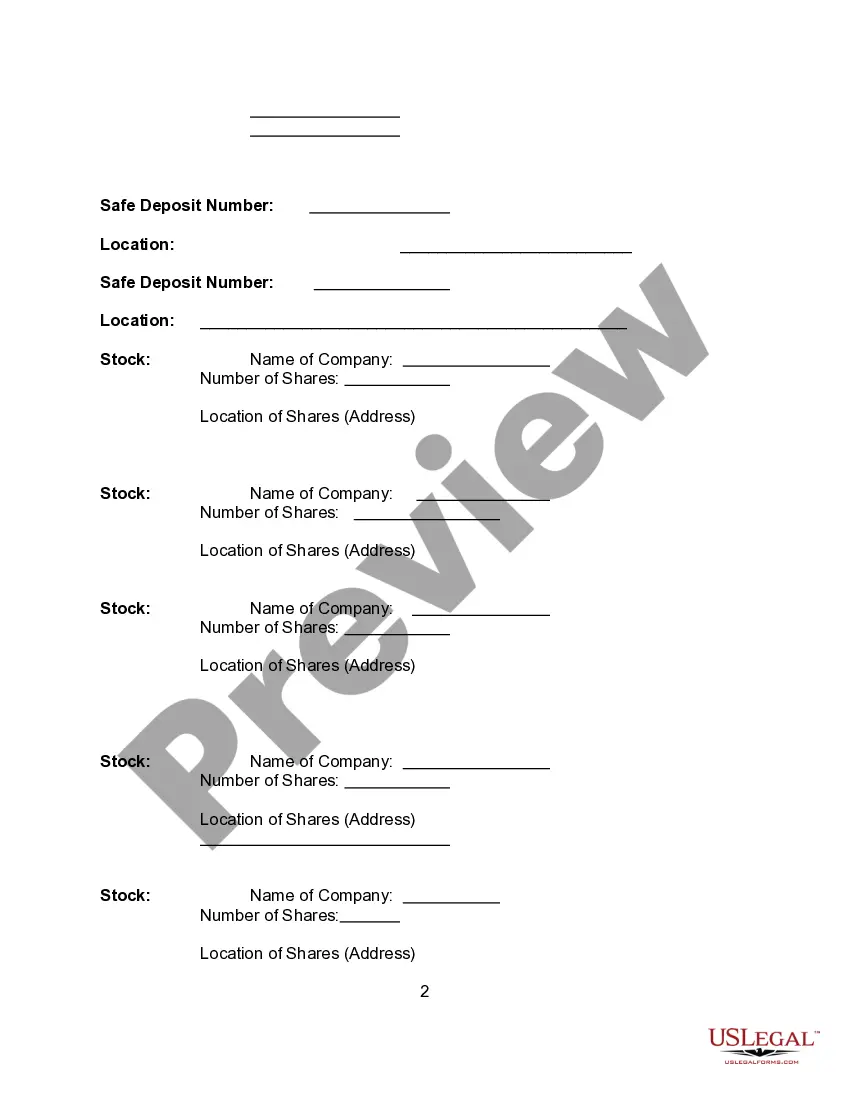

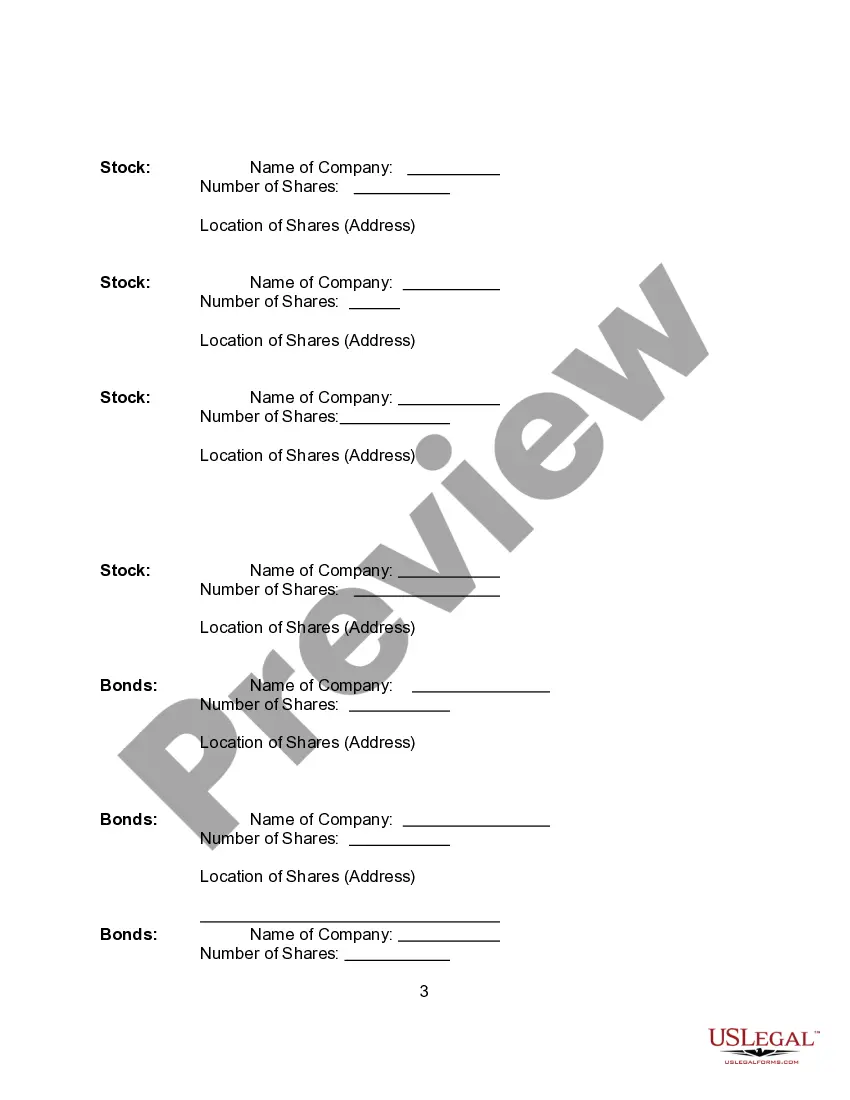

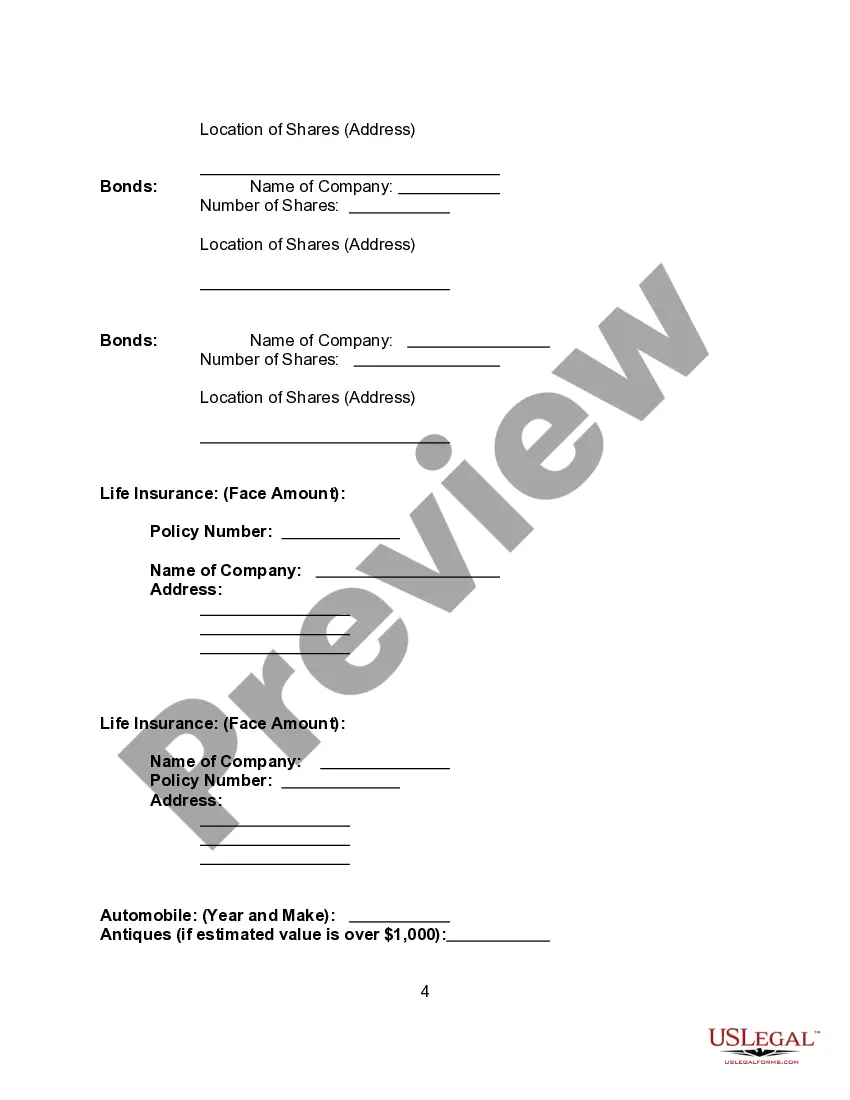

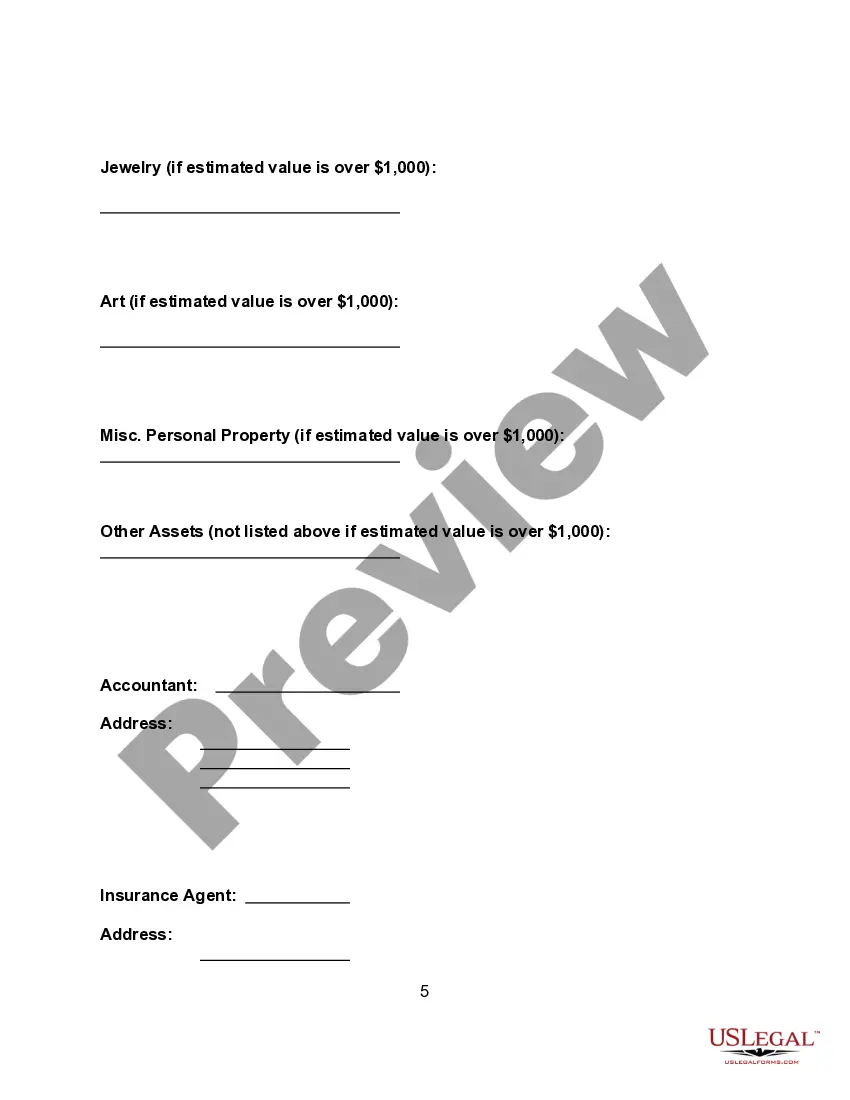

Delaware Asset Information Sheet

Description

How to fill out Asset Information Sheet?

If you wish to finalize, acquire, or print off approved document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site’s straightforward and user-friendly search to locate the documents you need.

Numerous templates for commercial and personal uses are categorized by types and states, or keywords.

Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the form you require, click the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Employ US Legal Forms to obtain the Delaware Asset Information Sheet with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Delaware Asset Information Sheet.

- You can also retrieve forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Utilize the Review option to examine the form’s content. Do not forget to read the description.

Form popularity

FAQ

The state calculates its franchise tax based on a company's margin which is computed in one of four ways: Total revenue multiplied by 70% Total revenue minus cost of goods sold (COGS) Total revenue minus compensation paid to all personnel.

