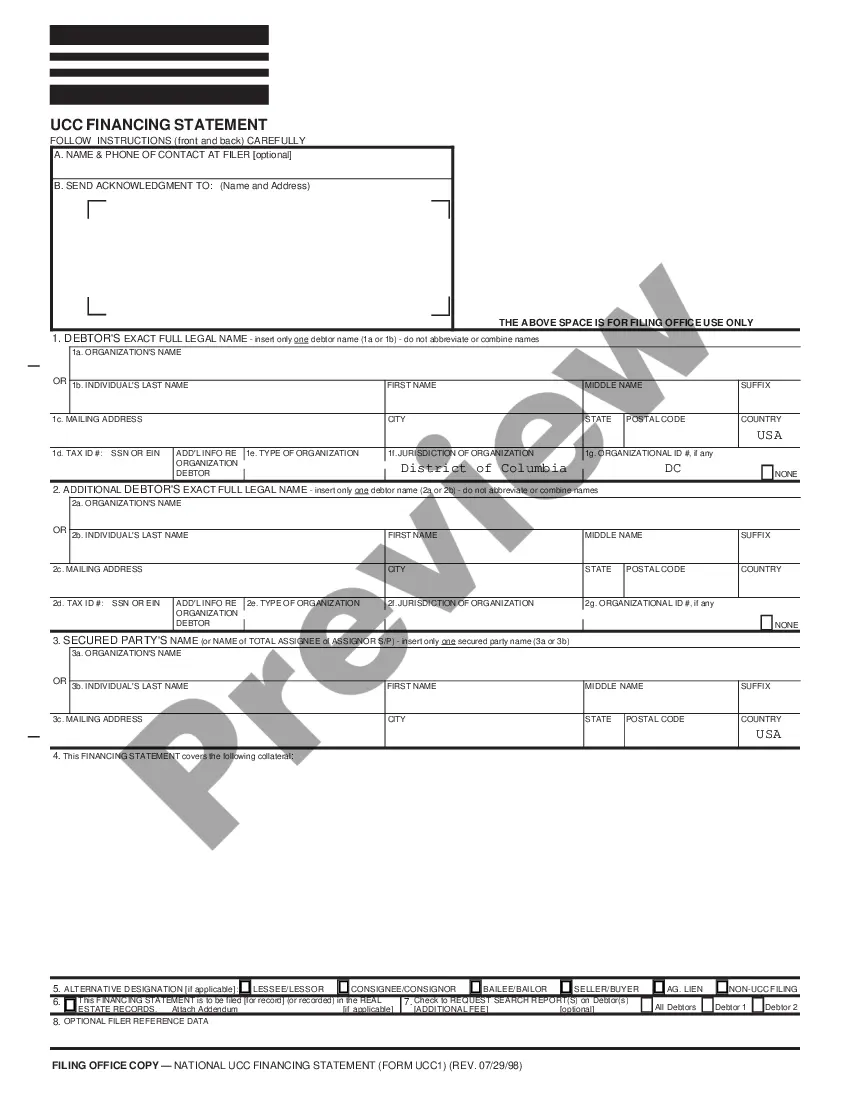

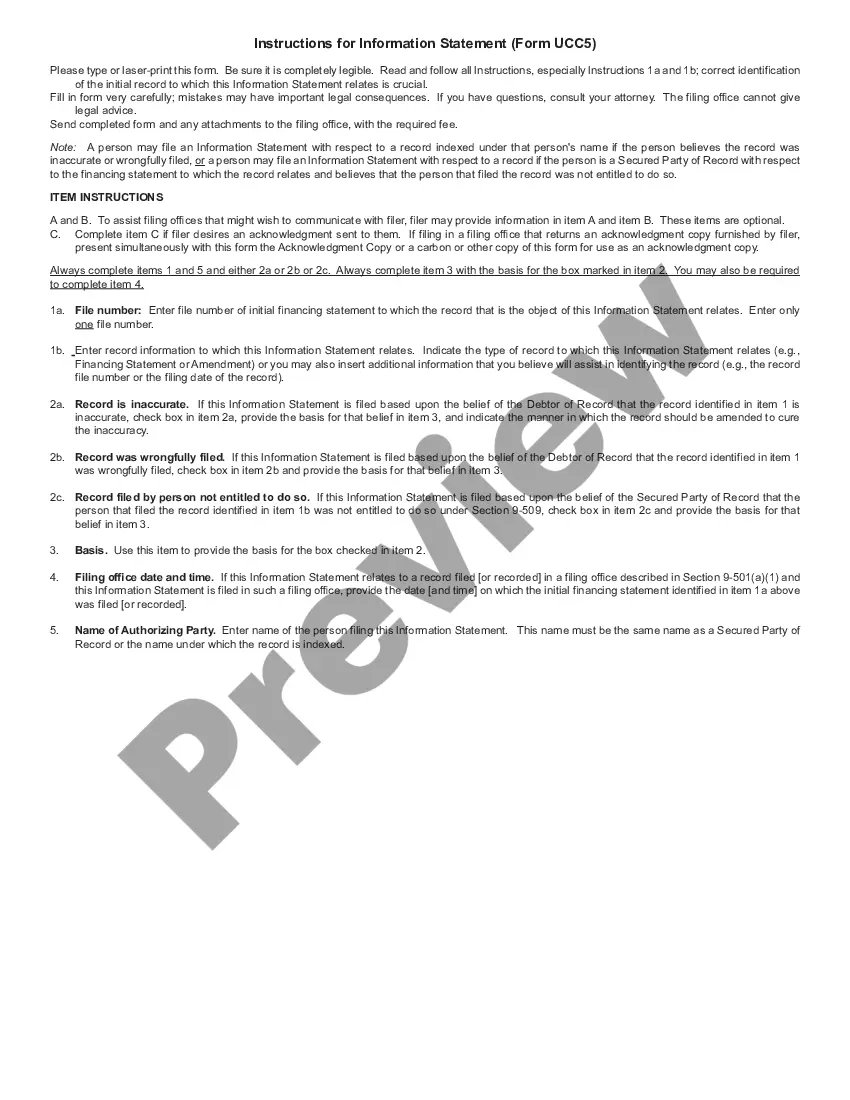

Correction Statement used to report inaccurate or wrongly filed records (as designated in the form) on file with the District of Columbia filing office.

District of Columbia UCC5 Correction Statement

Description

How to fill out District Of Columbia UCC5 Correction Statement?

The more documents you have to create - the more anxious you become.

There are numerous District of Columbia UCC5 Correction Statement templates available online, but you're unsure which ones to trust.

Simplify your search and ease the burden of finding samples with US Legal Forms. Obtain professionally prepared forms designed to meet state requirements.

Enter the required information to create your profile and process your payment using either PayPal or a credit card. Select a convenient file format and receive your sample. Access every template you download in the My documents section. Just navigate there to create a new version of the District of Columbia UCC5 Correction Statement. Even when using professionally drafted templates, it is still essential to consider consulting a local attorney to verify that your form is accurately completed. Achieve more while spending less with US Legal Forms!

- If you already have a subscription to US Legal Forms, Log In to your account, and you will see the Download button on the District of Columbia UCC5 Correction Statement’s page.

- If you haven't used our platform before, complete the registration process by following these steps.

- Ensure the District of Columbia UCC5 Correction Statement is acceptable in your residing state.

- Double-check your selection by reviewing the description or by utilizing the Preview mode if available for the chosen document.

- Click Buy Now to begin the registration process and choose a payment plan that meets your needs.

Form popularity

FAQ

In the District of Columbia, UCC filings are made with the Department of Consumer and Regulatory Affairs. You can file in person or utilize online services to streamline your submission. Platforms like uslegalforms offer resources to help you prepare and submit your District of Columbia UCC5 Correction Statement without hassle.

You should file a UCC statement in the state where the debtor is located. This location determines the jurisdiction and legal framework for your filing. If you need to file a District of Columbia UCC5 Correction Statement, make sure to do so through the District of Columbia's designated filing office to ensure validity and enforceability.

