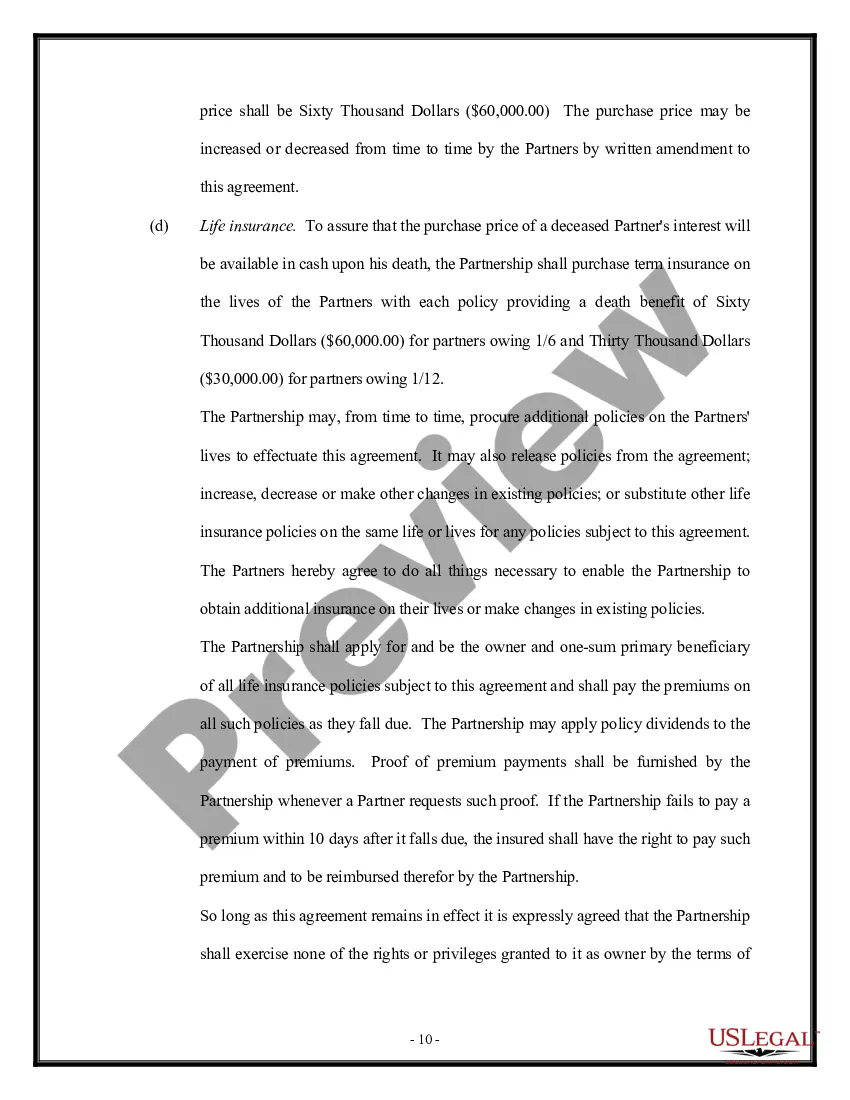

Delaware General Partnership Agreement - version 1

Description

How to fill out General Partnership Agreement - Version 1?

Have you ever been in a situation where you require documents for either business or personal activities nearly every day.

There are numerous authentic document templates accessible online, but finding ones you can rely on is challenging.

