District of Columbia Release of Call on Production

Description

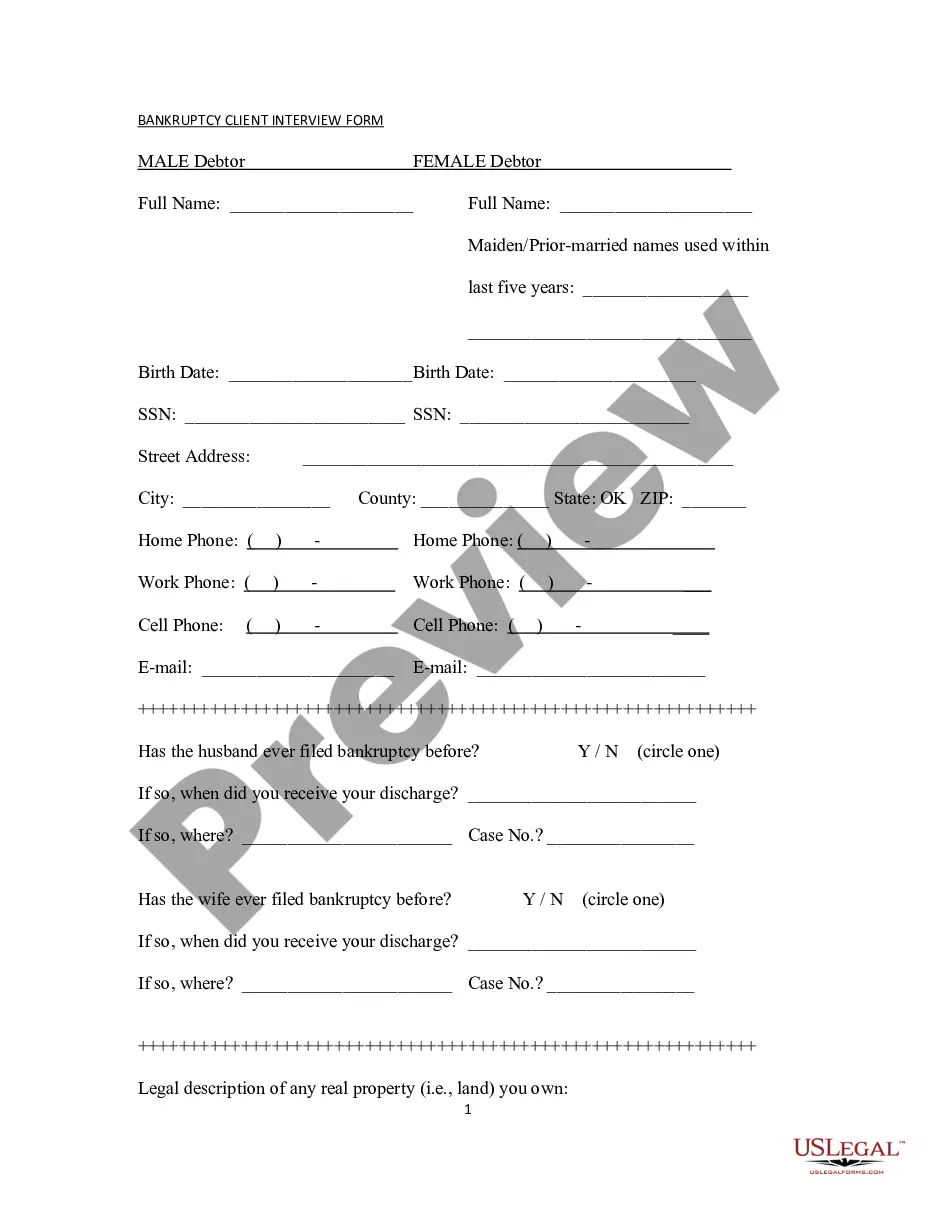

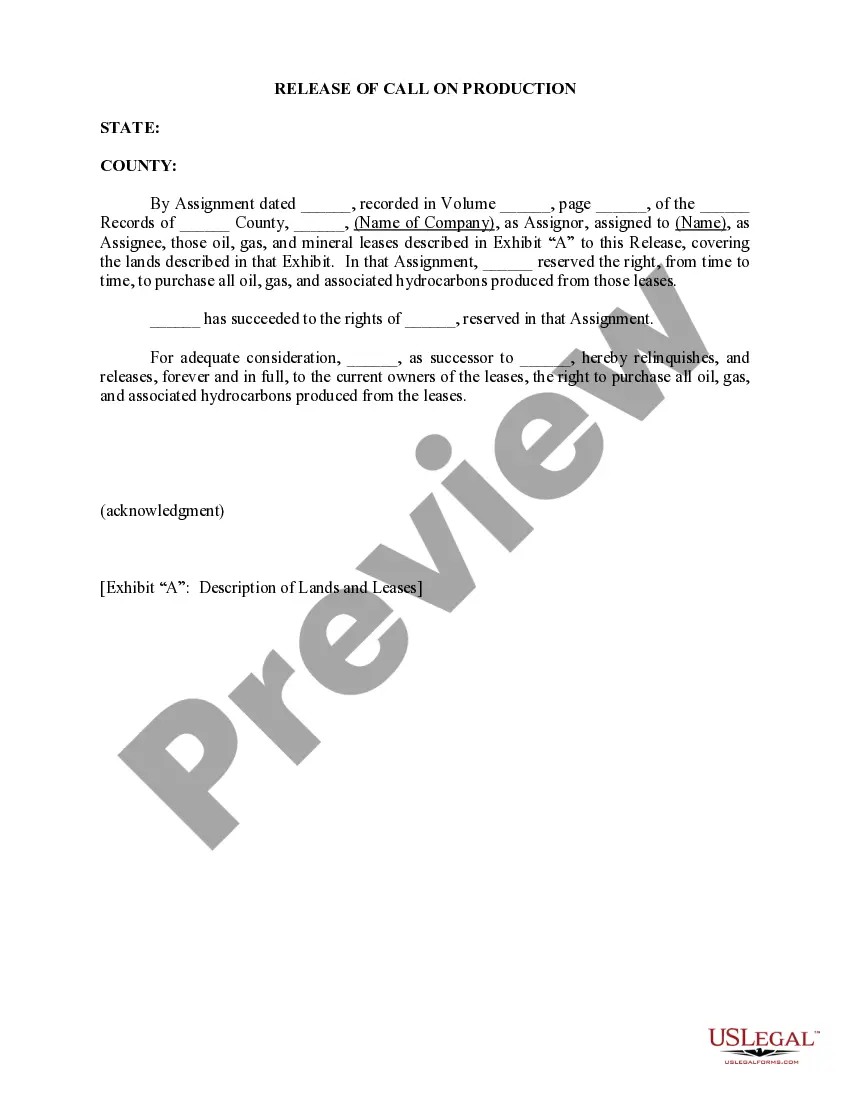

How to fill out Release Of Call On Production?

It is possible to spend hrs on the Internet looking for the legitimate file template that meets the federal and state demands you will need. US Legal Forms supplies 1000s of legitimate types which are analyzed by specialists. You can easily download or produce the District of Columbia Release of Call on Production from the assistance.

If you currently have a US Legal Forms account, you may log in and click the Down load option. Afterward, you may complete, edit, produce, or signal the District of Columbia Release of Call on Production. Every legitimate file template you purchase is the one you have for a long time. To obtain one more copy of any bought form, check out the My Forms tab and click the related option.

If you work with the US Legal Forms web site the first time, keep to the simple recommendations beneath:

- Initially, make sure that you have selected the correct file template for the state/area of your choosing. Browse the form explanation to make sure you have selected the appropriate form. If available, take advantage of the Preview option to search with the file template also.

- If you would like get one more edition of the form, take advantage of the Look for discipline to find the template that fits your needs and demands.

- Once you have discovered the template you desire, click on Get now to continue.

- Choose the pricing strategy you desire, enter your credentials, and register for a free account on US Legal Forms.

- Full the financial transaction. You can utilize your charge card or PayPal account to pay for the legitimate form.

- Choose the formatting of the file and download it in your system.

- Make adjustments in your file if required. It is possible to complete, edit and signal and produce District of Columbia Release of Call on Production.

