Delaware Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

You can dedicate time online looking for the legal document web template that meets the state and federal requirements you have.

US Legal Forms provides thousands of legal templates that are verified by experts.

You can obtain or create the Delaware Unrestricted Charitable Contribution of Cash using the service.

Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize expert and state-specific templates to meet your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, edit, print, or sign the Delaware Unrestricted Charitable Contribution of Cash.

- Every legal document web template you purchase is yours forever.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the right document web template for your state/city of choice.

- Check the form description to confirm you have chosen the correct form.

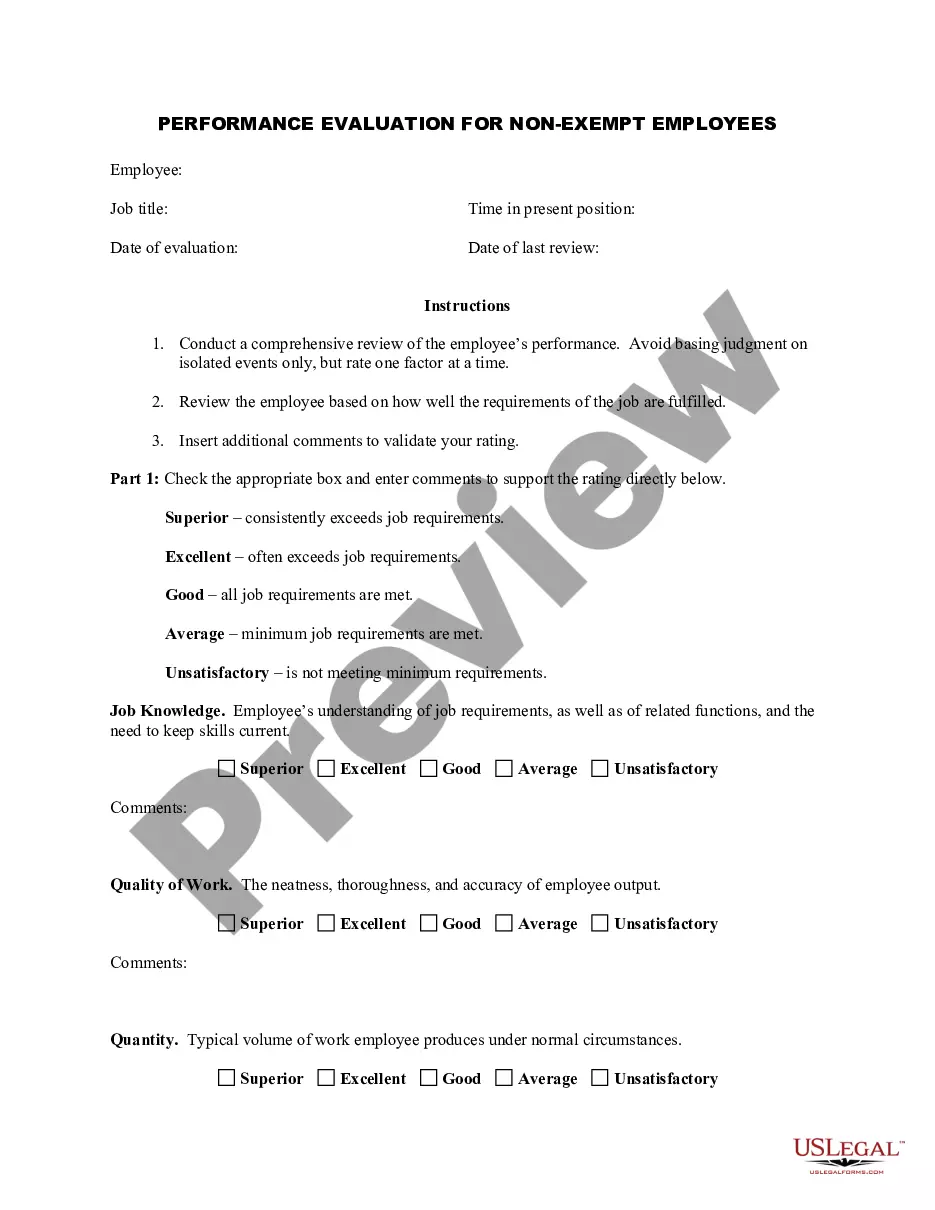

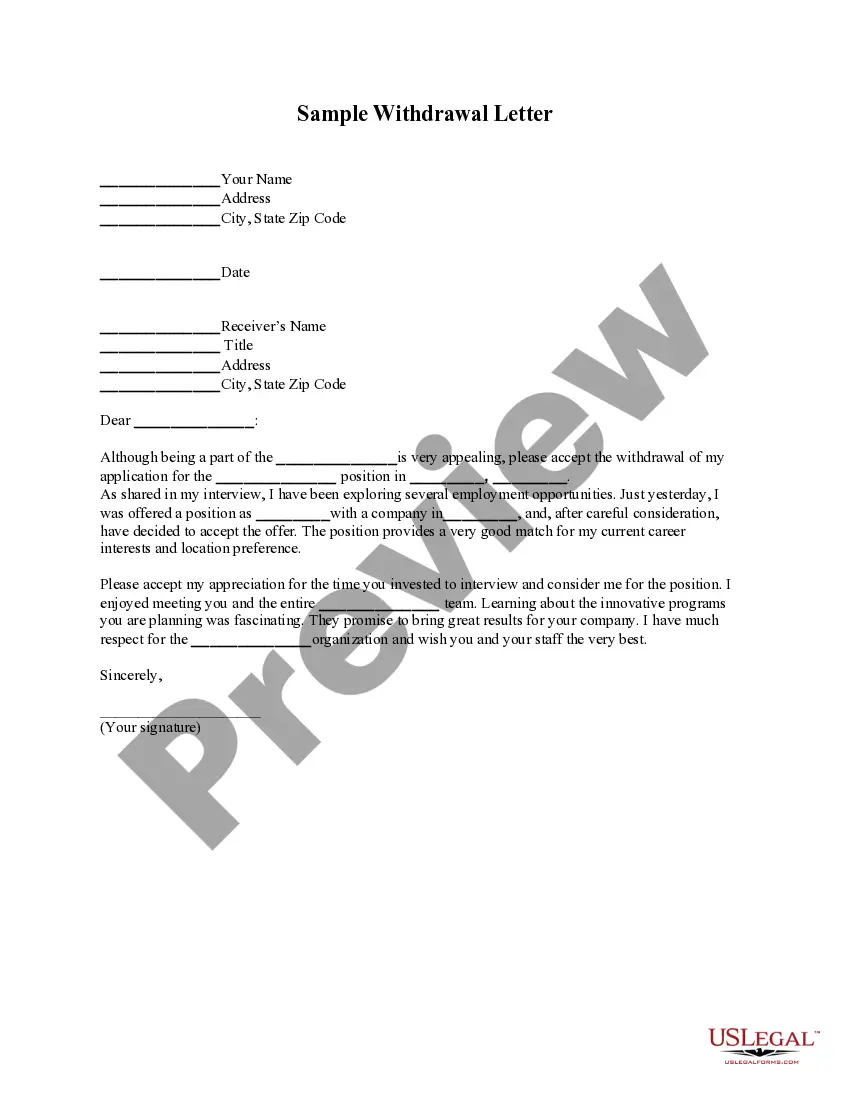

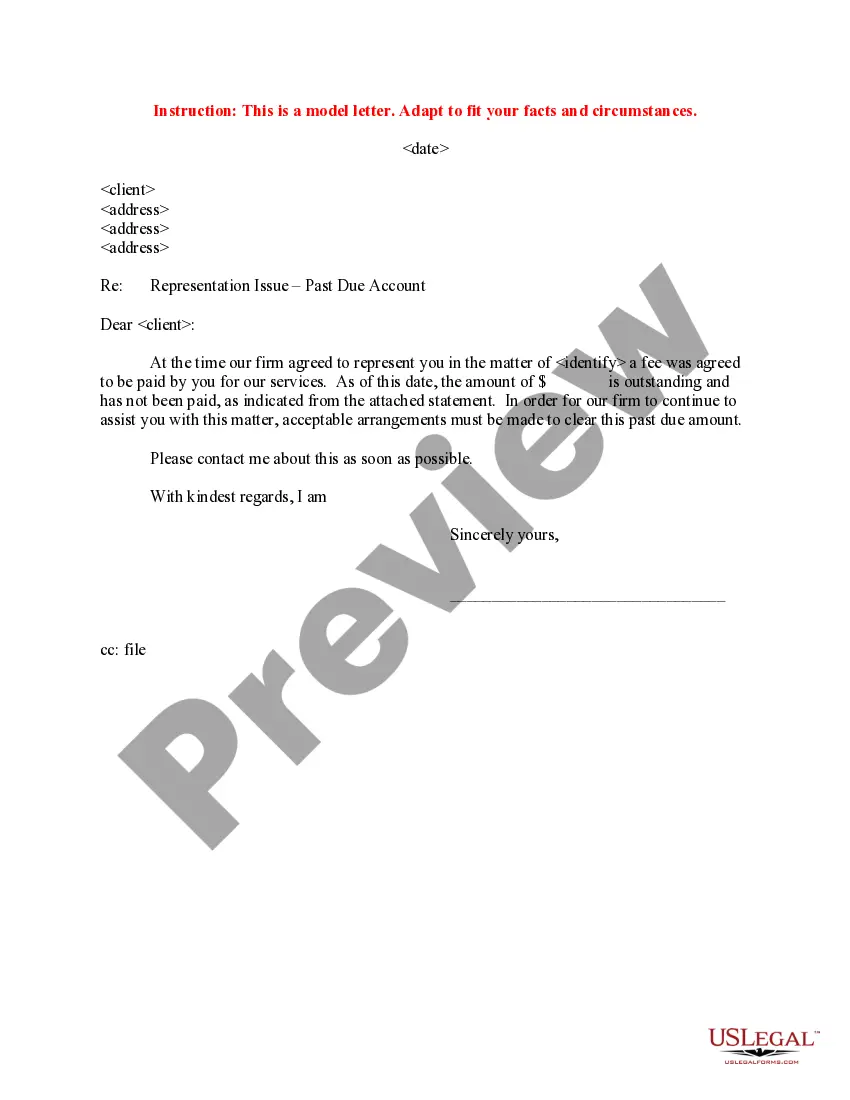

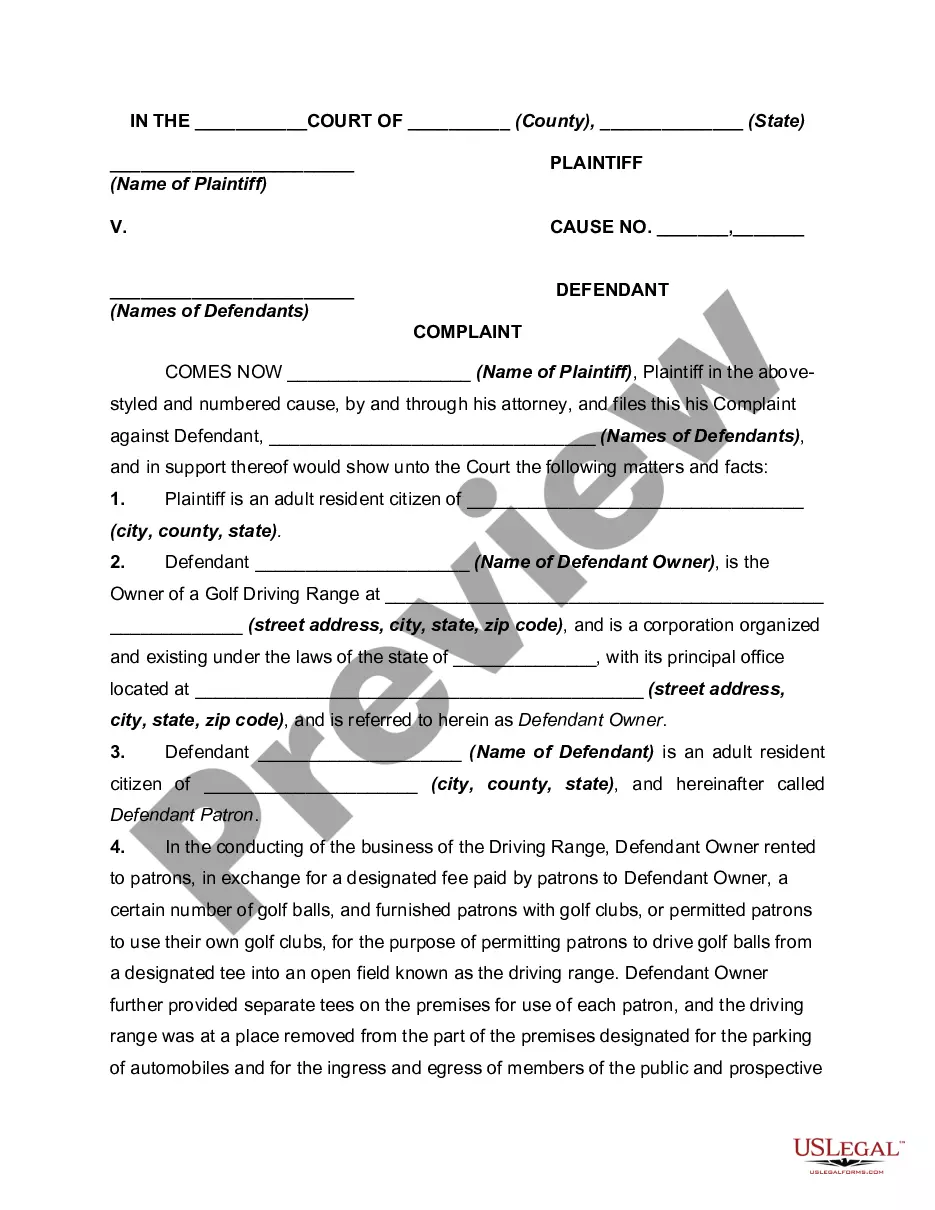

- If available, use the Preview button to view the document web template as well.

Form popularity

FAQ

