. There, you can enter the entity name or file number to access basic information. For a more thorough analysis, consider utilizing a Delaware Company Data Summary, which can provide detailed insights beyond what is available in the basic search.

In Delaware, the names of LLC members are generally not publicly accessible. This confidentiality is one of the appealing features of forming an LLC in Delaware. However, while specific member names may not be listed, the Delaware Company Data Summary can still provide valuable insights into the LLC's overall structure and compliance status.

Absolutely, you can conduct a Delaware business search online through the Delaware Division of Corporations' website. The search tool allows you to find information about various entities, including their status and formation data. Using a Delaware Company Data Summary can enhance your research by providing more extensive information about the business.

Yes, Delaware LLCs are required to file an annual report, although the details may differ from those of corporations. This report typically includes basic information about the LLC and updates any essential changes. Relying on a Delaware Company Data Summary can help ensure you stay informed about compliance requirements and deadlines.