Delaware Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

It is feasible to spend hours online trying to locate the valid document format that meets the federal and state requirements you need.

US Legal Forms provides thousands of valid templates that are reviewed by experts.

You can easily download or print the Delaware Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan from the service.

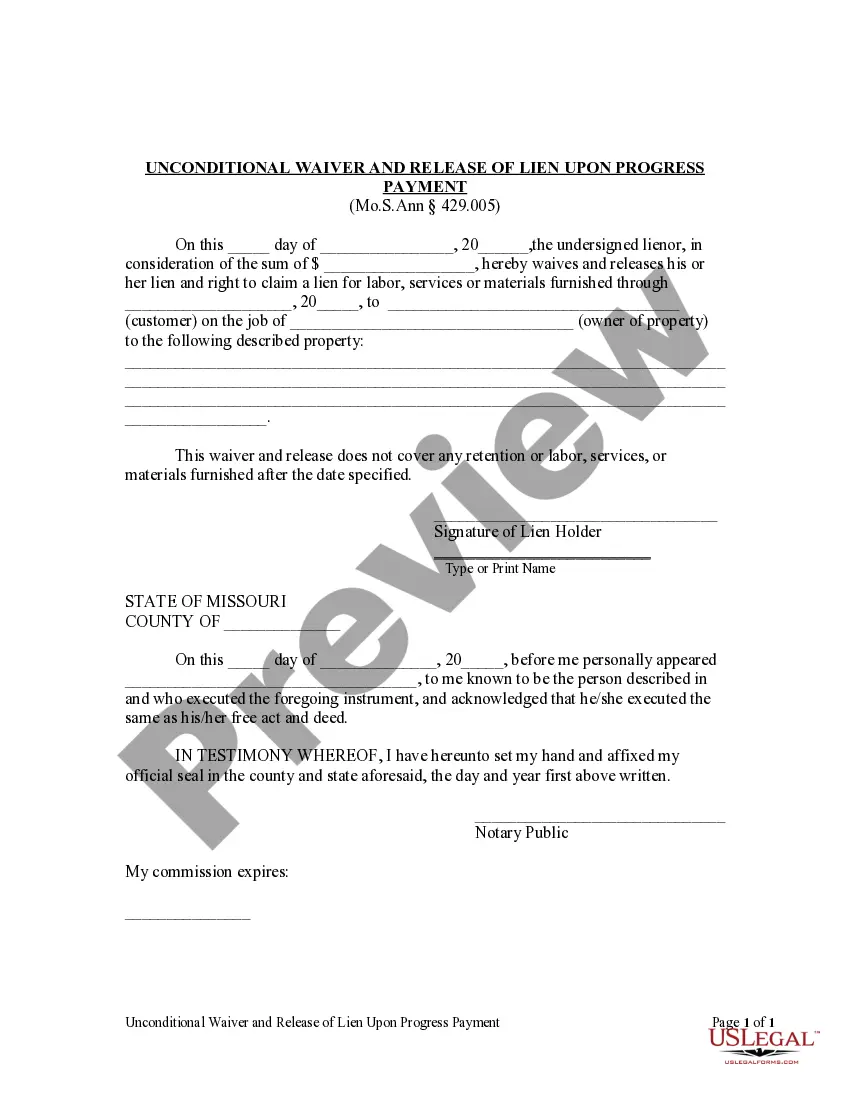

If available, use the Preview button to view the document format as well. If you wish to find another version of the form, use the Search section to locate the template that suits your needs and requirements. Once you have identified the format you want, click on Purchase now to proceed. Choose the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your system. Make modifications to your document if possible. You can complete, edit, sign, and print the Delaware Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the Delaware Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan.

- Every valid document format you purchase is yours indefinitely.

- To acquire another copy of any purchased template, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for the county/town of your choice.

- Review the template description to make sure you have chosen the correct form.

Form popularity

FAQ

Do home loans without a 'due on sale' clause exist? There are some kinds of mortgages where the contract does not have a ?due on sale? clause. Those include VA, USDA, and FHA loans. These types of mortgages lack such clauses because they actually can be transferred from one individual to another.

VA loans include certain contingencies that protect earnest money deposits and allow them to be refunded to the buyer under specific circumstances. Some of the most common VA contract contingencies include a home inspection contingency, financing contingency, home sale contingency and appraisal contingency.

Addendum for Release of Liability on Assumed Loan and/or Restoration of Seller's VA Entitlement. Description: This Addendum is used in conjunction with the Loan Assumption Addendum if the Seller wants to be released from future liability of the loan.

If the purchaser(s) is creditworthy and assumes the liability to the lender and VA to the same extent that you did when you obtained the loan, you will be released from liability on the loan. To obtain a release from liability, you should check with the company to whom you make your payments before you sell your home.

The essential purpose of the FHA and VA amendatory/escape clauses is to give the buyer the right to terminate the sales contract if the sales price exceeds the appraised value of the Property. Form 2A4-T includes the prescribed wording of the FHA and VA amendatory/escape clauses.

An FHA/VA financing addendum is attached to a purchase contract to state that a buyer with FHA/VA financing can back out of the sale if the appraised property value is less than the asking price.

The Bottom Line The FHA amendatory clause protects borrowers because if the appraisal comes back low, the buyer can cancel the transaction and get their earnest money back. Signing on the dotted line for a home that appraises for below the sales price could result in a bad investment for both lenders and buyers.

A seller financing addendum outlines the terms under which the seller of a property agrees to loan money to the buyer in order to purchase their property.