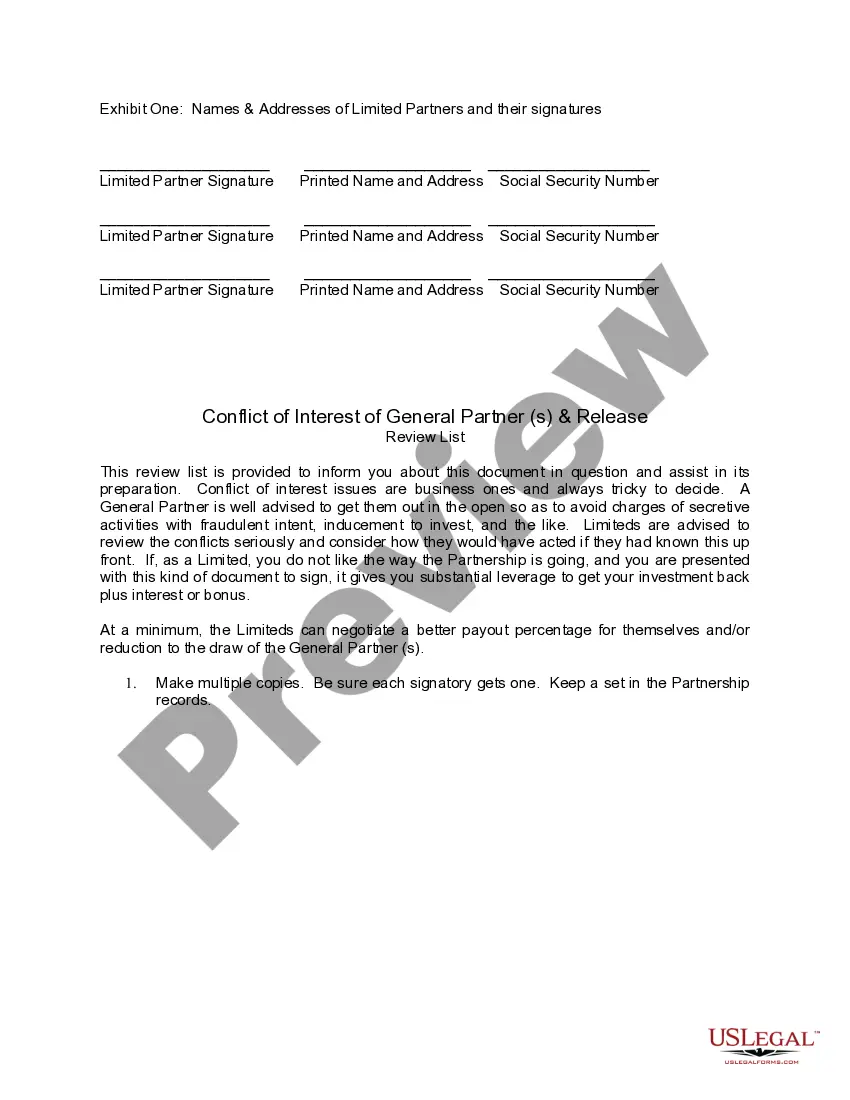

Delaware Conflict of Interest of General Partner and Release

Description

How to fill out Conflict Of Interest Of General Partner And Release?

If you desire to be thorough, download, or print legal document templates available online, utilize US Legal Forms, the premier choice for legal documentation that can be accessed via the internet.

Take advantage of the site’s straightforward and convenient search feature to find the documents you need. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to obtain the Delaware Conflict of Interest of General Partner and Release in just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to each form you downloaded in your account.

Click on the My documents section and select a form to print or download again.

- If you are a US Legal Forms user, Log In to your account and click the Download button to access the Delaware Conflict of Interest of General Partner and Release.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Remember to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to locate other versions of the legal form template.

- Step 4. Once you have found the form you want, click the Order Now button. Choose your payment plan and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal form and download it to your system.

- Step 7. Fill out, edit, and print or sign the Delaware Conflict of Interest of General Partner and Release.

Form popularity

FAQ

A general partner is a part-owner of a partnership business and is involved with its operations and shares in its profits. A general partner is often a doctor, lawyer, or another professional who has joined a partnership in order to remain independent while being part of a larger business.

A general partnership is a business entity made of two or more partners who agree to establish and run a business.

Partners are 'jointly and severally liable' for the firm's debts. This means that the firm's creditors can take action against any partner. Also, they can take action against more than one partner at the same time. This applies even if there is a partnership agreement that says otherwise.

A limited partnership consists of one or more general partners and one or more limited partners. The same person can be both a general partner and a limited partner, as long as there are at least two legal persons who are partners in the partnership.

General partners have unlimited liability and have full management control of the business. Limited partners have little to no involvement in management, but also have liability that's limited to their investment amount in the LP.

They do not require registration or a lot of paperwork. But all partnerships benefit from having a partnership agreement in place. In a general partnership, partners are all personally liable for the business's obligations. So, your personal assets could be at risk if someone sues your general partnership.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

Delaware Revised Uniform Limited Partnership Act (the "Act"). An ELP as such is not an entity with separate legal personality, and cannot own property in its own right; the general statutory position is that the property of the ELP will be held on statutory trusts by the GPs jointly under section 6(2) of the Law.

A general partner LLC, one of the most common types of partnerships, is arranged by two partners that have sole ownership of and liability for the business. This means they control all aspects of the business and are held financially responsible for its obligations and debts.

For non-tax purposes, a Delaware general partnership is a separate entity from its partners, may conduct business, acquire, hold, and dispose of property, and sue and be sued in its name, without the need to join all partners as parties.