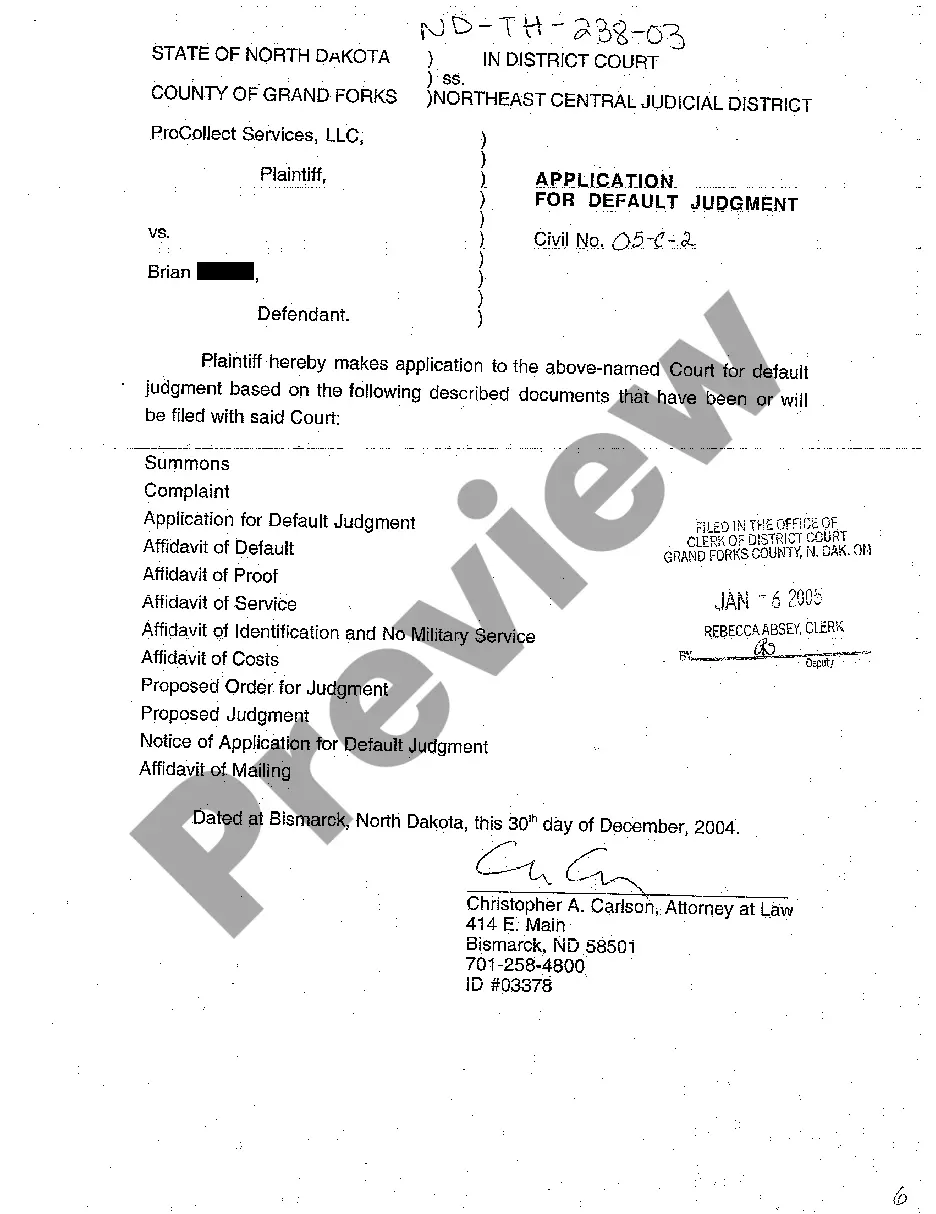

US Legal Forms provides a vast array of form templates, such as the Delaware General Partnership Agreement - version 1, designed to comply with state and federal regulations.

Once you find the correct form, click Acquire now.

Choose the pricing plan you want, fill in the required details to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Delaware General Partnership Agreement - version 1 template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/region.

