District of Columbia Golf Pro Services Contract - Self-Employed

Description

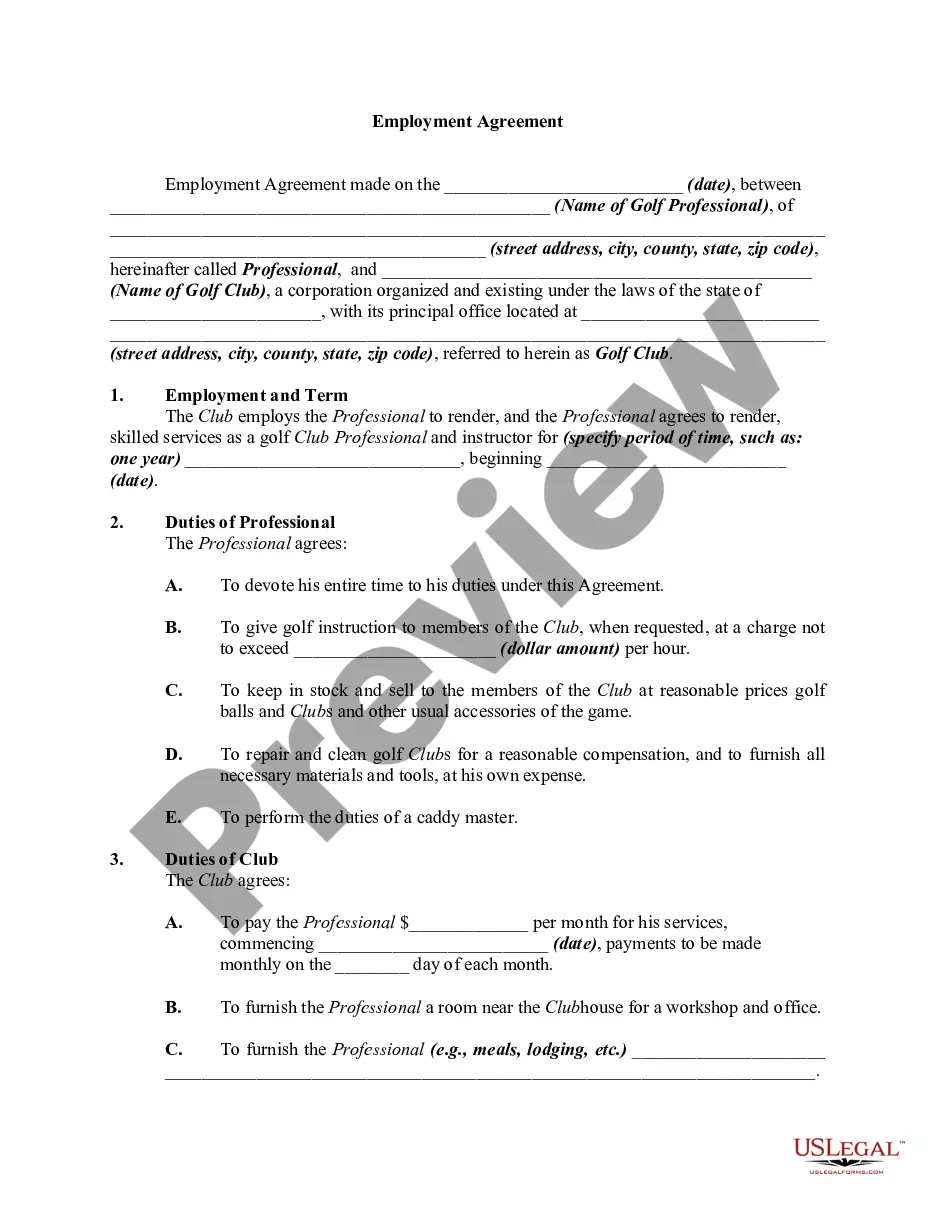

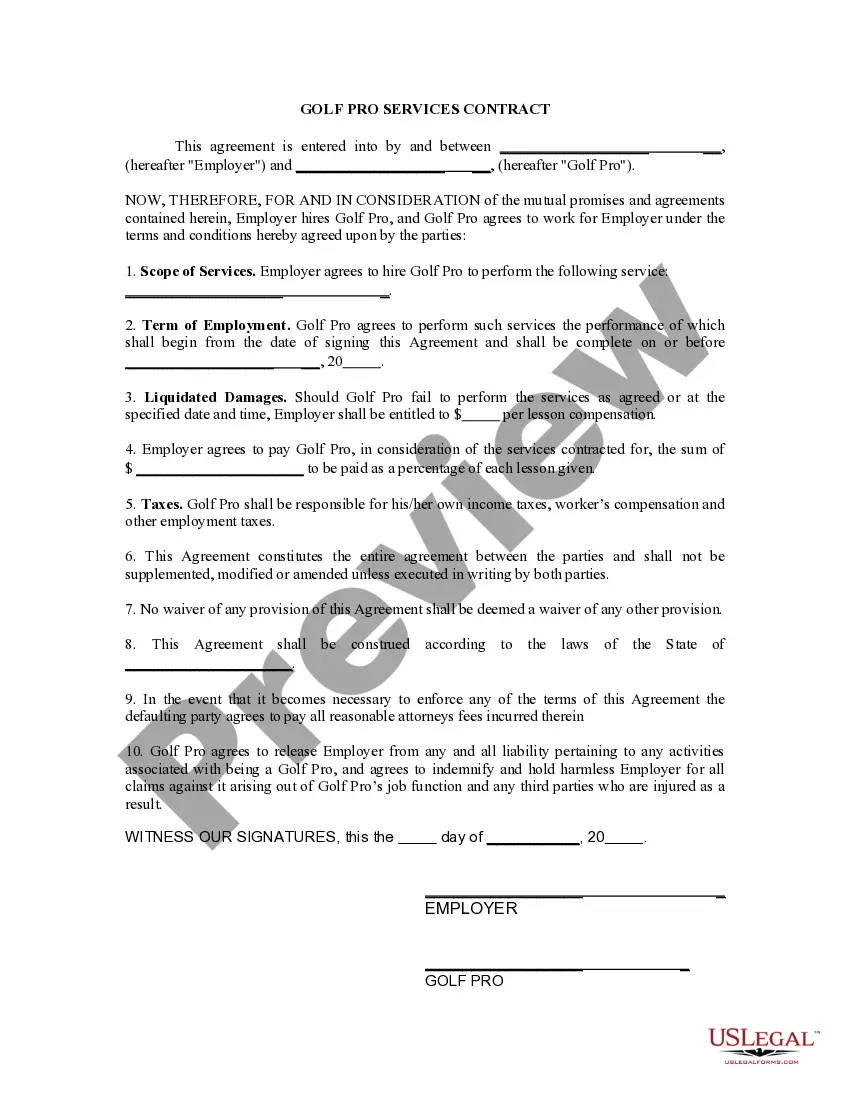

How to fill out Golf Pro Services Contract - Self-Employed?

You have the capability to spend hours online searching for the proper legal document format that meets the state and federal requirements you require. US Legal Forms provides thousands of legal templates that are vetted by professionals.

You can easily download or print the District of Columbia Golf Pro Services Contract - Self-Employed from the service. If you already have a US Legal Forms account, you can Log In and then click the Download button. Afterward, you can complete, modify, print, or sign the District of Columbia Golf Pro Services Contract - Self-Employed. Every legal template you acquire is yours indefinitely. To obtain another copy of any purchased template, navigate to the My documents section and click the corresponding button.

If you are using the US Legal Forms website for the first time, follow the straightforward instructions below: First, make sure that you have selected the correct format for the county/town of your choice. Review the template description to ensure you have chosen the right document. If available, utilize the Preview button to review the format as well. If you wish to find another version of the document, use the Search field to locate the template that meets your needs and requirements. Once you have found the format you need, click Get now to proceed. Select the pricing plan you prefer, enter your details, and create an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Access the formatting of the document and download it to your device. Make adjustments to your file if necessary. You can complete, modify, sign, and print the District of Columbia Golf Pro Services Contract - Self-Employed. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

