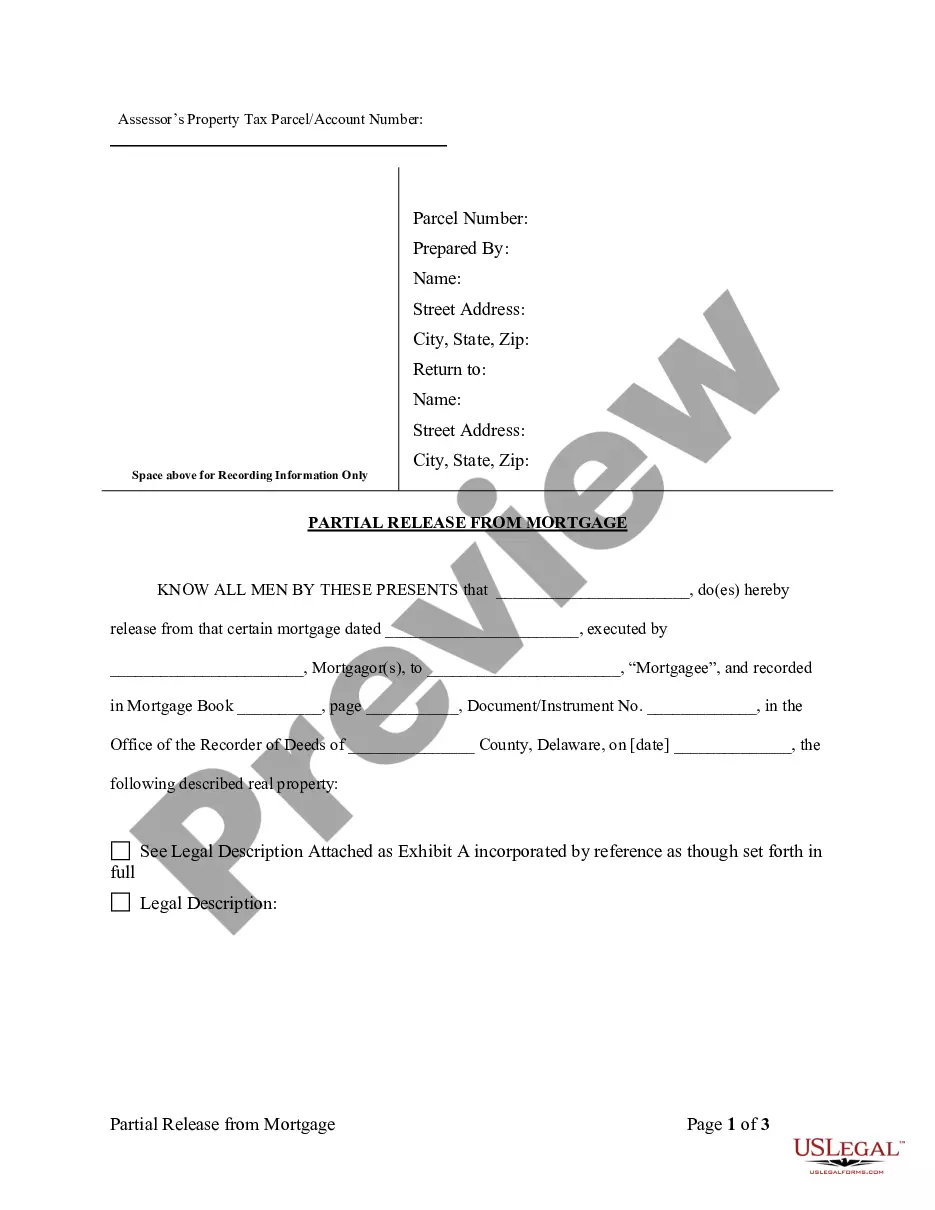

Delaware Partial Release of Property From Mortgage by Corporate Holder

Description

How to fill out Delaware Partial Release Of Property From Mortgage By Corporate Holder?

