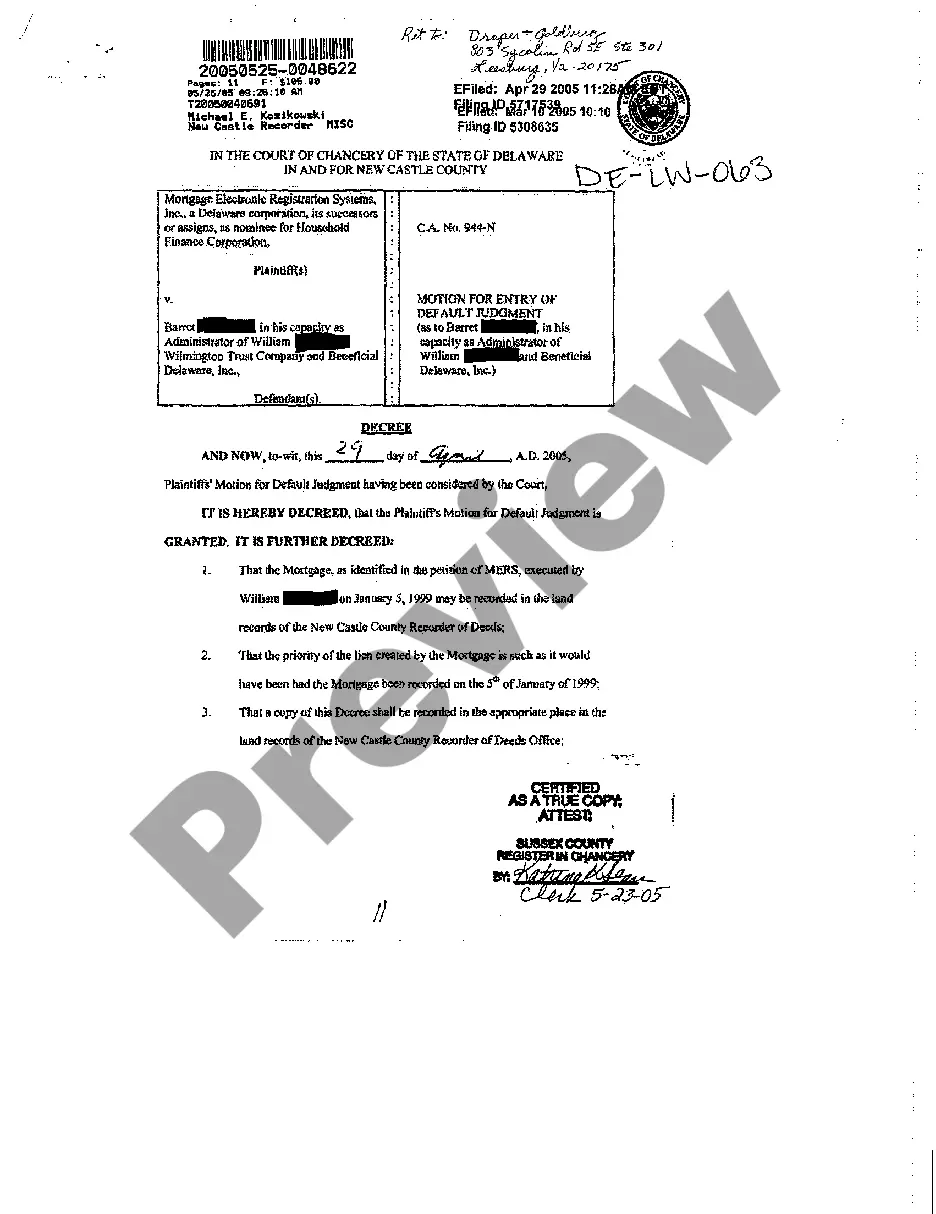

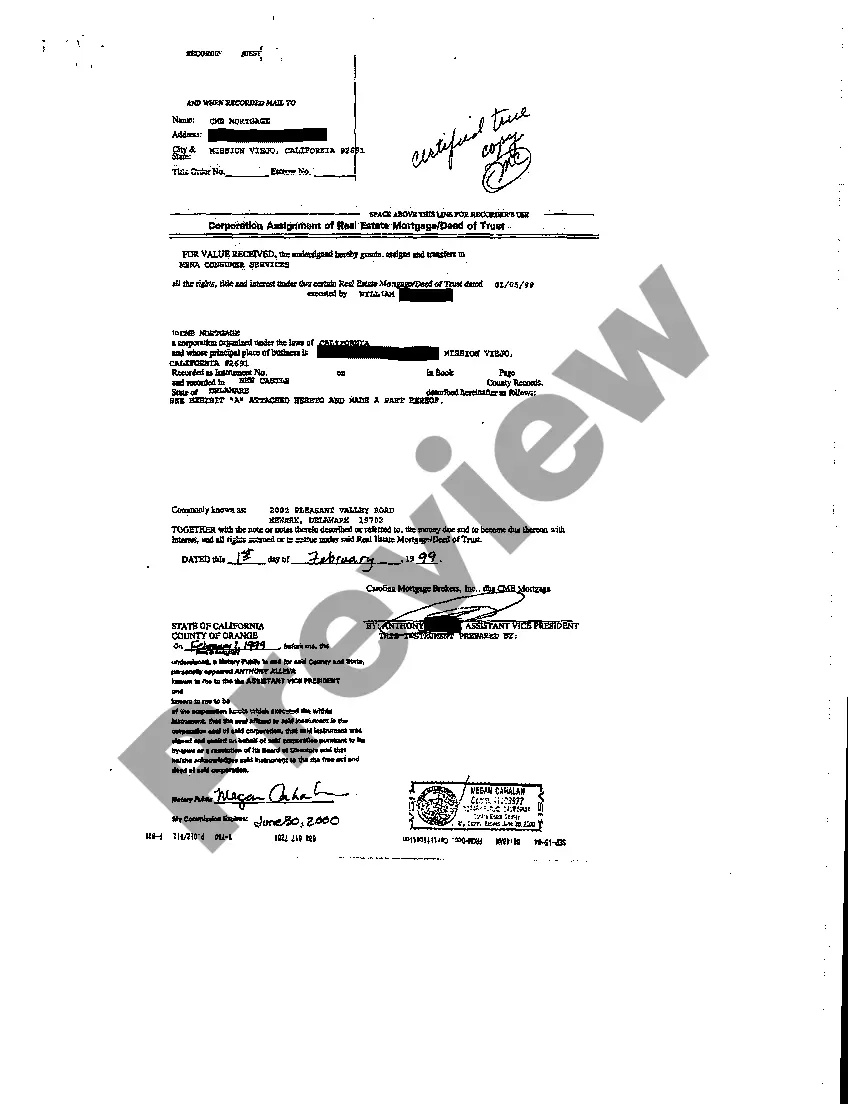

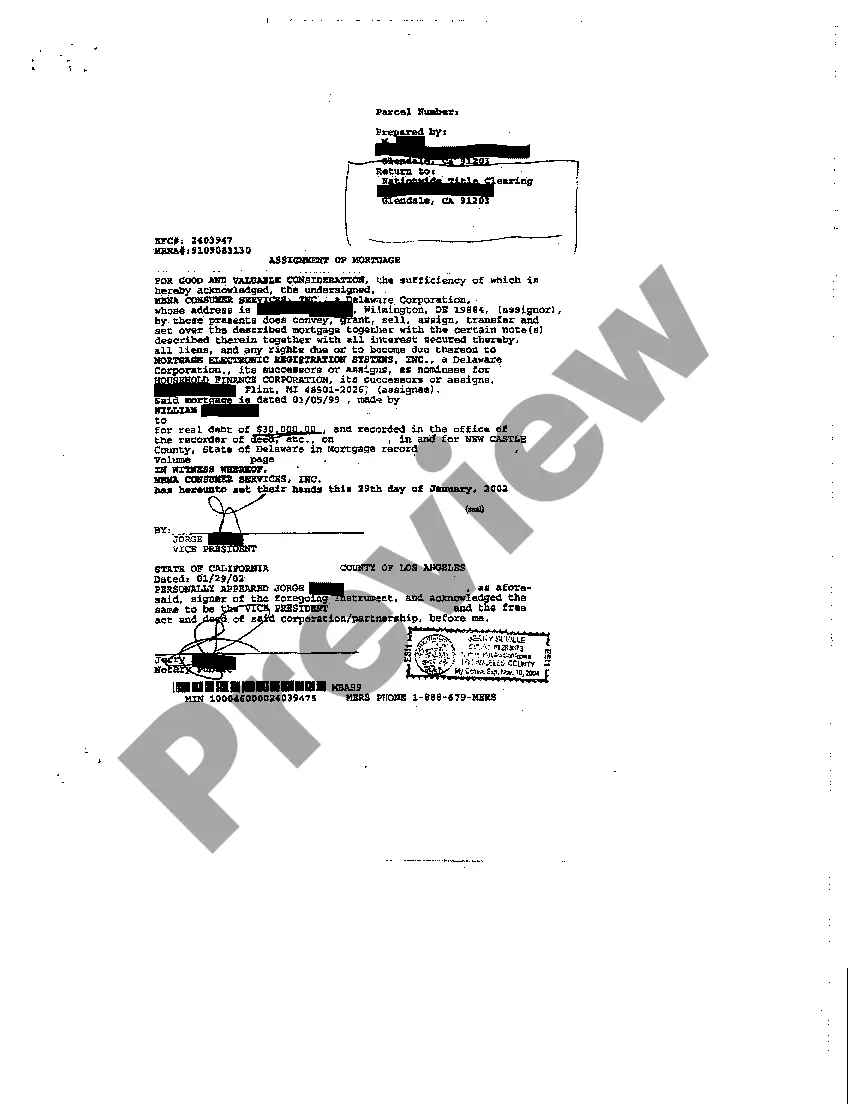

Delaware Decree granting Default Judgment regarding mortgage priority

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Decree Granting Default Judgment Regarding Mortgage Priority?

Among countless complimentary and paid examples available online, you cannot be assured of their dependability.

For instance, who produced them or if they are qualified enough to manage what you require from them.

Remain composed and utilize US Legal Forms! Discover Delaware Decree granting Default Judgment concerning mortgage priority examples crafted by experienced legal professionals and evade the costly and time-consuming process of searching for an attorney and then compensating them to draft a document for you that you can easily locate yourself.

Select a pricing option and establish an account. Settle the subscription fee using your credit/debit card or Paypal. Download the form in the required file format. After you have registered and completed your purchase, you may utilize your Delaware Decree granting Default Judgment regarding mortgage priority as frequently as necessary or for as long as it remains valid in your area. Modify it in your preferred editor, complete it, sign it, and print a hard copy of it. Achieve more for less with US Legal Forms!

- If you already possess a subscription, Log In to your account and locate the Download button beside the file you are seeking.

- You will also have access to your previously saved templates in the My documents section.

- If you are using our platform for the first time, adhere to the instructions outlined below to obtain your Delaware Decree granting Default Judgment regarding mortgage priority effortlessly.

- Ensure that the document you view is valid in your jurisdiction.

- Review the file by examining the details while utilizing the Preview feature.

- Hit Buy Now to commence the ordering process or search for another example using the Search bar in the header.

