Delaware Annuity as Consideration for Transfer of Securities

Description

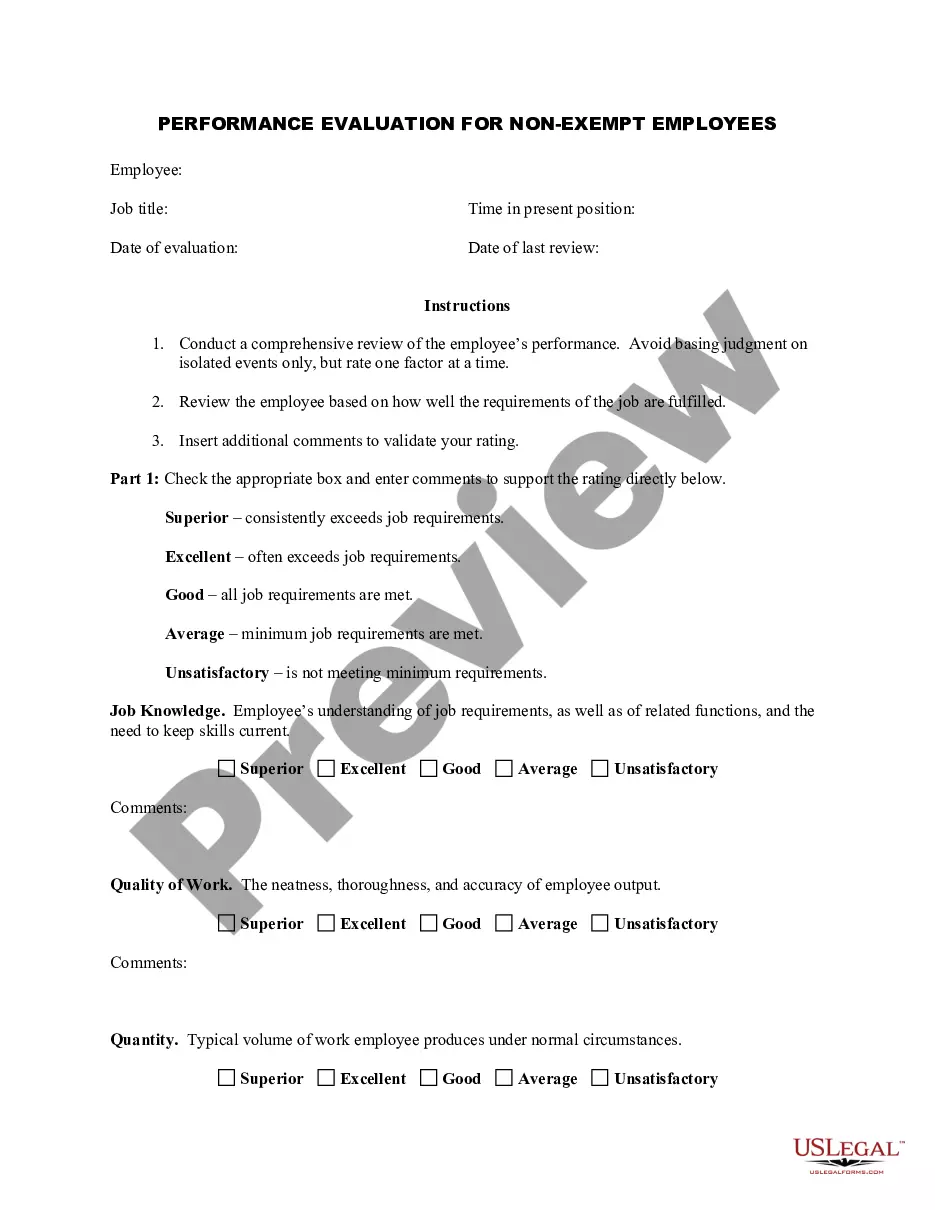

How to fill out Annuity As Consideration For Transfer Of Securities?