The greater the documentation you must generate - the more anxious you become.

You can obtain a vast quantity of Delaware Partial Release of Property From Mortgage by Corporate Holder forms online, but you may be uncertain which ones to trust.

Streamline the process of identifying templates more efficiently using US Legal Forms. Acquire expertly crafted documents that are tailored to comply with state regulations.

Submit the required details to establish your account and complete the transaction using your PayPal account or credit card. Select a suitable file format and obtain your copy. Access all documents you've received in the My documents section. Simply navigate there to prepare a new version of the Delaware Partial Release of Property From Mortgage by Corporate Holder. Even when crafting professionally made documents, it remains important to consider consulting a local attorney to double-check the completed template to ensure that your form is accurately filled out. Achieve more for less with US Legal Forms!

- If you already possess a US Legal Forms subscription, access your account, and you'll discover the Download option on the Delaware Partial Release of Property From Mortgage by Corporate Holder’s page.

- If you haven’t utilized our platform before, follow the signup process with these steps.

- Verify that the Delaware Partial Release of Property From Mortgage by Corporate Holder is acceptable in your state.

- Confirm your choice by reviewing the description or utilizing the Preview mode if available for the selected document.

- Press Buy Now to initiate the signup procedure and select a pricing plan that caters to your needs.

Form popularity

FAQ

A partial release of easement occurs when a property owner relinquishes some but not all of their rights to an easement on their land. This action can affect the use of the property and may involve negotiations with other property holders. In relation to a Delaware Partial Release of Property From Mortgage by Corporate Holder, understanding easement rights is crucial when dealing with property boundaries and uses. Using resources like US Legal Forms can guide you through the process of securing a partial release, ensuring you make informed decisions.

Delaware Code 272 outlines the legal framework regarding property releases in the state, including those that deal with mortgages. It can provide important guidelines for obtaining a Delaware Partial Release of Property From Mortgage by Corporate Holder. This code helps ensure that all parties involved understand their rights and responsibilities when a property is partially released from a mortgage. Familiarity with this code can empower you as a property owner or business entity in managing your mortgage obligations effectively.

To obtain a partial release of mortgage, the borrower must comply with the stipulations set by the lender, which usually includes making a payment or fulfilling specific conditions. Additionally, the borrower should provide evidence that the release meets legal requirements. The process can be complex, so utilizing resources like US Legal Forms may simplify navigating the Delaware Partial Release of Property From Mortgage by Corporate Holder.

Yes, a blanket mortgage typically includes a release clause that permits the borrower to release specific properties from the mortgage. This feature is particularly beneficial for real estate developers who might want to sell lots individually while keeping others under the mortgage. Understanding how the Delaware Partial Release of Property From Mortgage by Corporate Holder functions can help you leverage this aspect effectively.

A partial mortgage release is when a lender agrees to release a portion of the mortgaged property while maintaining the mortgage on the remainder. This often occurs in real estate transactions, allowing for flexibility in selling parts of the property. This process is critical in a Delaware Partial Release of Property From Mortgage by Corporate Holder, making it essential to navigate the requirements carefully.

A partial release of a deed of trust functions similarly to a partial discharge of a mortgage, allowing a portion of the secured property to be released from the obligations of the trust deed. This process can be employed when the property owner wishes to sell or refinance part of their property. In Delaware, particularly with the Delaware Partial Release of Property From Mortgage by Corporate Holder, understanding the nuances of such releases is crucial for protecting your interests.