A company's income is not a factor in the calculation of Delaware Franchise Tax. Even companies with no business activity must file the annual report and pay franchise tax to maintain good standing status.

Total Gross Assets shall be those total assets reported on the IRS Form 1120, Schedule L relative to the company's fiscal year ending the calendar year of the report. The tax rate under this method is $400 per million or portion of a million.

An annual report typically includes a business's name and address, the state in which the company was formed, a list of officers and directors, all business activities conducted within the state during the fiscal year, and name and contact information for the registered agent.

Delaware's default method of calculating annual franchise tax is based only on how many shares a Company has authorized in its charter: 5,000 shares or less (minimum tax) $175.00. 5,001 10,000 shares $250.00. Each additional 10,000 shares or portion thereof add $85.00.

The information required by a Delaware annual report is: The address of the corporation's physical location. The name and address of one officer. The names and addresses of all corporation directors.

There are ways to reduce your Delaware franchise costs in certain circumstances. To reduce the taxes paid by a startup, use the Assumed Par Value method. This method calculates the taxes by total assets. As long as your issued shares constitute a third to half of your authorized shares, this method will save you money.

Divide your total gross assets by your total issued shares carrying to 6 decimal places.Multiply the assumed par by the number of authorized shares having a par value of less than the assumed par.Multiply the number of authorized shares with a par value greater than the assumed par by their respective par value.More items...

Required Filing TimelinesDomestic Stock Corporations & Limited Liability Companies must file a complete statement of information (Annual Report) at the end of each year of operation.

The information required by a Delaware annual report is: The address of the corporation's physical location. The name and address of one officer. The names and addresses of all corporation directors.