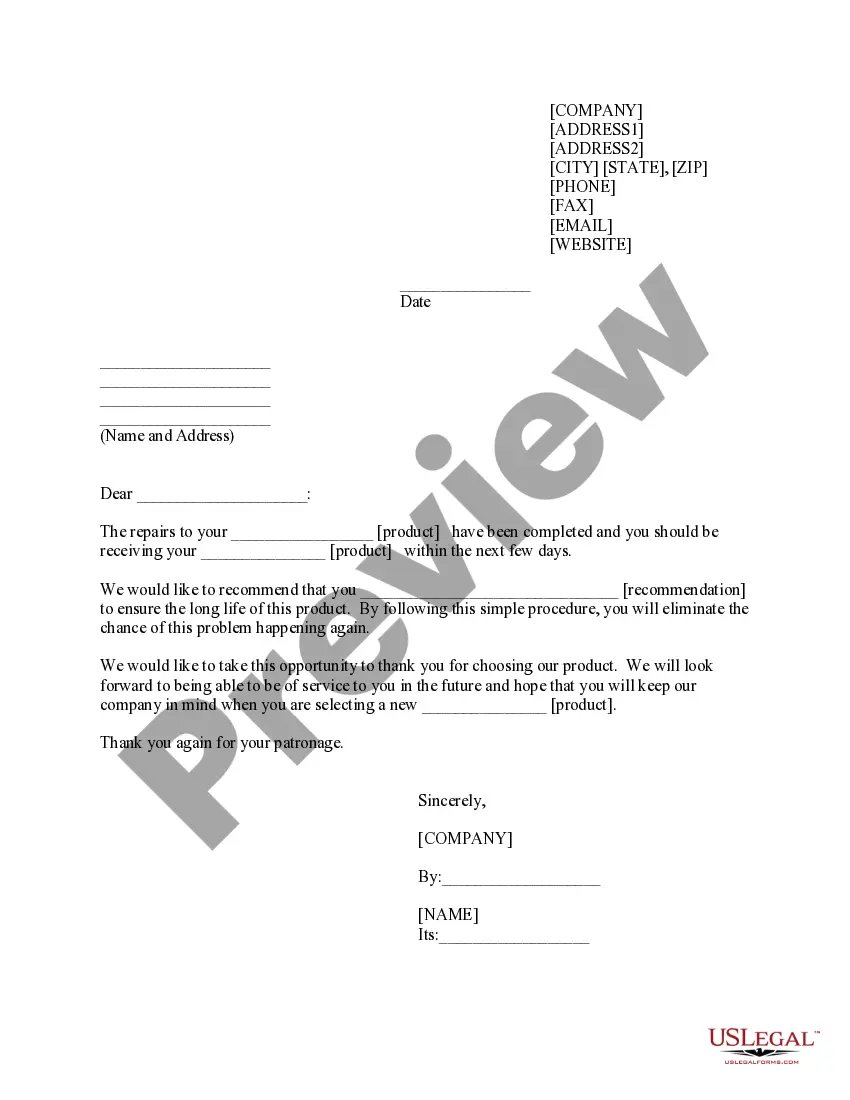

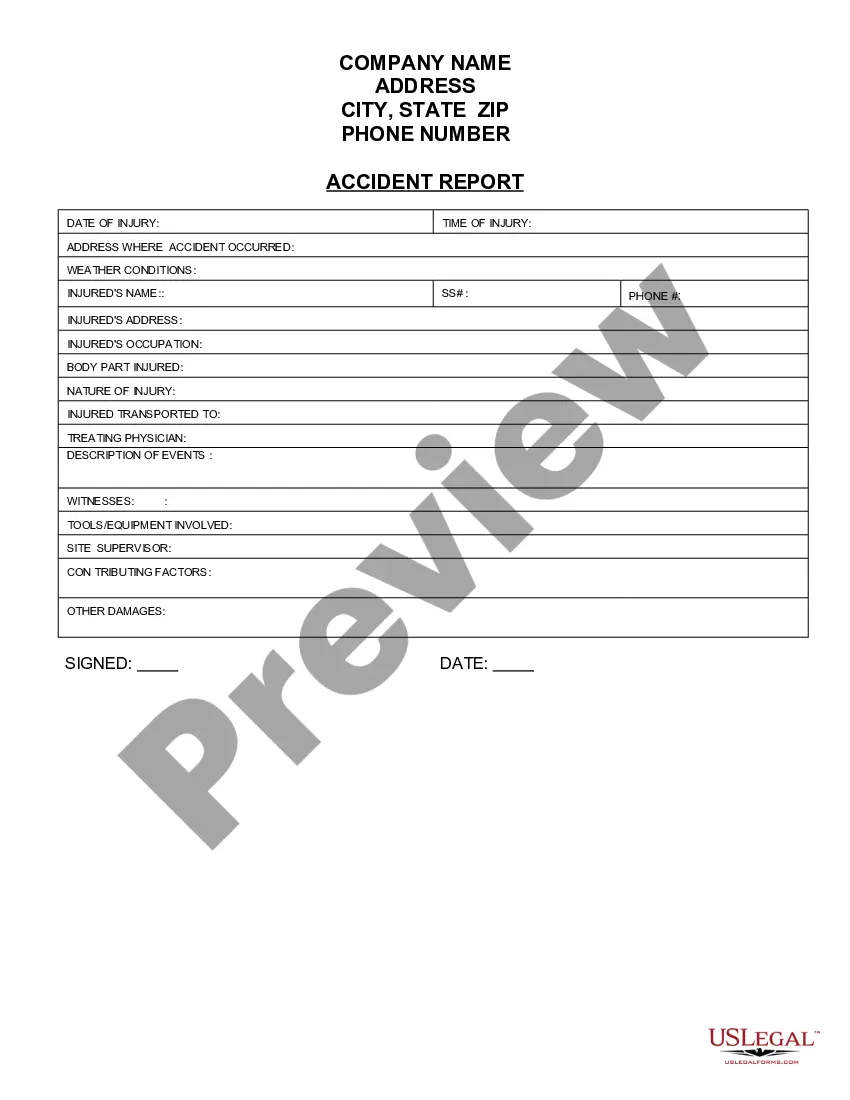

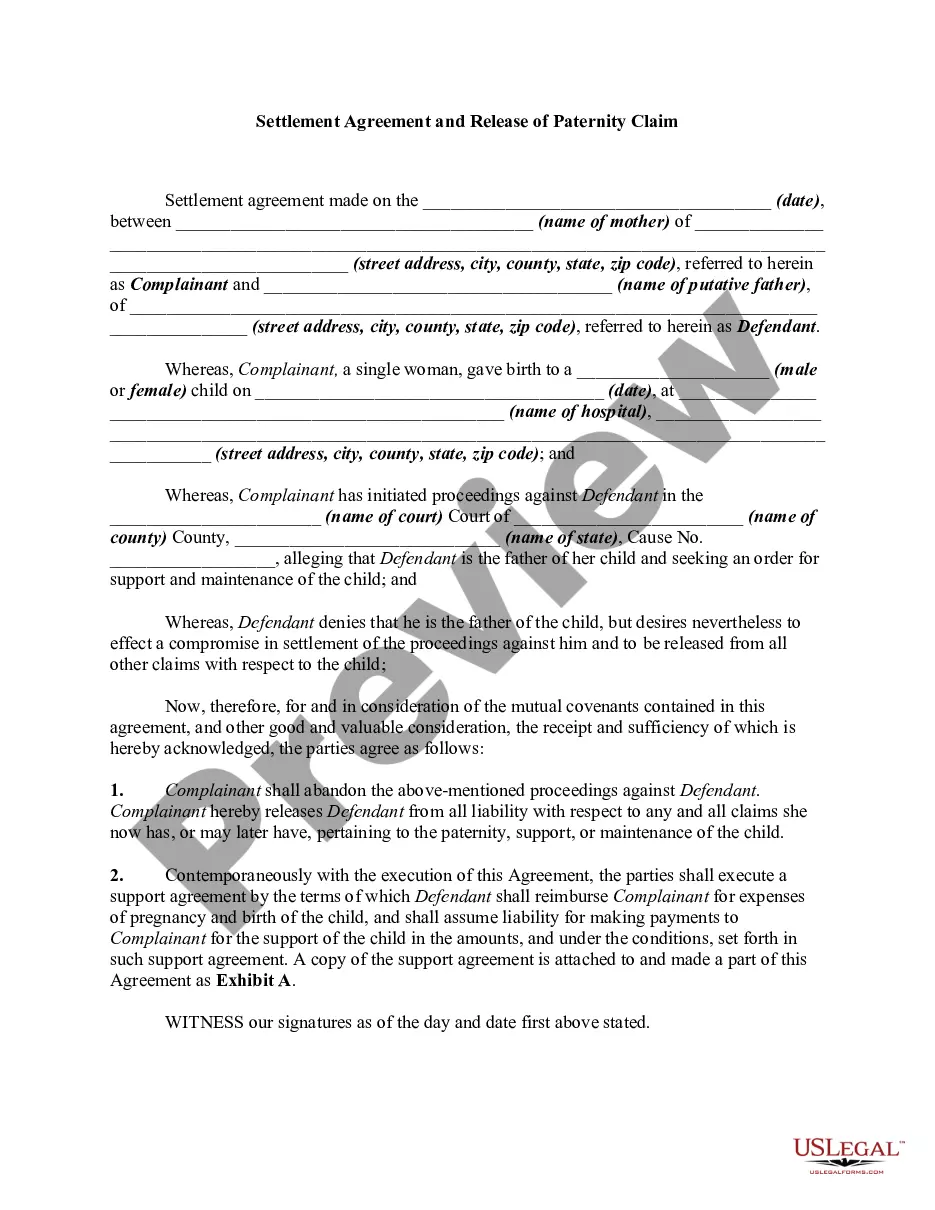

- Use the Preview button to review the document.

- Check the summary to confirm that you have chosen the correct form.

- If the form is not what you are looking for, utilize the Search field to locate the form that fits your needs.

Form popularity

FAQ

A general partnership is created any time two or more people agree to go into business together. There's no legal requirement for a contract or written agreement when you enter into a general partnership, but it's best to formalize the details of the arrangement in a written partnership agreement.

If you want to start a general partnership in the state of Delaware, there is no formal process to complete. Forming a general partnership in Delaware only requires you to work with your partner or partners. LLCs don't have any filing requirements like annual reports that corporations and nonprofits do.