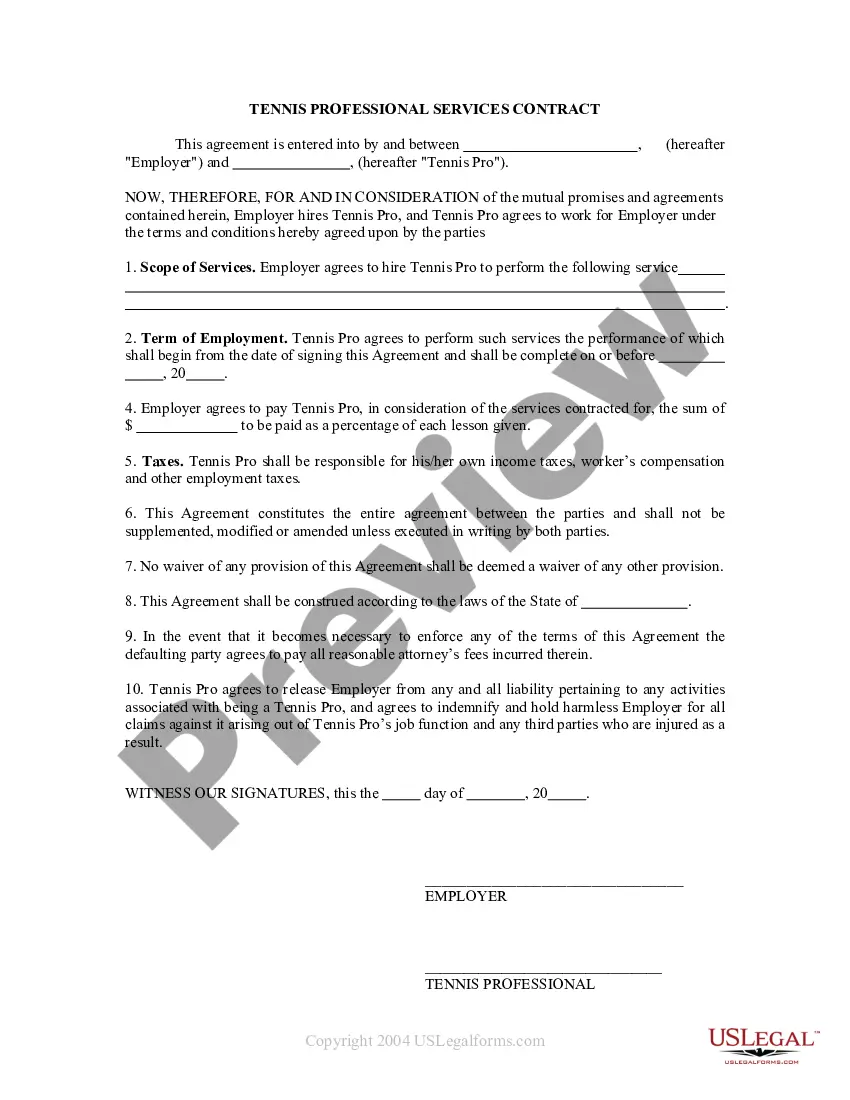

Yes, having a contract is advisable if you're self-employed, as it sets expectations for both you and your clients. A written agreement clarifies the scope of work, payment terms, and other essential details. Utilizing a District of Columbia Golf Pro Services Contract - Self-Employed can enhance your professionalism and protect your interests.

Yes, a self-employed person can be considered an independent contractor, as both operate their own businesses without an employer-employee relationship. However, independent contractors often work on a contract basis for specific projects. If you are drafting a District of Columbia Golf Pro Services Contract - Self-Employed, recognizing this distinction can help clarify your business status.

Yes, you can write your own service agreement, and it can be a straightforward process. However, utilizing templates can save you time and help ensure you include all necessary elements. The District of Columbia Golf Pro Services Contract - Self-Employed available at USLegalForms is a great resource to guide you through creating a binding agreement.

Writing a simple contract agreement requires clarity and straightforward language. Clearly state who the parties are, what services will be provided, and the payment structure. For a District of Columbia Golf Pro Services Contract - Self-Employed, being concise yet comprehensive can help both parties understand their obligations.

