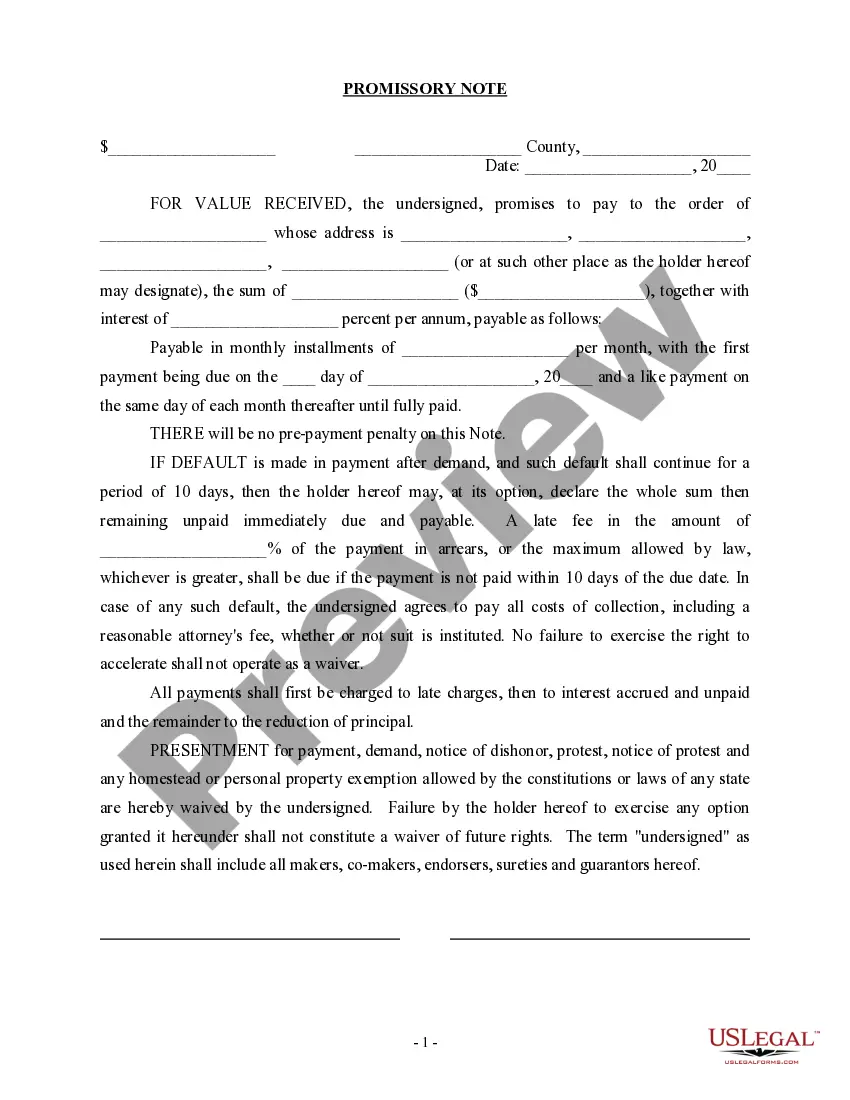

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

Delaware Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business

Description

How to fill out Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business?

Finding the correct legal document format can be challenging. It goes without saying that there are numerous templates available online, but how do you acquire the legal form you need? Visit the US Legal Forms website.

The service offers thousands of templates, including the Delaware Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase, which can be utilized for both business and personal purposes. All the forms are verified by experts and comply with federal and state regulations.

If you're already registered, Log In to your account and click the Download button to obtain the Delaware Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase. Use your account to review the legal forms you've previously acquired. Navigate to the My documents section of your account and retrieve another copy of the document you need.

Complete, modify, print, and sign the obtained Delaware Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download professionally crafted paperwork that adheres to state regulations.

- If you are new to US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/state. You can preview the form using the Review button and examine the form description to confirm it is the right one for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are sure the form is suitable, click the Get now button to obtain it.

- Choose the pricing plan you need and enter the required information. Create your account and complete the purchase using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

To secure a Delaware Promissory Note with real property, the debtor must create a security agreement that explicitly states the property as collateral. This agreement should be recorded to provide public notice of the creditor's interest in the asset. Using USLegalForms, you can find templates that help you draft the necessary documents accurately. With the right paperwork, you can ensure a smooth transaction when purchasing your business.

To perfect a security interest in a promissory note, you should take steps like drafting a security agreement and then filing the UCC-1 Financing Statement with the state. If the promissory note is secured by real property, ensure the filing accurately details the connection between the note and the property. Utilizing US Legal Forms can simplify this process, providing templates and guidance tailored to Delaware's legal requirements.

Secured Promissory Notes A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

Generally, a Secured Promissory Note will be secured using an additional document. If the property being used as collateral is personal property, the Note will be secured using a Security Agreement. If the property being used as collateral is real property, the Note will be secured using a Deed of Trust.

A real estate note is simply an IOU secured by property. In a conventional real estate transaction, a buyer makes a down payment, obtains a loan, and signs a note promising to pay a certain amount each month to the lender until the loan, plus interest, is paid.

What is a Secured Promissory Note? A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

A. As used in this section, "loan secured by real estate" means an obligation executed or assumed by the borrower that is secured by mortgage, deed of trust, or similar instrument, encumbering real estate that is owned by the borrower and upon which the bank relies as the principal security for the loan.

A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Collateral is an item of value used to secure a loan. Collateral minimizes the risk for lenders. If a borrower defaults on the loan, the lender can seize the collateral and sell it to recoup its losses. Mortgages and car loans are two types of collateralized loans.