How to Form a Delaware Limited Partnership (in 6 Steps)Step One) Choose an LP Name.Step Two) Designate a Registered Agent.Step Three) File the Certificate of Limited Partnership.Step Four) Create a Limited Partnership Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.

A general partner LLC, one of the most common types of partnerships, is arranged by two partners that have sole ownership of and liability for the business. This means they control all aspects of the business and are held financially responsible for its obligations and debts.

For non-tax purposes, a Delaware general partnership is a separate entity from its partners, may conduct business, acquire, hold, and dispose of property, and sue and be sued in its name, without the need to join all partners as parties.

Partnerships are unique business relationships that don't require a written agreement. However, it's always a good idea to have such a document.

To have a general partnership, two conditions must be true:The company must have two or more owners.All partners must agree to have unlimited personal responsibility for any debts or legal liabilities the partnership might incur.

A general partner is a part-owner of a partnership business and is involved with its operations and shares in its profits. A general partner is often a doctor, lawyer, or another professional who has joined a partnership in order to remain independent while being part of a larger business.

Updated November 2, 2020: A Delaware Limited Partnership refers to a business entity in the state of Delaware that consists of at least one general partner and at least one limited partner. The general partner can be either an individual or an entity, such as a corporation.

Partnerships must file Form SS-4 with the Internal Revenue Service. Form SS-4 is used to get an employer identification number, also known as a federal tax ID number, from the IRS. The IRS allows a partnership to file Form SS-4 online using the IRS website, by telephone, by fax or by mail.