A stock subscription is an agreement to purchase, at a stated price, a stated number of shares of stock of a corporation which is to be formed. Unless some restriction appears in the enabling statute or in the articles or certificate of incorporation, any natural person, and any corporation with the appropriate power, may be a subscriber to corporate stock. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Stock Subscription Agreement Among Several Subscribers

Description

How to fill out Stock Subscription Agreement Among Several Subscribers?

Are you currently in a situation where you require documents for both business or personal purposes almost every day.

There are numerous official document templates available online, but finding ones you can trust is not simple.

US Legal Forms provides thousands of form templates, similar to the Delaware Stock Subscription Agreement Among Multiple Subscribers, designed to comply with federal and state regulations.

Once you obtain the correct form, click Get now.

Select the pricing plan you want, complete the required information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Delaware Stock Subscription Agreement Among Multiple Subscribers template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct jurisdiction/region.

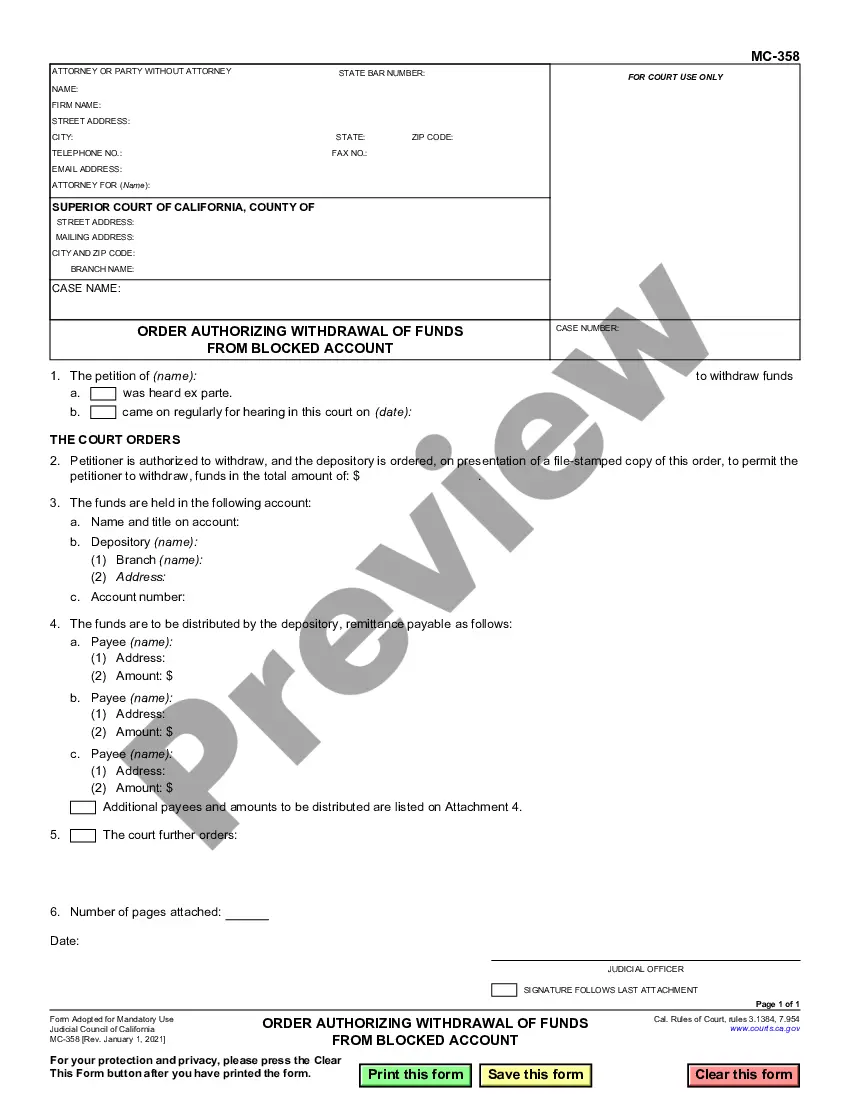

- Utilize the Review button to examine the form.

- Check the description to confirm you have selected the appropriate form.

- If the form is not what you are looking for, use the Search section to find the form that meets your needs and specifications.

Form popularity

FAQ

The process of a share subscription agreement begins with potential subscribers submitting their intent to buy shares under specified terms. After agreement on terms, the subscription is executed, often followed by payment. Using a professional platform like uslegalforms can simplify the preparation of a Delaware Stock Subscription Agreement Among Several Subscribers, ensuring all necessary steps are appropriately addressed.

To draft a share subscription agreement, begin by outlining the essential details such as the identities of the subscribers and the share terms. Specify the rights attached to the shares, including voting rights and profit distribution. Ensure that your document complies with state laws and considers any unique provisions relevant to your situation. Platforms like uslegalforms can offer valuable templates for a Delaware Stock Subscription Agreement Among Several Subscribers, making your drafting process more straightforward.

Creating a share agreement involves defining the roles of the shareholders and setting expectations around share ownership, dividends, and decision-making processes. A well-structured agreement ensures clarity and minimizes disputes in the future. Consider using a Delaware Stock Subscription Agreement Among Several Subscribers to guide you through the essential elements required in drafting this important document.

Determining the number of shares to issue during incorporation in Delaware involves various considerations, such as your business goals and the needs of potential investors. It's essential to balance between attracting investors and retaining control. Consulting a legal professional can provide insights into drafting a Delaware Stock Subscription Agreement Among Several Subscribers, helping to align your share issuance with your long-term business plans.

Subscription agreements and shareholder agreements serve different functions in a company’s structure. A subscription agreement is used to outline the terms of purchasing shares, while a shareholder agreement establishes how those shares are managed afterward. Emphasizing the importance of a Delaware Stock Subscription Agreement Among Several Subscribers can ensure clarity in the investment process and subsequent shareholder relations.

In a subscription agreement, the parties typically consist of the issuing company and the investors who wish to buy shares in that company. Each subscriber agrees to the terms set forth by the issuing company, ensuring that both sides are well-informed about their obligations. A Delaware Stock Subscription Agreement Among Several Subscribers provides a structured approach to these agreements, enhancing transparency and accountability.

In a share transfer agreement, the parties are typically the current shareholder, who is transferring the shares, and the new shareholder, who is receiving the shares. The agreement outlines the terms of the transfer, including any consideration given for the shares. Understanding these roles can facilitate a smooth transition of ownership and ensure compliance with legal requirements.

The parties to a Delaware Stock Subscription Agreement Among Several Subscribers usually include the company issuing the shares and the subscribers, who are the individuals or entities purchasing the shares. Each party has distinct roles and responsibilities defined in the agreement. It is vital that both parties fully understand their commitments to ensure a fruitful transaction.

A shareholder agreement governs the rights and responsibilities of shareholders in a company, detailing how they can buy or sell shares and the company's governance. In contrast, a share subscription agreement primarily focuses on the terms for buying new shares in the company. When you consider the Delaware Stock Subscription Agreement Among Several Subscribers, it becomes clear that this document helps streamline the initial investment process, while a shareholder agreement outlines ongoing shareholder relations.

While a subscription agreement lays the groundwork for purchasing shares, a shareholder agreement governs the ongoing relationship after shares are issued. The shareholder agreement typically includes terms about voting rights, transfer of shares, and company management. Understanding these differences is key when drafting a comprehensive Delaware Stock Subscription Agreement Among Several Subscribers alongside a shareholder agreement.