Delaware List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

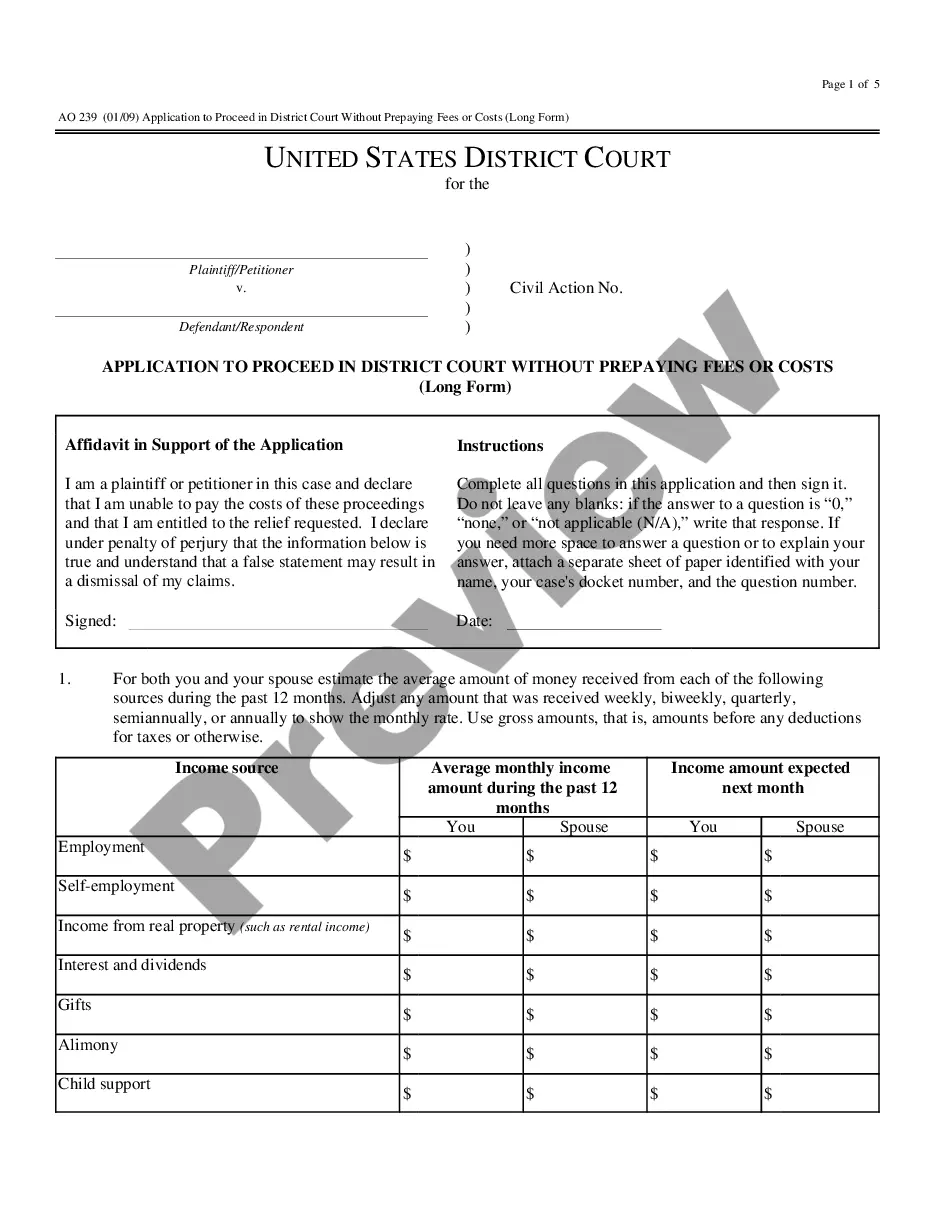

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

US Legal Forms - one of many most significant libraries of legal types in America - delivers a wide array of legal document web templates you can download or print. Utilizing the internet site, you will get a large number of types for business and person functions, sorted by types, claims, or search phrases.You will find the latest models of types like the Delaware List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 in seconds.

If you already have a monthly subscription, log in and download Delaware List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 from your US Legal Forms collection. The Down load switch will show up on each and every kind you perspective. You get access to all in the past acquired types in the My Forms tab of your accounts.

If you want to use US Legal Forms the first time, listed here are simple instructions to help you started out:

- Make sure you have picked out the best kind for your personal town/county. Select the Preview switch to check the form`s articles. Read the kind explanation to actually have selected the proper kind.

- If the kind doesn`t suit your demands, make use of the Search discipline towards the top of the screen to find the the one that does.

- Should you be content with the form, affirm your choice by clicking the Buy now switch. Then, choose the pricing plan you favor and supply your credentials to sign up for the accounts.

- Process the deal. Utilize your Visa or Mastercard or PayPal accounts to complete the deal.

- Pick the file format and download the form on your product.

- Make alterations. Fill out, revise and print and sign the acquired Delaware List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005.

Every single web template you put into your bank account lacks an expiry day and is your own eternally. So, if you want to download or print an additional duplicate, just proceed to the My Forms portion and click on in the kind you will need.

Get access to the Delaware List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 with US Legal Forms, probably the most extensive collection of legal document web templates. Use a large number of professional and status-certain web templates that satisfy your organization or person requirements and demands.

Form popularity

FAQ

Corporations, partnerships, and Limited Liability Companies (LLCs) do not receive a discharge under Chapter 7. However, few or no assets may be available for the collection of tax liabilities not paid by the bankruptcy estate. A bankruptcy discharge does not extinguish any attachment of the statutory federal tax lien.

However, each of your creditors must file a proof of claim (described below) within a certain time to prove how much you owe. If a creditor fails to do so, then the bankruptcy trustee will not make any payments to that creditor. In some cases, lack of a proof of claim may benefit you.

Most bankruptcy cases pass through the bankruptcy process with little objection by creditors. Because the bankruptcy system is encoded into U.S. law and companies can prepare for some debts to discharge through it, creditors usually accept discharge and generally have little standing to contest it.

Nondischargeable Debts are debts that cannot be extinguished in bankruptcy. As a threshold matter, regardless of the type of bankruptcy, 11 U.S.C.

Debts not discharged include debts for alimony and child support, certain taxes, debts for certain educational benefit overpayments or loans made or guaranteed by a governmental unit, debts for willful and malicious injury by the debtor to another entity or to the property of another entity, debts for death or personal ...

You will be able to get rid of your tax debts in Chapter 7 bankruptcy if you meet the following requirements: The taxes are income-based. Income taxes are the only kind of debt that Chapter 7 is able to discharge. The tax debt must be for federal or state income taxes or taxes on gross receipts.

Secured creditors generally get priority, while unsecured creditors are paid pro-rata on their claims. The intent of Chapter 7 is to give the debtor a ?fresh start? and for the creditors to recover as much as they otherwise would've been able to under non-bankruptcy law.