Delaware Option to Purchase Common Stock

Description

How to fill out Option To Purchase Common Stock?

US Legal Forms - one of many biggest libraries of legal varieties in the States - gives a wide range of legal papers web templates you may download or print out. While using web site, you can get 1000s of varieties for organization and individual uses, categorized by groups, claims, or keywords and phrases.You can find the most recent versions of varieties much like the Delaware Option to Purchase Common Stock within minutes.

If you have a membership, log in and download Delaware Option to Purchase Common Stock from the US Legal Forms catalogue. The Obtain key can look on each and every type you look at. You get access to all formerly downloaded varieties inside the My Forms tab of your own account.

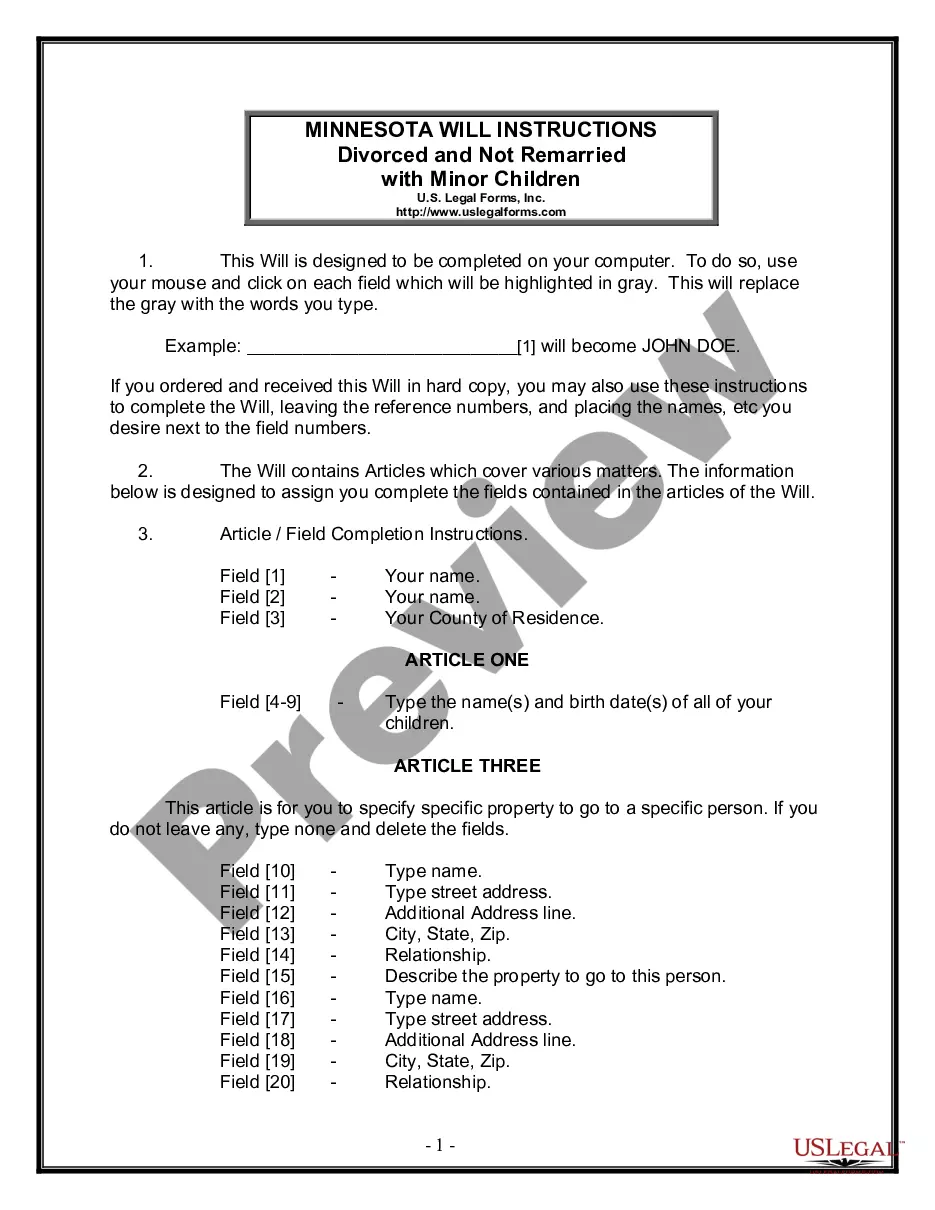

If you wish to use US Legal Forms initially, allow me to share basic directions to get you started off:

- Be sure to have chosen the best type for the area/region. Click the Review key to examine the form`s articles. Browse the type description to actually have chosen the correct type.

- If the type doesn`t suit your specifications, use the Research area at the top of the monitor to find the one that does.

- If you are pleased with the shape, confirm your choice by clicking on the Acquire now key. Then, choose the costs strategy you favor and provide your accreditations to sign up for an account.

- Method the transaction. Utilize your Visa or Mastercard or PayPal account to finish the transaction.

- Pick the file format and download the shape in your gadget.

- Make modifications. Load, revise and print out and indicator the downloaded Delaware Option to Purchase Common Stock.

Every single design you included with your money lacks an expiration date and is also your own property for a long time. So, if you wish to download or print out an additional version, just go to the My Forms section and click about the type you need.

Obtain access to the Delaware Option to Purchase Common Stock with US Legal Forms, the most comprehensive catalogue of legal papers web templates. Use 1000s of specialist and status-certain web templates that meet your company or individual needs and specifications.

Form popularity

FAQ

(a) A corporation may, whenever desired, integrate into a single instrument all of the provisions of its certificate of incorporation which are then in effect and operative as a result of there having theretofore been filed with the Secretary of State 1 or more certificates or other instruments pursuant to any of the ...

§ 243. Retirement of stock. (a) A corporation, by resolution of its board of directors, may retire any shares of its capital stock that are issued but are not outstanding.

Section 242 of the DGCL governs the procedures by which a corporation may amend its certificate of corporation, or charter, and generally requires approval by (a) the board of directors and (b) holders of a majority in voting power of the outstanding stock entitled to vote thereon and by the holders of a majority in ...

Stock options aren't actual shares of stock?they're the right to buy a set number of company shares at a fixed price, usually called a grant price, strike price, or exercise price. Because your purchase price stays the same, if the value of the stock goes up, you could make money on the difference.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

An option is a contract that's linked to an underlying asset, e.g., a stock or another security. Options contracts are good for a set period, which could be as short as a day or as long as a couple of years. When you buy an option, you have the right to trade the underlying asset, but you're not obligated to.

Section 232 - Delivery of notice; notice by electronic transmission (a) Without limiting the manner by which notice otherwise may be given effectively to stockholders, any notice to stockholders given by the corporation under any provision of this chapter, the certificate of incorporation, or the bylaws may be given in ...

§ 174. Liability of directors for unlawful payment of dividend or unlawful stock purchase or redemption; exoneration from liability; contribution among directors; subrogation.

Stock Option Plan (the ?Plan?) is to assist Delaware Management Holdings, Inc., a Delaware corporation (the ?Corporation?), and its subsidiaries in attracting, retaining, and rewarding high-quality executives, investment professionals, employees, and other persons who provide services to the Corporation and/or its ...

If (1) one corporation's (?the parent?) ownership in another corporation[1] or corporations (?the subsidiary?) amounts to at least 90% of the outstanding shares of each class of stock entitled to vote on a merger and (2) at least one of these corporations is a Delaware corporation and unless the laws or a foreign ...