US Legal Forms - among the biggest libraries of lawful kinds in the United States - provides a wide range of lawful file layouts you may download or produce. Using the website, you may get 1000s of kinds for business and person purposes, sorted by classes, claims, or search phrases.You will find the most recent types of kinds like the Delaware Agreement Between Widow and Heirs as to Division of Estate in seconds.

If you already have a membership, log in and download Delaware Agreement Between Widow and Heirs as to Division of Estate from the US Legal Forms catalogue. The Obtain option will appear on every single kind you view. You have accessibility to all in the past acquired kinds inside the My Forms tab of your respective account.

If you would like use US Legal Forms for the first time, allow me to share simple guidelines to get you began:

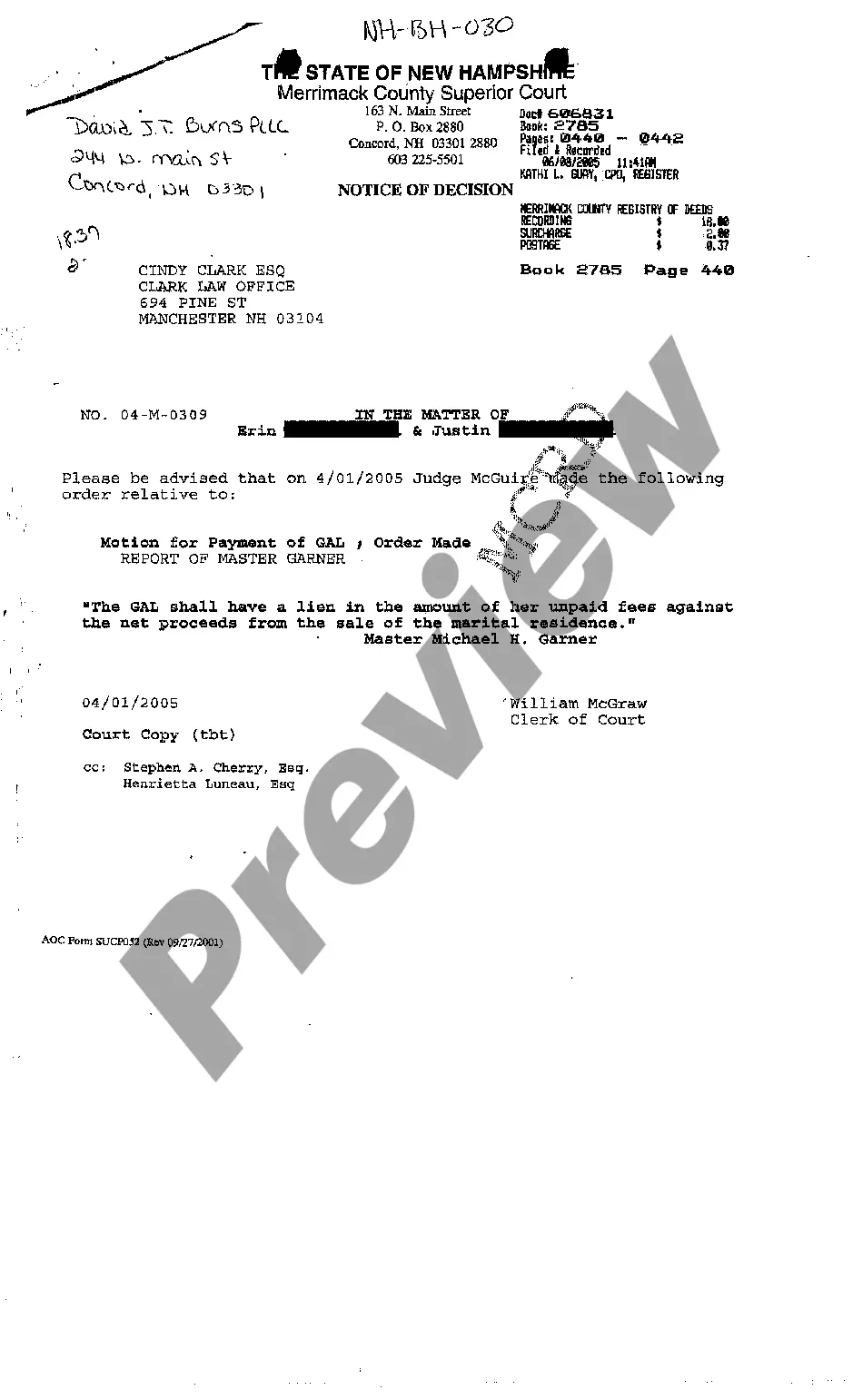

- Make sure you have chosen the best kind for the city/region. Select the Preview option to analyze the form`s content. Look at the kind information to actually have chosen the right kind.

- In case the kind doesn`t match your specifications, take advantage of the Look for discipline near the top of the monitor to get the one that does.

- Should you be pleased with the form, affirm your decision by clicking the Buy now option. Then, opt for the prices program you favor and offer your credentials to register to have an account.

- Method the purchase. Utilize your bank card or PayPal account to complete the purchase.

- Choose the formatting and download the form on the product.

- Make changes. Load, change and produce and signal the acquired Delaware Agreement Between Widow and Heirs as to Division of Estate.

Each template you added to your account lacks an expiration date and is also the one you have for a long time. So, if you wish to download or produce one more duplicate, just visit the My Forms area and then click about the kind you need.

Obtain access to the Delaware Agreement Between Widow and Heirs as to Division of Estate with US Legal Forms, one of the most substantial catalogue of lawful file layouts. Use 1000s of expert and state-distinct layouts that fulfill your organization or person requirements and specifications.