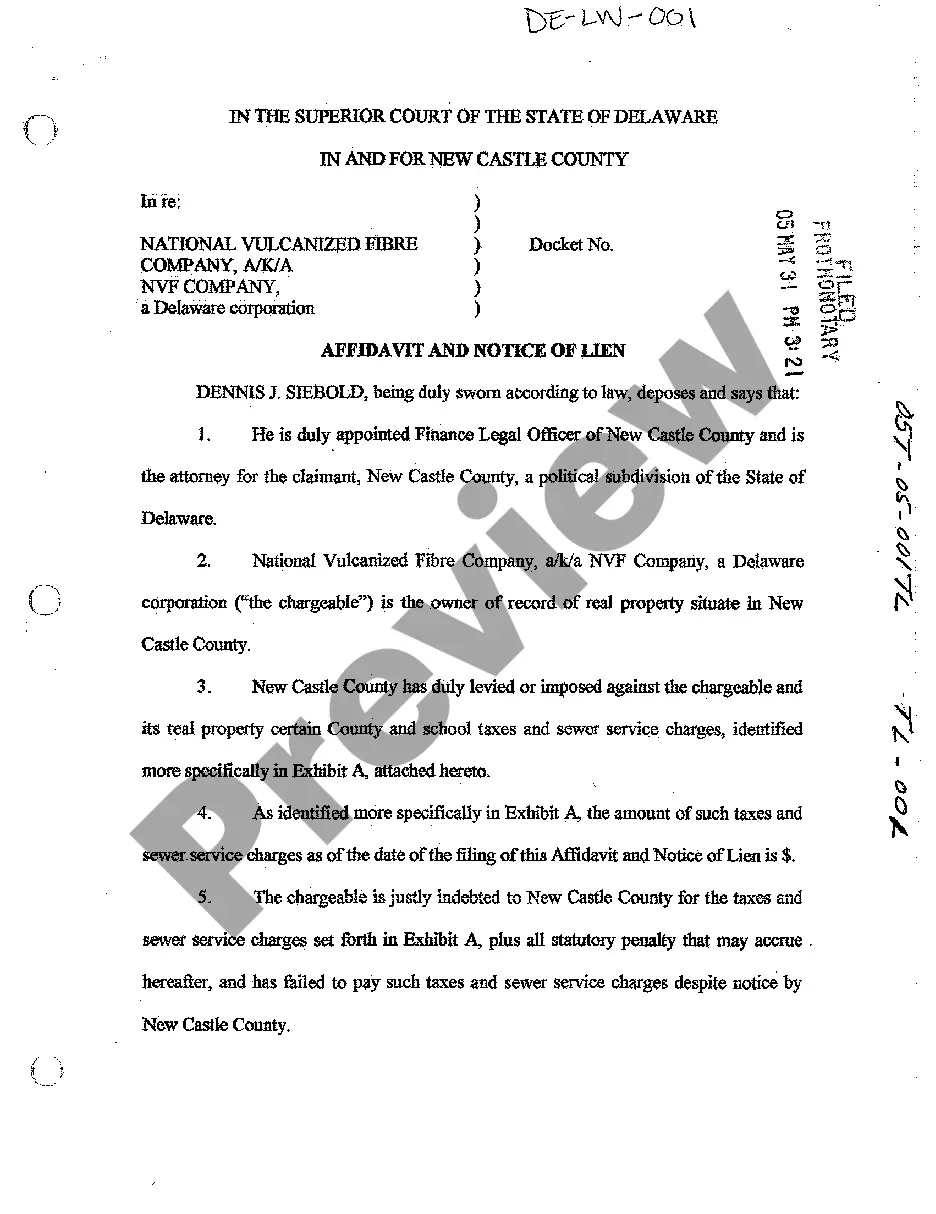

Delaware Affidavit and Notice of Lien for School Tax and Sewer Service

Description

How to fill out Delaware Affidavit And Notice Of Lien For School Tax And Sewer Service?

Among many complimentary and paid examples that you can find on the internet, you cannot guarantee their precision.

For instance, who authored them or if they possess sufficient qualifications to handle your requirements.

