District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor

Description

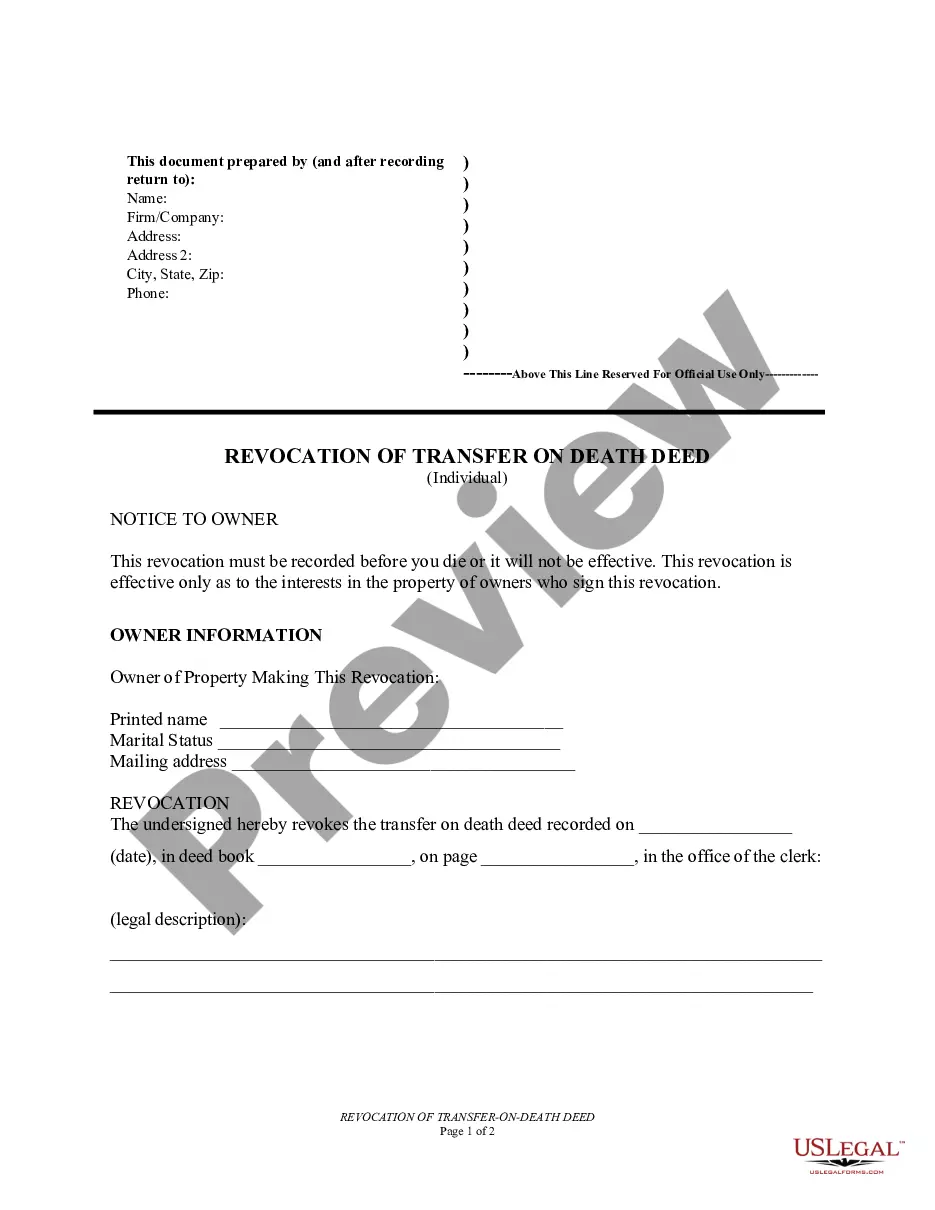

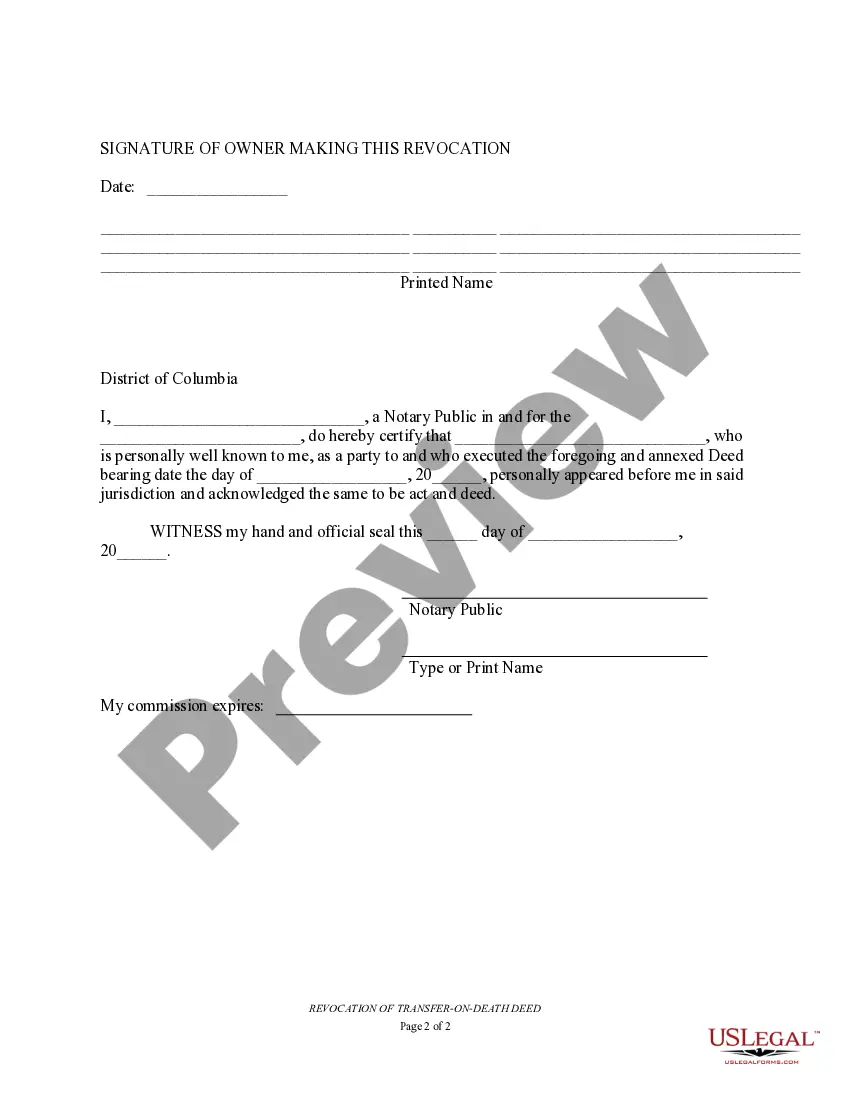

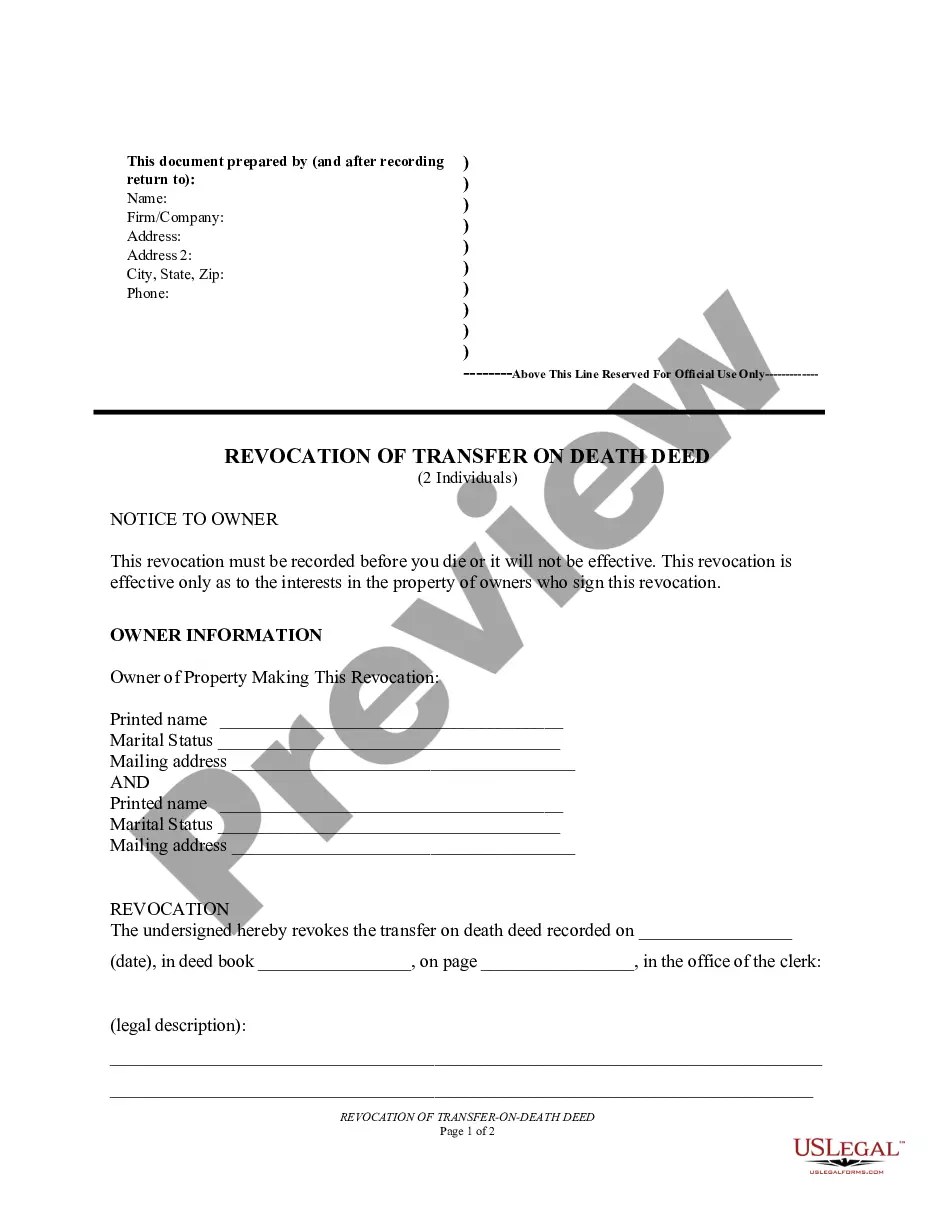

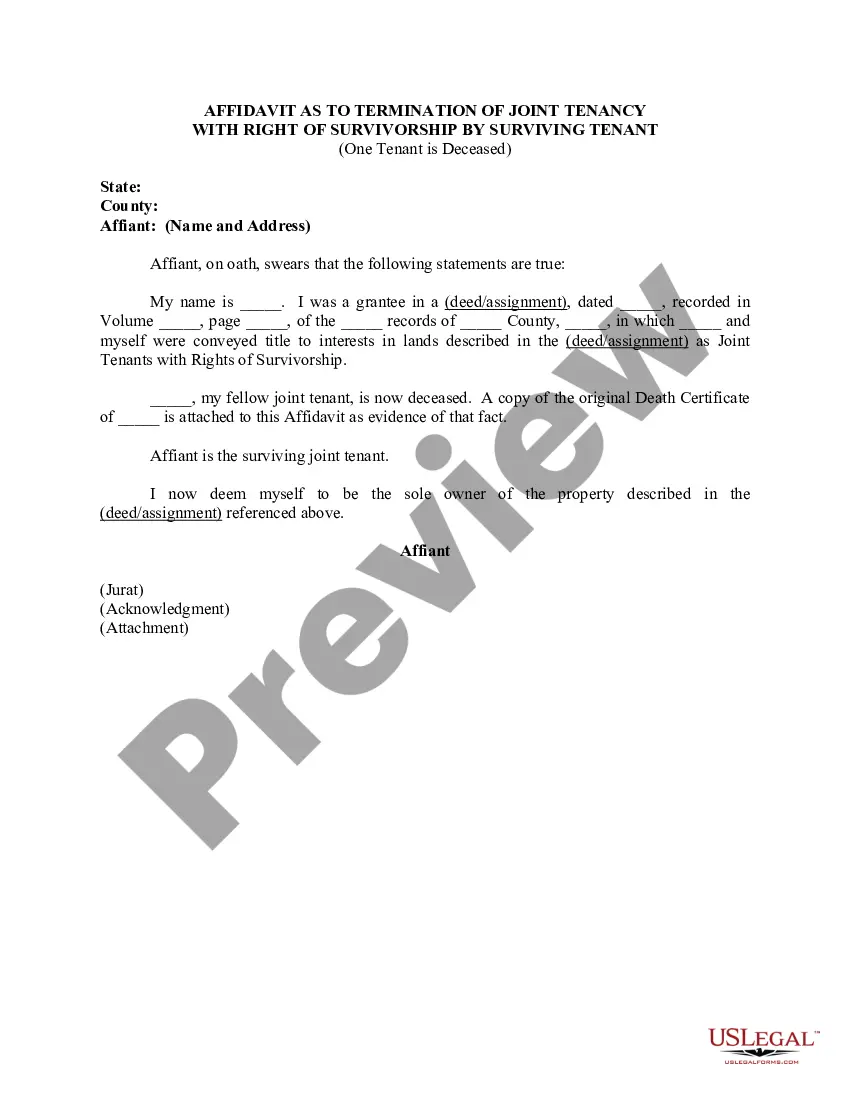

How to fill out District Of Columbia Revocation Of Transfer On Death Deed - Beneficiary Deed For One Grantor?

Utilize US Legal Forms to secure a printable District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for a single Grantor.

Our legally admissible forms are created and frequently refreshed by expert attorneys. Our collection is the most extensive Forms catalogue available online and offers reasonably priced and precise samples for individuals, legal professionals, and small to medium-sized businesses.

The templates are categorized based on state, and several can be previewed prior to download.

US Legal Forms offers a vast array of legal and tax document templates and packages catering to both business and personal requirements, including the District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor. Over three million users have successfully leveraged our platform. Select your subscription plan to access high-quality forms within a few clicks.

- Verify you have the correct form pertaining to the state requirements.

- Examine the form by reviewing the description and utilizing the Preview option.

- Click Buy Now if you have selected the desired document.

