Delaware Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

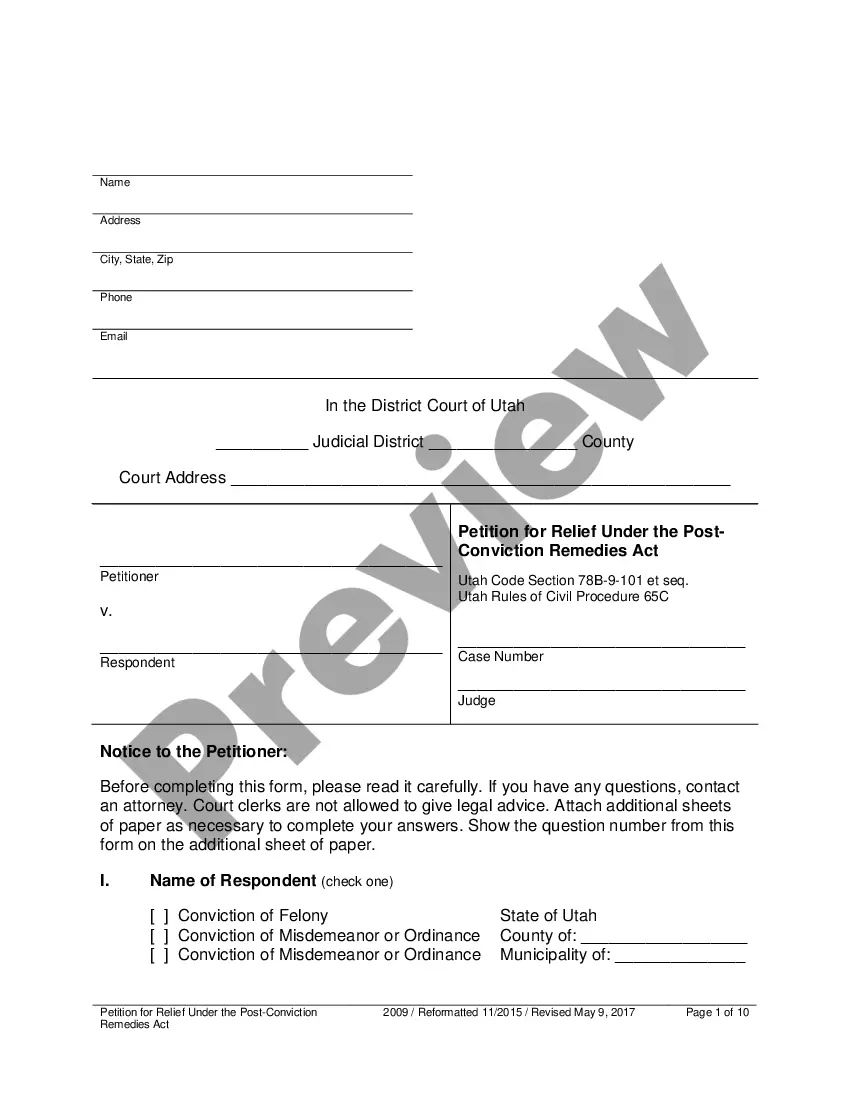

How to fill out Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

If you aim to be thorough, obtain, or generate legal document formats, utilize US Legal Forms, the largest repository of legal templates available online.

Take advantage of the site's user-friendly and convenient search feature to locate the documents you require. Numerous formats for business and personal use are arranged by categories and states, or keywords.

Use US Legal Forms to find the Delaware Liquidation of Partnership with Sale of Assets and Assumption of Liabilities in just a few clicks.

Every legal document format you purchase is yours indefinitely. You retain access to all documents you saved in your account.

Select the My documents section and choose a document to print or download again. Compete and obtain, and print the Delaware Liquidation of Partnership with Sale of Assets and Assumption of Liabilities with US Legal Forms. There are countless professional and state-specific forms available for your business or personal requirements.

- In case you are a current US Legal Forms subscriber, Log In to your account and click on the Download button to access the Delaware Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct state/region.

- Step 2. Use the Review option to examine the form's details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the document, use the Search bar at the top of the page to find alternative versions of the legal form format.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose your pricing plan and provide your information to create an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, print, or sign the Delaware Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

Form popularity

FAQ

There are 5 main ways to dissolve a partnership legally :Dissolution of Partnership by agreement.Dissolution by notice.Termination of Partnership by expiration.Death or bankruptcy.Dissolution of a Partnership by court order.

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

Generally, however, the liquidators of a partnership pay non-partner creditors first, followed by partners who are also creditors of the partnership. If any assets remain after satisfying these obligations, then partners who have contributed capital to the partnership are entitled to their capital contributions.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership.

On the dissolution of a partnership every partner is entitled, as against the other partners in the firm, and all persons claiming through them in respect of their interests as partners, to have the property of the partnership applied in payment of the debts and liabilities of the firm, and to have the surplus assets

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Under Section 17-801 of the DRULPA, a Delaware limited partnership will voluntarily dissolve upon the occurrence of certain events, including: (i) at a time specified in the limited partnership agreement; (ii) upon the happening of events specified in the limited partnership agreement; or (iii) the vote of at least two

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).