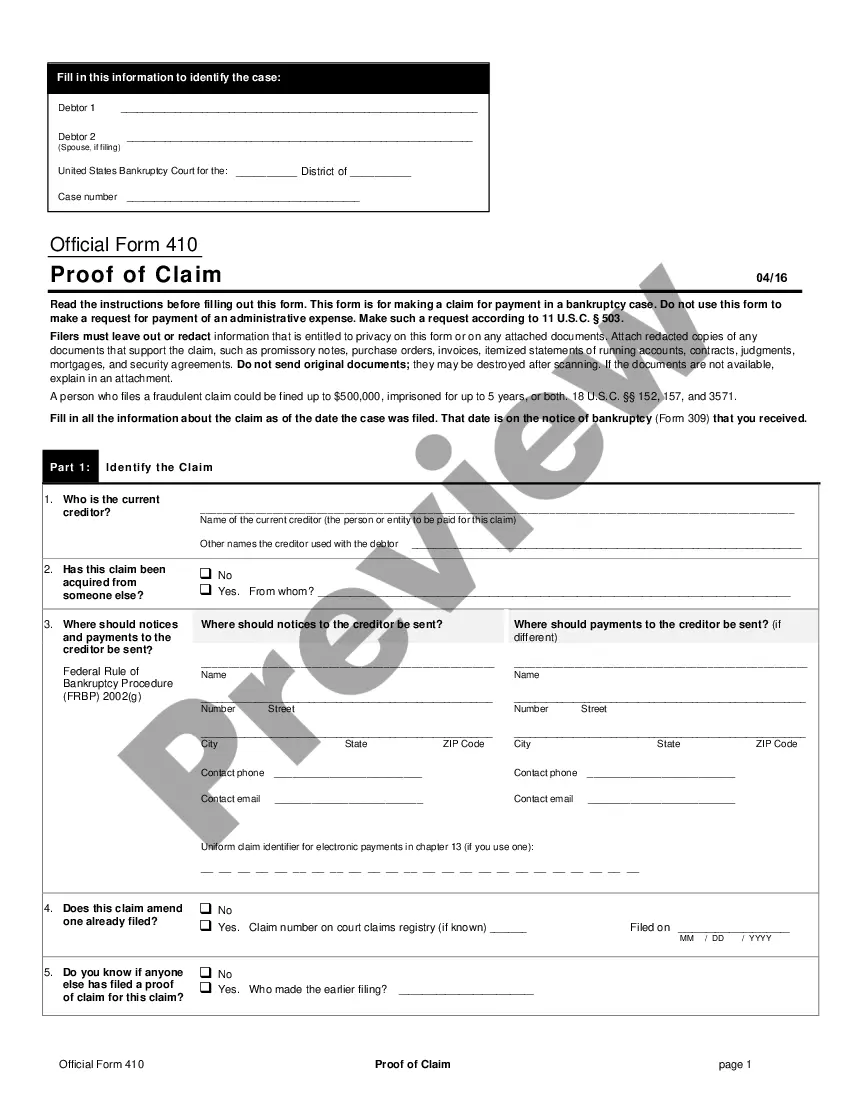

District of Columbia Request for Proof of Debt

Description

How to fill out Request For Proof Of Debt?

You can spend hours online searching for the valid document template that meets the federal and state standards you need. US Legal Forms provides thousands of valid forms that are evaluated by experts.

You can easily download or print the District of Columbia Request for Proof of Debt from the platform.

If you already possess a US Legal Forms account, you can sign in and click the Obtain button. After that, you can complete, modify, print, or sign the District of Columbia Request for Proof of Debt. Every legal document template you acquire is yours permanently. To get another copy of any purchased form, visit the My documents section and click the corresponding button.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of your document and download it to your device. Make modifications to your document if needed. You can complete, adjust, sign, and print the District of Columbia Request for Proof of Debt. Download and print thousands of document templates using the US Legal Forms site, which offers the broadest range of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you're using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, make sure you have selected the correct document template for your region/area of interest.

- Check the form description to ensure you have chosen the right template.

- If available, utilize the Preview button to review the document template as well.

- To find another version of your form, use the Search feature to locate the template that meets your needs and requirements.

- Once you have found the template you want, click Acquire now to proceed.

- Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

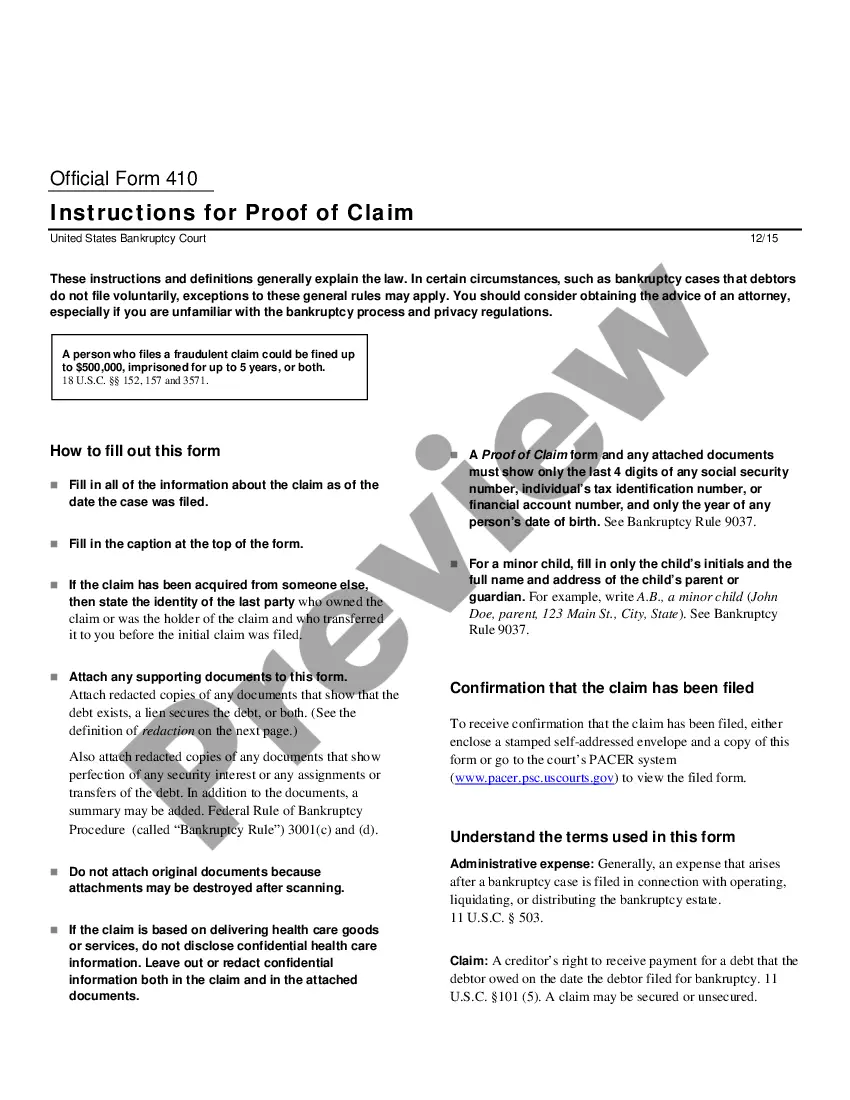

To request proof of debt, you can contact your creditor directly or use a formal letter. A District of Columbia Request for Proof of Debt can be initiated through various channels, such as email or postal mail. Ensure that you keep copies of your communications for your records. Using resources like USLegalForms can simplify this process by providing templates and guidance tailored to your needs.

When writing a letter to request proof of debt, start with your contact information and the date at the top. Next, address the recipient, and clearly state that you are requesting a District of Columbia Request for Proof of Debt. Be concise and polite, providing necessary details like your account information. This structured approach will make it easier for the creditor to process your request.

To ask for proof of debt, you should write to the creditor or debt collector. Clearly state your request for a District of Columbia Request for Proof of Debt in your communication. Include your account details, such as your name and account number, to help them locate your information quickly. This proactive step can help you understand your obligations and ensure all debts are valid.

When writing a letter requesting proof of debt, begin by addressing the creditor and including your account information. Clearly state your intention to obtain proof of debt under the District of Columbia Request for Proof of Debt. Use a polite yet firm tone, and list any specific documents or details you need. Platforms like US Legal Forms offer templates that can help you craft a professional letter with ease.

To demand proof of debt, you should start by sending a formal letter to the creditor. In this letter, clearly state your request for proof of debt under the District of Columbia Request for Proof of Debt guidelines. Be specific about the information you need and include your contact details for a prompt response. Using US Legal Forms can simplify this process by providing templates that guide you through the necessary steps.

Yes, you can send a debt verification letter via email. However, ensure that the letter includes all necessary details regarding the District of Columbia Request for Proof of Debt. Sending it through email allows for quicker communication, but make sure to keep a record of your correspondence for your files. Utilizing platforms like US Legal Forms can help you create and send these letters effectively.

Yes, collection agencies must provide proof of debt when requested. This is part of your rights under the Fair Debt Collection Practices Act. If you have received a notice from a collection agency, you can submit a District of Columbia Request for Proof of Debt to obtain this verification. Using platforms like uslegalforms can help you easily create and submit this request, ensuring you have the documentation you need to manage your debt effectively.