District of Columbia Engineering Agreement - Self-Employed Independent Contractor

Description

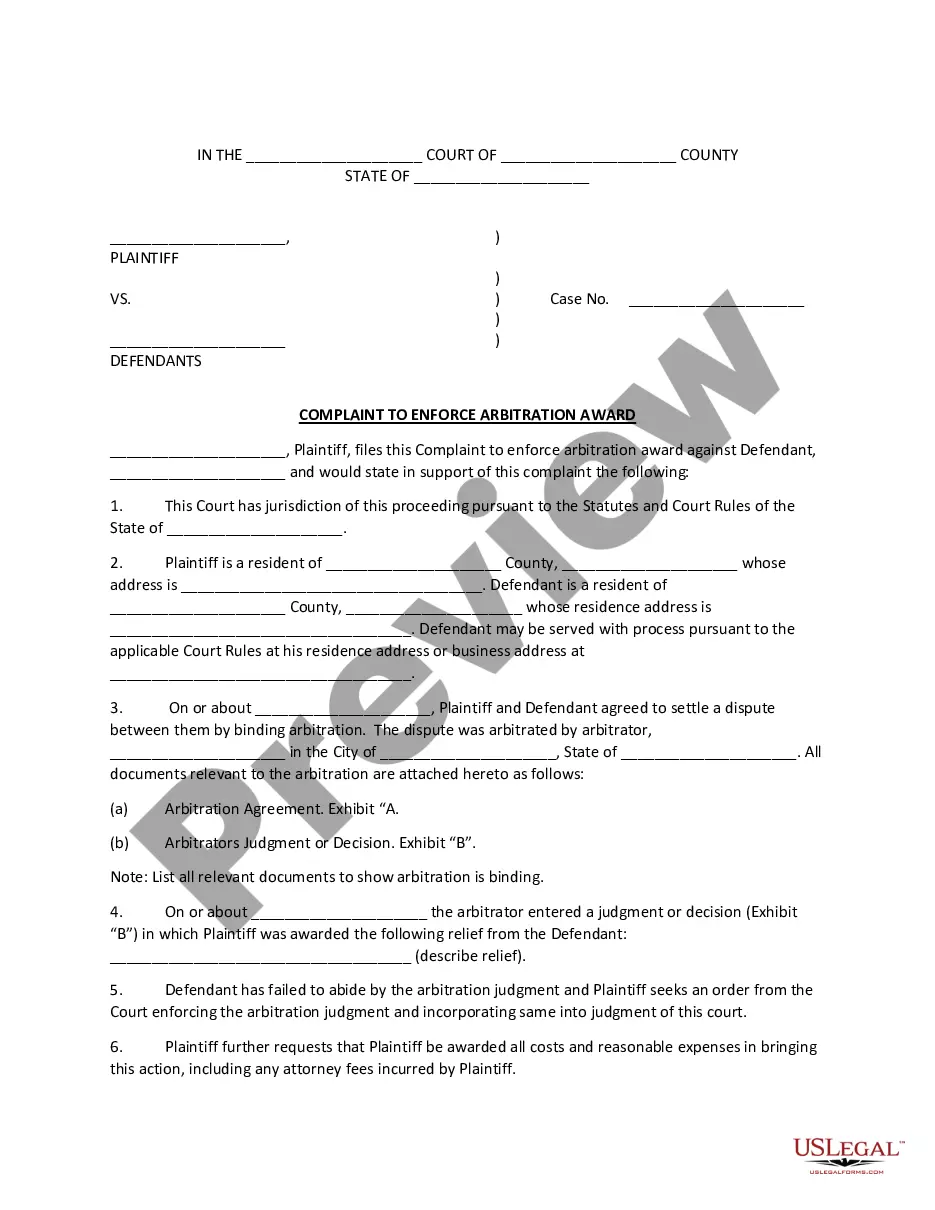

How to fill out Engineering Agreement - Self-Employed Independent Contractor?

It is feasible to spend hours online searching for the legal document template that satisfies the state and federal requirements you need.

