Delaware Expense Reimbursement Request

Description

How to fill out Expense Reimbursement Request?

Have you ever been in a scenario where you require documentation for personal or business purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn’t easy.

US Legal Forms offers thousands of template designs, including the Delaware Expense Reimbursement Request, that are designed to comply with federal and state regulations.

Once you find the right form, click Purchase now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess your account, simply Log In.

- After that, you can download the Delaware Expense Reimbursement Request template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct city/state.

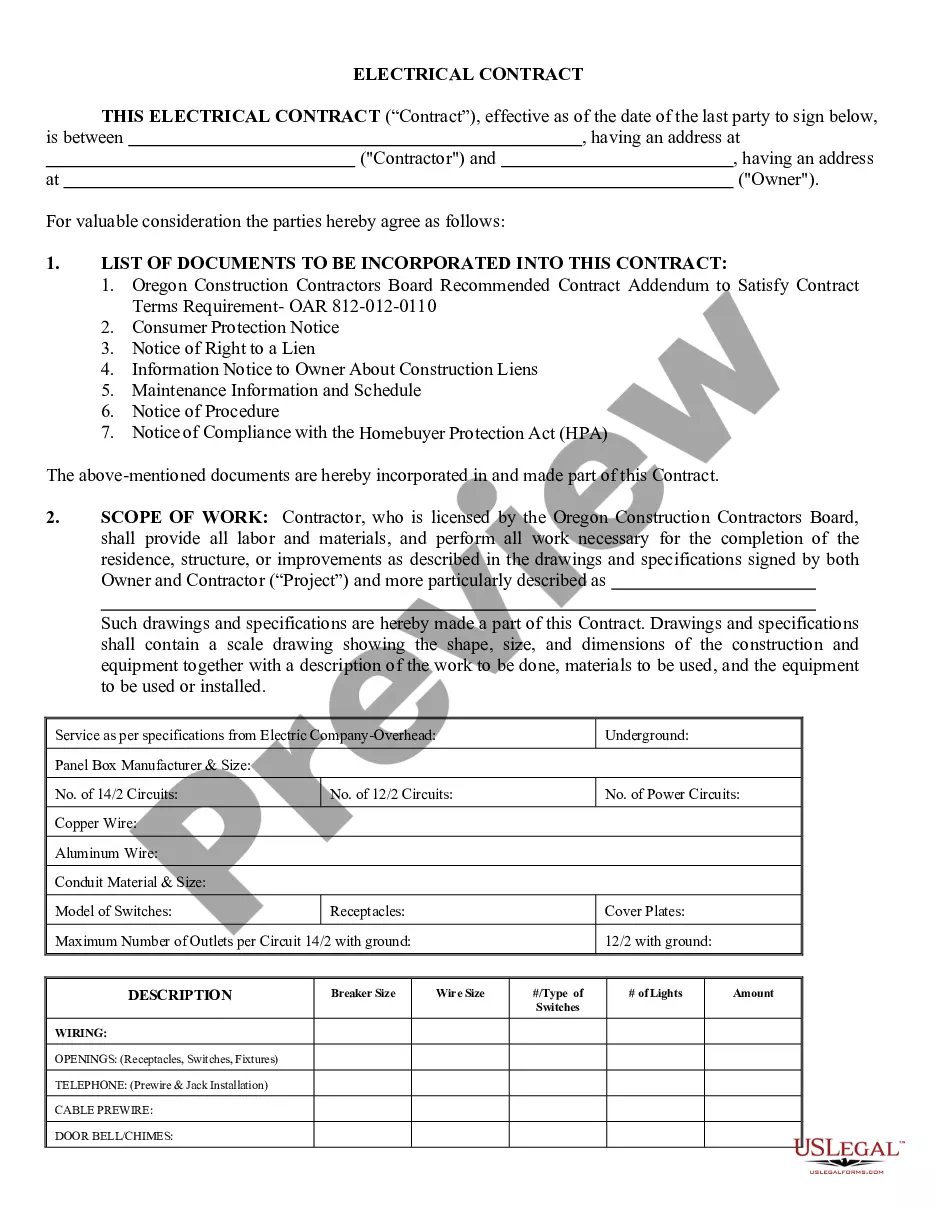

- Utilize the Preview feature to review the form.

- Check the description to confirm you have selected the right template.

- If the form isn’t what you are looking for, use the Search section to locate the form that suits your needs.

Form popularity

FAQ

How to create an expense reimbursement policyDetermine reimbursable expenses.List reimbursable expenses.Set up non-accountable plan expenses.Outline pre-approval process.Choose an expense reporting process.Create a reporting process & deadline.Build your reimbursement.Prepare for disputes.

How to Complete an Expense Reimbursement Form:Add personal information.Enter purchase details.Sign the form.Attach receipts.Submit to the management or accounting department.

Because reimbursements under the accountable plan are not wages and are not taxed, you do not have to report the amount. Do not include the amount with the employee's wages on Form W-2. Instead, report it in Form W-2 box 12 with code L.

How to Complete an Expense Reimbursement Form:Add personal information.Enter purchase details.Sign the form.Attach receipts.Submit to the management or accounting department.

Billable and Reimbursable ExpensesGo to the Gear icon.Under Your Company, choose Accounts and Settings.Select Expenses.Click Bills and expenses.Check the optoin to Track billable expenses and items as income.Hit Save.Click Done.

Reimburse without cash advance They make the whole payment to suppliers and reimburse the company. They have to record expenses and cash paid to the employees. The journal entry is debiting expense and credit cash. The transaction will record the expense on income statement and cash paid to the employees.

How to record reimbursementsKeep your receipts. It's important to keep an accurate record of your expenses.Add reimbursement costs to client bill. Add up all expenses for the project and add this amount to the client's bill.Bill client up to agreed-upon limits. Issue the bill promptly.Know before you go.

Expense reimbursements aren't employee income, so they don't need to be reported as such. Although the check or deposit is made out to your employee, it doesn't count as a paycheck or payroll deposit.

Send a Reimbursement Letter Before You Spend Making your request in writing allows you to create a budget for the event or project and provide advance justification for how and why spending money now will save money later.

Reimburse without cash advance They make the whole payment to suppliers and reimburse the company. They have to record expenses and cash paid to the employees. The journal entry is debiting expense and credit cash. The transaction will record the expense on income statement and cash paid to the employees.