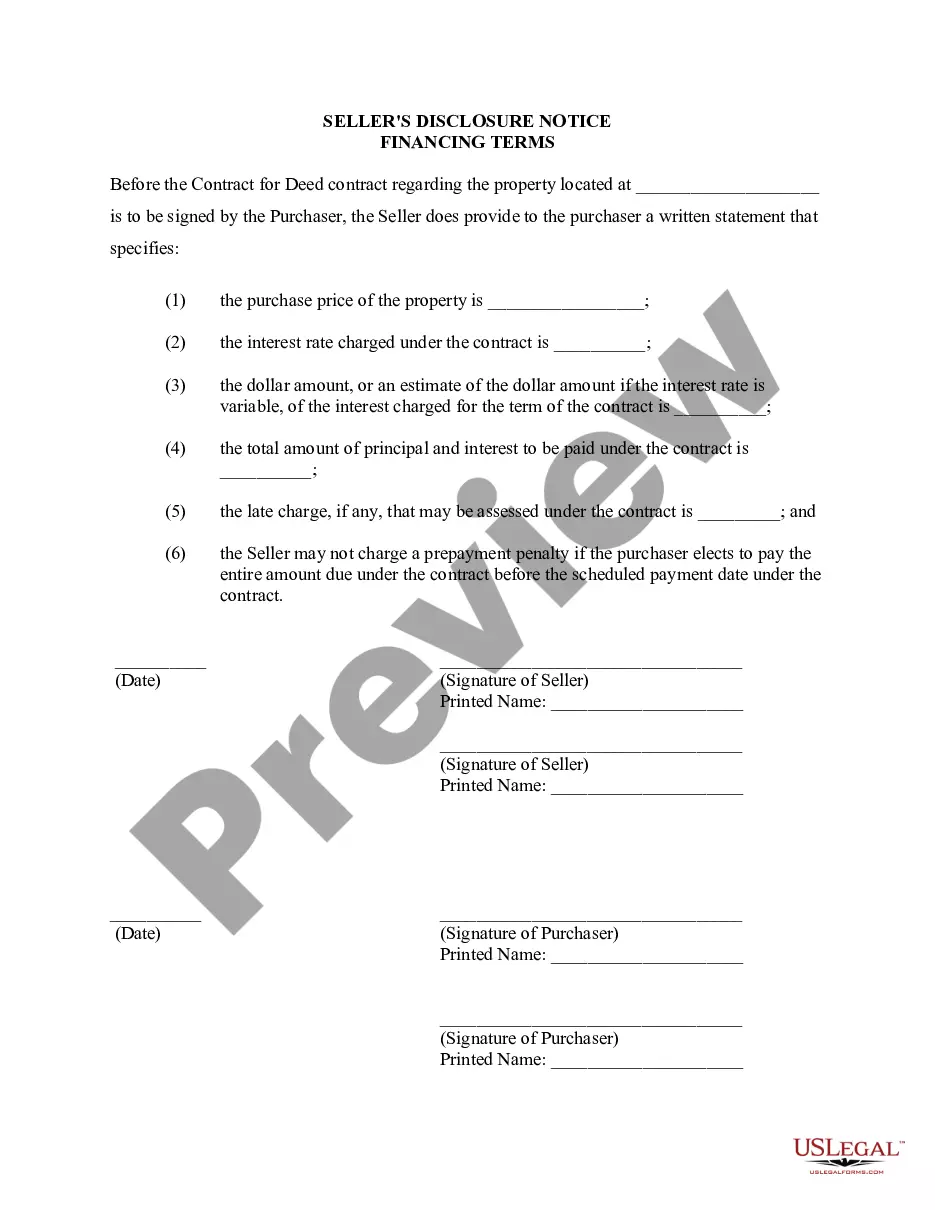

Delaware Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Delaware Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Utilize US Legal Forms to obtain a printable Delaware Seller's Disclosure of Financing Terms for Residential Property related to a Contract or Agreement for Deed also known as a Land Contract.

Our court-acceptable templates are formulated and continually revised by expert attorneys. We offer the most extensive forms library online and supply reasonably priced and precise templates for clients, lawyers, and small to medium-sized businesses.

The documents are organized into state-specific categories, and many can be previewed prior to being downloaded.

Create your account and make payment via PayPal or by card|credit card. Download the template to your device and feel free to reuse it multiple times. Use the Search field if you wish to locate another document template. US Legal Forms provides an extensive range of legal and tax templates and packages for business and personal requirements, including the Delaware Seller's Disclosure of Financing Terms for Residential Property connected with a Contract or Agreement for Deed also known as a Land Contract. Over three million users have already successfully engaged with our platform. Choose your subscription plan and acquire high-quality forms in just a few clicks.

- To download samples, users must have a membership and Log In to their account.

- Click Download next to any form desired and locate it in My documents.

- For users without a subscription, follow the instructions below to swiftly locate and download the Delaware Seller's Disclosure of Financing Terms for Residential Property related to a Contract or Agreement for Deed also known as a Land Contract.

- Ensure you choose the correct form based on the state it is required in.

- Examine the document by reviewing the description and utilizing the Preview feature.

- Hit Buy Now if it is the document you seek.

Form popularity

FAQ

One such alternative is the contract for deed. In a contract for deed, the purchase of property is financed by the seller rather than a third-party lender such as a commercial bank or credit union.

Other benefits include: no loan qualifying, low or flexible down payment, favorable interest rates and flexible terms, and a quicker settlement. The biggest risk when buying a home contract for deed is that you really don?t have a legal claim to the property until you have paid off the entire purchase price.

An Offer to Purchase Real Estate (the "Offer") is a document that sets out the basic proposed terms and conditions between the Buyer and the Seller in a real estate transaction. Once the Offer is signed by the Buyer and the Seller, and the contained contingencies are met, it then becomes a legally binding agreement.

What Is A Purchase Agreement? In real estate, a purchase agreement is a binding contract between a buyer and seller that outlines the details of a home sale transaction.Once both parties are in agreement and have signed the purchase agreement, they're considered to be under contract.

But unlike buyers, sellers can't back out and forfeit their earnest deposit money (usually 1-3 percent of the offer price). If you decide to cancel a deal when the home is already under contract, you can be either legally forced to close anyway or sued for financial damages.

Can you back out of an accepted offer? The short answer: yes. When you sign a purchase agreement for real estate, you're legally bound to the contract terms, and you'll give the seller an upfront deposit called earnest money.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.

Property disclosure statements essentially outline any flaws that the home sellers (and their real estate agents) are aware of that could negatively affect the home's value. These statements are required by law in most areas of the country so buyers can know a property's good and bad points before they close the deal.

Once both buyer and seller sign the purchase agreement, the contract is legally binding. In many cases, however, the contract has contingencies or certain conditions that must be met in order for the sale to go through.