Delaware Income Projections Statement

Description

As monthly projections are developed and entered into the income projections statement, they can serve as definite goals for controlling the business operation. As actual operating results become known each month, they should be recorded for comparison with the monthly projections. A completed income statement allows the owner/manager to compare actual figures with monthly projections and to take steps to correct any problems.

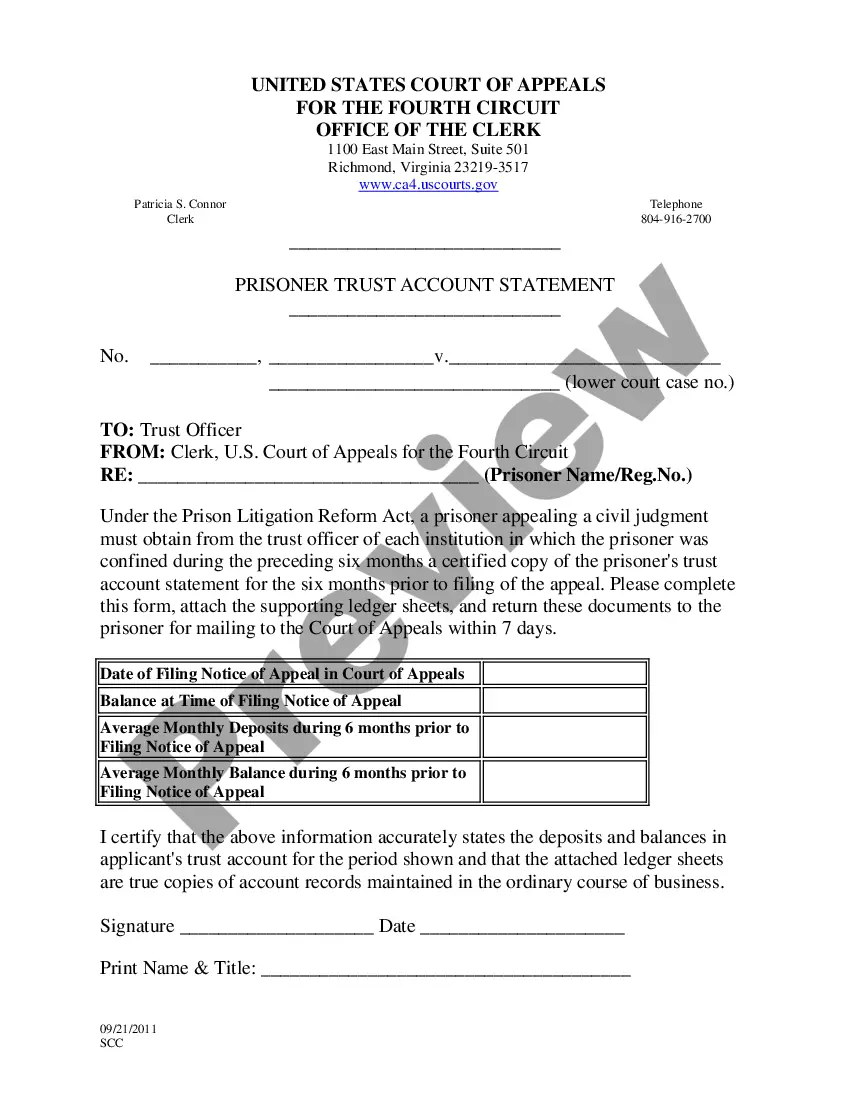

How to fill out Income Projections Statement?

You might invest hours online trying to identify the authentic document template that meets the federal and state specifications you require.

US Legal Forms offers a vast array of official forms that have been vetted by experts.

You can easily download or print the Delaware Income Projections Statement from the service.

If available, utilize the Preview button to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Delaware Income Projections Statement.

- Every official document template you purchase is yours permanently.

- To obtain an extra copy of a purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions provided below.

- First, ensure that you have chosen the correct document template for your region/city that you select.

- Check the form description to confirm that you have selected the appropriate form.

Form popularity

FAQ

Yes, Delaware requires residents to file a state income tax form to report their earnings and calculate taxes owed. This process includes a variety of forms that cater to different income scenarios. To simplify this task, consider using the Delaware Income Projections Statement to identify your tax obligations ahead of time.

Form 5403 in Delaware relates to the Personal Income Tax Return and is specifically for individuals expecting to claim certain deductions. This form plays a significant role in calculating exact liabilities and credits. For those who want accurate financial forecasting, the Delaware Income Projections Statement is invaluable.

Yes, Delaware has a personal state income tax that applies to individuals based on their income levels. This system ensures that tax rates are progressive, which means that higher incomes face higher rates. Utilizing the Delaware Income Projections Statement can provide clarity on how much you might owe, making your financial planning smoother.

Delaware income tax rates can vary based on your income level. While many find the rates competitive compared to other states, higher earners may feel the pinch. The Delaware Income Projections Statement helps you estimate your potential tax liabilities, allowing you to plan effectively.

On a Delaware tax return, you can choose from several filing statuses, including single, married filing jointly, and head of household. Each status affects your tax calculations differently, so it's crucial to select the one that fits your circumstances. To optimize your tax strategy, start by preparing a Delaware Income Projections Statement through our platform.

Delaware sourced income includes wages, salaries, and business revenue generated within the state. If you receive income from these sources, it's counted as Delaware sourced income for tax purposes. By utilizing our platform, you can easily generate a Delaware Income Projections Statement to identify and report your income accurately.

Filing a Delaware income tax return is necessary if you have income sourced from Delaware. This requirement applies to both residents and non-residents who have earned income while working in the state. Creating a Delaware Income Projections Statement can provide you with clarity about your potential tax obligations.

Yes, if you earn income in Delaware, you are required to file a separate state tax return. This applies even if you live in another state. To streamline this process, consider creating a Delaware Income Projections Statement to understand your liability and filing requirements better.

Any individual or entity whose income exceeds the federal filing threshold must file a Delaware tax return. This includes both residents and non-residents with Delaware-sourced income. For those navigating this process, utilizing our services can help you prepare an accurate Delaware Income Projections Statement.

Filing a tax return is generally mandatory if you meet specific income thresholds set by the state. The requirements can vary based on your situation. If you earn Delaware-sourced income, you should definitely consider filing a Delaware Income Projections Statement to ensure compliance and gauge your tax obligations.