Delaware Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

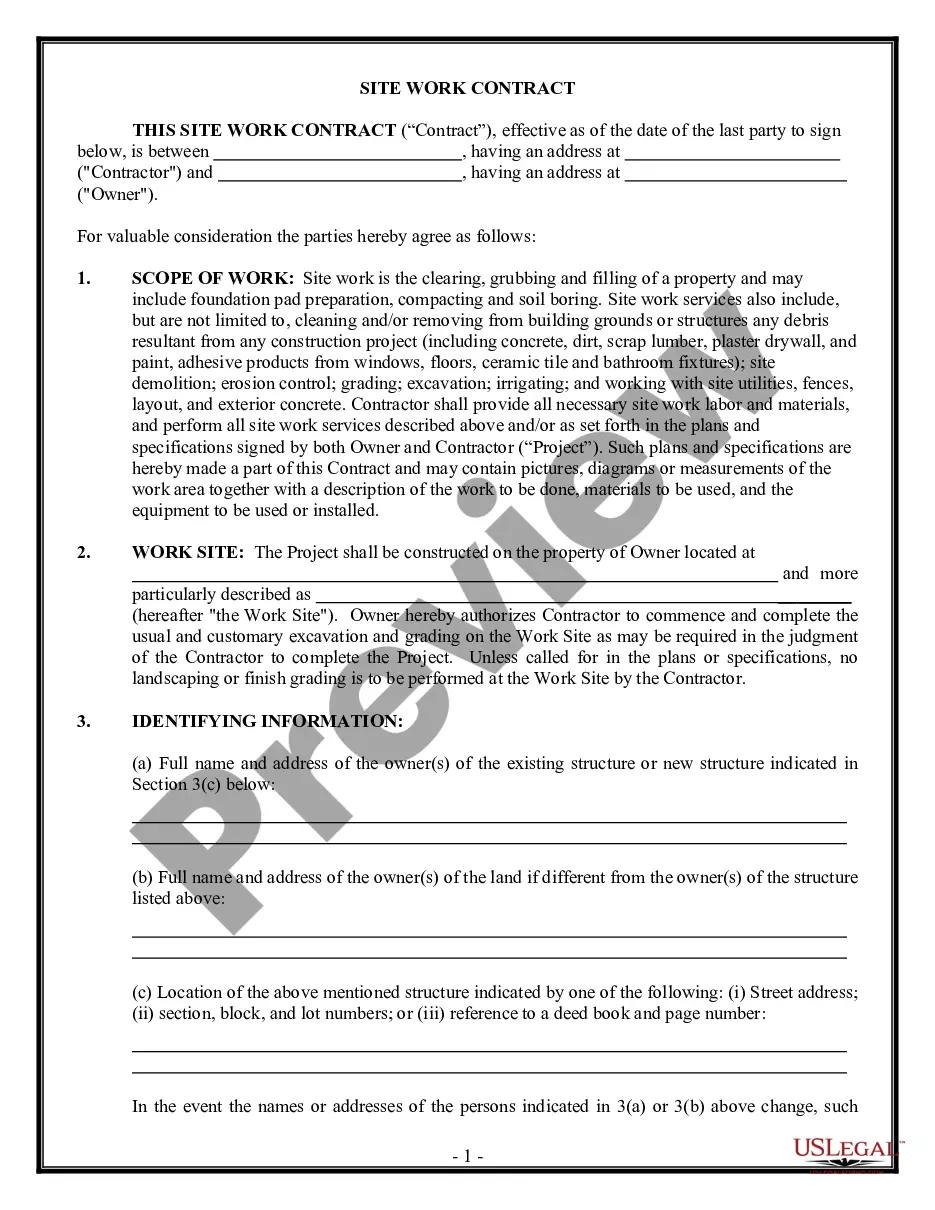

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

If you need to full, download, or printing authorized record web templates, use US Legal Forms, the most important collection of authorized varieties, which can be found online. Use the site`s simple and easy practical search to find the papers you require. Different web templates for business and individual functions are categorized by categories and states, or search phrases. Use US Legal Forms to find the Delaware Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form in just a few clicks.

When you are presently a US Legal Forms customer, log in to your bank account and click the Acquire button to find the Delaware Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form. You can also access varieties you in the past acquired inside the My Forms tab of the bank account.

If you are using US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for the correct town/land.

- Step 2. Utilize the Preview option to look over the form`s content material. Don`t overlook to read the outline.

- Step 3. When you are unhappy using the type, use the Search discipline towards the top of the display screen to get other variations in the authorized type web template.

- Step 4. When you have found the shape you require, select the Purchase now button. Opt for the rates program you prefer and add your accreditations to sign up to have an bank account.

- Step 5. Process the purchase. You should use your Мisa or Ьastercard or PayPal bank account to perform the purchase.

- Step 6. Find the file format in the authorized type and download it on your system.

- Step 7. Full, change and printing or sign the Delaware Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form.

Every authorized record web template you purchase is yours for a long time. You might have acces to each and every type you acquired in your acccount. Click the My Forms section and pick a type to printing or download again.

Remain competitive and download, and printing the Delaware Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form with US Legal Forms. There are millions of professional and state-distinct varieties you can utilize for your personal business or individual requirements.

Form popularity

FAQ

Secured creditors generally get priority, while unsecured creditors are paid pro-rata on their claims. The intent of Chapter 7 is to give the debtor a ?fresh start? and for the creditors to recover as much as they otherwise would've been able to under non-bankruptcy law.

The Chapter 7 Discharge. A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor.

Chapter 7 bankruptcy allows liquidation of assets to pay creditors. Unsecured priority debt is paid first in a Chapter 7, after which comes secured debt and then nonpriority unsecured debt. Filing Chapter 7 typically involves completing forms and a review of assets by the trustee.

A Chapter 7 bankruptcy is a type of bankruptcy that can quickly clear away debts. It's also called a liquidation bankruptcy because you will have to sell nonexempt possessions or assets to repay your creditors. Another name for it is a straight bankruptcy because there are no drawn-out repayment plans.

In Most Cases, Chapter 7 Filers Keep Their Property Most Chapter 7 bankruptcy cases are no-asset cases. That means the debtors give up nothing to the trustee. The exemption systems permit debtors to retain the means of day-to-day living, free from the claims of their creditors.

The U.S. bankruptcy code doesn't specify a minimum dollar amount someone must owe to make them eligible for a qualified filing. In short, any debt is enough debt. More important than the size of your debt is the size of your income. How much money you earn affects whether you qualify for Chapter 7.