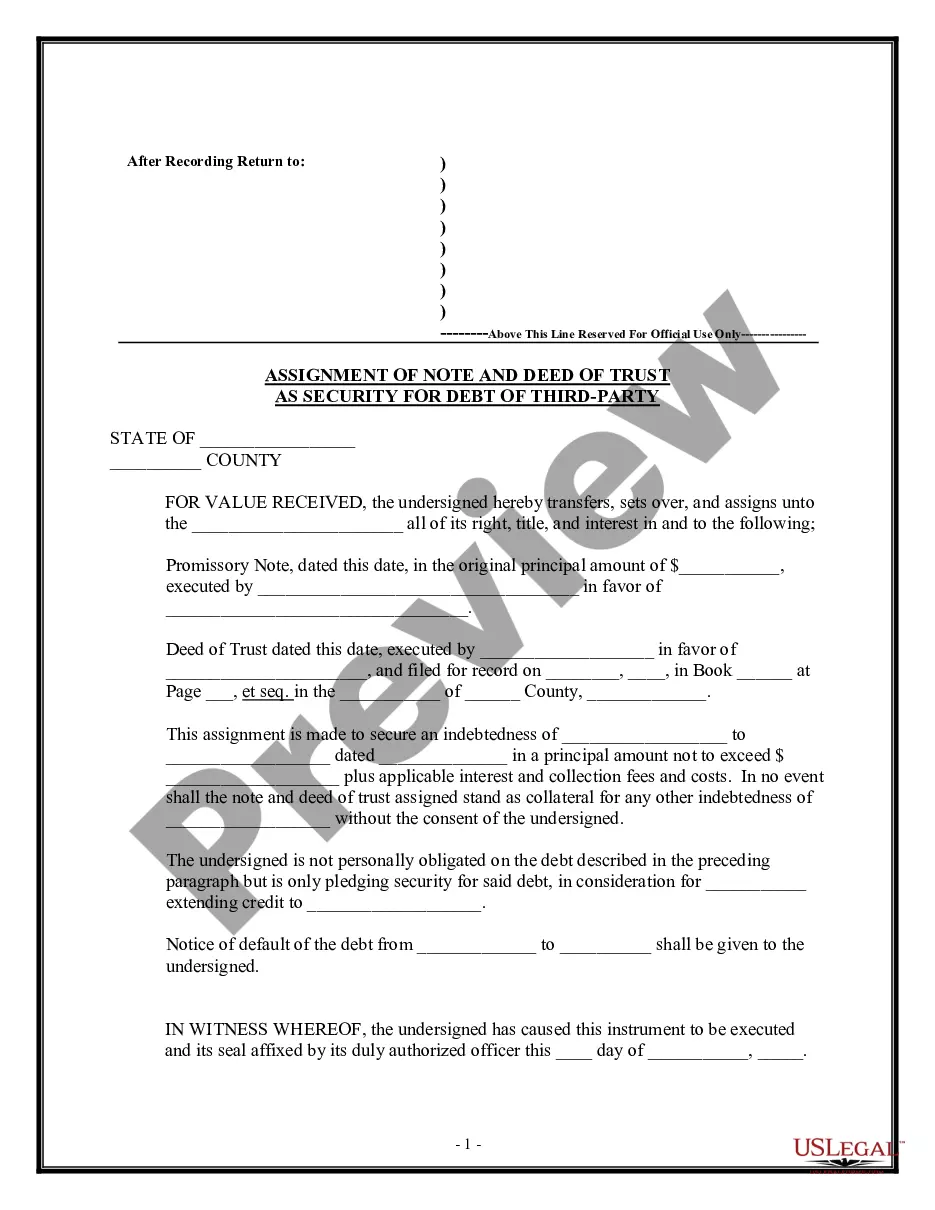

District of Columbia Agreement for Rights under Third Party Deed of Trust

Description

How to fill out Agreement For Rights Under Third Party Deed Of Trust?

US Legal Forms - one of the greatest libraries of lawful forms in America - offers an array of lawful document templates it is possible to acquire or print out. Utilizing the website, you will get a huge number of forms for organization and personal uses, sorted by groups, suggests, or keywords.You can find the most up-to-date versions of forms such as the District of Columbia Agreement for Rights under Third Party Deed of Trust within minutes.

If you already have a registration, log in and acquire District of Columbia Agreement for Rights under Third Party Deed of Trust from the US Legal Forms collection. The Down load switch can look on every single develop you perspective. You have accessibility to all in the past delivered electronically forms from the My Forms tab of your own profile.

If you want to use US Legal Forms the very first time, listed below are easy directions to help you get began:

- Ensure you have picked out the correct develop for your personal area/area. Select the Review switch to examine the form`s information. Browse the develop explanation to actually have selected the correct develop.

- When the develop doesn`t fit your demands, use the Look for field near the top of the display screen to discover the one who does.

- Should you be happy with the form, validate your decision by clicking the Buy now switch. Then, choose the rates strategy you want and give your references to register on an profile.

- Method the transaction. Utilize your Visa or Mastercard or PayPal profile to perform the transaction.

- Select the format and acquire the form on your gadget.

- Make adjustments. Load, modify and print out and signal the delivered electronically District of Columbia Agreement for Rights under Third Party Deed of Trust.

Every template you added to your bank account lacks an expiration day and is the one you have forever. So, in order to acquire or print out one more backup, just check out the My Forms area and click on on the develop you will need.

Get access to the District of Columbia Agreement for Rights under Third Party Deed of Trust with US Legal Forms, the most considerable collection of lawful document templates. Use a huge number of skilled and express-specific templates that fulfill your organization or personal requires and demands.

Form popularity

FAQ

A Security Affidavit is required on all Residential Deeds of Trust and Modifications. All Judgments, Orders, etc. must be certified by the DC Superior Court. All notarized documents must include the notary seal (if applicable), signature, name and expiration date.

There are three parties involved in a deed of trust: Trustor: This is the borrower. Trustee: This is the third party who will hold the legal title to the real property. Beneficiary: This is the lender.

A deed of trust can benefit the lender because it typically allows a faster foreclosure on a home. Most deeds of trust have a ?non-judicial foreclosure? clause, which means that the lender won't have to wait for the court system to review and approve the foreclosure process.

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

If the borrower defaults, the purchased property is collateral, so there's virtually zero risk of losing your money with trust deeds. With property foreclosure and options like property sale or refinance, your investment remains safe.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.

If you stop making payments towards your trust deed, without agreement from your trustee, they can: apply for an Earnings Arrestment Order to take the payments directly from your wages. ask the court to make you bankrupt. refuse to discharge you from the trust deed, which will stop your debt being written off.