US Legal Forms provides thousands of legal forms that are reviewed by professionals.

You can conveniently obtain or create the District of Columbia Engineering Agreement - Self-Employed Independent Contractor from my services.

If available, utilize the Preview option to browse through the document template as well. If you wish to find another version of your form, use the Lookup field to find the template that meets your needs and specifications. Once you have located the template you want, click Purchase now to proceed. Select the pricing plan you want, enter your details, and create an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal form. Choose the file format of your document and download it to your device. Make modifications to your document if necessary. You can complete, alter, sign, and create the District of Columbia Engineering Agreement - Self-Employed Independent Contractor. Access and create thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize expert and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, create, or sign the District of Columbia Engineering Agreement - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, go to the My documents section and click the corresponding option.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your state/city of choice.

- Review the form outline to confirm you have chosen the appropriate form.

Form popularity

FAQ

The choice between these terms often depends on context and personal preference. 'Self-employed' conveys a broader sense of owning a business, while 'independent contractor' clearly defines the work relationship and specific obligations in projects. For clarity, especially in legal documents like the District of Columbia Engineering Agreement - Self-Employed Independent Contractor, using the correct terminology is crucial for both parties.

Virginia recently enacted legislation aimed at clarifying the classifications of workers in the gig economy. This law affects how businesses engage with independent contractors, impacting their rights and protections. Those interested in understanding the implications, especially regarding the District of Columbia Engineering Agreement - Self-Employed Independent Contractor, may benefit from consulting resources or tools like uslegalforms.

Yes, individuals who receive a 1099 form typically work as independent contractors and are thus considered self-employed. They take on their responsibilities and manage taxes differently than traditional employees. Understanding this role is key, especially in navigating the District of Columbia Engineering Agreement - Self-Employed Independent Contractor, which outlines these responsibilities clearly.

While both terms can refer to individuals who run their own businesses, self-employed individuals may operate in various professions, whereas independent contractors specifically enter into contracts for specific tasks. The District of Columbia Engineering Agreement - Self-Employed Independent Contractor highlights this unique relationship, defining the scope and expectations clearly, making it vital for compliance.

The primary difference lies in the control and relationship dynamics. Employees work under the direction of their employer, while independent contractors manage their own business operations. The District of Columbia Engineering Agreement - Self-Employed Independent Contractor clarifies this distinction, emphasizing the independence of contractors in how they fulfill their duties.

To fill out an independent contractor agreement, begin by entering the names of both parties involved. Next, specify the nature of services and payment terms, including rates and schedule. Also, include key terms regarding confidentiality and termination conditions. For clarity and compliance, utilizing the District of Columbia Engineering Agreement - Self-Employed Independent Contractor template on USLegalForms can greatly simplify this process.

Filling out an independent contractor form involves providing personal details, such as your name and address, along with specific project information. Ensure you outline the services offered and the compensation structure. Accurate details help establish a clear working relationship. For detailed guidance, consider using the District of Columbia Engineering Agreement - Self-Employed Independent Contractor template available on USLegalForms.

Yes, an independent contractor is considered self-employed. This means they operate independently, handling their taxes and business operations. Unlike traditional employees, independent contractors retain control over how they complete their work. In the context of the District of Columbia Engineering Agreement - Self-Employed Independent Contractor, this relationship is crucial for defining legal responsibilities.

To write an independent contractor agreement, start by clearly defining the scope of work. Include important details such as payment terms, deadlines, and responsibilities. Additionally, consider incorporating clauses about confidentiality and termination. For those seeking a structured format, the District of Columbia Engineering Agreement - Self-Employed Independent Contractor can provide a solid foundation.

To fill out Schedule C for your taxes as an independent contractor, begin by reporting your income earned under the District of Columbia Engineering Agreement - Self-Employed Independent Contractor. Document all business expenses carefully, as these can reduce your taxable income. You will also need to calculate your net profit or loss, which you will report on your personal tax return. If you need further assistance, consider using the US Legal Forms platform for comprehensive guides and templates.