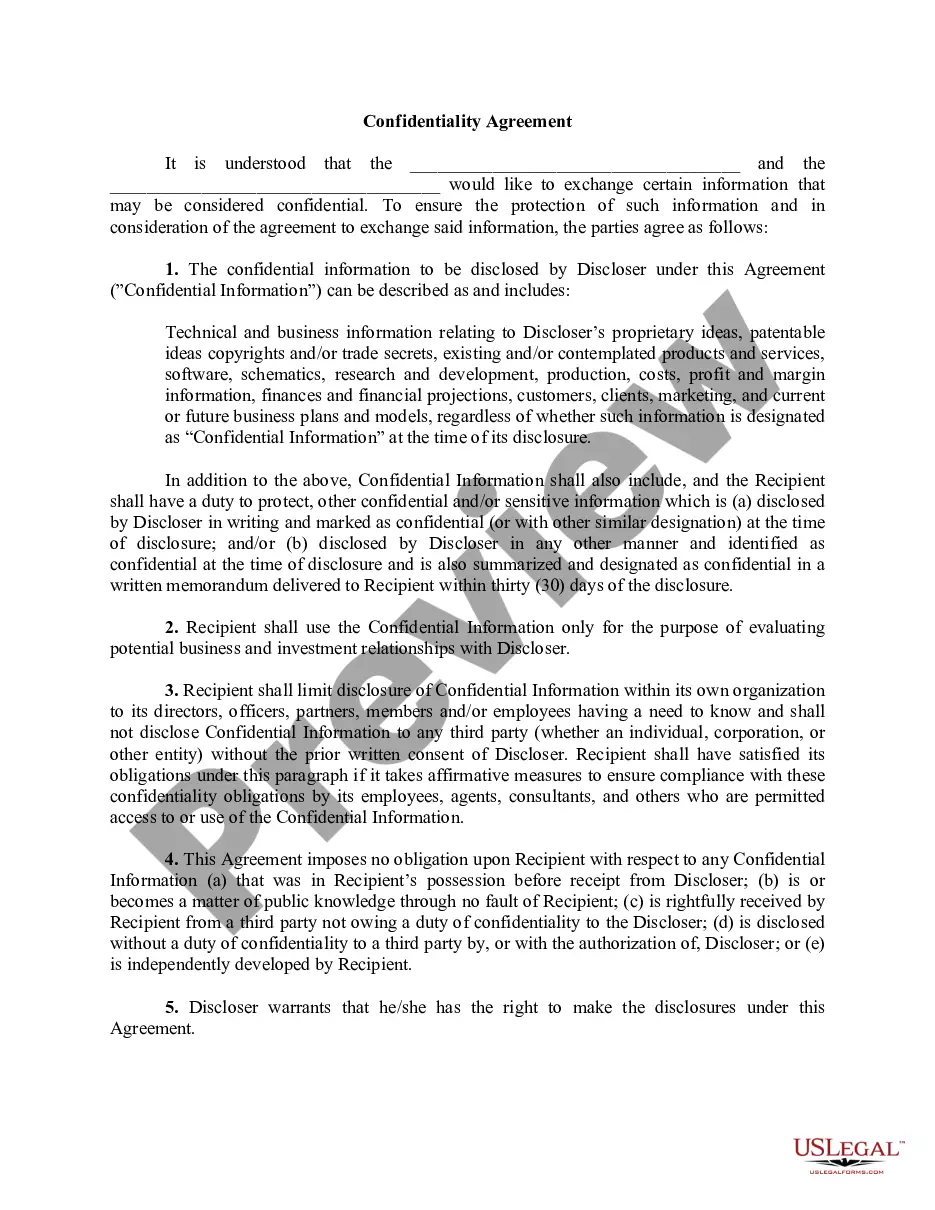

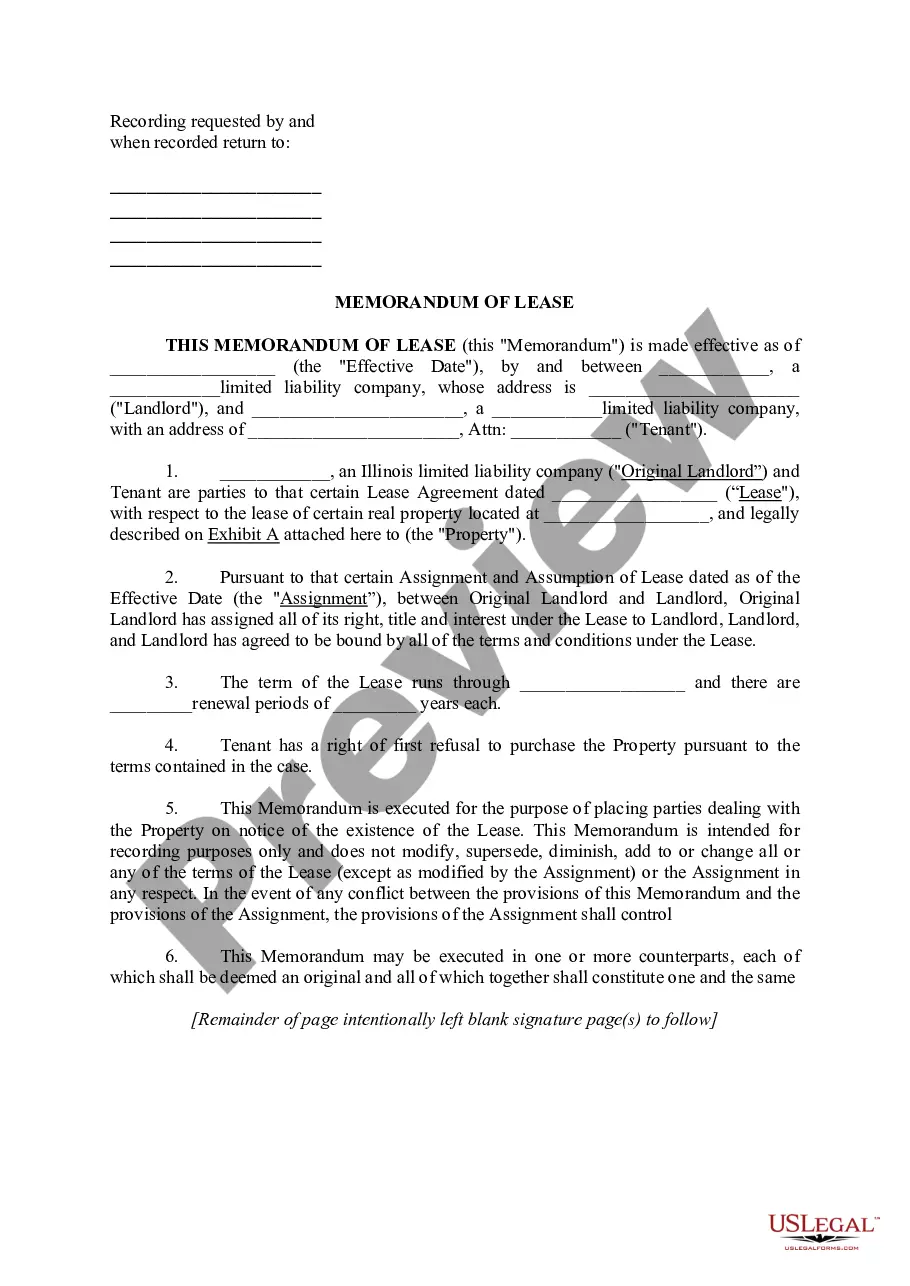

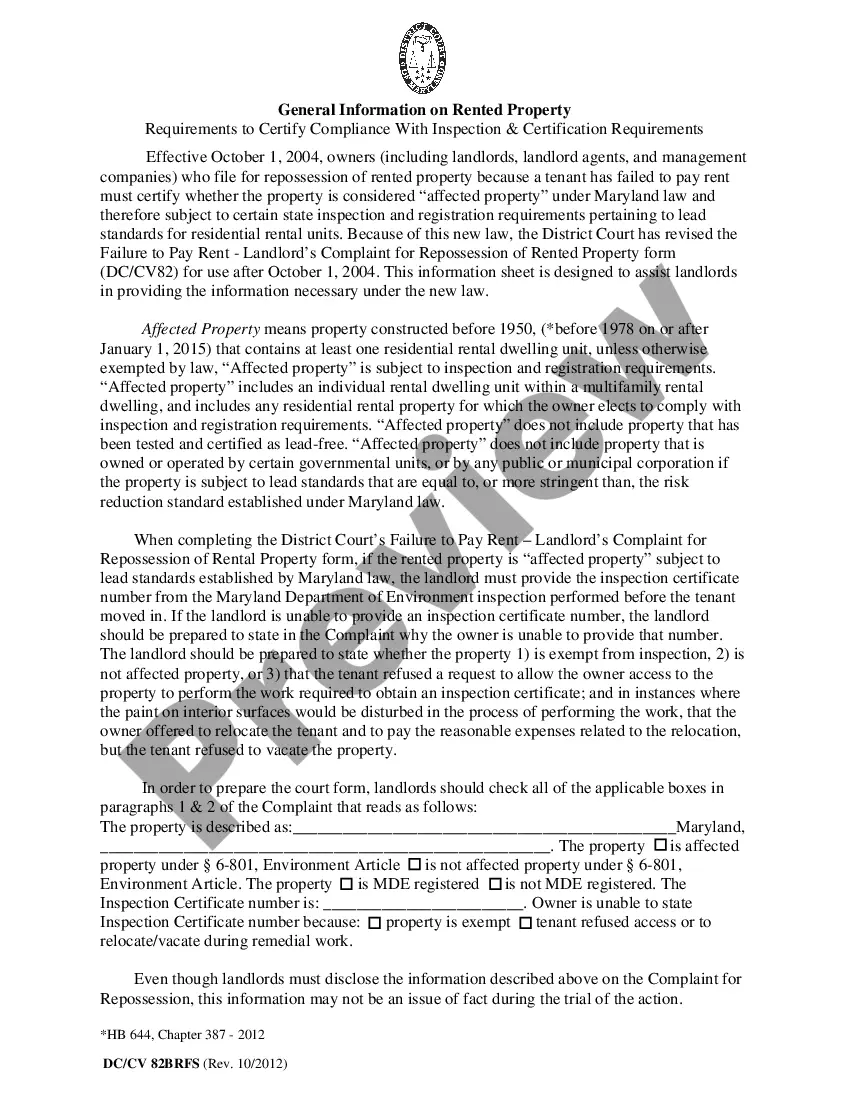

US Legal Forms - one of the largest collections of official documents in the USA - provides a variety of legal form templates that you can download or print.

By utilizing the website, you will access thousands of forms for commercial and personal purposes, organized by categories, states, or keywords. You can quickly find the latest versions of forms such as the Delaware Annuity as Consideration for Transfer of Securities.