Always remain calm and make use of US Legal Forms! Explore Delaware Affidavit and Notice of Lien for School Tax and Sewer Service templates crafted by experienced attorneys and avoid the costly and time-intensive process of searching for a lawyer and subsequently hiring them to produce a document for you that you could easily obtain.

Choose a pricing plan, register for an account, settle the subscription fee with your credit/debit card or PayPal, download the document in the desired format. Once you have registered and completed your payment, you can utilize your Delaware Affidavit and Notice of Lien for School Tax and Sewer Service as often as you wish or for as long as it remains applicable in your jurisdiction. Modify it with your favorite offline or online editor, fill it out, sign it, and produce a printed copy. Achieve more for less with US Legal Forms!

- If you currently hold a membership, Log In to your profile and locate the Download button adjacent to the form you’re after.

- You will also have access to your previously saved templates in the My documents section.

- If you are using our platform for the first time, adhere to the instructions below to acquire your Delaware Affidavit and Notice of Lien for School Tax and Sewer Service swiftly.

- Ensure that the document you find is permissible in your area.

- Review the template by examining the information using the Preview option.

- Click Buy Now to initiate the purchasing process or search for another example via the Search bar located in the header.

Form popularity

FAQ

Delaware operates as a tax lien state, meaning unpaid taxes create liens against the property. This process allows local governments to recover owed taxes through the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service. Understanding this system is important if you're investing in real estate, as it impacts ownership rights. Consider consulting US Legal Forms for clear information and assistance regarding tax policies in Delaware.

To file a lien on property in Delaware, you need to complete the relevant forms, such as the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service. Next, you must submit the completed forms to the appropriate county office. Proper filing ensures a legal claim that can secure the debt you are owed. Using US Legal Forms simplifies this process by providing you with the necessary documents and guidance.

Yes, Delaware is classified as a tax lien state. This means that when property taxes are unpaid, the local government can place a lien on the property through a process that often involves the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service. Understanding the implications of this designation can help property owners and investors navigate potential tax issues effectively. By utilizing resources like uslegalforms, you can stay informed and take the necessary steps to address liens properly.

In Delaware, a lien can typically remain on a property for 10 to 20 years, depending on the type of lien. For municipal or school taxes, the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service may be in place for a long duration to secure the tax obligation. It's essential to act timely to address any liens, as they may hinder your property sale or refinancing options. Knowledge of these timelines can empower you to take appropriate actions.

In Delaware, judgments generally do expire after a period of 5 years if they are not renewed. This means that if a creditor does not take action to renew the judgment, it can no longer be enforced. Understanding this timeline is crucial for anyone dealing with debts or liens, including the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service. Being informed can help you make better decisions regarding your obligations.

To conduct a lien search in Delaware, you can start by visiting the county recorder's office or accessing their online database. This process will help you identify any existing liens, including the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service. Additionally, using uslegalforms can streamline your search and provide you with necessary documentation. It’s always a good idea to check for liens before purchasing a property to avoid any unexpected issues.

In Delaware, a lien usually remains on your property for 10 years. This includes the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service, which can be renewed if necessary. It is crucial to address any outstanding obligations promptly to avoid prolonged complications. You can consult professionals or use resources from uslegalforms to navigate this process effectively.

Generally, property tax liens, including those stemming from unpaid school taxes or sewer service fees, have the highest priority in Delaware. These liens take precedence over most other types of liens, such as mortgage liens or judgement liens. Knowing this is crucial for property owners and creditors alike, as the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service solidifies this claim to ensure recovery of amounts owed.

A certificate of release of tax lien is a document issued to confirm that a tax lien has been satisfied and released from the property. This document is essential for property owners to prove that they have resolved their tax debts, particularly those associated with the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service. Having this certificate not only clears the title but also can facilitate future transactions related to the property.

To place a lien on a property in Delaware, you must file a Delaware Affidavit and Notice of Lien for School Tax and Sewer Service with the appropriate county office. The process typically involves preparing the necessary documentation, detailing the amounts owed, and submitting it to local authorities. By correctly completing this process, you ensure that your lien is valid and recognized, which aids in recovering funds owed to you.