Delaware Certificate of Conversion From Partnership To Limited Partnership

Description

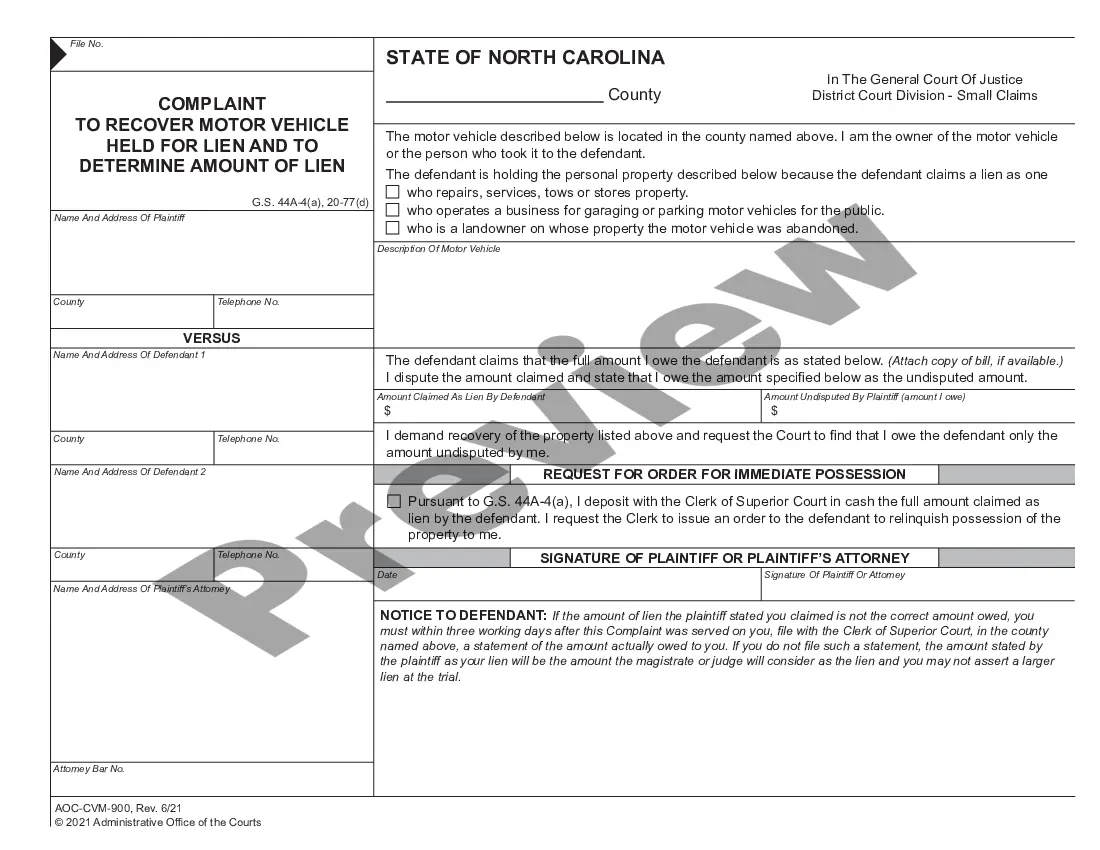

How to fill out Delaware Certificate Of Conversion From Partnership To Limited Partnership?

US Legal Forms is the simplest and most lucrative method to find suitable official templates.

It boasts the largest online collection of business and personal legal documents created and verified by legal experts.

Here, you can discover printable and fillable templates that adhere to national and local laws - just like your Delaware Certificate of Conversion From Partnership To Limited Partnership.

Review the form description or preview the document to ensure it suits your requirements, or search for another by using the search tab above.

Press Buy now when you are confident about its suitability with all your criteria, then choose the subscription plan that appeals to you most.

- Acquiring your template involves just a few easy steps.

- Users with an existing account and a valid subscription just need to Log In to the online platform and download the form onto their device.

- Afterward, they can find it in their profile under the My documents section.

- If you are using US Legal Forms for the first time, this is how you can obtain a professionally prepared Delaware Certificate of Conversion From Partnership To Limited Partnership.

Form popularity

FAQ

Section 276 of the Delaware Corporation Law addresses the processes involved in mergers and consolidations of corporations. It lays out the requirements for the necessary documentation, including the filing of a Delaware Certificate of Conversion From Partnership To Limited Partnership when applicable. Understanding this section is crucial for ensuring compliance during corporate restructuring.

Section 18-607 of the Delaware Limited Liability Company Act outlines the procedures for converting a partnership to a limited liability company. This section ensures that entities can undertake this change by filing the appropriate paperwork, such as a Delaware Certificate of Conversion From Partnership To Limited Partnership. It aims to facilitate smoother transitions while protecting stakeholders’ interests.

To convert your C Corp to an LLC in Delaware, you need to file a Delaware Certificate of Conversion From Partnership To Limited Partnership with the Secretary of State. Additionally, prepare and submit the necessary formation documents for your new LLC. It’s advisable to consult with a legal expert to ensure a smooth transition while complying with all state regulations.

When a corporation converts to an LLC, it changes its legal structure while retaining its legal identity. This process often involves filing a Delaware Certificate of Conversion From Partnership To Limited Partnership, ensuring that the transition is officially recognized. The members benefit from flexibility in management and tax treatment while protecting personal assets from business liabilities.

When you convert a partnership to an LLC, you typically need a new Employer Identification Number (EIN). The conversion alters the business structure, which the IRS recognizes as a new entity. Therefore, obtaining a new EIN is necessary to avoid any confusion for tax purposes and maintain compliance. If you are unsure about the requirements, consulting with a platform like uslegalforms can help clarify the process and ensure you are on the right track.

