This due diligence form is a worksheet and checklist that is used for gathering in formation about the current status of individual immigrant and nonimmigrant employees that the acquiring company hopes to retain following the business transactions.

Delaware Foreign Employee Status Worksheet and Document Checklist

Description

How to fill out Foreign Employee Status Worksheet And Document Checklist?

Are you currently in a position where you require documents for both business or personal purposes nearly every day.

There are numerous legal document templates available online, but locating reliable versions can be challenging.

US Legal Forms provides a wide array of form templates, including the Delaware Foreign Employee Status Worksheet and Document Checklist, which are designed to comply with state and federal regulations.

Once you find the correct form, click on Get now.

Select the pricing plan you prefer, complete the required information to create your account, and finalize the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Delaware Foreign Employee Status Worksheet and Document Checklist template.

- If you do not have an account and wish to use US Legal Forms, follow these instructions.

- Retrieve the necessary form and ensure it is for the correct city/county.

- Utilize the Preview button to review the form.

- Check the details to confirm you have chosen the appropriate form.

- If the form does not meet your expectations, use the Search field to find the form that suits your preferences.

Form popularity

FAQ

Delaware requires non-residents to file a return only if they meet certain income thresholds from Delaware sources. The specific amounts may vary based on the type of income and individual circumstances. The Delaware Foreign Employee Status Worksheet and Document Checklist can assist you in determining whether you need to file based on your income.

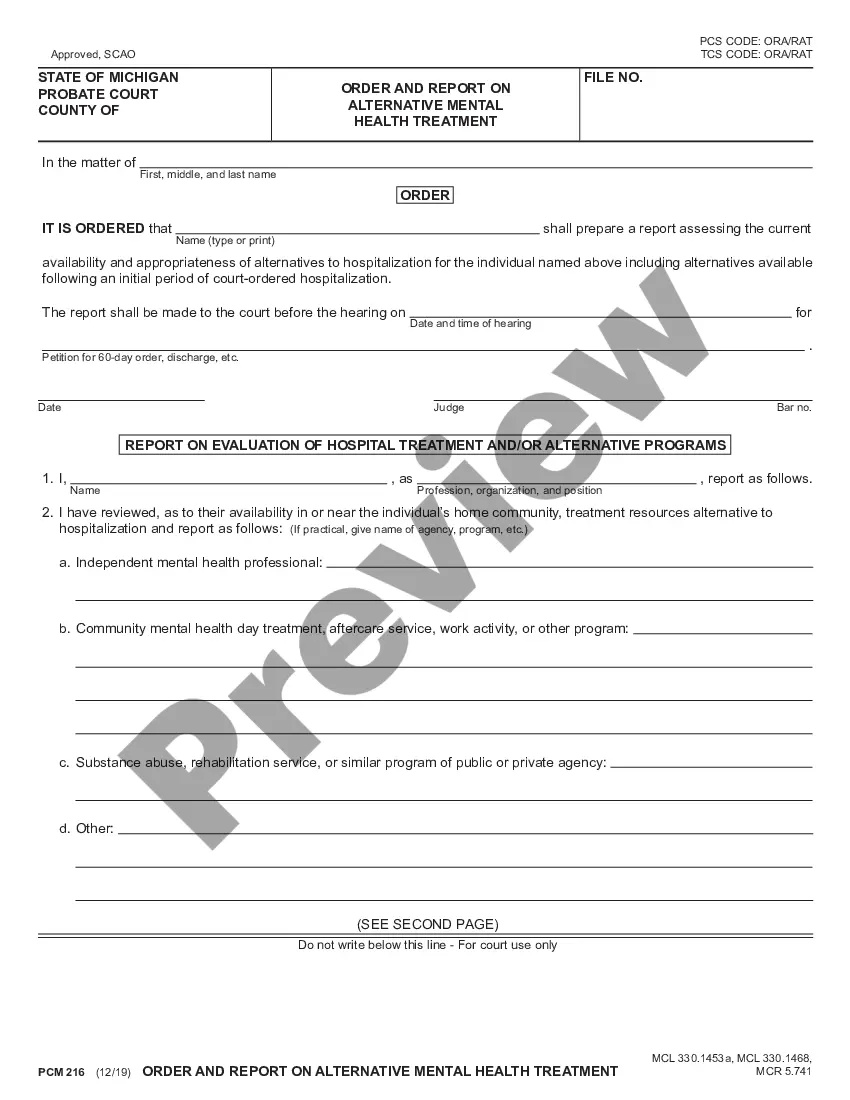

Employers must verify the employment eligibility of their workers by presenting documents such as a U.S. passport, a permanent resident card, or an EAD. According to federal law, completing Form I-9 is also essential in the process. As you gather these documents, refer to your Delaware Foreign Employee Status Worksheet and Document Checklist to ensure compliance.

The I-765 form is an application for employment authorization in the United States, typically necessary for individuals seeking an Employment Authorization Document (EAD). The I-766 is the actual EAD issued to individuals who have successfully completed the I-765 application process. Understanding these differences is crucial as you prepare your Delaware Foreign Employee Status Worksheet and Document Checklist.

To register your business in Delaware, you must file a Certificate of Registration of a Foreign Limited Liability Company with the Delaware Division of Corporations (DOC). You can download a copy of the application form from the SOS website.

Charter documents are essentially the formation documents of a company, such as the Articles of Incorporation or Articles of Organization.

To register a foreign LLC in Delaware, you must file a Delaware Certificate of Registration of a Foreign Limited Liability Company with the Delaware Division of Corporations. You can submit this document by mail, in person, or online.

Generally, there are no restrictions on foreign ownership of a company formed in the United States. The procedure for a foreign citizen to form a company in the US is the same as for a US resident. It is not necessary to be a US citizen or to have a green card to own a corporation or LLC.

To register a foreign corporation in Delaware, you must file a Delaware Foreign Corporation Certificate with the Delaware Division of Corporations. You can submit this document by mail, fax, or in person. The Foreign Corporation Certificate for a foreign Delaware corporation costs $245 to file.

The answer is, yes, anyone in the world can form a Delaware LLC! The state of Delaware does not restrict non-U.S. residents from owning or managing Delaware LLCs, nor do they require any physical presence in the state of Delaware, or even within the U.S., for that matter.

A Foreign Corporation is a term used in the United States for an existing corporation that is registered to do business in a state or jurisdiction other than where it was originally incorporated.