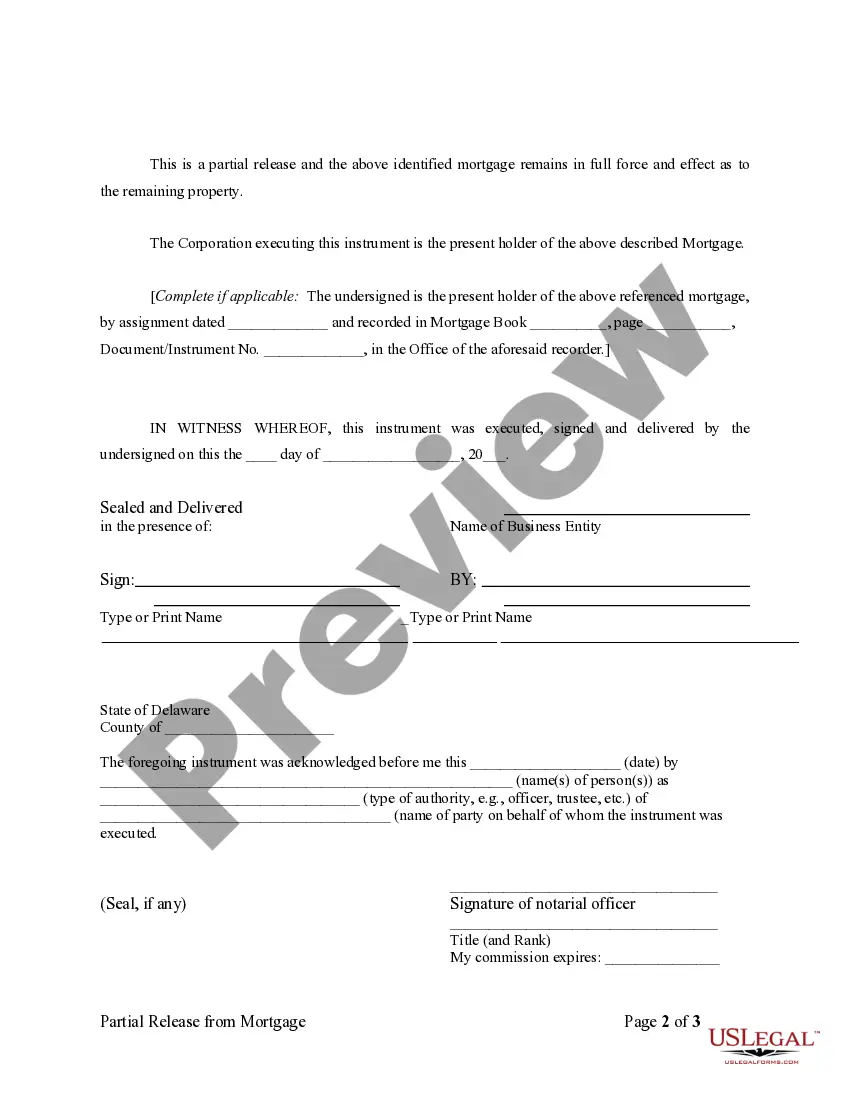

The grantor on a partial release of a mortgage is typically the property owner who holds the mortgage. This individual or entity requests the lender to release a portion of the property from the mortgage obligation. In the case of Delaware Partial Release of Property From Mortgage by Corporate Holder, the grantor must work closely with their lender to ensure that the release aligns with contractual terms.

A release clause in a mortgage specifies the terms under which a lender agrees to release part of the property from the mortgage. This clause is beneficial when you wish to sell a portion of the property without affecting the entire mortgage. For instance, in a Delaware Partial Release of Property From Mortgage by Corporate Holder, this clause allows flexibility for property owners, ensuring that transactions can occur without undue complications.

To obtain a partial release of a mortgage, you should start by contacting your lender to discuss your intentions. You may need to provide documentation that details the property in question and your reason for the release. Utilizing services like USLegalForms can streamline this process, helping you prepare necessary documents and navigate negotiations for the Delaware Partial Release of Property From Mortgage by Corporate Holder.

The official document from a mortgage holder that releases a debtor from a mortgage is often called a satisfaction of mortgage or a release of mortgage. In Delaware Partial Release of Property From Mortgage by Corporate Holder cases, this document indicates that a specific portion of the property is no longer encumbered by the mortgage. It is crucial to obtain and properly record this document to ensure clear property titles. Accessing templates through US Legal Forms can simplify obtaining such important documents.