- Create your account and complete payment via PayPal or credit card.

- Download the form to your device and feel free to use it repeatedly.

- Employ the Search engine if you wish to locate another document template.

Form popularity

FAQ

A beneficiary deed generally does not serve as proof of ownership during the grantor's lifetime, but it operates to transfer ownership automatically upon the grantor's death. This means that while the District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor outlines the intended transfer of property, the property remains under the grantor’s control until their passing. Therefore, it's crucial to understand that the deed does facilitate transfer but does not convey ownership rights until that time. If you're navigating this process, consider using US Legal Forms to find the right resources and documentation for your situation.

While a transfer on death deed offers many advantages, there are notable disadvantages as well. It may limit your control over the property as the beneficiaries become owners after your passing. Additionally, creditors can still make claims against the property, potentially affecting your beneficiaries. It is crucial to weigh these factors and consider how a District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor fits into your overall estate plan.

In the District of Columbia, a transfer on death deed does not avoid inheritance tax. However, it effectively allows you to transfer property outside of the probate process, which can simplify the overall transfer of assets. While this method streamlines ownership transition, it’s wise to consult a legal expert regarding tax obligations associated with inherited property.

Filling out a transfer on death affidavit requires clear information about the property and the named beneficiaries. You need to provide details such as the property address, the names of the beneficiaries, and your identification information. It's recommended to consult legal resources or use platforms like USLegalForms to find structured templates that guide you through this process.

A transfer on death deed does not directly avoid capital gains tax. When a beneficiary inherits property through a District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor, they assume the property's basis for tax purposes. This means any capital gains tax will be assessed on the property’s appreciation from the time of inheritance. Therefore, individuals should consult with a tax advisor to better understand any implications.

Yes, the District of Columbia permits the use of transfer on death deeds. This legal tool allows individuals to designate beneficiaries who will receive property upon their passing. You can easily initiate this process by following specific guidelines laid out by the local laws. Utilizing forms from USLegalForms can simplify filling out the necessary documentation.

Yes, a power of attorney can change a deed while the grantor is still alive and competent. The agent can execute a new deed or modify an existing one as outlined in their authority. However, the District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor requires careful consideration to protect the grantor's intentions.

Deeds may be transferred through a power of attorney when the grantor is alive and capable of making decisions. The designated agent can manage the property as specified in the power of attorney. Ensure that all transactions align with your future plans, especially if you intend to utilize the District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor.

While it is not legally required to hire a lawyer to create a transfer on death deed, it is highly recommended. A lawyer can ensure that the document is properly drafted and executed, minimizing the risk of future disputes. Consulting with a professional is especially beneficial when dealing with the District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor.

To contest a transfer on death deed, you must file a legal action in the appropriate court, citing your reasons clearly. Valid grounds include lack of capacity or improper execution of the deed. Understanding the District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor will guide you in preparing your case effectively.