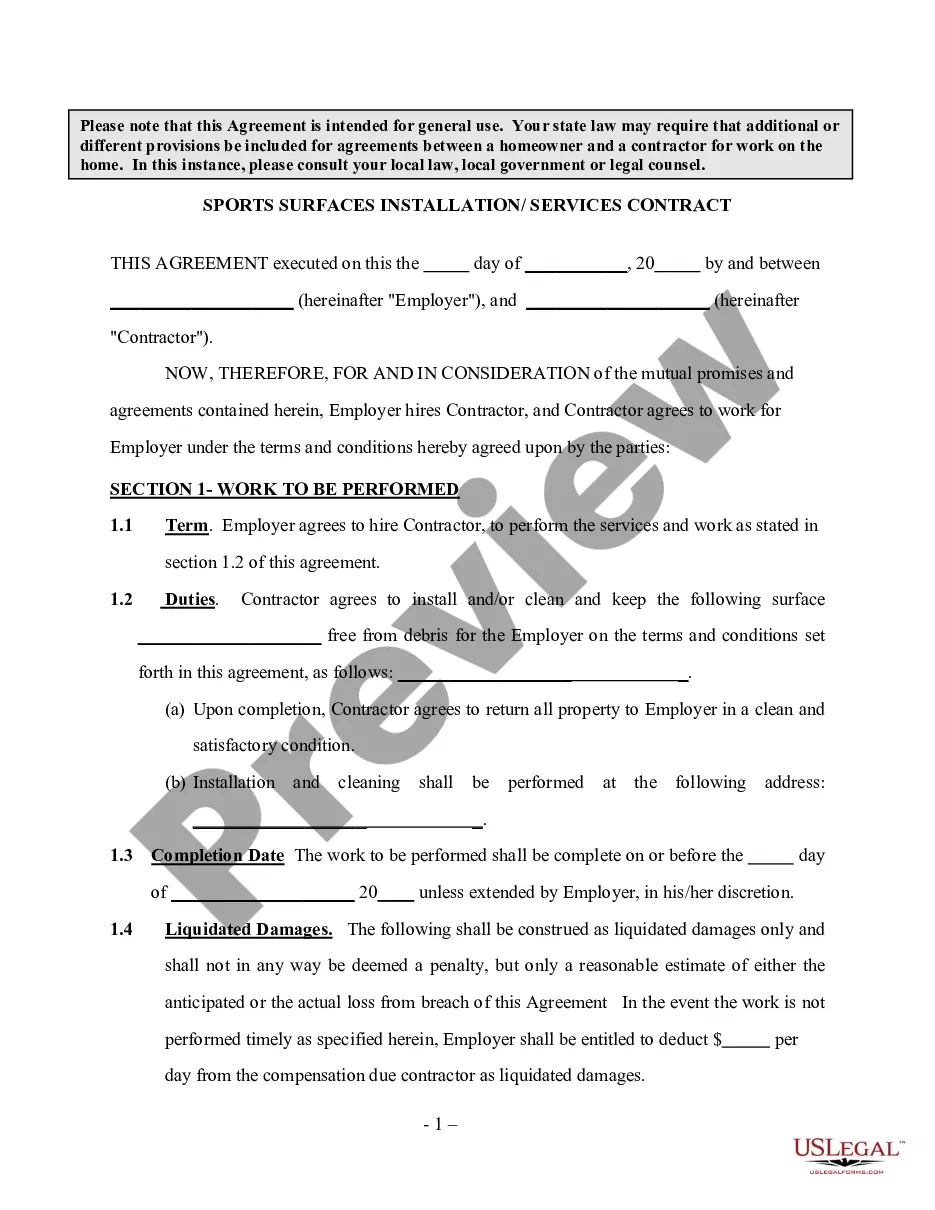

To write a contract agreement for services, start with identifying the parties involved, outline the scope of work, and set payment terms. You may also want to include deadlines and conditions for modifications. Using a District of Columbia Golf Pro Services Contract - Self-Employed template from USLegalForms can simplify this process and ensure thorough documentation.

Writing a service contract agreement involves several key steps. Begin with a clear description of the services to be provided, followed by terms regarding payment and duration. For those using a District of Columbia Golf Pro Services Contract - Self-Employed, including clauses on termination and confidentiality brings additional security to your agreement.

The 5 C's of a contract include clarity, consistency, credibility, compliance, and completeness. Each element ensures that the agreement stands firm and serves both parties well. When drafting a District of Columbia Golf Pro Services Contract - Self-Employed, focusing on these aspects can help prevent misunderstandings and ensure a solid foundation.

The terms self-employed and independent contractor are often used interchangeably, but they can imply different relationships. A self-employed individual typically runs their own business, while an independent contractor usually provides services to a client under a contract. If you're considering a District of Columbia Golf Pro Services Contract - Self-Employed, it's important to understand the context in which you're using these terms.

To effectively file the FR-500 in Washington, D.C., visit the D.C. Office of Tax and Revenue website and access the online form. Fill in the required fields with your business's information accurately. After submitting your FR-500, you ensure compliance with local tax laws, vital for anyone administering a District of Columbia Golf Pro Services Contract - Self-Employed.

Yes, in Washington, D.C., many contractors must obtain a license to legally offer their services. Certain professions, including some golf-related services, may have specific licensing requirements. By ensuring compliance with licensing regulations, you can confidently operate under a District of Columbia Golf Pro Services Contract - Self-Employed.