UCC filings are primarily state matters rather than federal. Each state regulates its own UCC filings through the Secretary of State's office. As you navigate the requirements for a District of Columbia UCC5 Correction Statement, remember that local rules may vary. Ensuring compliance with state-specific guidelines will safeguard your interests.

Filing a UCC statement involves completing a form and submitting it to the appropriate state office. In the District of Columbia, this can often be done online through platforms like uslegalforms. They simplify the process, ensuring you can file your District of Columbia UCC5 Correction Statement accurately and efficiently, with clear guidance available along the way.

A fixture filing is related, but it is not a UCC-1. While a UCC-1 filing secures a creditor's interest in general personal property, a fixture filing specifically addresses goods that become part of real property. When you need to make a District of Columbia UCC5 Correction Statement for a fixture, the requirements vary slightly, so it’s important to understand the distinctions.

Yes, UCC fixture filings must be continued to remain effective. Typically, the continuation must be filed within a specific period, usually five years, from the initial filing date. If you do not continue your District of Columbia UCC5 Correction Statement, the filing will lapse, losing its legal effect. Therefore, staying on top of your filings is crucial for protecting your interests.

Terminating a UCC filing requires the submission of a termination statement to the appropriate jurisdiction. This statement should cite the original filing and indicate that the obligation has been fulfilled. If you have previously filed a District of Columbia UCC5 Correction Statement, ensure that your termination complies with those corrections for a seamless process.

To challenge a UCC lien, you can contest its validity by demonstrating any errors or discrepancies in the filing. If you find inaccuracies, you can file a District of Columbia UCC5 Correction Statement to address these issues. Resolving these errors can help you protect your assets and potentially remove the lien.

A financing statement becomes seriously misleading if it fails to include identifying details or contains incorrect information regarding the debtor or collateral. Properly drafted UCC filings are crucial for securing interests in assets. Submitting a District of Columbia UCC5 Correction Statement can help remedy any misleading entries to protect your financial interests.

A UCC filing may be invalid if it lacks necessary information or if there are significant errors in the details provided. Furthermore, a filing may be deemed invalid if it does not comply with state regulations. Utilizing a District of Columbia UCC5 Correction Statement can rectify potential issues and solidify the validity of your filing.