In this guaranty, the guarantor is guaranteeing both payment and performance of all leases now or later entered into with lessee and all the obligations and liabilities due and to become due to lessor from lessee under any lease, note, or other obligation of lessee to lessor. Such a blanket guaranty would suggest a close business relationship between the lessee and guarantor like that of a parent and subsidiary corporation.

Delaware Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease

Description

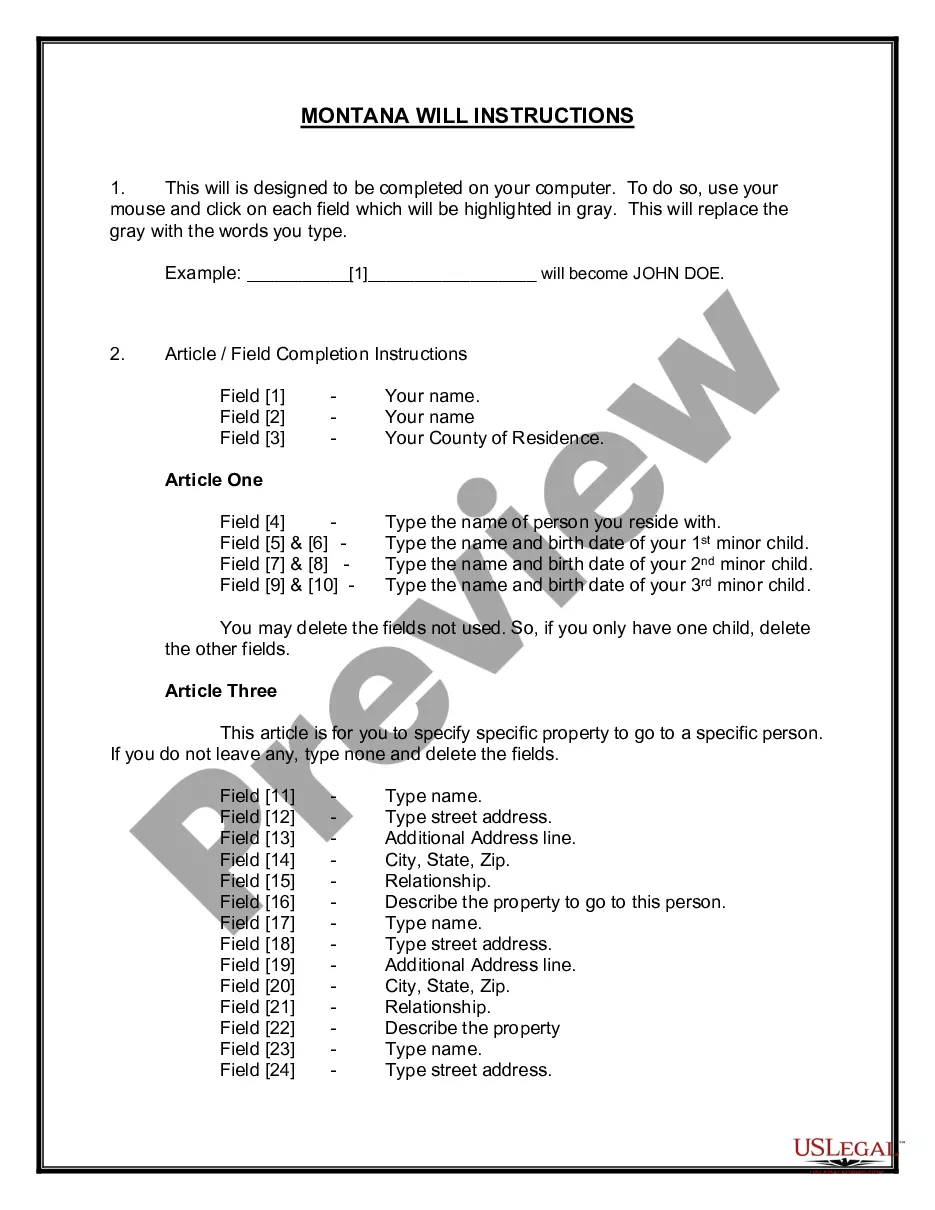

How to fill out Continuing Guaranty Of Payment And Performance Of All Obligations And Liabilities Due To Lessor From Lessee Under Lease?