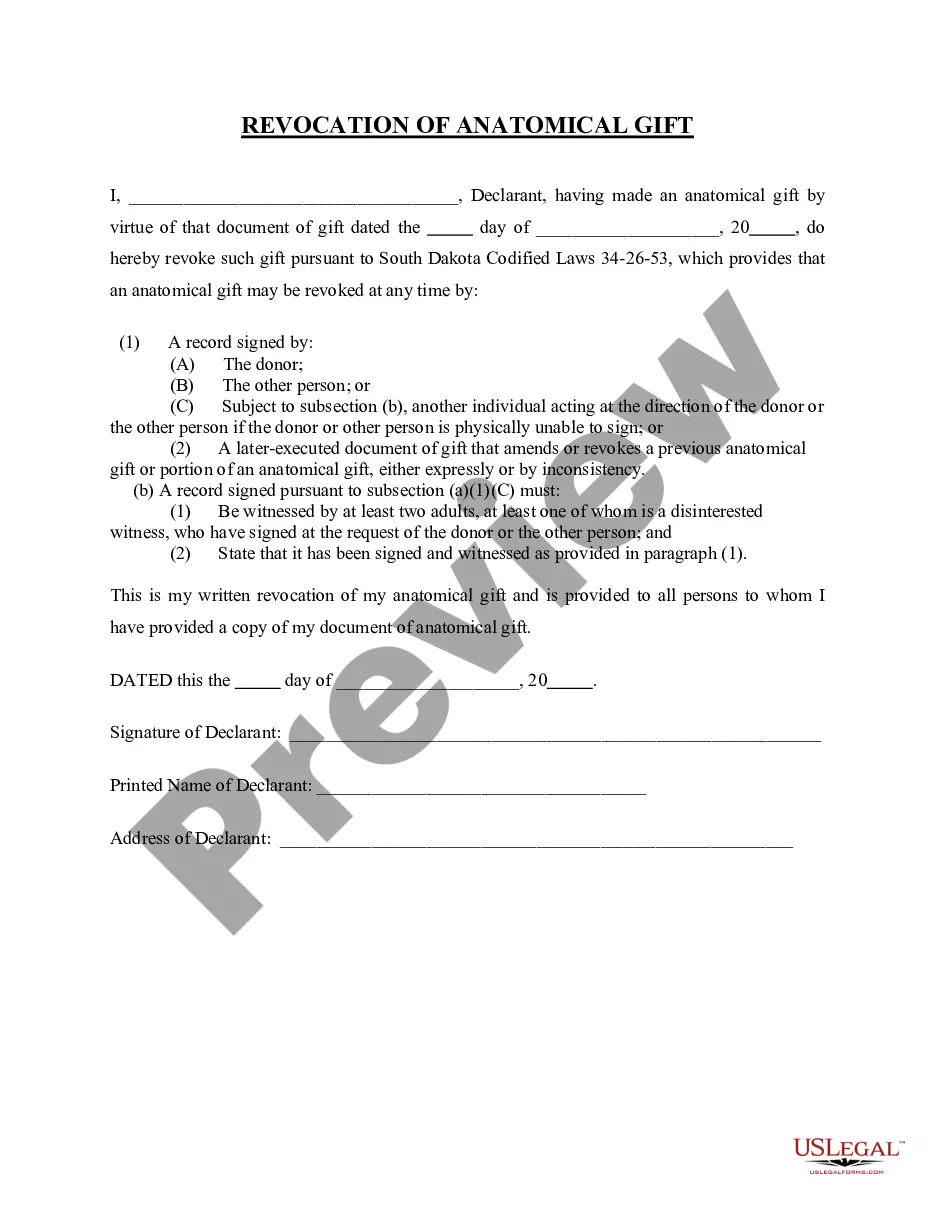

Yes, a partnership can be converted into an LLC through a formal conversion process. This necessitates filing the appropriate documentation, such as the Delaware Certificate of Conversion From Partnership To Limited Partnership. This conversion provides the partnership with benefits like limited liability and enhanced management options. Engaging with a reliable service, like uslegalforms, can simplify the conversion process and ensure all steps are executed correctly.

Converting a partnership into a private limited company can have some drawbacks. One primary disadvantage is the potential for increased regulatory requirements and compliance obligations. Furthermore, the owners may incur additional costs during the conversion process, including legal fees and taxes; hence, understanding the implications of the Delaware Certificate of Conversion From Partnership To Limited Partnership is crucial. It's also important to consider how the change might affect existing contracts and relationships.

An LLC conversion refers to the process of changing the legal structure of a business entity. Specifically, it allows a partnership to transform into a limited liability company through a formal process that includes filing a Delaware Certificate of Conversion From Partnership To Limited Partnership. This change can provide benefits like limited liability protection, which helps safeguard your personal assets. Additionally, LLCs often enjoy greater flexibility in management and taxation.

Delaware does not require a formal plan of dissolution for partnerships or limited partnerships; however, it is often beneficial to have one. A plan of dissolution outlines how to wind up the business affairs, distribute assets, and settle liabilities. It provides clarity and direction during the dissolution process. If you are converting a partnership to a limited partnership, understanding this may influence your approach to the Delaware Certificate of Conversion From Partnership To Limited Partnership.

In Delaware, while it is not legally required for limited partnerships to have a written operating agreement, it is highly recommended. This document lays out the rights and responsibilities of partners, minimizing potential disputes. A clear operating agreement can be crucial, especially during the conversion process. When pursuing your Delaware Certificate of Conversion From Partnership To Limited Partnership, consider drafting an operating agreement to ensure a smooth operation of your new entity.