Delaware Promissory Note - Payable on Demand

Description

How to fill out Promissory Note - Payable On Demand?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document models that you can download or print.

By using the website, you will find countless documents for business and personal purposes, organized by categories, states, or keywords. You can access the most recent documents such as the Delaware Promissory Note - Payable on Demand within minutes.

If you already have a subscription, Log In and download the Delaware Promissory Note - Payable on Demand from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved documents in the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finish the transaction.

Choose the format and download the form onto your device. Edit. Fill out, modify, print, and sign the saved Delaware Promissory Note - Payable on Demand. Each template you have added to your account has no expiration date and is yours permanently. Therefore, if you want to download or print another copy, simply head to the My documents section and click on the form you desire. Access the Delaware Promissory Note - Payable on Demand with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have chosen the correct form for your jurisdiction.

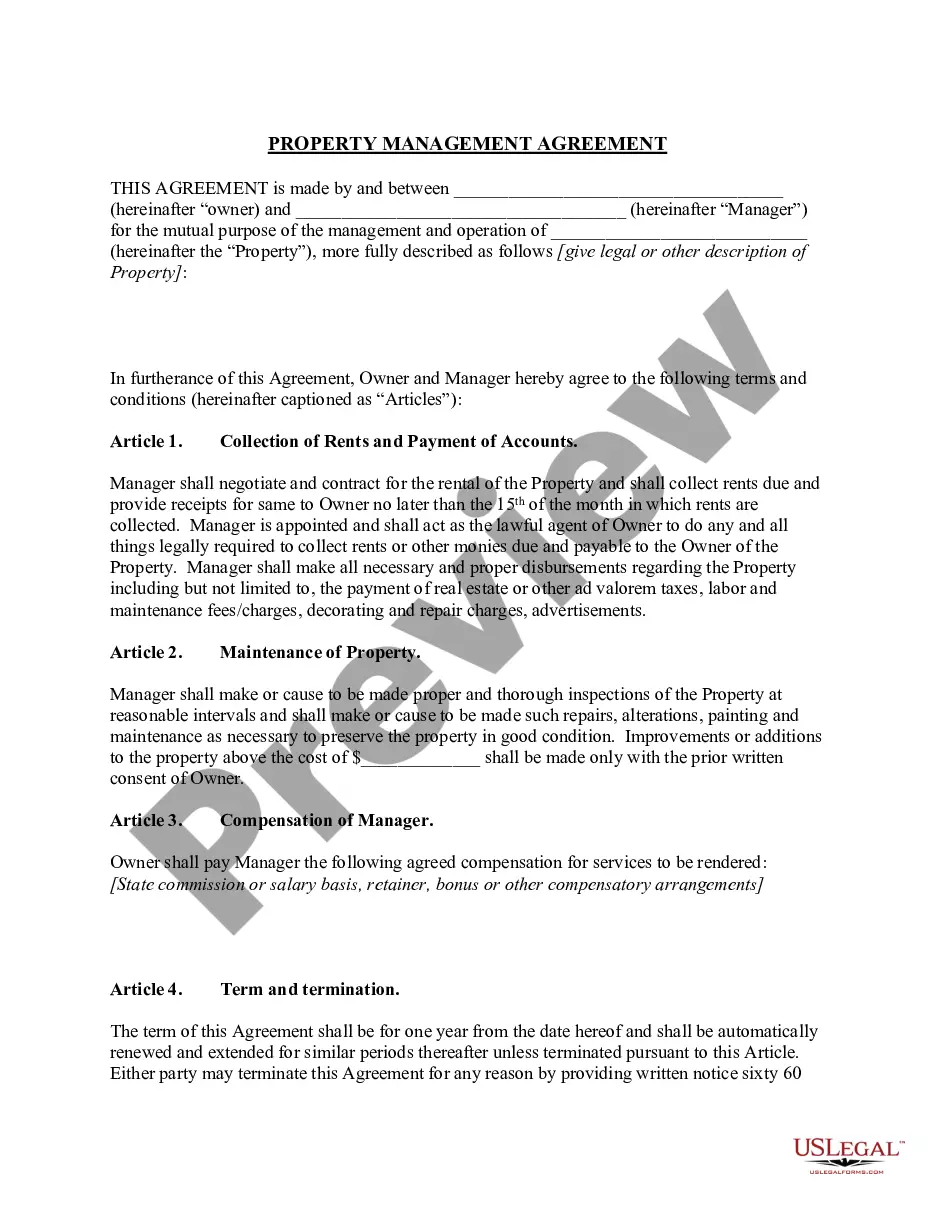

- Click on the Preview button to review the content of the form.

- Check the form details to confirm that you have selected the correct one.

- If the form does not fulfill your requirements, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Next, select your preferred pricing plan and enter your information to create an account.

Form popularity

FAQ

To write a simple Delaware Promissory Note - Payable on Demand, start with the date and the amounts clearly defined. State the names of the borrower and lender, specify the demand nature of the repayment, and sign the document. Keep the language straightforward to ensure all parties understand their obligations.

Yes, a Delaware Promissory Note - Payable on Demand allows the lender to request payment whenever they choose. This type of note does not specify a fixed date for repayment, providing flexibility for the lender. It's essential to detail this demand feature in the note to avoid any misunderstandings.

A Delaware Promissory Note - Payable on Demand generally follows a clear format that includes key elements like the principal amount, interest rate, payment terms, and signatures of both parties. You should start with a title that clearly states it is a promissory note. Follow this with the date, names of the borrower and lender, and a defined repayment schedule.

Demand payment of a Delaware Promissory Note - Payable on Demand refers to the borrower's obligation to repay the lender upon request. Unlike a scheduled payment plan, this type of note allows the lender to demand the total amount owed at any time. This provides the lender with immediate access to funds, ensuring financial flexibility.

A Delaware Promissory Note - Payable on Demand is typically made payable through clear terms outlined during its creation. By stating when the payment is due and to whom it is payable, you can ensure that all parties understand their rights and responsibilities. This level of transparency is essential for maintaining trust between the borrower and lender.

Yes, a Delaware Promissory Note - Payable on Demand can be made payable to the bearer. This means that whoever holds the note can demand payment. This feature adds a layer of liquidity, allowing for easy transfer and access to funds.

A Delaware Promissory Note - Payable on Demand can certainly be made payable. The terms of the note can outline when and how the borrower must repay the amount owed. This clarity helps prevent misunderstandings and ensures that both parties are aware of their obligations.

Yes, a Delaware Promissory Note - Payable on Demand can be structured to allow immediate payment upon request. This means that the lender can demand repayment at any time, providing flexibility and security. Such notes are beneficial for situations where quick access to funds is essential.

Yes, both a promissory note and a bill of exchange can be made payable at the holder's request. This payability enhances financial flexibility, allowing holders to receive funds whenever they need. Crafting these documents correctly ensures enforceability and clarity. For assistance in creating a Delaware Promissory Note - Payable on Demand, you can rely on the tools provided by US Legal Forms.

To write an on-demand promissory note, include the borrower's name, the lender's name, the principal amount, and clearly state that it is payable on demand. Be sure to specify interest rates, if any, and any other relevant details. This clarity helps both parties understand their obligations. For templates and further guidance on a Delaware Promissory Note - Payable on Demand, consider using US Legal Forms.