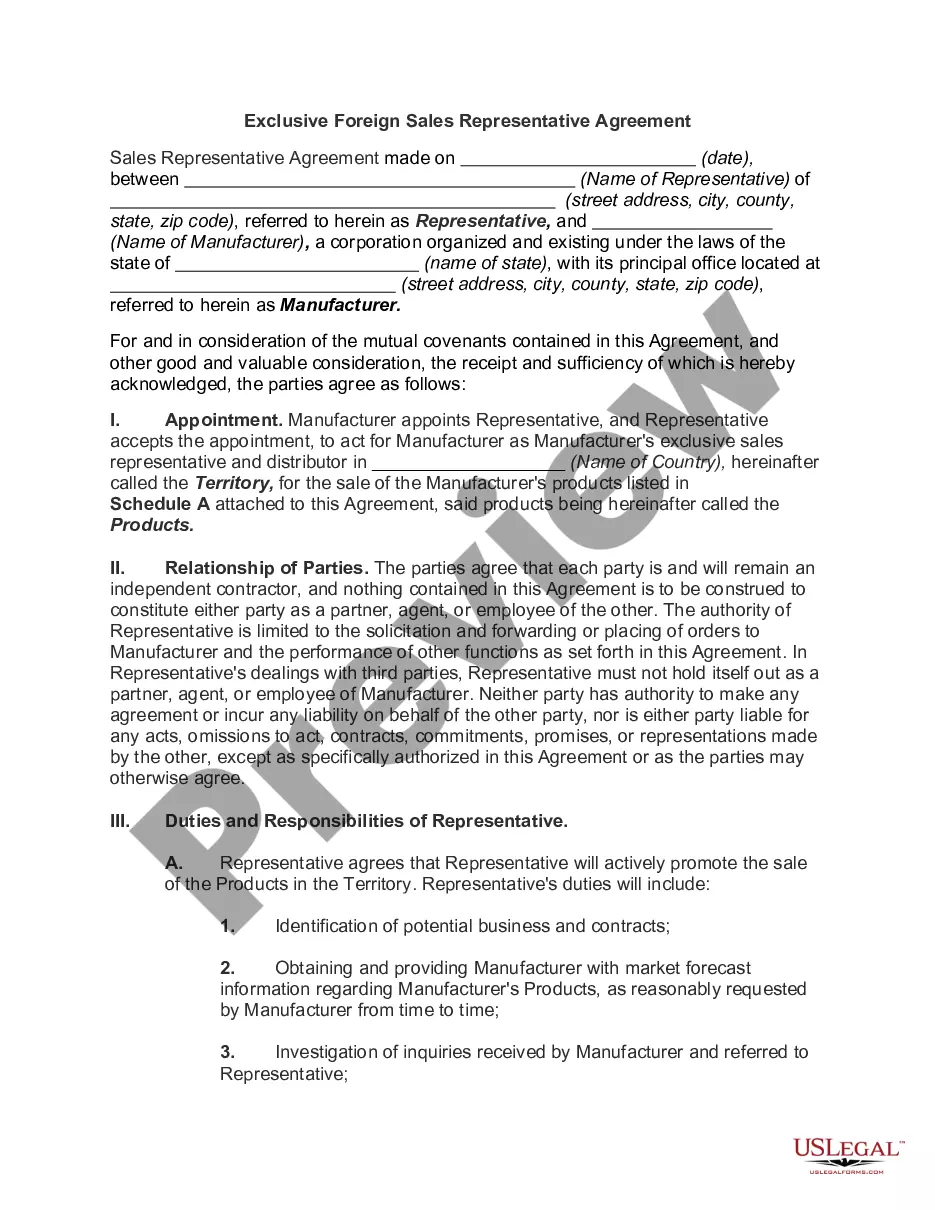

If you already possess a monthly subscription, Log In to access Delaware Annuity as Consideration for Transfer of Securities in the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Process the order. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make amendments. Fill out, modify, print, and sign the downloaded Delaware Annuity as Consideration for Transfer of Securities. Each template you save to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another version, simply visit the My documents section and click on the form you need. Access the Delaware Annuity as Consideration for Transfer of Securities with US Legal Forms, the most extensive library of official document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

