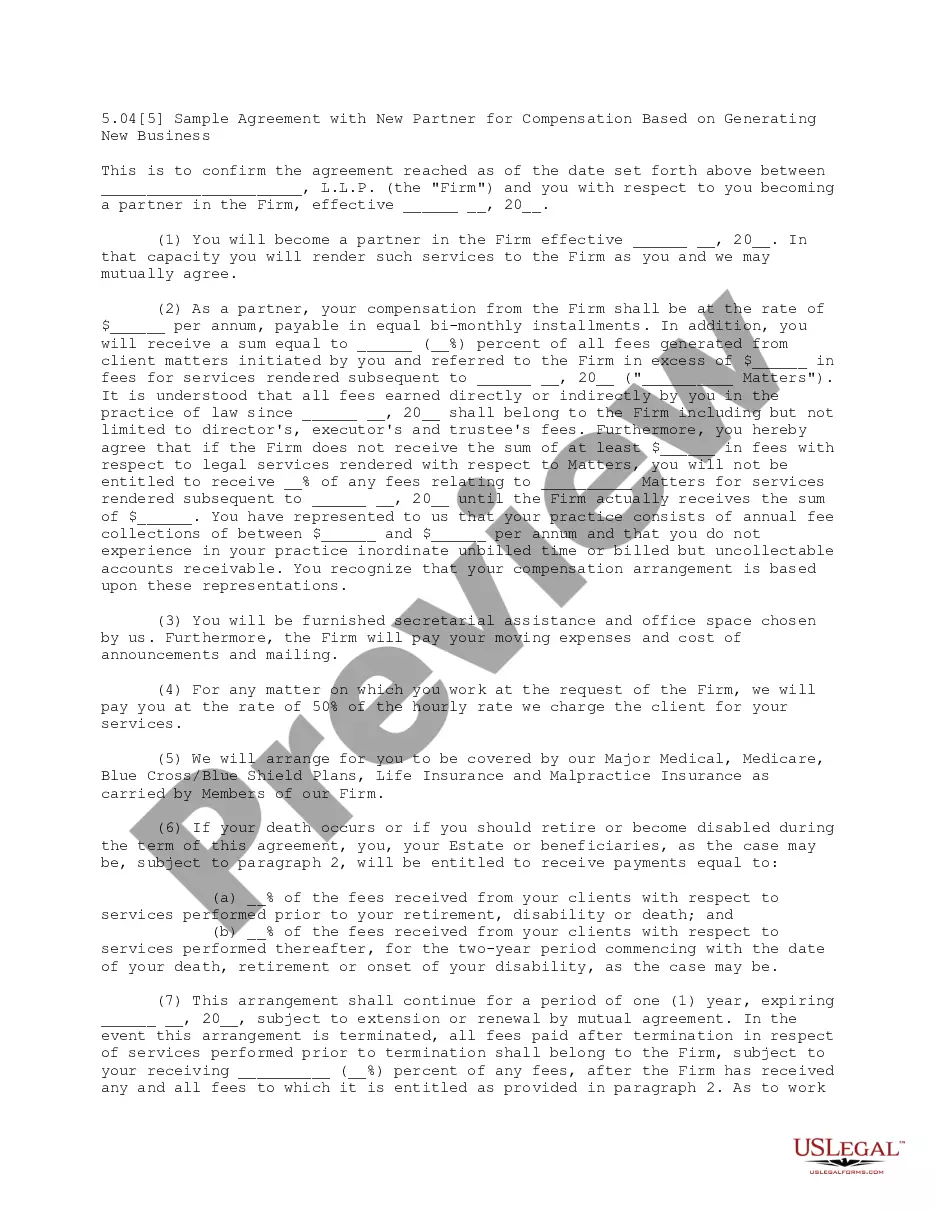

This is an agreement between the firm and a new partner, for compensation based on generating new business. It lists the base draw and the percentage of fees earned by generating new business. It also covers such areas as secretarial help, office space, medical insurance, and malpractice insurance.

District of Columbia Agreement with New Partner for Compensation Based on Generating New Business

Description

How to fill out Agreement With New Partner For Compensation Based On Generating New Business?

If you wish to comprehensive, down load, or produce authorized file themes, use US Legal Forms, the greatest variety of authorized forms, which can be found online. Take advantage of the site`s simple and handy research to obtain the paperwork you will need. Numerous themes for company and individual functions are categorized by classes and suggests, or key phrases. Use US Legal Forms to obtain the District of Columbia Agreement with New Partner for Compensation Based on Generating New Business within a handful of mouse clicks.

When you are previously a US Legal Forms customer, log in for your account and click the Download option to find the District of Columbia Agreement with New Partner for Compensation Based on Generating New Business. You may also entry forms you earlier acquired inside the My Forms tab of your own account.

If you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the form for your correct city/nation.

- Step 2. Use the Review option to examine the form`s content. Never forget to see the outline.

- Step 3. When you are not happy with all the form, take advantage of the Research industry on top of the display to discover other types of your authorized form template.

- Step 4. Upon having identified the form you will need, click the Buy now option. Choose the prices strategy you prefer and put your qualifications to register to have an account.

- Step 5. Procedure the deal. You may use your credit card or PayPal account to finish the deal.

- Step 6. Pick the structure of your authorized form and down load it on your device.

- Step 7. Full, edit and produce or sign the District of Columbia Agreement with New Partner for Compensation Based on Generating New Business.

Every authorized file template you purchase is the one you have for a long time. You may have acces to every form you acquired with your acccount. Click the My Forms section and select a form to produce or down load once again.

Contend and down load, and produce the District of Columbia Agreement with New Partner for Compensation Based on Generating New Business with US Legal Forms. There are many expert and express-specific forms you can utilize for your personal company or individual requirements.

Form popularity

FAQ

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 from District sources, must file a D-30 (whether or not it has net income).

The Federal/State E-File program allows taxpayers to file their federal and DC returns electronically at the same time. (Electronic filing does not increase the probability of being audited).

DC. Option 2: If you owe D.C. income taxes, you will either have to submit a D.C. tax return or extension by the tax deadline in order to avoid late filing penalties. You can only eFile and IRS tax extension, but not a Washington, D.C. extension.

Modernized e-File (MeF) - Unincorporated business franchise taxpayers that have a Federal Employer Identification Number (FEIN) are encouraged to e-file the D-30 Unincorporated Business Franchise Tax Return through MeF.

MyTax.DC.gov Offers the ability to file online the D 30/Schedules to registered taxpayers provided you are not filing a Combined Report or short year return.

Tax Registration with the OTR (FR-500) In order to register your LLC with the OTR, you need to file an FR-500. The FR-500 can only be filed online. Get started: Go to the MyTax homepage and click ?Register a New Business: Form FR-500? (it's in the middle of the page).

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 must file a D 30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

Generally, every corporation or financial institution must file a Form D-20 (including small businesses, professional corporations, and S corporations) if it is carrying on or engaging in any trade, business, or commercial activity in the District of Columbia (DC) or receiving income from DC sources.