Delaware Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission

Description

How to fill out Notice Of Violation Of Fair Debt Act - Letter To The Federal Trade Commission?

You might spend multiple hours online trying to locate the valid document template that fulfills the federal and state requirements you need.

US Legal Forms offers a vast collection of valid forms that are evaluated by experts.

It is easy to access or download the Delaware Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission from their services.

If you wish to get another version of the document, use the Search field to find the template that fits your needs and requirements.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- Afterward, you can fill out, edit, print, or sign the Delaware Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission.

- Every valid document template you buy is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, make sure you have chosen the correct document template for your desired state/city.

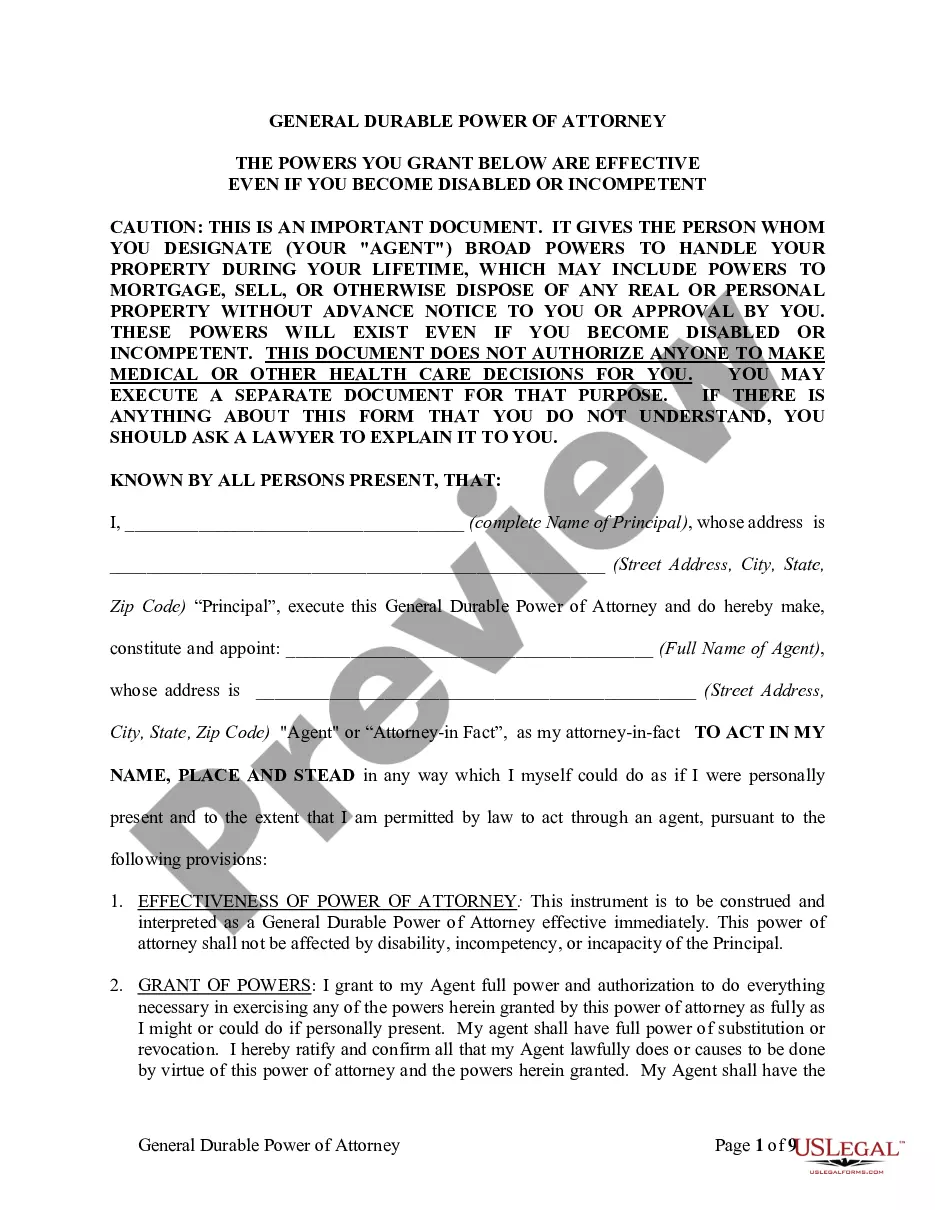

- Read the form description to confirm you have selected the right document.

- If available, utilize the Preview button to review the document template as well.

Form popularity

FAQ

The third collection letter should include the following information:Mention of all previous attempts to collect.Invoice number and amount.Original invoice due date.Current days past due.Instructions on what they should do next.A warning of the impending consequences.More items...

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

What Is an FDCPA Validation Letter? The FDCPA is a federal law that protects consumers from abusive collection practices by debt collectors and collection agencies. Whether the FDCPA applies to foreclosures generally depends on if the foreclosure is judicial or nonjudicial.

A collection letter is a written notification to inform a consumer of his due payments. It is an official message to a borrower. A collection letter may include reminders, inquiries, warnings or notification of possible legal actions.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay. Get help with your money questions.

The FTC enforces the Fair Debt Collection Practices Act (FDCPA), which prohibits deceptive, unfair, and abusive debt collection practices.

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

A debt collection letter should include the following information:The amount the debtor owes you.The initial due date of the payment.A new due date for the payment, whether ASAP or longer.Instructions on how to pay the debt.More items...?

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.