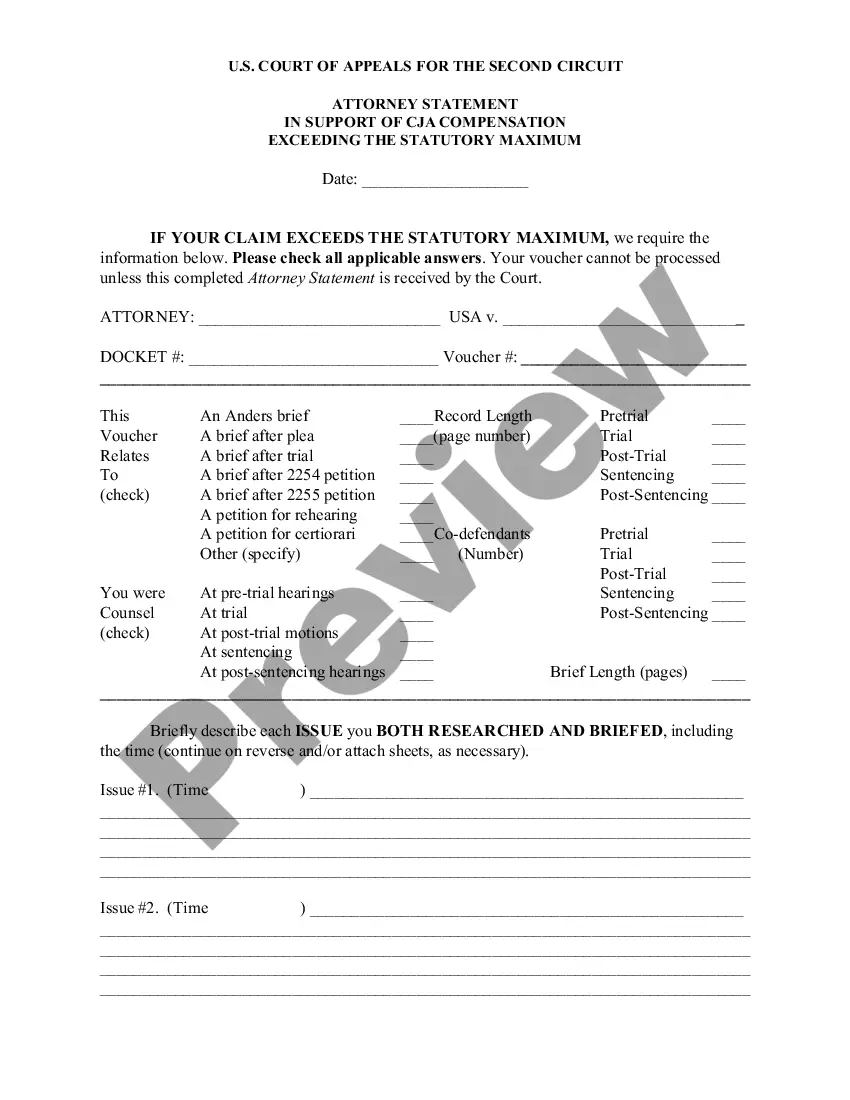

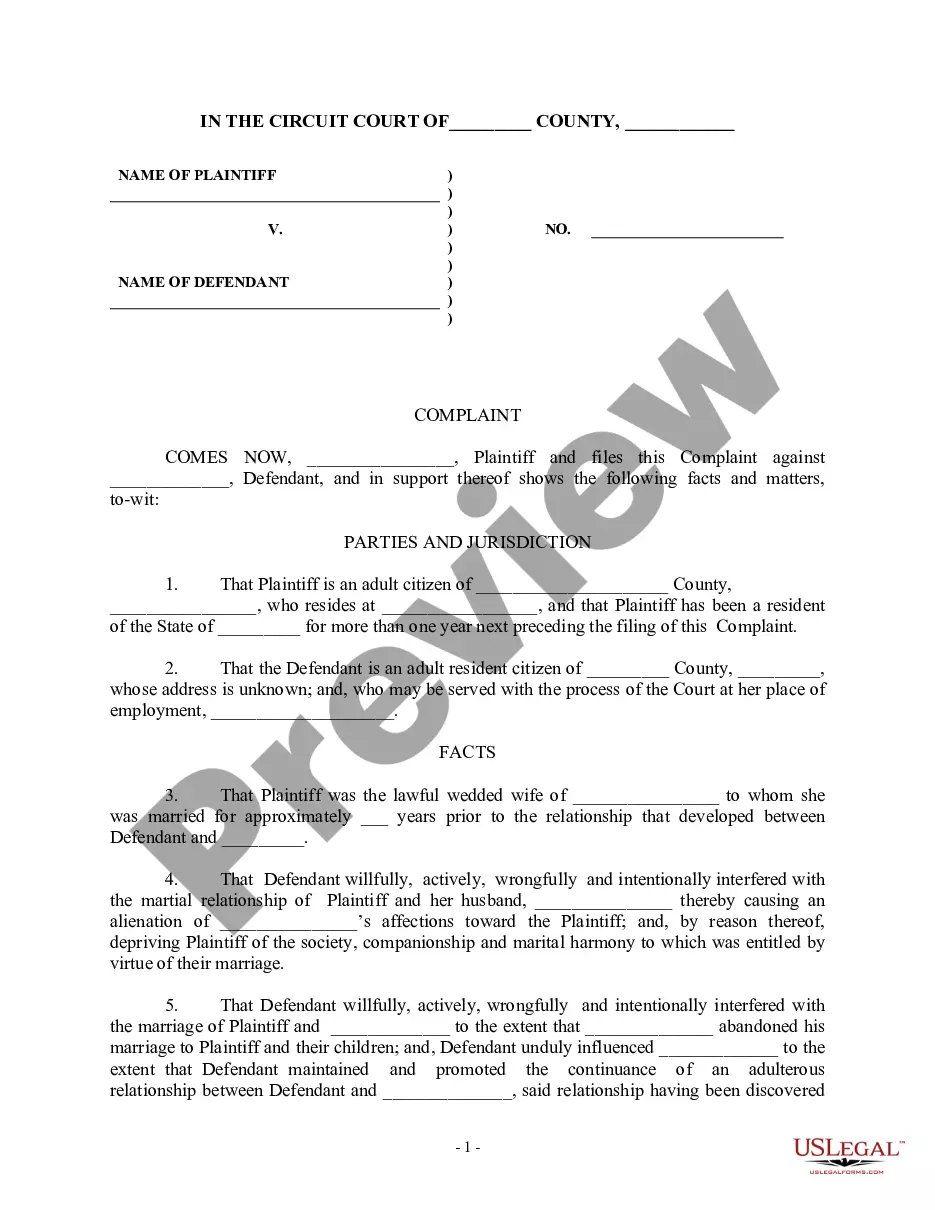

- If you're using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/region.

- Click the Review button to inspect the content of the form.

- Read the form's description to confirm that you have chosen the appropriate form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Next, select your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

Anyone selling variable annuities must carry a securities license. Learn from the experts and get our 101-level guide, Annuities Explained, delivered to your inbox for free.

Variable annuities are securities and under FINRA's jurisdiction. Annuities are often products investors consider when they plan for retirementso it pays to understand them. They also are often marketed as tax-deferred savings products.

This includes common and preferred stocks; call and put options; bonds and other individual fixed income investments; as well as all forms of packaged products (except for those that also require a life insurance license to sell).

Delaware Life was acquired by Group One Thousand One, LLC ("Group1001") (formerly known as Delaware Life Holdings, LLC) from Sun Life Financial Inc. in August 2013. Since then, Delaware Life has launched seven annuities under the Delaware Life name, with more than $9 billion of total sales.

SunLife was one of the UK investment companies, pensions and insurance businesses that Axa sold to the UK insurer Phoenix Group in a $375 million deal back in 2016.

Agents represent the insurers that appoint them. Brokers legally represent the annuity purchaser (or prospective purchasers). A broker solicits and accepts applications for insurance and then places the coverage with an insurer.

1 Indexed annuities also are subject to state insurance regulation. Indexed annuities that are not regulated by the SEC include minimum guarantees that limit and in many cases eliminate the potential for investment losses.

You must have a 200bSeries 6200b through the Financial Industry Regulatory Authority (FINRA) to sell variable annuities or mutual funds. A 200bSeries 7200b registration adds the ability to sell stocks and bonds, and a 200bSeries 63200b adds commodities and any other security-related product.

Delaware Life Holdings Completes Purchase of Sun Life Financial U.S. Annuity Business.

There are four basic types of annuities to meet your needs: immediate fixed, immediate variable, deferred fixed, and deferred variable annuities. These four types are based on two primary factors: when you want to start receiving payments and how you would like your annuity to grow.