Charitable contributions are usually classified as either cash or non-cash donations. A Delaware Unrestricted Charitable Contribution of Cash is classified based on its monetary value and its eligibility for tax deduction. You can further classify these contributions depending on their purpose, such as supporting education or health care. Accurate classification is crucial for tax reporting, so consider seeking assistance from an expert or using platforms like uslegalforms to guide you.

Typically, you cannot claim any charitable donation without proper documentation. However, the IRS allows a cash contribution of up to $250 as a deduction without a proper receipt, but you must still be able to show that you made the Delaware Unrestricted Charitable Contribution of Cash. It’s important to maintain a record of your transactions and any correspondence with the charity. Consider using uslegalforms for templates to help organize and verify your contributions.

Qualifying contributions often include donations made to recognized charities, non-profits, and governmental units. A Delaware Unrestricted Charitable Contribution of Cash falls under this category, provided the organization is eligible and you retain proper documentation. Contributions made to individuals or non-qualified entities do not usually qualify. Always double-check with IRS guidelines or a tax professional to ensure your contribution is deductible.

To claim charitable contributions, you must itemize your deductions on your tax return. This includes providing proof of your Delaware Unrestricted Charitable Contribution of Cash, such as receipts or statements from the charities. Be sure to accurately complete Schedule A of your tax form to include these deductions. Additionally, think about using a platform like uslegalforms to simplify the recordkeeping process and ensure compliance.

For most taxpayers, the maximum amount you can write off for charitable donations is generally limited to 60% of your adjusted gross income when donating cash to qualified charities. Donations exceeding this limit can carry over to future tax years. This limit applies to the Delaware Unrestricted Charitable Contribution of Cash, providing a significant tax deduction opportunity. Keep careful records to support your claims when tax season arrives.

The IRS generally allows individuals to deduct up to 60% of their adjusted gross income for cash donations to qualified charities. When it comes to Delaware Unrestricted Charitable Contribution of Cash, this means you can potentially maximize your tax benefits. However, it's crucial to keep documentation of all contributions to ensure compliance with tax regulations. Always consider consulting a tax advisor for personalized advice.

To deduct charitable contributions, you must itemize your deductions on your tax return. If your contributions qualify as a Delaware Unrestricted Charitable Contribution of Cash, they can significantly impact your taxable income. Make sure to gather all necessary receipts and documentation to support your claims. For a straightforward process, check out USLegalForms for easy-to-use templates and guides.

Yes, charities must register in Delaware to legally solicit contributions within the state. The registration process ensures that your donations are eligible for tax deductions as Delaware Unrestricted Charitable Contribution of Cash. This registration also provides transparency and builds trust with donors. For guidance on compliance, consider using resources like USLegalForms to streamline the process.

To deduct your charitable contributions, you must first determine if your donation qualifies as a Delaware Unrestricted Charitable Contribution of Cash. Ensure you keep detailed records of your donations, as documentation is vital for tax purposes. You can claim this deduction on Schedule A of your federal tax return. Consult a tax professional to maximize your benefits and confirm eligibility.