Delaware Joint-Venture Agreement - Speculation in Real Estate

Description

How to fill out Joint-Venture Agreement - Speculation In Real Estate?

Are you currently in a situation where you need documents for business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of form templates, including the Delaware Joint-Venture Agreement - Investment in Real Estate, designed to meet state and federal requirements.

Once you locate the correct form, just click Get now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using your PayPal or credit card. Select a convenient document format and download your copy. You can find all the form templates you have purchased in the My documents menu. You can retrieve another copy of the Delaware Joint-Venture Agreement - Investment in Real Estate whenever needed. Click on the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service provides professionally crafted legal document templates that you can utilize for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and hold an account, simply Log In.

- After that, you can download the Delaware Joint-Venture Agreement - Investment in Real Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/county.

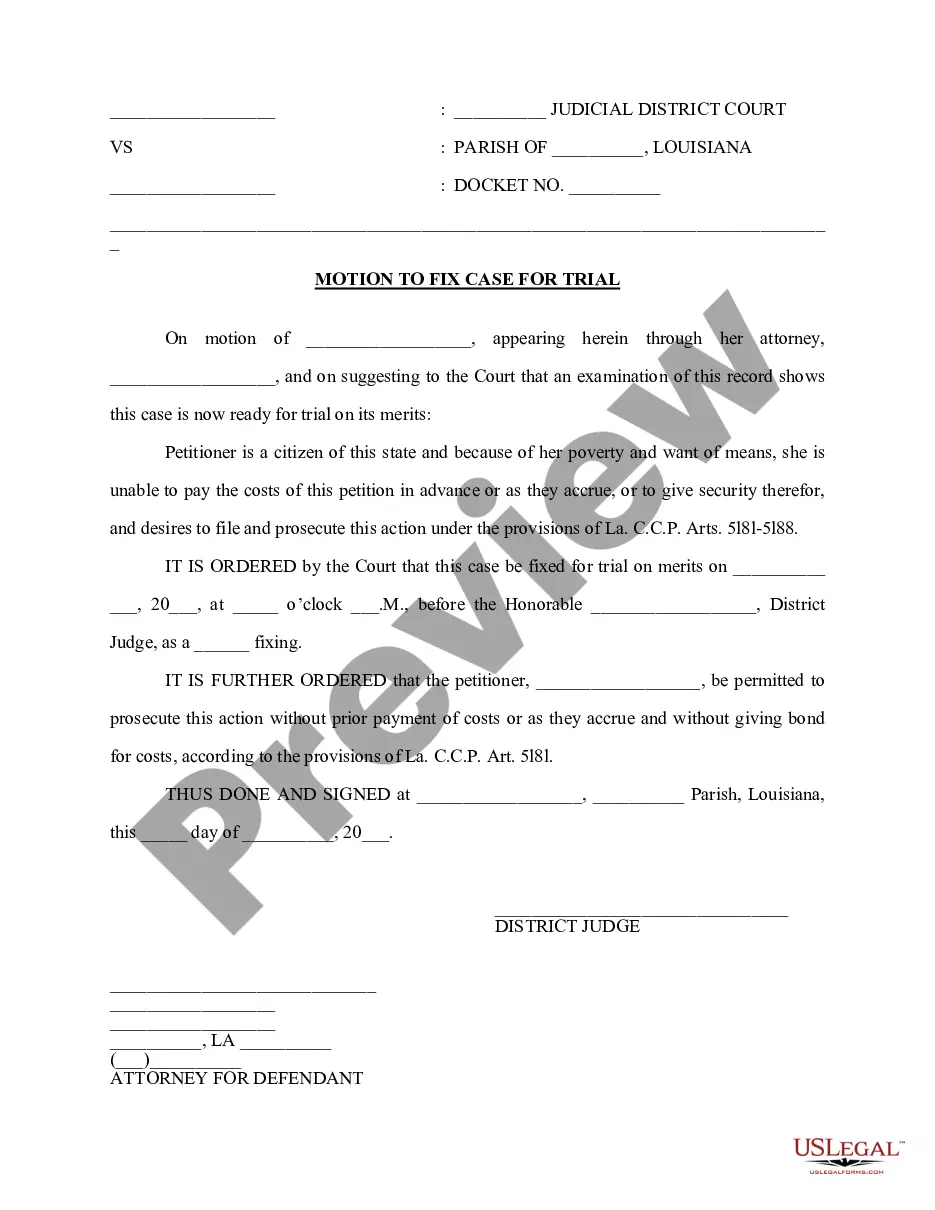

- Utilize the Review option to examine the form.

- Read the information to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your needs and requirements.

Form popularity

FAQ

A real estate joint venture (JV) is a deal between multiple parties to work together and combine resources to develop a real estate project. Most large projects are financed and developed as a result of real estate joint ventures.

Advantages of joint venture One of the most important joint venture advantages is that it can help your business grow faster, increase productivity and generate greater profits. Other benefits of joint ventures include: access to new markets and distribution networks. increased capacity.

In the property market, a joint venture is a temporary but formalised partnership of builders, finance houses and developers, which contract with each other for a particular development project, such as a housing estate, often through the creation of a temporary subsidiary company called a Special Purpose Vehicle (SPV)

A real estate joint venture contract is an agreement between two or more individuals or businesses who have decided to put their money and other resources together to purchase real estate.

Commercial real estate can be an excellent diversifier to an existing investment portfolio. Investors with significant capital may consider investing in real estate through a joint venture.

Courts permit a contract for partnership to be implied without any formal agreement. To determine whether a joint venture has been formed, courts consider whether each party has agreed to contribute money, assets, labor or skill with the understanding that profits will be shared between them.

Bringing on a joint venture (JV) partner for a real estate investor is a major decision. Partners can infuse capital and help take your business to the next level. In fact, many investors believe that creating a partnership is the best business decision they ever made.

The parties set out to accomplish a specific, mutually beneficial goal. Both parties contribute resources, share ownership of the joint venture's assets and liabilities, and share in the implementation of the project. The joint venture is temporary (but can be short or longer-term), dissolving once the goal is reached.

Other key considerationsuse of funds and financing of the JVC ; access to information (including financial information); transfer/sale of shares in the JV and exit mechanisms (including transfer/sale restrictions, drag-along rights and tag-along rights);

A joint venture in real estate is when two or more investors combine their resources for a property development or investment. Despite working together, each party maintains their own unique business identity while working together on a deal.