Selecting the appropriate legal document template can be challenging.

Certainly, there are numerous designs accessible online, but how do you access the legal document you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: First, make sure you have selected the correct document for your city/region.

You can browse the document using the Preview button and review the document description to ensure it is the right one for you.

If the document does not meet your requirements, use the Search field to find the suitable document.

Once you are confident that the document is appropriate, click the Purchase now button to obtain the document.

Choose the pricing plan you need and enter the required information.

Create your account and pay for the order using your PayPal account or Visa or Mastercard.

Select the submission format and download the legal document template to your device.

Complete, review, print, and sign the retrieved Delaware Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Owed to Lessor by Lessee under Lease.

US Legal Forms is the largest repository of legal documents where you can find various document templates.

Take advantage of the service to download professionally crafted documents that comply with state requirements.

- The service offers a vast array of templates, including the Delaware Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Owed to Lessor by Lessee under Lease.

- These can be utilized for business and personal purposes.

- All of the forms are reviewed by experts and meet federal and state standards.

- If you are already registered, Log In to your account and then click the Obtain button to retrieve the Delaware Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Owed to Lessor by Lessee under Lease.

- Use your account to search through the legal documents you previously purchased.

- Visit the My documents section of your account and download another copy of the documents you require.

Form popularity

FAQ

The guaranty language of a lease refers to the specific wording used in the lease agreement to define the roles and responsibilities of the guarantor. When discussing the Delaware Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, precise language is crucial for clarity and enforceability. Clear guaranty language helps both lessor and lessee understand their obligations, reducing the risk of disputes.

A payment guaranty is a commitment made by a guarantor to fulfill payment obligations in the event that the lessee fails to do so. With the Delaware Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, this concept is essential for protecting lessors from potential financial losses. It establishes a clear obligation for the guarantor, thereby reinforcing the leasing arrangement.

A guaranty of payment clause stipulates that the guarantor must cover any outstanding payments owed under a lease if the lessee fails to comply. When it comes to the Delaware Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, this type of clause affirms that the lessor can rely on the guarantor for financial assurance. Thus, it ensures that the lessor's interests are safeguarded.

The guaranty of recourse obligations is a provision that holds the guarantor accountable for the lessee's responsibilities under the lease. In the framework of the Delaware Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, this means the lessor can pursue the guarantor for any unpaid debts if the lessee fails to fulfill their obligations. This adds an extra layer of security for the lessor.

The main purpose of a payment guarantee is to provide assurance to the lessor that payments will be made, even if the lessee defaults. By utilizing a Delaware Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, the lessor gains additional protection against financial loss. This guarantee strengthens the trust between parties and promotes a smoother leasing process.

A reaffirmation of guaranty is an agreement where a guarantor confirms their commitment to ensure payment and performance on behalf of the borrower under a lease. In the context of the Delaware Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, this reaffirmation provides additional security for the lessor. Importantly, it reinforces the guarantor's obligations and protects the interests of the lessor.

Definition of guaranty (Entry 1 of 2) 1 : an undertaking to answer for the payment of a debt or the performance of a duty of another in case of the other's default or miscarriage. 2 : guarantee sense 3. 3 : guarantor. 4 : something given as security (see security sense 2) : pledge used our house as a guaranty for the

A continuing guaranty is an agreement by the guarantor to be liable for the obligations of someone else to the lender, even if there are several different obligations that are made, renewed or repaid over time. In contrast, a specific guaranty is limited only to one individual transaction.

Purpose of GuarantyThe guarantor agrees to pay the obligations of the borrower under the loan agreement in the event that the borrower does not pay. In addition to being an alternate source of repayment, guaranties provide evidence that the guarantor intends to stand behind the borrower.

A guarantee which extends to a series of transactions is called a continuing guarantee. It is not confined to a single transaction. In this guarantee, the surety is liable to pay the creditor for all the transactions. However, it is very important to find out if the guarantee is a continuing one or not.