Delaware FCRA Disclosure and Authorization Statement

Description

How to fill out FCRA Disclosure And Authorization Statement?

If you want to complete, download, or print legal document templates, use US Legal Forms, the largest assortment of legal forms available online.

Utilize the website's straightforward and user-friendly search to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or by keywords.

Every legal document template you acquire is yours permanently. You will have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Compete and download, and print the Delaware FCRA Disclosure and Authorization Statement with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to find the Delaware FCRA Disclosure and Authorization Statement in just a few clicks.

- If you are already a US Legal Forms member, Log Into your account and click the Download button to access the Delaware FCRA Disclosure and Authorization Statement.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

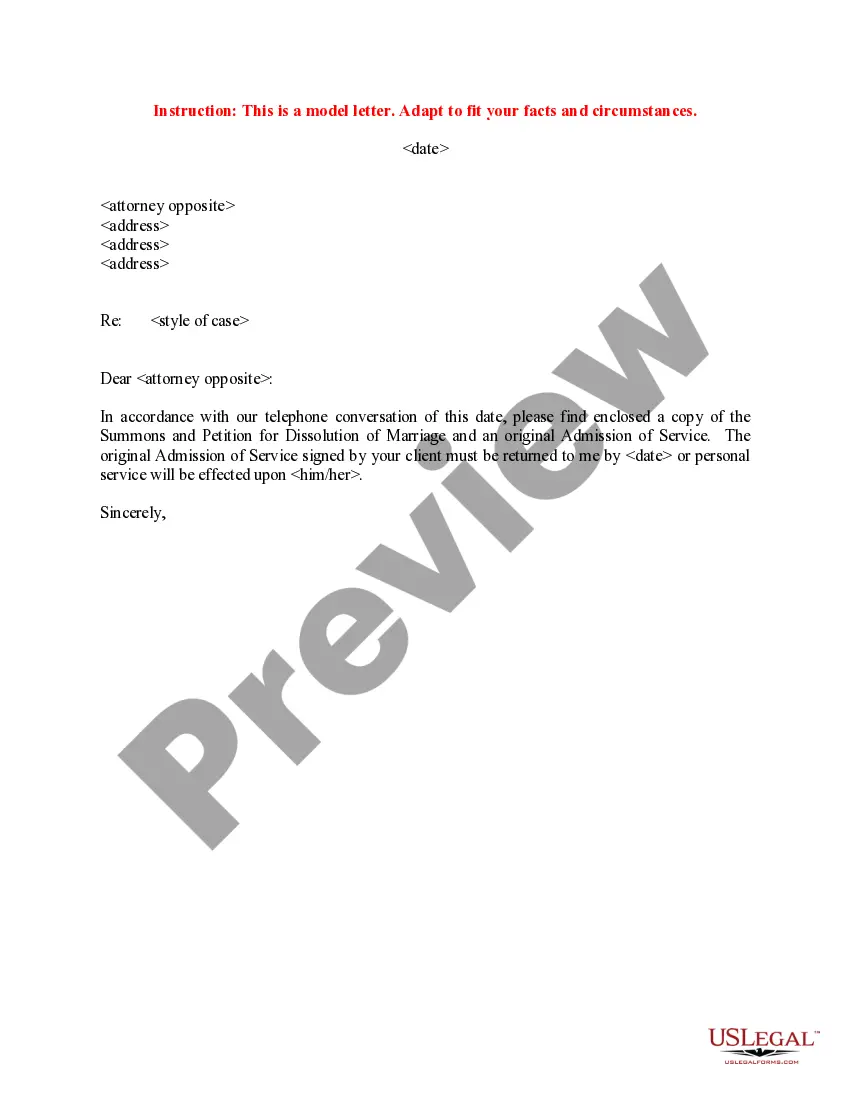

- Step 2. Use the Preview mode to review the form's content. Don't forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to register for the account.

- Step 5. Proceed with the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Delaware FCRA Disclosure and Authorization Statement.

Form popularity

FAQ

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all

A Summary of Your Rights Under the Fair Credit Reporting Act. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of. information in the files of consumer reporting agencies.

The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes. The form of the disclosure must meet very specific criteria set forth in the statute.

FCRA compliance typically means adhering to the requirements set forth by the Fair Credit Reporting Act. These requirements generally require employers to conduct background checks that are accurate, transparent, and fair to consumers.

The Fair Credit Reporting Act (FCRA) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. The law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your consumer reports.

While the Fair Credit Reporting Act (FCRA) requires that a disclosure of rights be provided in a separate document, it may include lines for signature and date, and be part of an application packet, the 9th U.S. Circuit Court of Appeals ruled.

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection of consumers' credit information and access to their credit reports. It was passed in 1970 to address the fairness, accuracy, and privacy of the personal information contained in the files of the credit reporting agencies.

The Fair Credit Reporting Act (FCRA) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. The law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your consumer reports.

The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes. The form of the disclosure must meet very specific criteria set forth in the statute.

FCRA Authorization: Obtain Permission for a Background Check A compliant FCRA authorization form is an acknowledgement that a pre-employment background check will be conducted. It can be presented as a self-contained document or jointly with an FCRA disclosure form.