Form popularity

FAQ

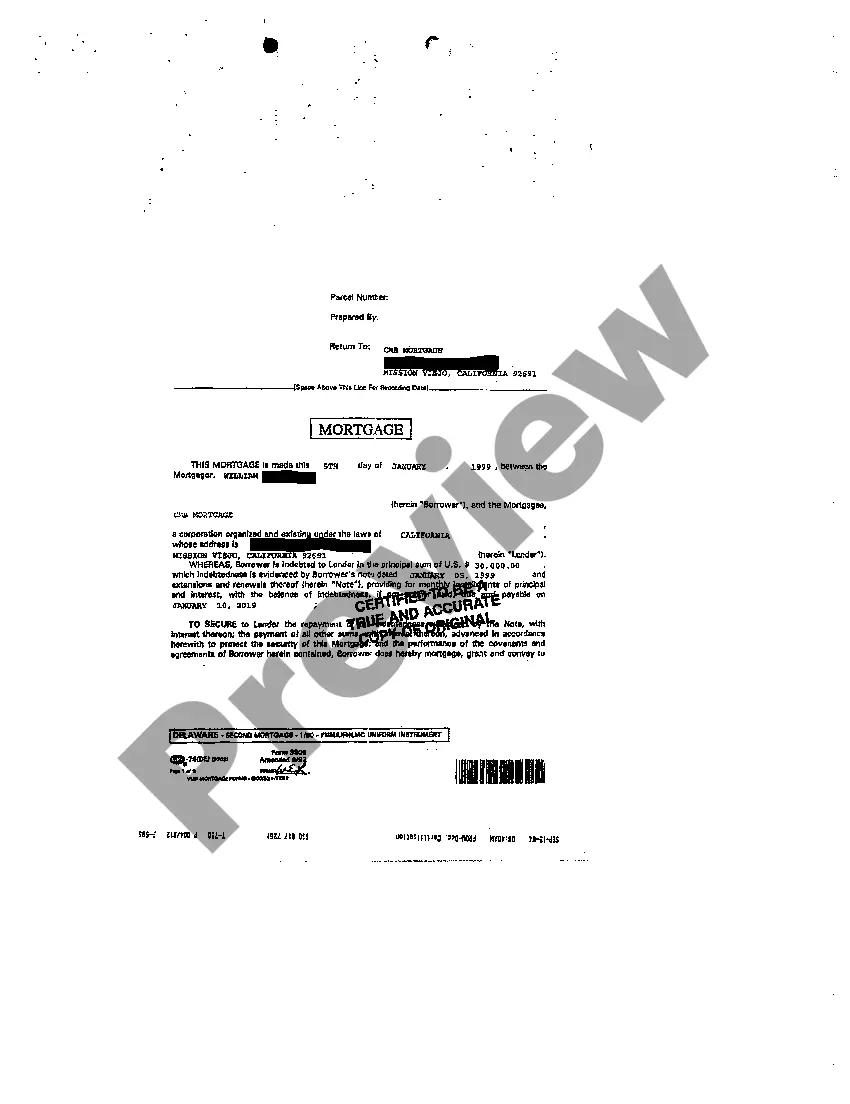

Typically, a mortgage holds priority over a judgment lien in Delaware. This means that if a default occurs, the holder of the mortgage is first in line to collect proceeds from the property sale. Understanding these dynamics is essential, especially when dealing with a Delaware Decree granting Default Judgment regarding mortgage priority. Using the uslegalforms platform can help you navigate these legal concepts effectively.

In Delaware, a buyer has seven days to cancel their contract after receiving the public offering statement. This cancellation right ensures that buyers have time to review crucial information about the property. If you are uncertain about your rights regarding a Delaware Decree granting Default Judgment regarding mortgage priority, consulting a legal expert can provide clarity and guidance.

A default judgment in Delaware occurs when one party fails to respond or appear in court. In such cases, the court may issue a Delaware Decree granting Default Judgment regarding mortgage priority in favor of the responding party. This legal tool enables the winning party to enforce their claims without further contestation. Understanding this process can help you navigate legal expectations and protect your rights efficiently.

In Delaware, a judgment typically lasts for 10 years. This duration is crucial for understanding your rights and obligations regarding the Delaware Decree granting Default Judgment regarding mortgage priority. After this period, you may need to renew the judgment if you still wish to enforce it. Therefore, staying informed about the timeline can help you manage your financial responsibilities effectively.

Enforcing a judgment in Delaware involves several steps. First, you must obtain a certified copy of the Delaware Decree granting Default Judgment regarding mortgage priority. Next, you can apply for a writ of execution, which allows you to collect the amount owed. Additionally, you may seek assistance from a legal professional to ensure that the enforcement process aligns with state laws.

A default judgment typically remains active indefinitely unless a party successfully petitions the court to vacate it. However, the enforceability of the judgment may vary based on state laws. Understanding the implications of a Delaware Decree granting Default Judgment regarding mortgage priority is crucial, as it can affect the lender's ability to collect on the debt over time.

Writing a motion for default judgment involves clearly outlining the facts of the case and including proof of service to show that the defendant was properly notified. You should also provide evidence establishing your right to the Delaware Decree granting Default Judgment regarding mortgage priority. This motion must be clear and concise, allowing the court to easily understand the request.

An example of a default judgment occurs when a homeowner fails to respond to a foreclosure lawsuit. In such cases, the court may issue a ruling favoring the lender without a hearing. This type of judgment illustrates the importance of the Delaware Decree granting Default Judgment regarding mortgage priority, as it solidifies the lender's claim against the property.

Rule 59 of the Delaware Superior Court outlines the procedures for obtaining a new trial or altering a judgment. It allows parties to challenge the court's decision if they believe there was an error. Understanding this rule can be particularly useful when dealing with a Delaware Decree granting Default Judgment regarding mortgage priority, as it may impact potential remedies.

To make a default judgment, you must first file a complaint with the court. If the defendant does not respond within the required time frame, you can then request a default judgment. This process is essential for obtaining a Delaware Decree granting Default Judgment regarding mortgage priority when the opposing party fails to engage in the legal proceedings.