Down load and produce 1000s of file web templates utilizing the US Legal Forms site, that offers the most important variety of legitimate types. Use skilled and state-distinct web templates to take on your company or person requirements.

Form popularity

FAQ

The filing of the D 30 is a requirement for operating or continuing to operate a motor vehicle for hire in the District by a non resident. The minimum tax is $250 if DC gross receipts are $1M or less.

DC participates in the Modernized e-File program for Corporation (D-20 family), Unincorporated Business Franchise (D-30 family with an EIN only) tax returns and Partnership Return of Income (D-65).

The processing window for selected tax returns could take up to six weeks. Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return.

The persons subject to the Ballpark Fee (?feepayers?) are persons that have income of $5,000,000 or more in annual District gross receipts and either are subject to filing franchise tax returns (whether Corporate or Unincorporated) or are employers required to make unemployment insurance contributions.

File Form D-4 whenever you start new employment. Once filed with your employer, it will remain in effect until you file a new certificate. You may file a new withholding allowance certificate any time the number of withholding allowances you are entitled to increases.

2. FP-31 Tax Return. The FP-31 tax return is essential for individuals who use property for business purposes in D.C. This includes rental property owners, freelancers, contractors, and 1099-NEC employees.

Corporations must report income as follows: Net income of corporations in the District on a combined reporting basis. Corporations must pay a minimum tax as follows: $250 minimum tax, if DC gross receipts are $1 million or less.

Corporations pay franchise tax if they meet any of the following: Incorporated or organized in California. Qualified or registered to do business in California. Doing business in California, whether or not incorporated, organized, qualified, or registered under California law.